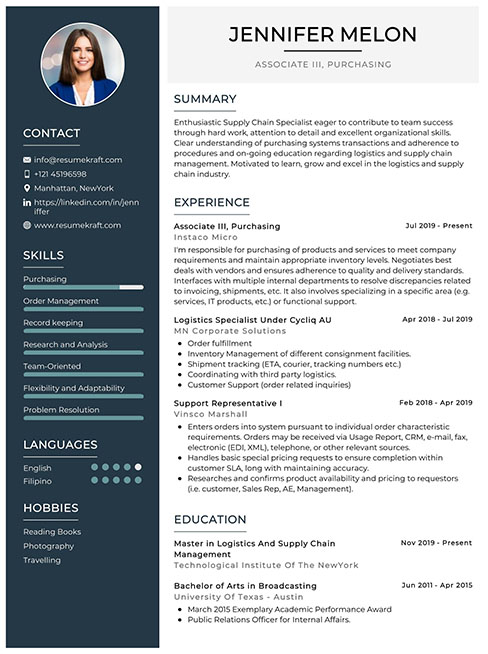

So you’ve set your sights on a career as a Financial Advisor, a role that is both intellectually stimulating and personally rewarding. With the increasing focus on personal finance and wealth management, Financial Advisors have become the cornerstone for helping individuals achieve their financial goals. But to carve your niche in this competitive field, acing the interview is the first major hurdle you need to cross. This article is a treasure trove of the most relevant interview questions you may face, complete with insights and sample answers to ensure you walk into your interview brimming with confidence.

Before diving into the questions, it’s essential to understand what the role entails. Financial Advisors wear multiple hats; they are planners, strategists, and educators rolled into one. Their work involves not just asset allocation but also tax planning, estate planning, and more. By the end of this guide, you’ll be better prepared to tackle any question thrown your way, so let’s get started!

- Top 21 Financial Advisor Interview Questions and Answers

- 1. Can you describe your experience with portfolio management?

- 2. How do you approach financial planning for a new client?

- 3. Explain a complex financial concept in simple terms.

- 4. How do you handle clients who are averse to taking risks?

- 5. How do you stay updated on financial markets and trends?

- 6. Can you discuss a time you helped a client achieve their financial goal?

- 7. What financial software are you familiar with?

- 8. Describe your experience with retirement planning.

- 9. How do you gain the trust of a new client?

- 10. Explain the difference between active and passive investment strategies.

- 11. How do you handle conflicts of interest?

- 12. What are your career goals as a Financial Advisor?

- 13. How would you react if a client wants to invest in a scheme you don’t recommend?

- 14. How do you handle stressful situations?

- 15. How would you advise a client looking for quick returns?

- 16. How do you evaluate investment opportunities?

- 17. What’s your approach to asset allocation?

- 18. Can you explain the concept of Tax Loss Harvesting?

- 19. How do you prioritize tasks?

- 20. What is your biggest professional achievement?

- 21. How do you manage client expectations?

- Conclusion

Top 21 Financial Advisor Interview Questions and Answers

Your future employer will likely probe into a variety of topics, ranging from technical know-how to soft skills like communication and problem-solving. Here’s a curated list of the top 21 questions to prepare for.

1. Can you describe your experience with portfolio management?

In this question, the interviewer is seeking to understand your hands-on experience with managing investment portfolios, which is a critical part of being a financial advisor.

Sample Answer

“In my previous role at XYZ Financial, I managed portfolios for over 50 clients with diverse financial goals. By implementing a mix of long-term and short-term investment strategies, I successfully generated an average annual return of 8% over three years.”

2. How do you approach financial planning for a new client?

This question aims to assess your methodology for building financial plans, which often serve as the roadmap for your client’s financial future.

Sample Answer

“My approach is holistic and starts with a thorough understanding of the client’s financial situation, goals, and risk tolerance. I then craft a personalized financial plan that includes not just investment strategies but also tax planning, estate planning, and other elements.”

Build your resume in just 5 minutes with AI.

3. Explain a complex financial concept in simple terms.

The ability to simplify complex information is crucial for a Financial Advisor, as you’ll need to explain intricate financial concepts to clients who may not have a financial background.

Sample Answer

“Compound interest is like a snowball effect for your money. Imagine rolling a small snowball down a snowy hill; it gathers more snow and grows larger as it rolls. Similarly, compound interest helps your money grow faster over time as the interest earns interest on itself.”

4. How do you handle clients who are averse to taking risks?

Risk tolerance varies among clients. This question aims to gauge your ability to deal with clients who are risk-averse and how you’d tailor your advice accordingly.

Sample Answer

“For risk-averse clients, I typically focus on more conservative investment options like bonds or dividend-paying stocks. I also emphasize the importance of a diversified portfolio to mitigate risk and educate them on how a balanced approach can achieve their financial goals with minimal risk.”

5. How do you stay updated on financial markets and trends?

Being up-to-date on market trends is essential for any Financial Advisor. The question seeks to know how you keep your knowledge current.

Sample Answer

“I follow several financial news outlets and subscribe to relevant publications. I also participate in webinars and workshops, and network with other professionals to gain diverse perspectives on market trends.”

6. Can you discuss a time you helped a client achieve their financial goal?

This question serves as an avenue for you to discuss your practical experience and your ability to deliver results.

Sample Answer

“One of my clients wanted to buy a home within five years but had no proper savings strategy. I helped them set up a diversified investment portfolio and a monthly saving plan. Within four years, they had saved enough for a down payment.”

7. What financial software are you familiar with?

In this digital age, proficiency in financial software is a must. This question assesses your technical skills.

Sample Answer

“I have hands-on experience with financial planning software like MoneyGuidePro and risk assessment tools like Riskalyze. I’m also proficient in using Excel for financial modeling.”

8. Describe your experience with retirement planning.

Retirement planning is often a key concern for clients, and this question tests your expertise in this particular area.

Sample Answer

“I have extensive experience in creating customized retirement plans. These plans take into account various income sources, like pensions and investments, and are designed to provide a stable income for clients during their retirement years.”

9. How do you gain the trust of a new client?

Trust is a cornerstone of the Financial Advisor-client relationship. This question aims to assess your interpersonal skills.

Sample Answer

“I believe in full transparency and open communication. During initial meetings, I take time to understand the client’s needs and provide a clear roadmap. I also provide regular updates and reviews to maintain transparency.”

10. Explain the difference between active and passive investment strategies.

Understanding

different investment approaches is crucial for a Financial Advisor. This question tests your technical expertise.

Sample Answer

“Active investment involves frequent buying and selling with the aim to outperform the market. Passive investment, on the other hand, aims to mimic a market index and generally involves less trading and lower costs.”

11. How do you handle conflicts of interest?

This question probes into your ethical standing, a critical trait for any financial advisor.

Sample Answer

“Ethical conduct is non-negotiable for me. If a conflict of interest arises, I disclose it to the concerned parties and recuse myself from the situation if needed.”

12. What are your career goals as a Financial Advisor?

Your interviewer wants to assess your long-term vision and gauge whether you’ll be a fit for the company in the long run.

Sample Answer

“In the short term, I aim to broaden my client base and gain expertise in specialized financial products. In the long run, I aspire to take up leadership roles, possibly heading a team of Financial Advisors.”

13. How would you react if a client wants to invest in a scheme you don’t recommend?

This question aims to test your client management skills, particularly when clients do not agree with your professional recommendations.

Sample Answer

“I would lay out the pros and cons of the investment and explain why I don’t recommend it. Ultimately, it’s the client’s decision, but I believe in providing all necessary information for them to make an informed choice.”

14. How do you handle stressful situations?

The role of a Financial Advisor can be stressful at times, especially during market downturns. This question tests your stress management skills.

Sample Answer

“I prioritize tasks and keep a level head, focusing on what can be controlled. I also take short breaks to clear my mind, ensuring that stress doesn’t affect my decision-making.”

15. How would you advise a client looking for quick returns?

Quick returns often come with high risks, and this question assesses how you’d counsel a client seeking rapid gains.

Sample Answer

“I would caution the client about the risks involved in investments that promise quick returns. While I can suggest higher-risk options, I make sure they are aware of the potential downsides.”

16. How do you evaluate investment opportunities?

Evaluating investments is a core responsibility, and this question aims to test your analytical abilities and decision-making skills.

Sample Answer

“I use a mix of quantitative and qualitative methods, such as financial ratios and management competency, to evaluate investment opportunities. I also assess how the investment aligns with the client’s goals and risk tolerance.”

17. What’s your approach to asset allocation?

Asset allocation is a critical aspect of financial planning, and your answer should reflect your understanding and strategy regarding the same.

Sample Answer

“I believe in a diversified approach, spreading assets across various classes like equities, bonds, and alternative investments. The allocation is primarily driven by the client’s financial goals, time horizon, and risk tolerance.”

18. Can you explain the concept of Tax Loss Harvesting?

Tax considerations are an important part of financial planning. This question aims to gauge your understanding of tax-saving strategies.

Sample Answer

“Tax Loss Harvesting involves selling off underperforming assets to realize losses, which can offset gains in other parts of the portfolio. It’s a strategic way to lower the tax burden.”

19. How do you prioritize tasks?

Time management and prioritization are vital skills for a Financial Advisor, given the multifaceted nature of the role.

Sample Answer

“I prioritize tasks based on urgency and importance. Client meetings and time-sensitive investment decisions take precedence. I also allocate specific times for research and professional development.”

20. What is your biggest professional achievement?

This question provides an opportunity to discuss a career highlight that you are particularly proud of.

Sample Answer

“My biggest professional achievement was recovering a client’s portfolio from a 20% loss to a 10% gain within a year through strategic asset reallocation and timely investments.”

21. How do you manage client expectations?

Managing client expectations is pivotal in a service-oriented profession like this. Your answer should reflect your skills in communication and relationship management.

Sample Answer

“I manage client expectations through transparent and regular communication. I provide realistic projections and keep them informed about the potential risks and rewards of their financial choices.”

Conclusion

You’re now equipped with the top 21 Financial Advisor interview questions and their expert-crafted answers. Remember, apart from technical proficiency, interpersonal skills, ethical conduct, and a thorough understanding of financial markets are the hallmarks of a successful Financial Advisor. Good luck with your interview, and may you forge a rewarding career in this exciting field!

Remember to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.