Top 19 Clinical Coordinator Interview Questions and Answers

Securing a role as a clinical coordinator is an exciting step forward in one’s career in the healthcare sector. It involves overseeing clinical trials or healthcare services and ensuring the smooth and effective functioning of healthcare facilities. As you gear up to land that coveted position, being well-prepared for the interview is crucial. In this article, we delve deep into the role of a clinical coordinator and walk you through the frequently asked interview questions, complemented with robust sample answers to each one.

To facilitate your preparation for the clinical coordinator role, we have carefully curated a list of 19 prominent questions that you might encounter during your interview. We endeavor to equip you with insights and responses that would showcase your understanding and commitment to the role. Let’s gear up and step confidently onto the platform where your knowledge meets opportunity.

- Top 19 Clinical Coordinator Interview Questions and Answers

- 1. Can you explain the role of a clinical coordinator?

- 2. What motivated you to pursue a career as a clinical coordinator?

- 3. How would you ensure the compliance of your team with the regulatory requirements?

- 4. Can you discuss a time when you improved a process or implemented a new strategy in a clinical setting?

- 5. How do you manage your team during high-pressure situations, such as emergencies?

- 6. Describe a situation where you had to deal with a difficult team member and how you handled it.

- 7. Can you explain how you stay abreast of the latest developments in the healthcare sector?

- 8. How do you ensure the satisfaction of patients under your care?

- 9. How would you foster a culture of continuous improvement in your team?

- 10. How do you handle confidential information in a clinical setting?

- 11. How would you ensure that your team meets its goals and objectives?

- 12. Can you talk about a challenging decision you had to make in your past role and how you approached it?

- 13. How do you manage work-life balance for yourself and your team?

- 14. What strategies would you employ to retain high-performing employees?

- 15. How would you deal with a situation where there are conflicts among team members?

- 16. How familiar are you with the healthcare management software used in clinical settings?

- 17. How do you prioritize tasks when the clinical setting is extremely busy?

- 18. How do you stay motivated in a demanding job such as a clinical coordinator?

- 19. Can you explain how you would handle a situation where a team member is resistant to adopting new technology?

- Conclusion

Top 19 Clinical Coordinator Interview Questions and Answers

As we begin, keep in mind that the potential questions could touch upon various aspects including your technical knowledge, managerial skills, and understanding of the healthcare environment. Let’s delve into each question, with a detailed explanation followed by a sample answer to help you forge the perfect responses.

1. Can you explain the role of a clinical coordinator?

Understanding the responsibilities and scope of the role you are interviewing for is essential.

Sample Answer

“A clinical coordinator plays a pivotal role in healthcare settings, overseeing the planning and implementation of clinical programs and ensuring they comply with regulatory standards. The role involves liaising with various departments, managing staff, and ensuring patient satisfaction by delivering high-quality services. Drawing from my experience and skills, I am prepared to take on these responsibilities to foster a positive and efficient clinical environment.”

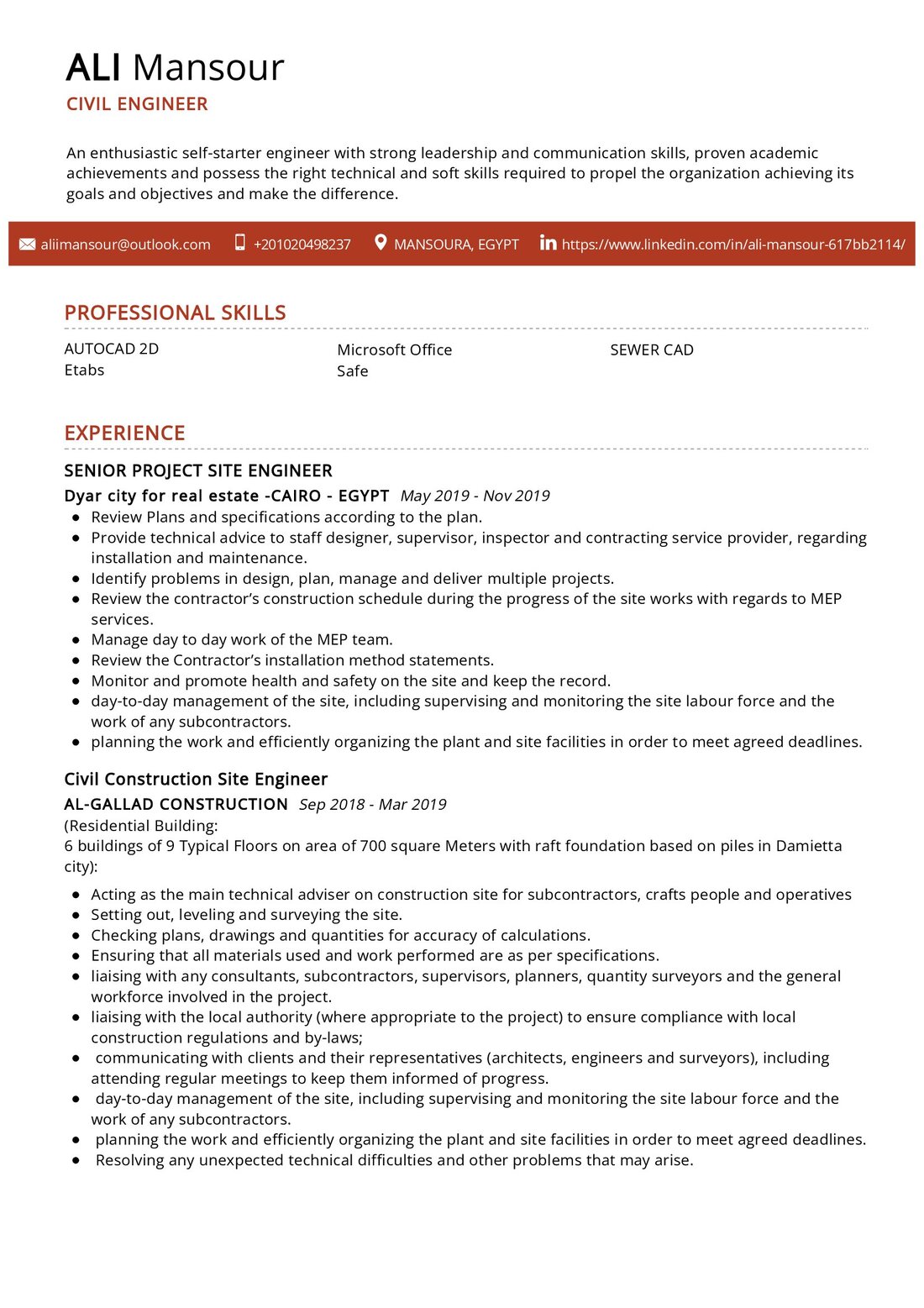

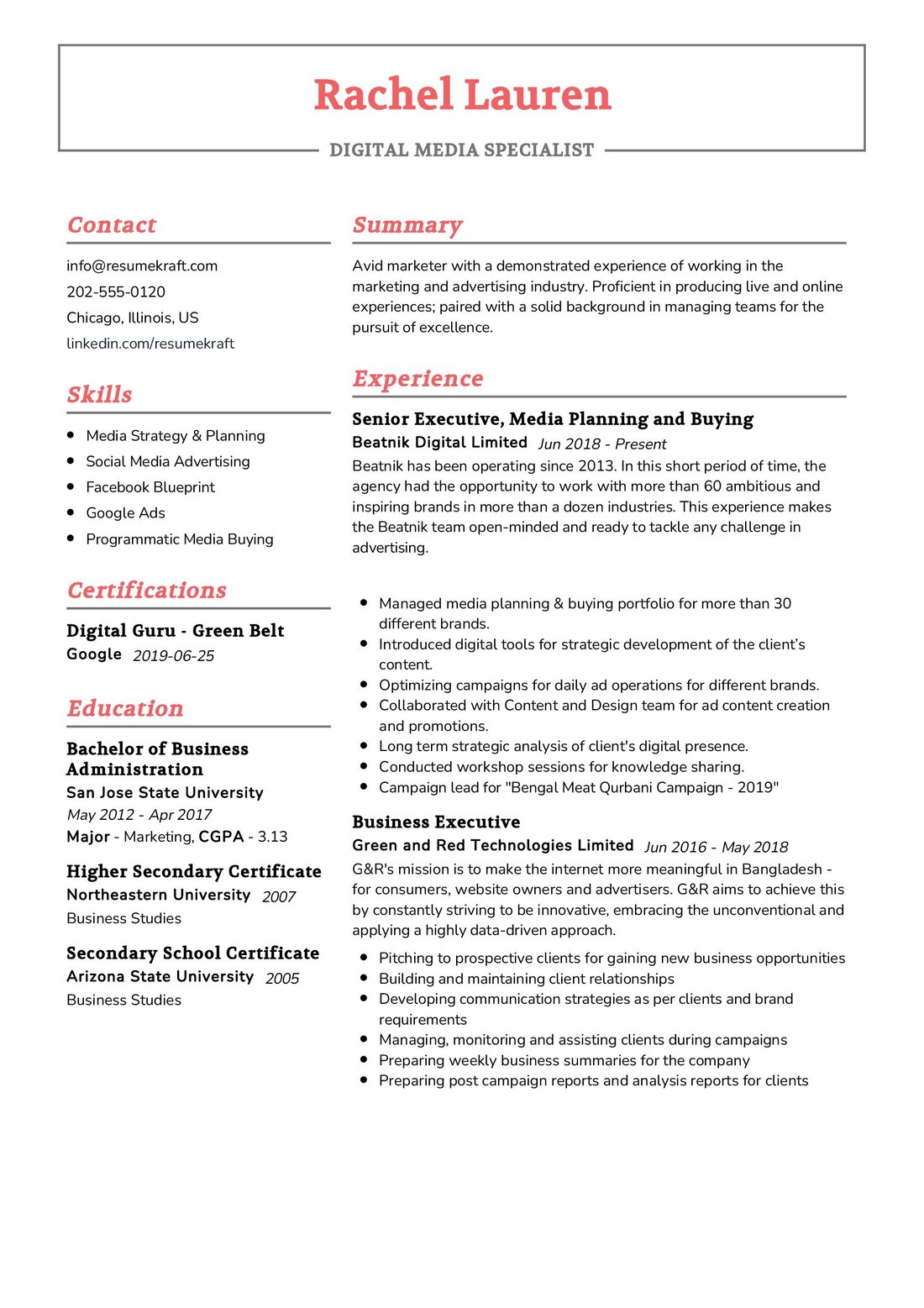

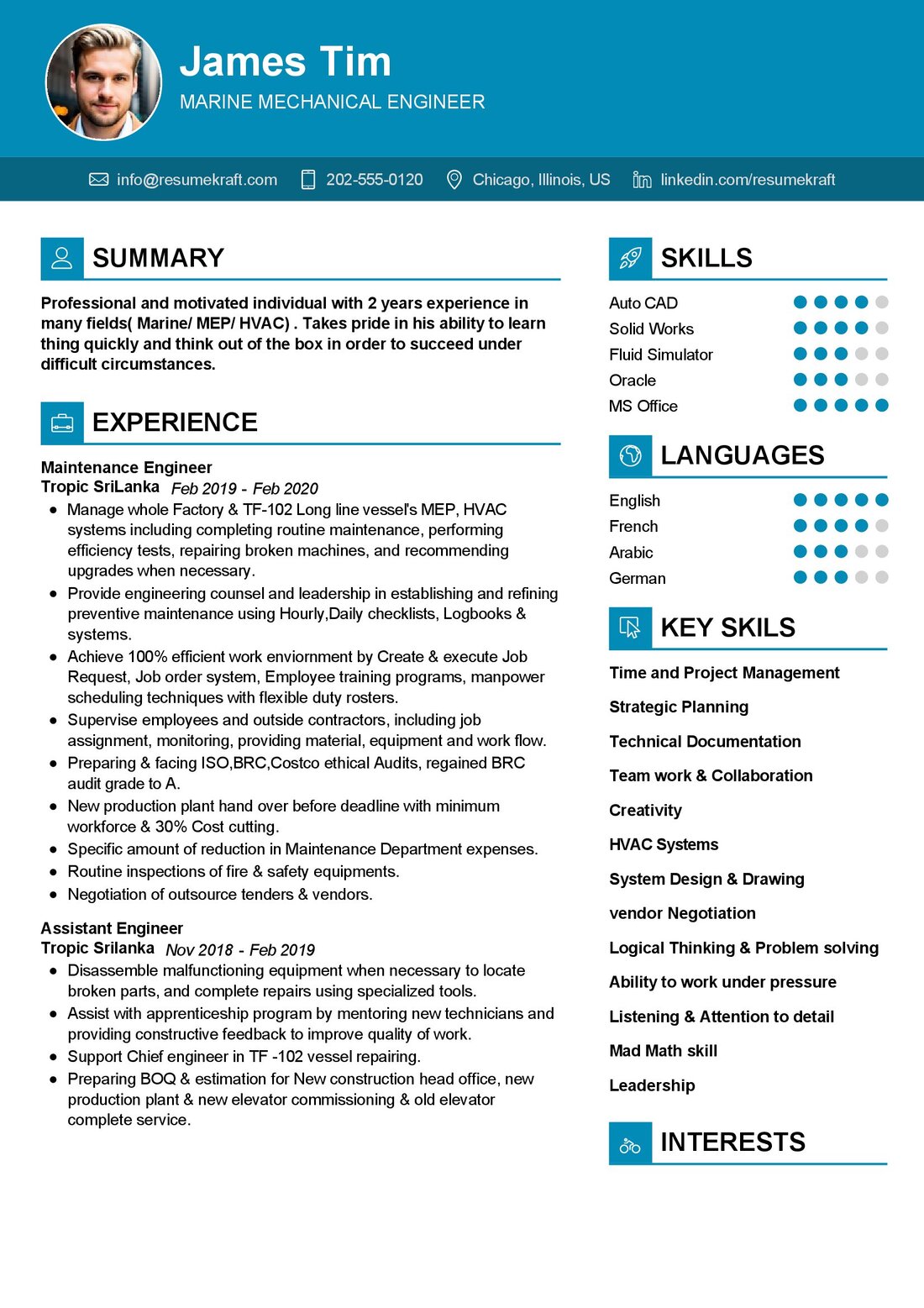

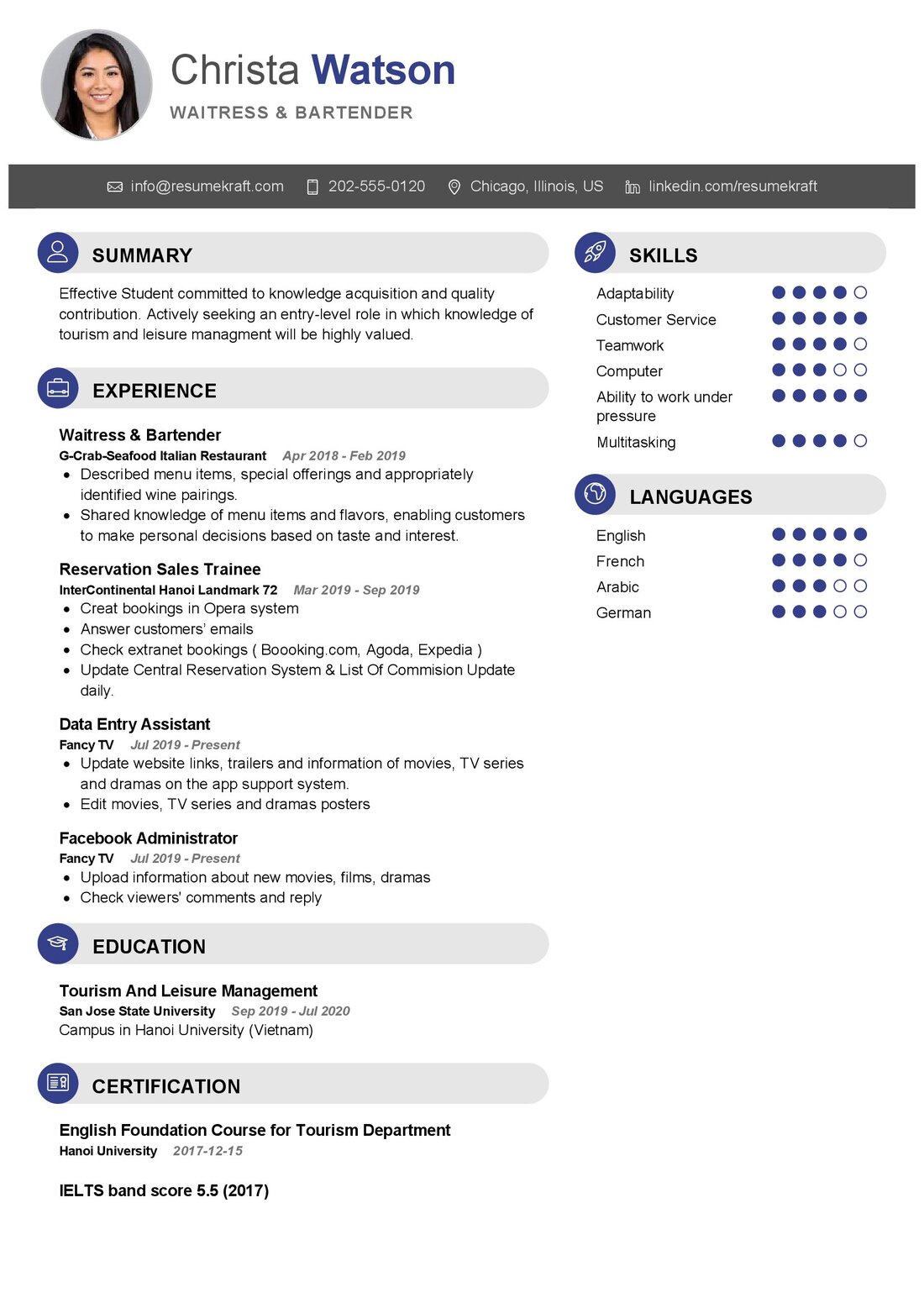

Build your resume in just 5 minutes with AI.

2. What motivated you to pursue a career as a clinical coordinator?

This question seeks to understand your passion and commitment to this career path.

Sample Answer

“Having worked in the healthcare sector for several years, I have developed a profound respect for roles that serve as a linchpin in clinical settings. I am driven by a desire to facilitate better healthcare delivery through effective coordination and management of clinical programs. Leveraging my skills and experience, I am eager to contribute positively to your esteemed organization and foster a culture of excellence.”

3. How would you ensure the compliance of your team with the regulatory requirements?

Compliance with regulations is a fundamental aspect of healthcare, making this question vital.

Sample Answer

“To ensure compliance, I would implement regular training sessions, keeping the team updated with the latest regulations and guidelines. Creating a comprehensive manual detailing the necessary protocols and encouraging an open dialogue for any queries would be my approach. Moreover, conducting regular audits and feedback sessions will help maintain a culture of compliance and continuous improvement.”

4. Can you discuss a time when you improved a process or implemented a new strategy in a clinical setting?

This question assesses your proactive and innovative approach to improving healthcare delivery.

Sample Answer

“Certainly, at my previous role, I noticed the appointment scheduling system was creating bottlenecks and delays. I initiated a transition to a more streamlined, digital scheduling system that allowed for better tracking and reduced wait times. By training the staff on the new system and seeking feedback to make continuous improvements, we enhanced the patient experience substantially and increased efficiency.”

5. How do you manage your team during high-pressure situations, such as emergencies?

Handling emergencies efficiently is a critical part of a clinical coordinator’s role.

Sample Answer

“In high-pressure situations, maintaining calm and composed leadership is key. I would prioritize urgent tasks and delegate them effectively, ensuring smooth communication and swift action. Additionally, I’d foster a culture of preparedness through regular drills and training, equipping the team to handle emergencies proficiently, while always putting patient safety and care at the forefront.”

6. Describe a situation where you had to deal with a difficult team member and how you handled it.

Conflict resolution skills are essential in maintaining a harmonious working environment.

Sample Answer

“In my previous role, I had a team member who often missed deadlines, affecting the team’s performance. I arranged a private meeting to understand their perspective and realized they were struggling with work-life balance. We worked out a more flexible schedule and provided additional support, which not only improved their performance but also fostered a more supportive and understanding work environment.”

7. Can you explain how you stay abreast of the latest developments in the healthcare sector?

Being updated with the latest trends and developments indicates your enthusiasm and commitment to the role.

Sample Answer

“I regularly read reputed healthcare journals and subscribe to newsletters from healthcare organizations. I also attend webinars and workshops to enhance my knowledge and network with professionals in the field. These avenues provide me with the latest updates and insights, which I strive to incorporate in my work to foster innovation and improvement in healthcare delivery.”

8. How do you ensure the satisfaction of patients under your care?

Patient satisfaction is a crucial metric in healthcare, making this question central to your role as a clinical coordinator.

Sample Answer

“To ensure patient satisfaction, I prioritize transparent and empathic communication, where we actively listen to the patient’s concerns and needs. Regular feedback surveys and creating a comfortable

and welcoming environment are also part of my approach. It’s vital to foster a culture where the patient’s wellbeing is central, and every team member works collaboratively to provide the best possible care.”

9. How would you foster a culture of continuous improvement in your team?

In this role, promoting a progressive and learning environment is essential.

Sample Answer

“I believe in setting clear expectations and goals for the team, followed by regular check-ins to discuss progress and potential improvements. Encouraging open communication where team members can share their ideas and feedback freely is pivotal. I also emphasize on continuous learning through workshops and training sessions to keep the team updated and foster a culture of constant growth and improvement.”

10. How do you handle confidential information in a clinical setting?

Handling sensitive information with utmost confidentiality is a significant part of the role.

Sample Answer

“Confidentiality is a cornerstone in healthcare. I adhere strictly to the regulatory compliance and the guidelines of the organization when it comes to handling sensitive information. I ensure that my team is well-trained and aware of the importance of maintaining confidentiality, employing secure channels for communication and encouraging them to report any breaches immediately to maintain trust and integrity in the clinical environment.”

11. How would you ensure that your team meets its goals and objectives?

Meeting goals and objectives timely is imperative in a clinical setting, ensuring a smooth workflow.

Sample Answer

“To ensure the team meets its objectives, I believe in creating a supportive and collaborative work environment. I would establish clear objectives and timelines, regularly monitor the progress, and facilitate the removal of any obstacles hindering the performance. Moreover, recognizing and celebrating achievements fosters motivation and encourages the team to consistently strive towards meeting their goals.”

12. Can you talk about a challenging decision you had to make in your past role and how you approached it?

This question gauges your problem-solving and decision-making skills in difficult situations.

Sample Answer

“In my past role, there was an instance where a key member of the team had to be let go due to consistent underperformance despite several interventions. It was a difficult decision as they had been with us for a long time. I approached it by having a candid, respectful conversation with the individual, explaining the reasons clearly, and offering support in finding new opportunities. It was important to make a decision that safeguarded the quality of service we provided while also being compassionate.”

13. How do you manage work-life balance for yourself and your team?

Work-life balance is essential in maintaining a healthy work environment and avoiding burnout.

Sample Answer

“For myself, I ensure to allocate time for personal rejuvenation and encourage my team to do the same. I promote a culture where employees can openly discuss their workload and we find collaborative solutions to manage it effectively, ensuring that no one is overwhelmed. Additionally, I advocate for regular breaks and utilizing leaves to recharge, fostering a work environment that respects and values the importance of balance in life.”

14. What strategies would you employ to retain high-performing employees?

Employee retention is vital in maintaining a steady and experienced workforce.

Sample Answer

“To retain high-performing employees, I would focus on creating a positive work environment where their efforts are recognized and rewarded. Providing opportunities for career growth through training and development programs, and offering mentorship can be significant. Moreover, maintaining open communication channels where they can voice their concerns and receive constructive feedback would foster a nurturing and encouraging work atmosphere.”

15. How would you deal with a situation where there are conflicts among team members?

Conflict resolution is a skill that is pivotal in maintaining harmony in the work environment.

Sample Answer

“In cases of conflicts, I would arrange for a meeting with the concerned parties to understand each one’s perspective clearly. Encouraging open and respectful communication is key. I would facilitate a solution-driven discussion where we can find a middle ground, promoting understanding and collaboration. It’s imperative to address conflicts timely to maintain a positive and productive work environment.”

16. How familiar are you with the healthcare management software used in clinical settings?

Your familiarity with tools and software used in healthcare settings is a vital aspect of the role.

Sample Answer

“I am proficient with several healthcare management software, having worked with systems like EPIC and Cerner in my previous roles. I believe in staying updated with the latest technologies and am quick to adapt to new systems, ensuring smooth integration and utilization in clinical workflows to enhance efficiency and patient care.”

17. How do you prioritize tasks when the clinical setting is extremely busy?

Understanding your approach to task prioritization in a hectic environment reflects your managerial skills.

Sample Answer

“In busy settings, I prioritize tasks based on urgency and importance, adopting a systematic approach to address the most critical issues first. I believe in delegating tasks effectively, leveraging the strengths of different team members to ensure smooth workflow. Constant communication and a collaborative approach help in managing the tasks proficiently without compromising on the quality of care.”

18. How do you stay motivated in a demanding job such as a clinical coordinator?

This question aims to understand your personal motivation and how you sustain it in a demanding role.

Sample Answer

“I stay motivated by keeping the larger goal in sight, which is to provide the best possible care to the patients. The satisfaction of seeing positive outcomes and the difference we make in patients’ lives is a significant motivator. I also value self-care and take time to recharge, coming back with renewed energy and focus. Moreover, cultivating a positive and supportive work environment where the team motivates each other is instrumental in sustaining motivation.”

19. Can you explain how you would handle a situation where a team member is resistant to adopting new technology?

Handling resistance to change is a common challenge, and your approach to this can be telling.

Sample Answer

“In such situations, I would take time to understand the concerns and apprehensions of the team member. Providing proper training and demonstrating the benefits of the new technology in improving efficiency can be persuasive. I believe in adopting a patient and collaborative approach, encouraging them to slowly familiarize themselves with the technology, offering support and feedback to ease the transition, ensuring a cohesive and adaptable team.”

Conclusion

Preparing for a clinical coordinator interview requires a deep understanding of the role and the responsibilities it entails. Through this comprehensive guide featuring the top 19 questions and answers, we hope to equip you with the confidence and readiness to shine in your interview. Remember, each question is a window to showcase your skills, experience, and your commitment to enhancing healthcare services. Good luck, and may you steer your career to new heights with a successful interview.

Remember to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.