Record to Report, or R2R, is a finance and accounting management process that encompasses the entire spectrum of activities from data recording to final reporting. Given its crucial role in financial closing and reporting, R2R positions are in demand, attracting numerous aspirants. In this comprehensive guide, we will be walking you through a meticulously compiled list of top R2R interview questions and answers to help you ace the interview and make a striking impression. This set of questions is aimed at giving you a deeper understanding and a glimpse into what potential employers are looking for.

Let’s begin our journey into the world of R2R, offering insights into the essence of the role and giving you the tools and knowledge to stand out in a competitive job market. With 27 key questions and detailed answers, we’re setting the stage for you to delve into the intricacies of the R2R process and land that coveted position.

- Top 27 R2R Interview Questions and Answers

- 1. Can you explain what the R2R process involves?

- 2. How does the R2R process contribute to financial closing?

- 3. What is the significance of reconciliations in the R2R process?

- 4. How does the R2R process interact with other financial processes like P2P and O2C?

- 5. Can you describe a situation where you identified and resolved a discrepancy during reconciliation?

- 6. How do you ensure accuracy and compliance with regulations during the R2R process?

- 7. What role does technology play in optimizing the R2R process?

- 8. Can you elaborate on the challenges faced during the R2R process and how you overcome them?

- 9. How do you prioritize tasks during month-end closing to ensure timely completion?

- 10. What measures do you take to safeguard the confidentiality and integrity of financial data?

- 11. How do you stay updated on the latest industry trends and regulatory changes affecting the R2R process?

- 12. What strategies do you employ to enhance efficiency and accuracy in financial reporting?

- 13. How do you handle pressure and maintain accuracy during peak financial closing periods?

- 14. How do you collaborate with other departments to ensure smooth financial closing and reporting?

- 15. Can you discuss a specific instance where you improved a financial process or resolved a complex issue in the R2R cycle?

- 16. What steps would you take to resolve discrepancies identified during account reconciliations?

- 17. How do you ensure timely and accurate delivery of financial reports to stakeholders?

- 18. Can you elaborate on the significance of audit trails in the R2R process?

- 19. How do you assess the accuracy and reliability of financial data before final reporting?

- 20. Can you discuss the role of Key Performance Indicators (KPIs) in evaluating the effectiveness of the R2R process?

- 21. How do you manage and organize voluminous financial data to prevent errors and ensure efficient processing?

- 22. Can you explain the impact of currency fluctuations on financial reporting and how you account for them?

- 23. How do you approach training and mentoring junior team members in the R2R process?

- 24. Can you discuss a time when you worked under tight deadlines and how you ensured the quality of your work?

- 25. How do you handle disagreements or differing opinions within the team, especially during stressful financial closing periods?

- 26. What role does continuous improvement play in the R2R process, and how do you contribute to it?

- 27. How do you assess and mitigate risks associated with the R2R process?

- Conclusion

Top 27 R2R Interview Questions and Answers

1. Can you explain what the R2R process involves?

The R2R process is foundational in finance and accounting, involving several steps from recording financial transactions to preparing final reports. This question seeks to evaluate your fundamental understanding of the R2R cycle.

Sample Answer

“The R2R process is a comprehensive cycle in financial and accounting management. It begins with recording transactions and journal entries, followed by reconciling accounts, closing the books, and preparing financial reports and statements. This process ensures the accuracy and integrity of financial data, enabling organizations to make informed business decisions.”

2. How does the R2R process contribute to financial closing?

The R2R cycle is integral to the financial closing process. Understanding this interrelation showcases your knowledge of the significance of R2R in financial management.

Sample Answer

“The R2R process is pivotal to financial closing as it encompasses the aggregation, reconciliation, and reporting of financial data. By ensuring accurate recording and reconciliation of transactions, R2R facilitates the timely closing of books. Additionally, it aids in the preparation of financial statements and reports, which reflect the financial health of the organization.”

3. What is the significance of reconciliations in the R2R process?

Reconciliations are a key component of R2R, ensuring the accuracy and integrity of financial data. This question assesses your understanding of the importance of reconciliations in the R2R cycle.

Sample Answer

“Reconciliations play a vital role in the R2R process by validating the accuracy and consistency of financial data across different accounts and systems. They identify discrepancies, facilitate corrections, and ensure that financial statements are reliable and free from errors. This, in turn, strengthens financial integrity and compliance with regulatory standards.”

4. How does the R2R process interact with other financial processes like P2P and O2C?

Understanding the interplay between different financial processes demonstrates your comprehensive knowledge of finance and accounting management.

Sample Answer

“The R2R process interacts seamlessly with Procure to Pay (P2P) and Order to Cash (O2C) cycles. While P2P focuses on procurement and payment transactions, and O2C on sales and cash collection, R2R consolidates data from both, ensuring accurate financial reporting and enabling comprehensive financial analysis.”

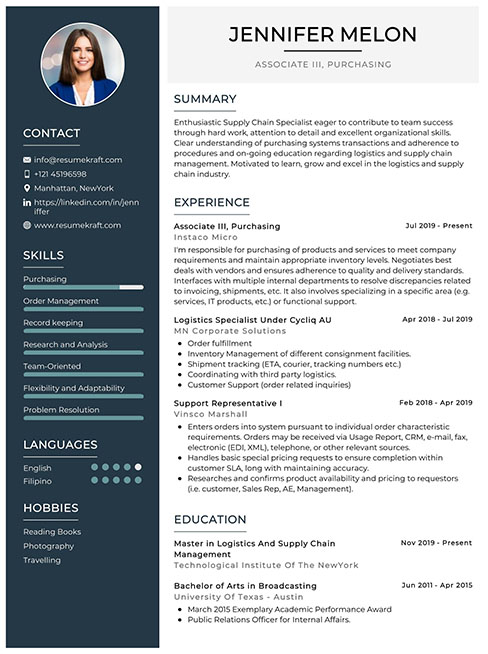

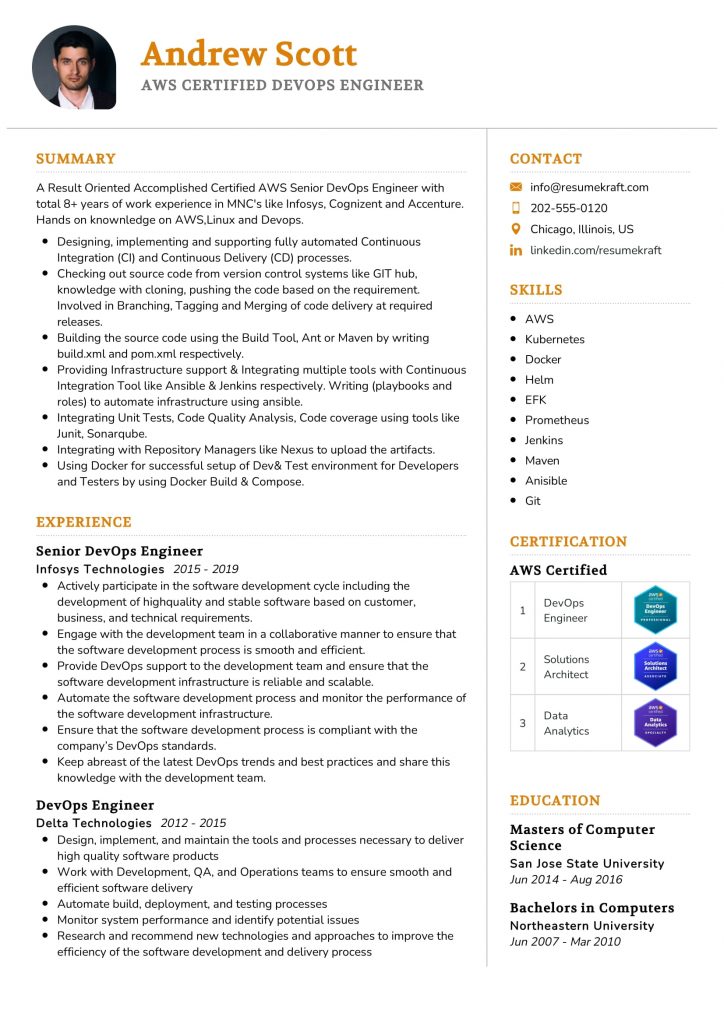

Build your resume in just 5 minutes with AI.

5. Can you describe a situation where you identified and resolved a discrepancy during reconciliation?

Your experience with identifying and resolving discrepancies during reconciliation demonstrates your problem-solving skills and attention to detail.

Sample Answer

“During a monthly reconciliation, I noticed a significant discrepancy between the general ledger and bank statement. Upon thorough investigation, it was discovered that a batch of transactions was erroneously duplicated. I promptly rectified the error and implemented additional checks to prevent such discrepancies in the future.”

6. How do you ensure accuracy and compliance with regulations during the R2R process?

Ensuring accuracy and compliance is fundamental in the R2R cycle. Your approach to maintaining these standards is indicative of your commitment to quality and adherence to regulations.

Sample Answer

“I ensure accuracy by implementing stringent checks and balances throughout the R2R process, from data entry to final reporting. Regular reconciliations, audit trails, and internal controls are key. For compliance, I stay updated on relevant regulations and guidelines, ensuring that all financial activities and reports align with the applicable standards.”

7. What role does technology play in optimizing the R2R process?

Technology is a significant enabler in enhancing and optimizing financial processes. This question gauges your awareness of the impact of technology on R2R.

Sample Answer

“Technology is a linchpin in optimizing the R2R process. It automates routine tasks, reduces manual errors, and accelerates financial closing. Advanced software solutions facilitate real-time data access, analytics, and reporting, enabling more informed decision-making and ensuring compliance with evolving regulatory requirements.”

8. Can you elaborate on the challenges faced during the R2R process and how you overcome them?

Discussing challenges and solutions offers insights into your problem-solving abilities and experience in managing the intricacies of the R

2R process.

Sample Answer

“One of the key challenges in the R2R process is managing voluminous data and ensuring its accuracy. To overcome this, I leverage automation and implement rigorous checks at each stage. Additionally, staying abreast of regulatory changes is crucial, for which I regularly attend workshops and training sessions to ensure compliance.”

9. How do you prioritize tasks during month-end closing to ensure timely completion?

Month-end closing is a critical time in financial management. Your strategy for prioritizing tasks reflects your organizational skills and ability to meet deadlines.

Sample Answer

“During month-end closing, I create a detailed checklist and timeline for all tasks, prioritizing them based on complexity and dependency. Regular communication with stakeholders and leveraging automation helps in streamlining activities and addressing any issues promptly, ensuring a smooth and timely closing.”

10. What measures do you take to safeguard the confidentiality and integrity of financial data?

Handling sensitive financial data requires utmost diligence. This question assesses your commitment to safeguarding data integrity and confidentiality.

Sample Answer

“Safeguarding financial data is paramount. I adhere to strict access controls, ensuring that only authorized personnel have access to sensitive information. Regular audits, data encryption, and secure communication channels are also employed to protect data integrity and prevent unauthorized access or leaks.”

11. How do you stay updated on the latest industry trends and regulatory changes affecting the R2R process?

Staying informed about industry trends and regulations is vital for effective financial management. This question explores your approach to continuous learning and staying updated.

Sample Answer

“I subscribe to industry publications, participate in webinars, and attend conferences to stay abreast of the latest trends and regulations. Networking with peers and joining professional forums also provides insights and diverse perspectives, enabling me to adapt and align the R2R process with evolving industry standards.”

12. What strategies do you employ to enhance efficiency and accuracy in financial reporting?

Efficiency and accuracy in financial reporting are critical. Your strategies for enhancing these elements demonstrate your proactive approach to improving financial management.

Sample Answer

“Enhancing efficiency and accuracy in reporting involves a multifaceted approach. I advocate for the adoption of advanced software tools, implement robust internal controls, and conduct regular training sessions for the team. Additionally, a culture of continuous improvement and feedback helps in identifying areas for optimization.”

13. How do you handle pressure and maintain accuracy during peak financial closing periods?

Handling pressure while maintaining accuracy is a valuable skill in finance. This question assesses your ability to manage stress and deliver quality results.

Sample Answer

“I manage pressure by staying organized, maintaining a positive mindset, and keeping open lines of communication with my team. A well-structured plan, contingency measures, and regular breaks help in maintaining focus and accuracy, even during peak financial closing periods.”

14. How do you collaborate with other departments to ensure smooth financial closing and reporting?

Collaboration across departments is key to seamless financial management. Your approach to interdepartmental collaboration reflects your teamwork and communication skills.

Sample Answer

“I foster strong relationships with other departments through regular meetings and open communication channels. Understanding their needs, addressing queries promptly, and providing clear guidelines ensure alignment of objectives and facilitate smooth financial closing and reporting.”

15. Can you discuss a specific instance where you improved a financial process or resolved a complex issue in the R2R cycle?

Discussing specific instances of improvement or problem resolution showcases your hands-on experience and contribution to enhancing the R2R process.

Sample Answer

“In a previous role, I identified recurrent discrepancies during reconciliations, indicating a flaw in data entry. I initiated a thorough review of the process, pinpointed the issue, and implemented automated validations, leading to a significant reduction in errors and improving the overall efficiency of the R2R cycle.”

16. What steps would you take to resolve discrepancies identified during account reconciliations?

Resolving discrepancies is an essential task in the R2R process. Your approach to resolving such issues indicates your problem-solving skills and attention to detail.

Sample Answer

“To resolve discrepancies, I conduct a detailed analysis to identify the root cause, verify transaction details, and collaborate with relevant departments for clarification. Once the discrepancy is understood, corrective actions are taken promptly, and additional controls are implemented to prevent recurrence.”

17. How do you ensure timely and accurate delivery of financial reports to stakeholders?

Timely and accurate reporting is fundamental in maintaining stakeholder trust and meeting organizational objectives. This question assesses your commitment to delivering quality reports on time.

Sample Answer

“I implement detailed reporting schedules, conduct regular progress reviews, and maintain open communication with stakeholders regarding timelines and expectations. Leveraging technology for automation and validation also enhances accuracy and efficiency in report generation.”

18. Can you elaborate on the significance of audit trails in the R2R process?

Audit trails are crucial in ensuring transparency and compliance in the R2R cycle. This question gauges your understanding of the importance of maintaining audit trails in financial processes.

Sample Answer

“Audit trails are essential as they provide a chronological record of financial transactions and activities, enhancing transparency and accountability. They facilitate internal and external audits, ensure compliance with regulations, and aid in detecting and investigating discrepancies or fraudulent activities.”

19. How do you assess the accuracy and reliability of financial data before final reporting?

Assessing the accuracy and reliability of financial data is a key responsibility in the R2R process. Your methods for ensuring data accuracy and reliability reflect your diligence and commitment to quality.

Sample Answer

“I employ a combination of automated validations, manual checks, and reconciliations to assess data accuracy. Regular audits and reviews of internal controls also contribute to data reliability. Additionally, cross-verification with relevant departments ensures that the financial data is comprehensive and accurate.”

20. Can you discuss the role of Key Performance Indicators (KPIs) in evaluating the effectiveness of the R2R process?

KPIs are vital in measuring the success and effectiveness of financial processes. Your knowledge of KPIs in the R2R process indicates your understanding of performance measurement and improvement.

Sample Answer

“KPIs serve as quantifiable metrics to evaluate the efficiency, accuracy, and timeliness of the R2R process. They help in identifying bottlenecks, assessing compliance, and measuring the impact of improvements. Regular monitoring of KPIs facilitates continuous enhancement of the R2R process.”

21. How do you manage and organize voluminous financial data to prevent errors and ensure efficient processing?

Managing large volumes of data is a common challenge in the R2R process. Your strategies for managing and organizing data indicate your organizational skills and ability to prevent errors.

Sample Answer

“I leverage advanced data management tools and establish standardized procedures for data entry and validation. Implementing a robust filing system, conducting regular backups, and performing periodic data quality checks are also crucial in managing voluminous financial data efficiently.”

22. Can you explain the impact of currency fluctuations on financial reporting and how you account for them?

Currency fluctuations can significantly affect financial reporting for multinational organizations. This question assesses your understanding of this impact and your ability to account for currency variations.

Sample Answer

“Currency fluctuations can lead to variations in the reported values of assets, liabilities, and income in the financial statements of companies dealing in multiple currencies. I account for them by using the relevant exchange rates on transaction

dates and reporting dates, and recognizing exchange differences in accordance with accounting standards.”

23. How do you approach training and mentoring junior team members in the R2R process?

Training and mentoring junior members is part of fostering team growth and development. Your approach to this responsibility reflects your leadership and interpersonal skills.

Sample Answer

“I adopt a hands-on and supportive approach to training and mentoring. Clear communication of expectations, regular feedback, and encouragement of questions foster a conducive learning environment. I also facilitate access to learning resources and share practical insights and experiences to enhance their understanding of the R2R process.”

24. Can you discuss a time when you worked under tight deadlines and how you ensured the quality of your work?

Working under tight deadlines is a common scenario in finance. Your experience and strategies for ensuring quality under pressure indicate your time management and prioritization skills.

Sample Answer

“During a particularly challenging quarter-end closing, timelines were tight due to additional reporting requirements. I developed a prioritized action plan, delegated effectively, and maintained open communication with the team. Regular quality checks and staying focused ensured the accuracy and timeliness of our deliverables.”

25. How do you handle disagreements or differing opinions within the team, especially during stressful financial closing periods?

Handling disagreements effectively is vital for maintaining team harmony and productivity. Your approach to resolving conflicts reflects your interpersonal and conflict-resolution skills.

Sample Answer

“I approach disagreements with open-mindedness and empathy. Encouraging constructive dialogue, acknowledging differing viewpoints, and finding common ground help in resolving conflicts. Maintaining a positive and respectful atmosphere, even during stressful times, fosters collaboration and strengthens team cohesion.”

26. What role does continuous improvement play in the R2R process, and how do you contribute to it?

Continuous improvement is essential for optimizing financial processes. Your contribution to continuous improvement indicates your proactive approach and commitment to enhancing the R2R process.

Sample Answer

“Continuous improvement is integral to refining the R2R process. I actively seek feedback, analyze performance metrics, and identify areas for enhancement. Implementing best practices, leveraging technology, and fostering a culture of innovation contribute to the ongoing optimization of the R2R process.”

27. How do you assess and mitigate risks associated with the R2R process?

Risk assessment and mitigation are critical in ensuring the reliability and integrity of the R2R process. This question assesses your ability to identify, evaluate, and address risks in financial management.

Sample Answer

“I conduct regular risk assessments, identifying potential vulnerabilities and areas of concern within the R2R process. Developing and implementing robust internal controls, maintaining compliance with regulations, and ensuring data security are key strategies in mitigating risks and safeguarding the integrity of the process.”

Conclusion

Embarking on a career in the dynamic field of Record to Report is a journey filled with learning and growth opportunities. Equipping yourself with the knowledge and insights shared in this comprehensive guide of top R2R interview questions and answers will undoubtedly bolster your confidence and prepare you to tackle interviews with finesse. Remember, understanding the nuances of the R2R process, showcasing your problem-solving abilities, and demonstrating your commitment to accuracy and compliance will set you apart in the competitive job market.

Remember to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.