Fable Fintech, a leader in the financial technology space, is renowned for its innovative solutions in cross-border payments and financial services. If you’re aspiring to land a job at Fable Fintech, you need to be well-prepared for the interview process. Fable Fintech looks for candidates who are not only technically proficient but also demonstrate problem-solving abilities, adaptability, and strong communication skills. In this article, we will cover the Top 36 Fable Fintech Interview Questions that will help you prepare comprehensively. Each question is followed by a succinct answer and an explanation to give you insights into what the interviewers are seeking.

Top 36 Fable Fintech Interview Questions

1. What is Fable Fintech, and why do you want to work here?

Fable Fintech is a company focused on providing innovative financial solutions, particularly in cross-border payments. I want to work at Fable Fintech because it’s a leader in the fintech industry, and I am excited about the opportunity to contribute to the growth and evolution of financial services with cutting-edge technology.

Explanation:

This question assesses your knowledge about the company and your alignment with its vision.

2. Can you explain cross-border payments and their challenges?

Cross-border payments refer to transactions made across national borders. These payments often face challenges such as varying regulations, high transaction fees, and delays due to differing banking systems in various countries.

Explanation:

This answer tests your understanding of the fintech domain, especially in areas where Fable Fintech operates.

3. What programming languages are most useful in fintech, and why?

Languages like Python, Java, and C++ are highly useful in fintech due to their reliability, performance, and ability to handle complex calculations. Python is especially popular for its versatility and ease of use in data analysis and machine learning.

Explanation:

This demonstrates your technical knowledge and ability to adapt to the fintech industry’s demands.

4. How do you stay updated with trends in the fintech industry?

I regularly read fintech blogs, follow industry leaders on social media, and attend webinars and conferences to stay updated. This helps me stay informed about emerging trends and innovations that can impact the sector.

Explanation:

The interviewer is looking for candidates who actively engage with the industry and show a passion for learning.

Build your resume in just 5 minutes with AI.

5. Describe a challenging problem you’ve solved in a previous project.

In my previous role, I faced an issue with integrating a payment gateway due to API limitations. I solved it by researching alternative methods and optimizing the existing infrastructure to accommodate the gateway’s constraints, which improved transaction processing speed.

Explanation:

Problem-solving skills are crucial, and this question gauges your ability to overcome challenges.

6. What role does security play in fintech, and how would you implement it?

Security is critical in fintech due to the sensitivity of financial data. Implementing encryption, multi-factor authentication, and constant monitoring are essential steps to safeguard data and prevent breaches.

Explanation:

This question assesses your understanding of the importance of cybersecurity in fintech.

7. How do APIs function in fintech applications?

APIs (Application Programming Interfaces) enable different systems to communicate with each other. In fintech, APIs are often used to connect banking systems, payment gateways, and third-party services for seamless integration and data exchange.

Explanation:

This evaluates your technical knowledge and understanding of APIs in the financial ecosystem.

8. What is blockchain, and how is it used in fintech?

Blockchain is a decentralized ledger technology that ensures transparency and security in transactions. In fintech, blockchain is used to facilitate secure and immutable financial transactions, particularly in areas like cryptocurrency and smart contracts.

Explanation:

Understanding emerging technologies like blockchain is crucial for fintech roles.

9. How would you handle a situation where a client is unsatisfied with a product?

I would listen carefully to the client’s concerns, validate their feelings, and propose a solution that addresses their needs. It’s important to communicate clearly and provide reassurance that the issue will be resolved promptly.

Explanation:

Customer service skills are essential in client-facing roles, even in fintech.

10. What are some of the most significant regulatory challenges in fintech?

Fintech companies must navigate complex regulations such as KYC (Know Your Customer), AML (Anti-Money Laundering), and data protection laws like GDPR. Compliance with these regulations is critical to avoid penalties and maintain customer trust.

Explanation:

Regulatory knowledge is key for working in the highly regulated fintech industry.

11. Explain the concept of digital wallets.

A digital wallet is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. It allows users to make transactions digitally without carrying physical cash or cards.

Explanation:

Digital wallets are a significant part of fintech solutions, and understanding their functionality is crucial.

12. How does machine learning impact the fintech industry?

Machine learning helps fintech companies analyze large datasets to detect fraud, predict market trends, and personalize customer experiences. It plays a critical role in improving decision-making processes and operational efficiency.

Explanation:

This answer demonstrates your awareness of AI and machine learning applications in fintech.

13. Can you describe a time when you had to work under tight deadlines?

In my previous role, I had to develop a feature for a payment platform within a week. I successfully completed the task by prioritizing my workload, collaborating with my team, and ensuring constant communication to meet the deadline.

Explanation:

Time management and teamwork are important skills that interviewers often assess.

14. How would you integrate AI into a fintech product?

AI can be integrated into fintech products by implementing chatbots for customer service, automating credit risk assessments, and detecting fraudulent activities in real-time. AI enhances operational efficiency and customer experiences.

Explanation:

AI is transforming fintech, and this question gauges your understanding of its practical applications.

15. How do you approach learning new technologies?

I approach learning new technologies by researching online courses, practicing through small projects, and collaborating with colleagues who are experts in that area. Continuous learning is key to staying relevant in the tech world.

Explanation:

The fintech industry evolves quickly, and the ability to learn new technologies is a valuable trait.

16. What are the advantages of cloud computing in fintech?

Cloud computing offers scalability, cost efficiency, and enhanced security in fintech. It allows companies to quickly scale their operations and store sensitive data in secure environments with minimal infrastructure costs.

Explanation:

Cloud computing is integral to modern fintech solutions, and understanding its benefits is essential.

17. How would you ensure compliance with data privacy laws in a fintech application?

To ensure compliance, I would implement data encryption, secure user authentication methods, and follow best practices for data storage. Regular audits and staying updated with evolving laws like GDPR are crucial for maintaining compliance.

Explanation:

Data privacy laws are stringent in fintech, and compliance is non-negotiable for regulatory success.

18. What is your experience with payment gateways?

I have experience integrating various payment gateways like Stripe, PayPal, and Razorpay. These integrations allow users to make seamless online transactions and require careful handling of sensitive financial information.

Explanation:

Payment gateways are a central component of fintech, and prior experience is a strong asset.

19. What is KYC, and why is it important?

KYC (Know Your Customer) is a regulatory process that verifies the identity of clients to prevent illegal activities like money laundering. It is important to ensure compliance with financial regulations and protect against fraud.

Explanation:

KYC is a crucial regulatory requirement in fintech, ensuring that companies operate within the law.

20. Can you explain the difference between traditional banking and digital banking?

Traditional banking involves physical branches and manual processes, while digital banking allows customers to perform transactions and access services online. Digital banking offers greater convenience and speed for customers.

Explanation:

Understanding the shift from traditional to digital banking is important for any fintech role.

21. How do you ensure a fintech product is user-friendly?

Ensuring a fintech product is user-friendly involves conducting user research, creating intuitive interfaces, and continuously gathering feedback from users to make improvements. Simplicity and accessibility are key to user satisfaction.

Explanation:

User experience is critical in fintech, where customers expect seamless and easy-to-use products.

22. What is two-factor authentication, and how does it enhance security?

Two-factor authentication (2FA) requires users to verify their identity through two different methods, such as a password and a verification code sent to their phone. It adds an extra layer of security and reduces the risk of unauthorized access.

Explanation:

2FA is a widely-used security feature that enhances protection for financial transactions.

23. How would you handle a technical issue in a live fintech application?

In the event of a technical issue, I would first isolate the problem, communicate with the relevant teams, and work on a quick resolution. Keeping the client informed and ensuring minimal disruption to services is crucial.

Explanation:

Handling live issues requires quick thinking and effective communication with technical teams.

24. How do you ensure financial data is securely transmitted in a fintech application?

Securing financial data involves using encryption protocols like SSL/TLS, ensuring secure API communication, and using tokenization to protect sensitive information during transmission.

Explanation:

Data security is paramount in fintech, where sensitive financial information is frequently transmitted.

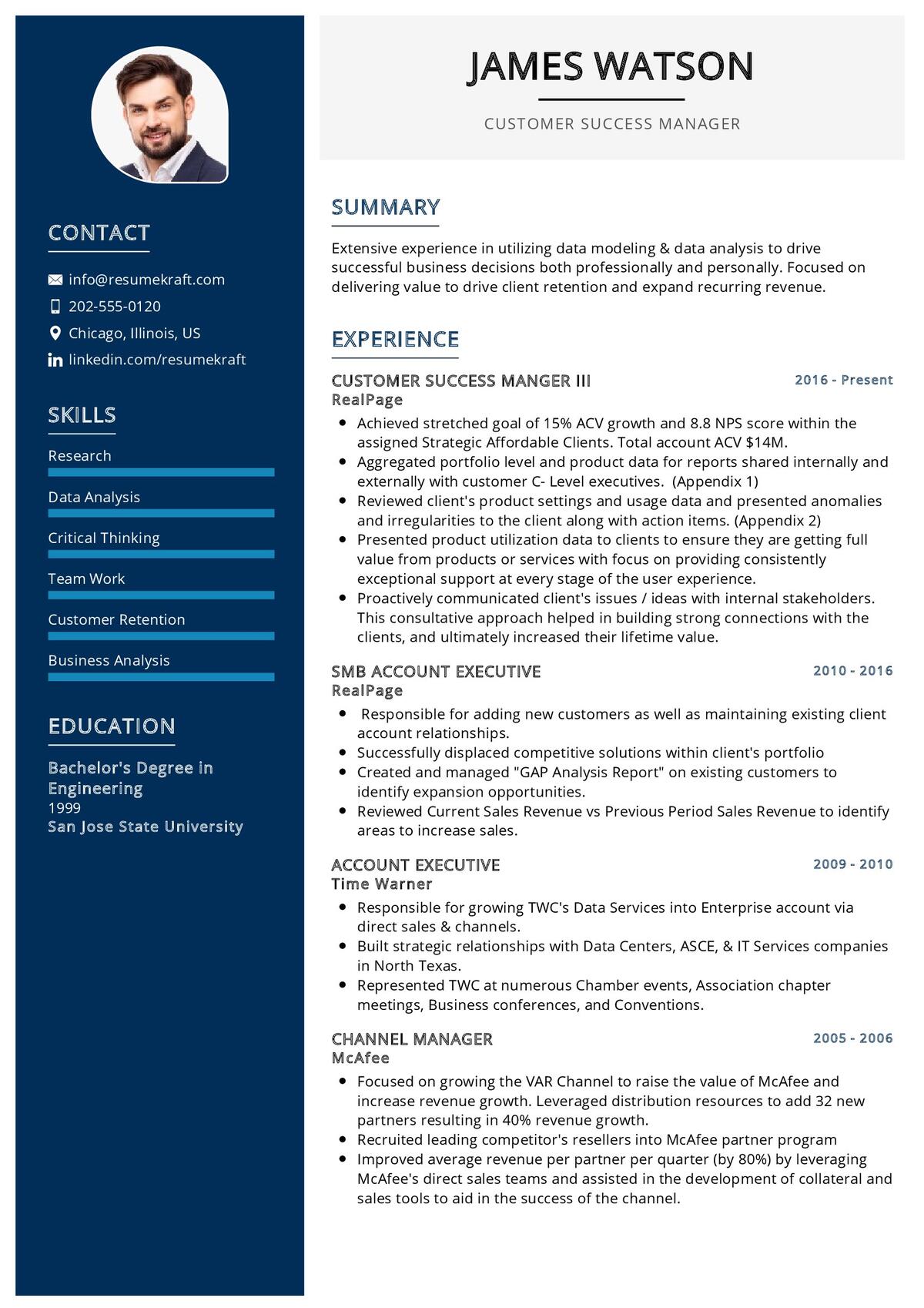

Planning to Write a Resume?

Check our job winning resume samples

25. What are your thoughts on cryptocurrency and its future in fintech?

Cryptocurrency has the potential to revolutionize fintech by offering decentralized, secure, and borderless transactions. However, it also faces regulatory challenges that need to be addressed before widespread adoption.

Explanation:

Understanding the impact of emerging trends like cryptocurrency is crucial for fintech professionals.

26. Can you explain the importance of UX/UI design in fintech?

UX/UI design is essential in fintech as it directly impacts how users interact with financial services. A well-designed interface makes complex processes intuitive, increasing user satisfaction and adoption rates.

Explanation:

UX/UI design is a key aspect of fintech products, ensuring ease of use and engagement for customers.

27. What is your approach to testing fintech applications?

I follow a thorough testing process that includes functional testing, security testing, and performance testing. Ensuring that the application is secure, reliable, and fast is essential before launching any fintech product.

Explanation:

Fintech applications must be rigorously tested to ensure they meet high standards of security and reliability.

28. How would you design a mobile payment solution?

To design a mobile payment solution, I would prioritize security, user experience, and seamless integration with various payment gateways. The solution must be fast, intuitive, and compatible with both Android and iOS platforms.

Explanation:

Mobile payment solutions are a significant part of fintech, requiring a balance of security and usability.

29. How do you handle data breaches in fintech?

In case of a data breach, the first step is to contain the breach, followed by identifying the source and assessing the damage. Informing affected users, working on damage control, and implementing stronger security measures are essential steps.

Explanation:

Handling a data breach effectively is crucial to maintaining user trust in fintech companies.

30. What are some challenges of working with financial data?

Working with financial data involves challenges such as ensuring accuracy, maintaining security, and complying with various regulatory requirements. Additionally, handling large volumes of sensitive information requires robust infrastructure.

Explanation:

Financial data is sensitive, and its proper handling is critical for regulatory and operational success.

31. What tools do you use for debugging fintech applications?

I use tools like Postman for API testing, Sentry for error tracking, and traditional debuggers within the development environment (such as Chrome Developer Tools or Python’s pdb) to identify and fix issues in fintech applications.

Explanation:

Debugging tools are essential for maintaining high-performing fintech applications.

32. How would you improve an existing fintech product?

To improve an existing fintech product, I would analyze user feedback, identify pain points, and work on solutions that enhance functionality, security, and user experience. Continuous improvement is key to staying competitive in the market.

Explanation:

Fintech products must evolve based on user needs and technological advancements.

33. How do you prioritize features in a fintech product?

I prioritize features based on their impact on user experience, security, and business goals. Balancing customer needs with technical feasibility is crucial for delivering a well-rounded product.

Explanation:

Feature prioritization is important for delivering a product that meets both user and business needs.

34. How do you ensure a fintech product is scalable?

To ensure scalability, I would use cloud infrastructure, implement microservices architecture, and design the system to handle increasing loads without affecting performance. Scalability ensures long-term growth for fintech products.

Explanation:

Scalability is critical for fintech products, as they must handle growing user bases and data loads.

35. Can you describe your experience working in agile development?

I have experience working in agile development, where I collaborated with cross-functional teams, participated in daily standups, and worked in short sprints to deliver features incrementally. This approach helped improve productivity and collaboration.

Explanation:

Agile development is commonly used in fintech, allowing for faster and more flexible product development.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.

36. How do you ensure a fintech application is accessible to all users?

Ensuring accessibility involves adhering to WCAG guidelines, providing alternative text for images, designing for screen readers, and ensuring that the user interface is usable by people with disabilities. Accessibility increases inclusivity and usability.

Explanation:

Accessibility is essential for reaching a wider audience and ensuring that fintech products are inclusive.

Conclusion

Fable Fintech provides exciting career opportunities for those who are passionate about fintech innovations, especially in areas like cross-border payments, blockchain, and AI. By preparing for these Fable Fintech interview questions, you’ll be well-equipped to demonstrate your expertise, problem-solving abilities, and passion for the industry.

As you prepare for your interview, it’s essential to have a well-structured resume that highlights your skills and experiences. Check out our resume builder to create a professional resume that stands out. You can also explore our free resume templates and resume examples to get inspiration and insights for crafting the perfect resume for your fintech career journey.