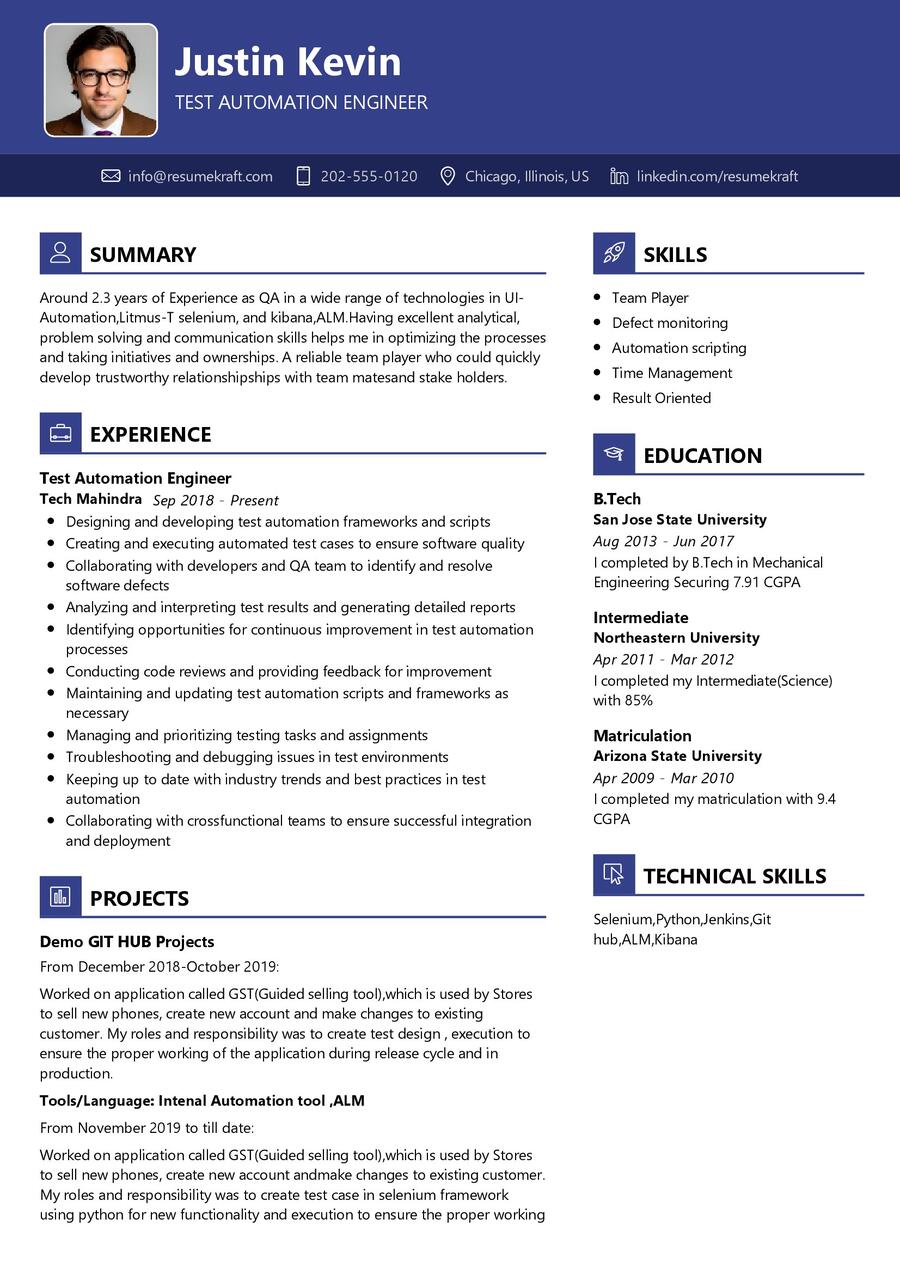

Test Automation Engineer CV Sample

Are you a Test Automation Engineer by profession and looking for a career change? We have good news for you! use our job-winning professional Test Automation Engineer CV Sample template. You don’t have to start writing from scratch. Just click “Edit CV” and modify it with your details. Update the template fonts and colors to have the best chance of landing your dream job. Find more CV Templates.