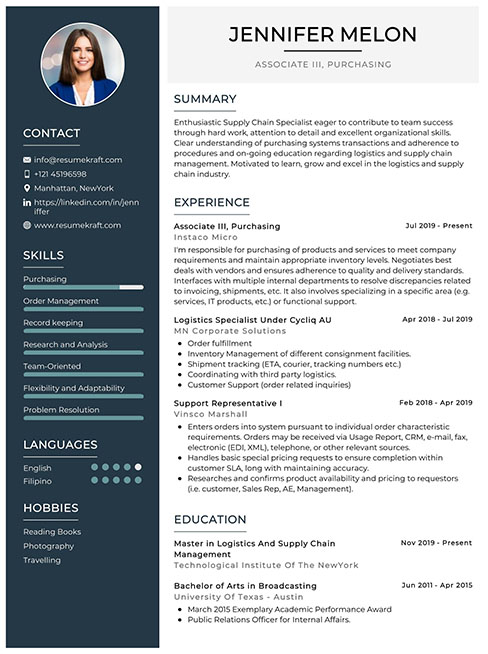

The realm of taxation is both fascinating and complex, offering a plethora of opportunities for aspiring tax professionals. Whether you’re looking to kickstart your career as a tax consultant, an auditor, or a tax advisor, you’ll have to prove your expertise in tax concepts and regulations during interviews. To help you prepare, this article offers a list of common tax-related interview questions, complete with well-thought-out answers and explanations.

This guide aims to cover a wide range of questions that recruiters commonly ask in interviews for tax-related roles. These questions aren’t just for freshers; they’re also relevant for those making a career transition. So, without further ado, let’s get into the specifics and help you arm yourself with the knowledge you need to succeed.

- Top 19 Basic Tax Questions for Interview

- 1. Can you explain the difference between a tax credit and a tax deduction?

- 2. What is Alternative Minimum Tax (AMT)?

- 3. Can you explain the basics of progressive taxation?

- 4. How do you handle deadline pressure during tax season?

- 5. What are capital gains, and how are they taxed?

- 6. Can you explain the concept of Double Taxation?

- 7. What is a W-4 form, and what is its importance?

- 8. How do VAT and Sales Tax differ?

- 9. What

- 10. Can you explain the concept of Tax Evasion?

- 11. What is the difference between Tax Avoidance and Tax Evasion?

- 12. How do you keep up with changing tax laws and regulations?

- 13. What are Depreciable Assets, and how are they accounted for in taxation?

- 14. Can you discuss the importance of auditing in taxation?

- 15. Explain the concept of Withholding Tax.

- 16. How would you resolve a discrepancy in a client’s tax return?

- 17. What is Estate Tax, and when does it apply?

- 18. What strategies do you recommend for tax planning?

- 19. How do you handle ethical dilemmas in taxation?

- Conclusion

Top 19 Basic Tax Questions for Interview

Remember, tax interviews can be tough, and they often require you to have both theoretical knowledge and practical experience. Here are the questions you should prepare for.

1. Can you explain the difference between a tax credit and a tax deduction?

Understanding basic tax terms like tax credits and deductions is fundamental for anyone in a tax-related role. Tax credits reduce the amount of income tax you have to pay, while tax deductions lower your taxable income.

Sample Answer

“A tax credit directly reduces the tax liability dollar-for-dollar. For example, if you owe $1,000 in taxes and have a $300 tax credit, you’ll owe $700. On the other hand, a tax deduction lowers your taxable income. If you have a $50,000 income and a $5,000 deduction, you’ll be taxed on $45,000. In short, tax credits lower your tax bill, and tax deductions lower the income on which the bill is calculated.”

2. What is Alternative Minimum Tax (AMT)?

The concept of the Alternative Minimum Tax is essential for tax professionals, as it ensures that individuals and corporations pay a minimum amount of income tax.

Sample Answer

“Alternative Minimum Tax (AMT) is designed to prevent taxpayers, particularly high-income individuals or corporations, from avoiding their fair share of taxes by using various exemptions, deductions, or credits. It sets a minimum tax rate that these entities are required to pay, regardless of the deductions they may qualify for.”

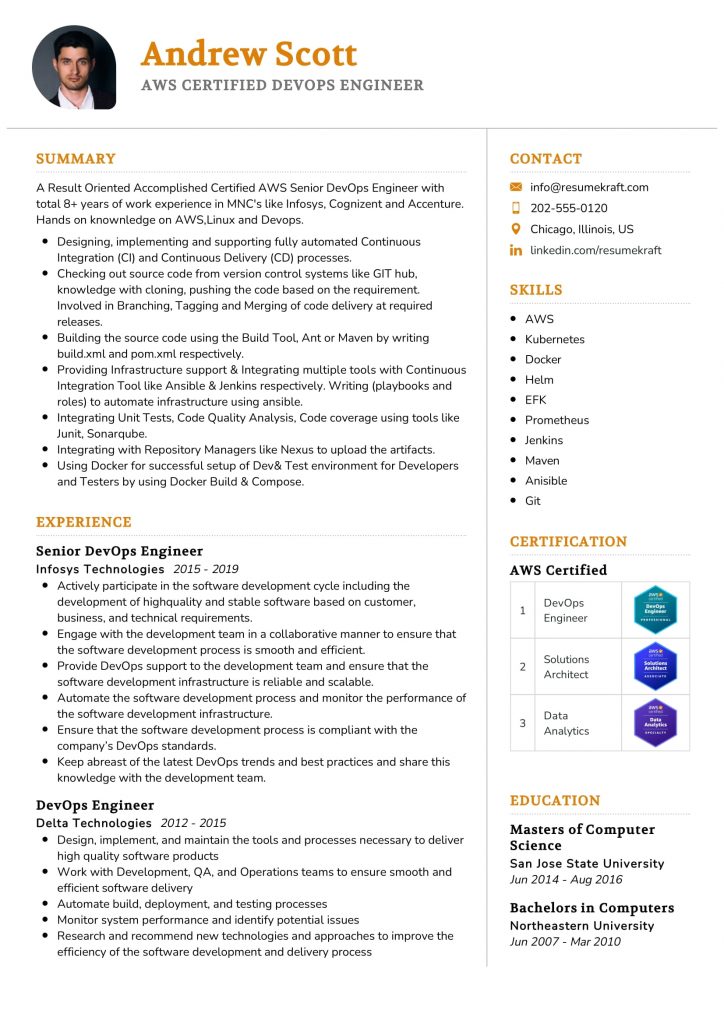

Build your resume in just 5 minutes with AI.

3. Can you explain the basics of progressive taxation?

Progressive taxation is a cornerstone of many tax systems around the world, making it an essential concept to understand.

Sample Answer

“Progressive taxation refers to a tax system where the rate of taxation increases as the income of the taxpayer increases. The idea is to distribute the tax burden more equitably, with wealthier individuals contributing a higher percentage of their income. This system aims to achieve social equity and economic redistribution.”

4. How do you handle deadline pressure during tax season?

Tax season is notoriously hectic. How you handle stress and meet deadlines is key to succeeding in a tax-related role.

Sample Answer

“I excel in high-pressure situations and employ a detailed planning strategy to get through tax season. I prioritize tasks based on their complexity and deadline urgency, utilize project management software to keep track of responsibilities, and work in focused time blocks to maximize efficiency.”

5. What are capital gains, and how are they taxed?

Capital gains are an important concept, especially for roles that deal with investments or property taxation.

Sample Answer

“Capital gains are the profits made from selling an asset like stocks, real estate, or bonds. They are generally taxed differently than regular income. In the United States, for example, short-term capital gains are taxed as regular income, whereas long-term capital gains have a lower tax rate, which varies depending on your overall income level.”

6. Can you explain the concept of Double Taxation?

Double taxation is a complex issue often encountered in international tax law, and understanding it is crucial for professionals in the field.

Sample Answer

“Double taxation occurs when the same income is taxed by two or more jurisdictions. This commonly happens in international business settings, where income earned in one country is also subject to taxation in the taxpayer’s home country. Various treaties and mechanisms are in place to mitigate the effects of double taxation.”

7. What is a W-4 form, and what is its importance?

Understanding basic tax forms is essential for anyone working in a tax-related role in the United States.

Sample Answer

“A W-4 form is used by employees in the United States to indicate their tax situation to employers. It helps employers determine the correct amount of federal income tax to withhold from an employee’s paycheck. The form includes allowances and status, which factor into the withholding calculation.”

8. How do VAT and Sales Tax differ?

Both Value-Added Tax (VAT) and Sales Tax are indirect taxes, but they work differently.

Sample Answer

“Sales tax is a tax on the end consumer and is added at the point of sale. Value-Added Tax (VAT), on the other hand, is applied at each stage of production or distribution. While sales tax is a one-time charge on the consumer, VAT is collected incrementally and is usually more complex to administer.”

9. What

steps would you take to ensure compliance with tax laws and regulations?

Compliance is a critical aspect of any tax-related role, as failure to comply can result in severe penalties for companies.

Sample Answer

“Ensuring compliance involves multiple steps, including staying updated with current tax laws, regularly auditing financial records, and implementing robust internal controls. I’d also consult legal experts when needed and would make sure to file all tax documents well before deadlines to allow time for any necessary corrections.”

10. Can you explain the concept of Tax Evasion?

Understanding the legal boundaries of taxation is essential to operate effectively and ethically in this field.

Sample Answer

“Tax evasion is the illegal act of deliberately falsifying information to reduce tax liability. This can include underreporting income, inflating deductions, or hiding money and its source. Tax evasion is a criminal offense that can result in severe fines and imprisonment.”

11. What is the difference between Tax Avoidance and Tax Evasion?

Distinguishing between legal tax minimization and illegal activities is critical in the taxation industry.

Sample Answer

“Tax Avoidance involves legally planning your transactions to minimize tax liabilities. It uses legitimate methods within the tax code to reduce taxes. On the other hand, Tax Evasion is the illegal practice of deliberately avoiding paying taxes owed. The primary difference is that tax avoidance is legal and tax evasion is not.”

12. How do you keep up with changing tax laws and regulations?

In the ever-evolving field of taxation, staying updated is not just an asset but a necessity.

Sample Answer

“I make it a point to subscribe to industry newsletters, follow trusted tax experts on social media, and regularly read publications from authoritative bodies like the IRS. I also participate in webinars and training programs to continually enhance my knowledge and understanding of the subject.”

13. What are Depreciable Assets, and how are they accounted for in taxation?

Understanding the treatment of assets, especially depreciable assets, is crucial for effective tax management.

Sample Answer

“Depreciable assets are long-term assets like machinery, buildings, or equipment that lose value over time due to wear and tear. In taxation, the cost of these assets can be spread over their useful life through a process called depreciation. This helps businesses reduce their taxable income each year for the lifespan of the asset.”

14. Can you discuss the importance of auditing in taxation?

Auditing is an integral part of taxation, ensuring compliance and accuracy in tax reporting.

Sample Answer

“Auditing serves as a validation mechanism, ensuring that all financial transactions and reports are accurate and in compliance with tax laws. It helps identify discrepancies, fraud, or errors that might lead to incorrect tax filing, thereby avoiding potential legal complications and penalties.”

15. Explain the concept of Withholding Tax.

Withholding Tax is a fundamental concept, especially relevant for roles dealing with employee taxation or international taxation.

Sample Answer

“Withholding tax is the amount held by the payer of income and paid directly to the government. For employees, this means a portion of their paycheck is withheld to cover income, Social Security, and Medicare taxes. In international settings, withholding tax may be applied on income earned within a country by a resident of another country.”

16. How would you resolve a discrepancy in a client’s tax return?

Problem-solving is an invaluable skill in the tax industry, where discrepancies can result in legal complications.

Sample Answer

“I would first thoroughly review all the documents and information provided by the client to identify the root cause of the discrepancy. Then, consult with legal experts and possibly the client to clarify any ambiguities. Depending on the issue, filing an amended tax return or taking corrective measures would be the next steps.”

17. What is Estate Tax, and when does it apply?

Estate Tax is a specialized area of taxation, generally applicable in cases of inheritance and wealth transfer.

Sample Answer

“Estate Tax is levied on the transfer of a deceased person’s estate before distribution to the heirs. In the U.S., for instance, federal estate tax applies to estates valued above a certain exemption limit, which is $11.7 million for individuals as of 2021. Taxes are paid from the estate itself before distribution.”

18. What strategies do you recommend for tax planning?

Effective tax planning can save substantial sums of money, making it an essential service offered by tax professionals.

Sample Answer

“Some of the key strategies I recommend include making the most of tax-advantaged accounts like 401(k)s, taking advantage of tax credits, and deductions, and optimizing the timing of income and expenses to reduce taxable income. It’s also crucial to consider the implications of short-term vs long-term capital gains.”

19. How do you handle ethical dilemmas in taxation?

Ethics plays a critical role in taxation, especially when clients request strategies that skirt the line of legality.

Sample Answer

“If faced with an ethical dilemma, I would refer to the professional guidelines and ethics codes that govern tax professionals. Open communication with the client about why a particular strategy is not advisable would be my approach. If the issue persists, consulting with senior colleagues or legal advisors would be the next step.”

Conclusion

Congratulations, you’ve reached the end of our exhaustive list of basic tax questions you might encounter in a tax-related job interview. Whether you’re a fresher or an experienced professional making a career shift, this guide aims to prepare you for a variety of questions that test both your technical knowledge and situational readiness. With this preparation, you’re now better equipped to ace that interview and step into your next role with confidence.

Remember to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.