As a fresher KYC Analyst, you play a crucial role in ensuring compliance and risk management within financial institutions by verifying customer identities and monitoring transactions. This entry-level position not only offers new graduates the opportunity to gain valuable experience in the fast-paced financial sector but also equips them with essential skills in data analysis, regulatory knowledge, and attention to detail. However, with a competitive job market, freshers often face challenges in showcasing their limited experience. This article will guide you in crafting a compelling resume that highlights your academic achievements, projects, and transferable skills, making you stand out to potential employers.

- Fresher KYC Analyst resume examples

- Fresher KYC Analyst resume format

- Fresher KYC Analyst resume with no experience

- How to list your hard skills and soft skills on your fresher resume

- How to list your education and certifications on your fresher resume

- How to write your fresher KYC Analyst resume summary or objective

- Additional sections for a fresher KYC Analyst resume

- Key takeaways for writing a professional fresher KYC Analyst resume

- Frequently Asked Questions for Fresher KYC Analyst Resumes

Fresher KYC Analyst resume examples

Fresher KYC Analyst resume examples are invaluable for new graduates and entry-level job seekers as they provide a clear blueprint of what recruiters seek in candidates, despite limited work experience. These examples highlight essential skills, relevant coursework, and internships, helping beginners effectively showcase their potential. By understanding how to present their qualifications compellingly, freshers can significantly enhance their chances of standing out in a competitive job market.

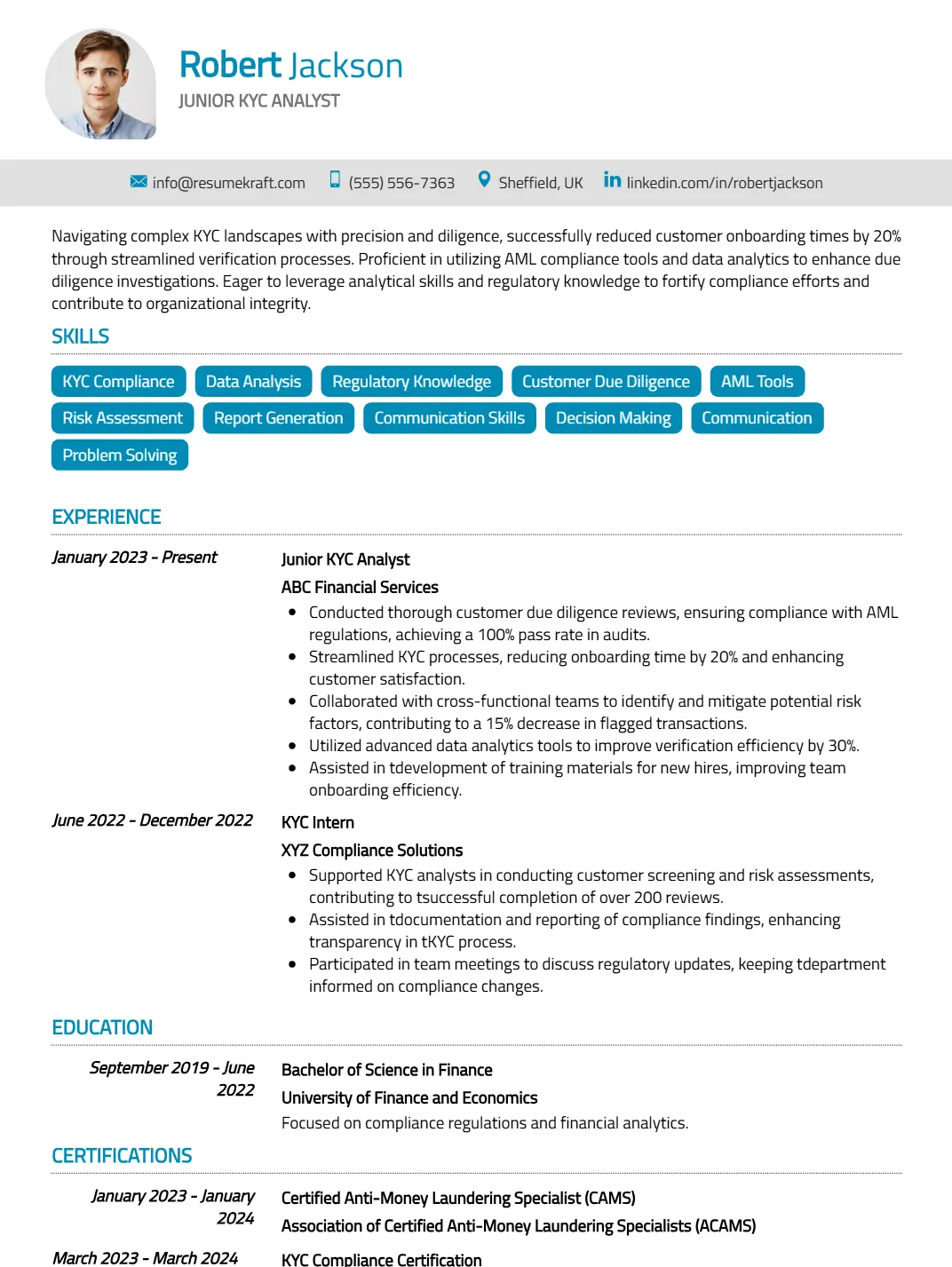

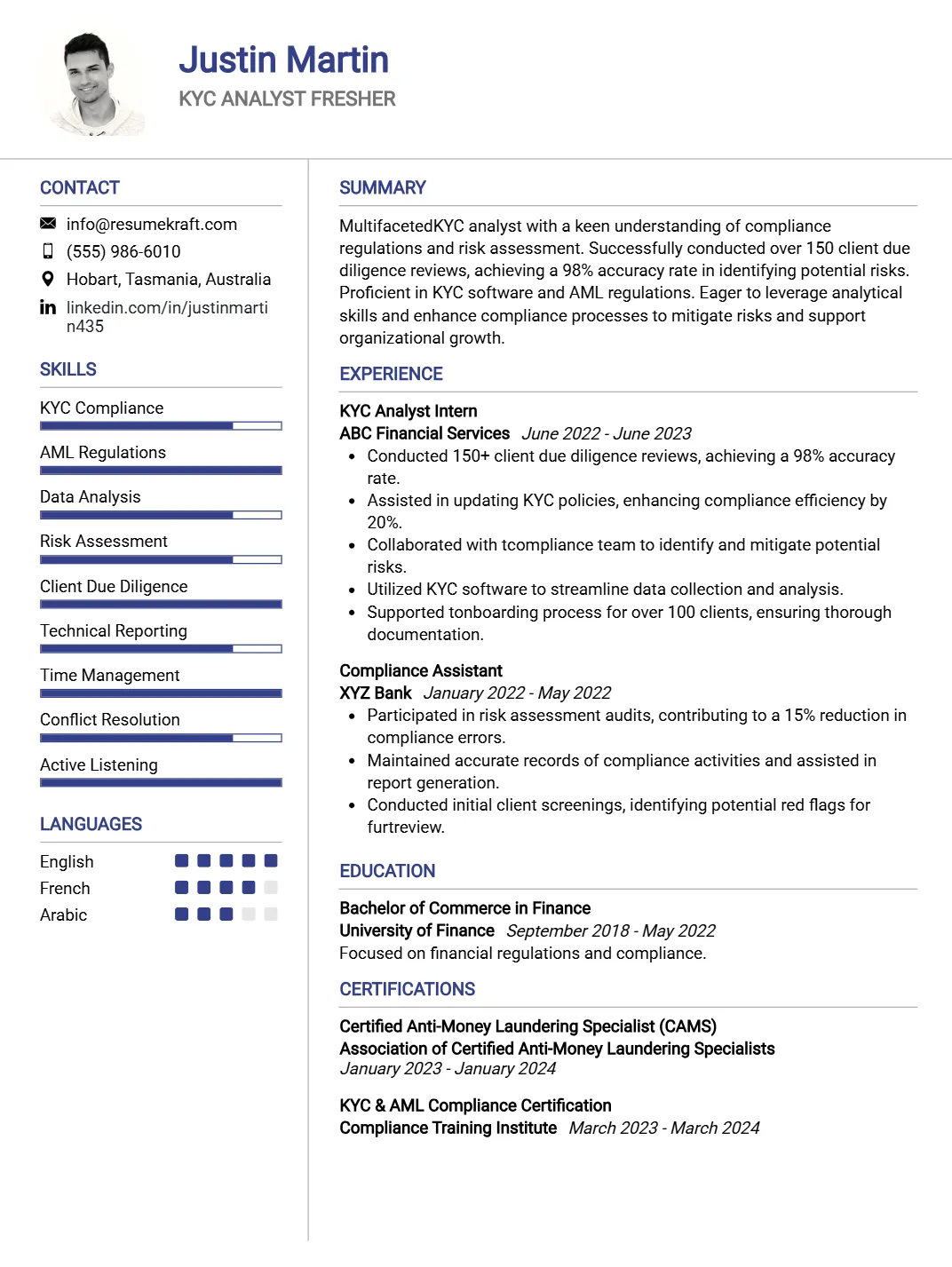

Fresher KYC Analyst Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills and experience for a Fresher KYC Analyst position, showcasing their expertise in KYC Compliance, Data Validation, and Risk Assessment. The structured format enhances readability and emphasizes key competencies, making it appealing to hiring managers. By incorporating industry-specific keywords, the resume ensures ATS compatibility, increasing visibility in applicant tracking systems. Furthermore, the strategic presentation of achievements from their Junior Analyst and internship roles demonstrates practical knowledge that aligns with the demands of the KYC field.

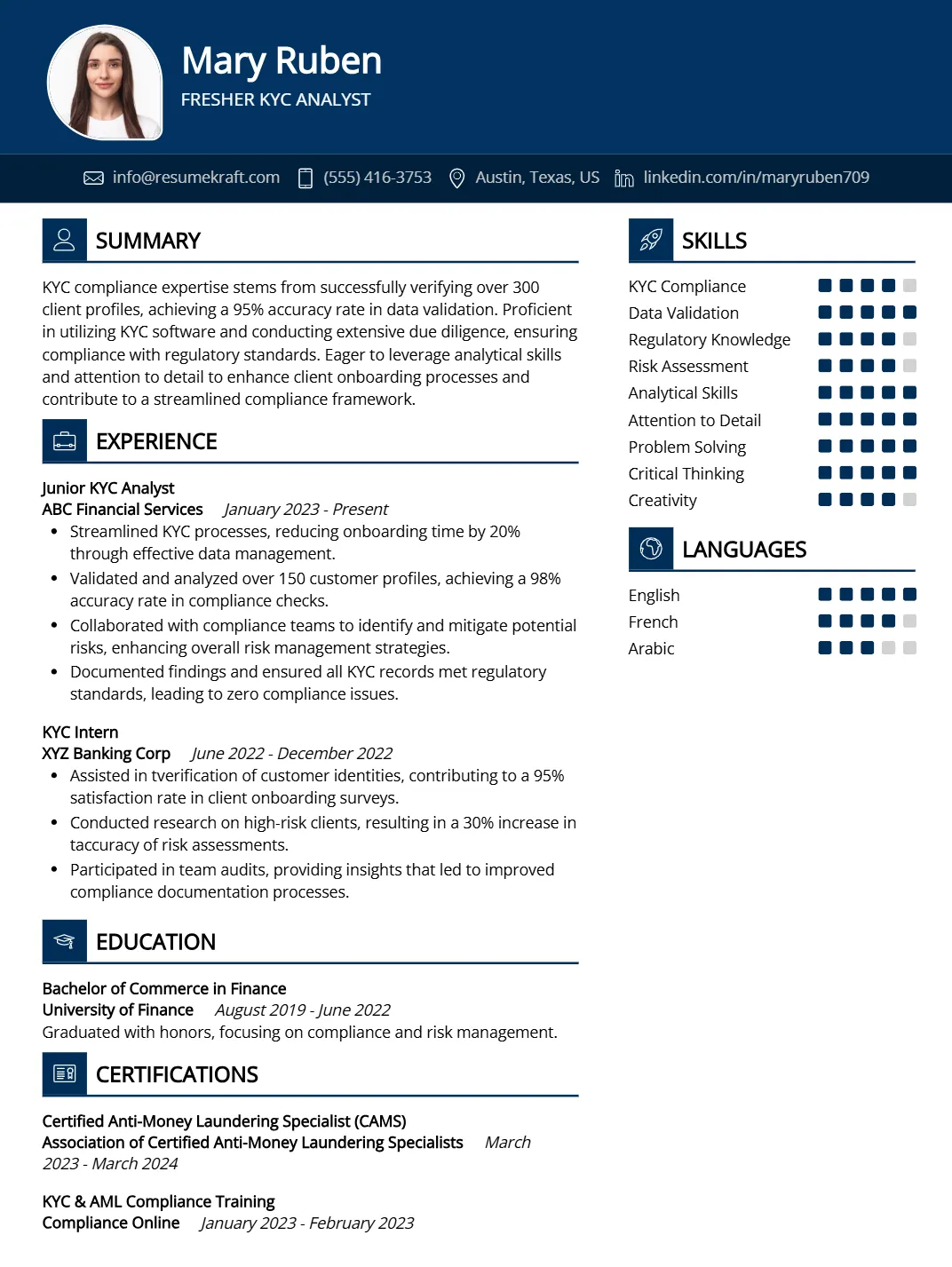

Entry-Level KYC Analyst Resume

Why This Resume Works

This resume effectively showcases the candidate’s alignment with the Entry-Level KYC Analyst position by highlighting key skills such as KYC Compliance, Data Analysis, and Risk Assessment. With relevant internship experience, it demonstrates practical knowledge that stands out. The structured format allows for easy navigation, enhancing readability for hiring managers. Additionally, the use of industry-specific keywords ensures ATS compatibility. Strategic presentation of achievements emphasizes attention to detail and regulatory knowledge, making the candidate a compelling choice for potential employers in the compliance sector.

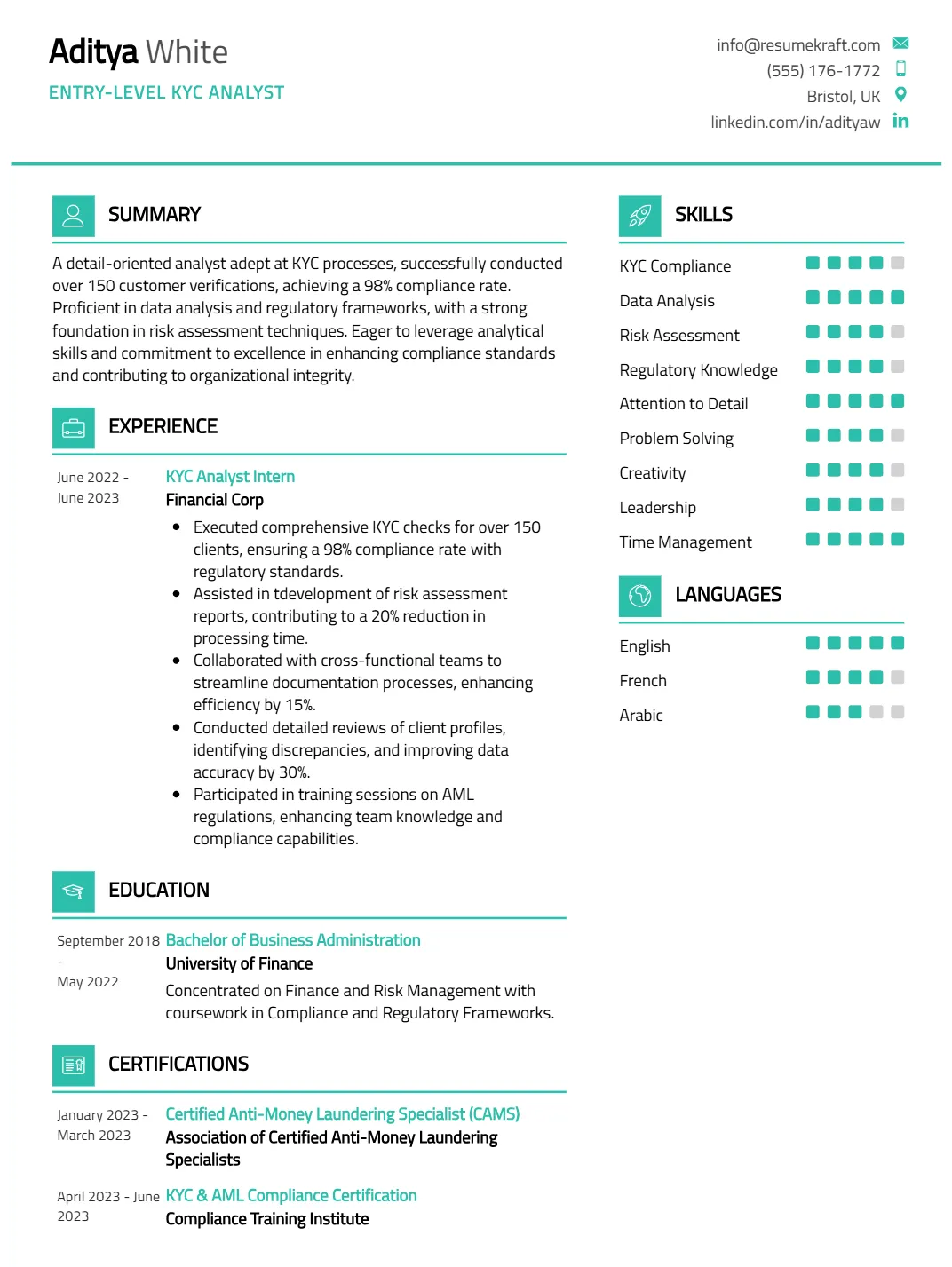

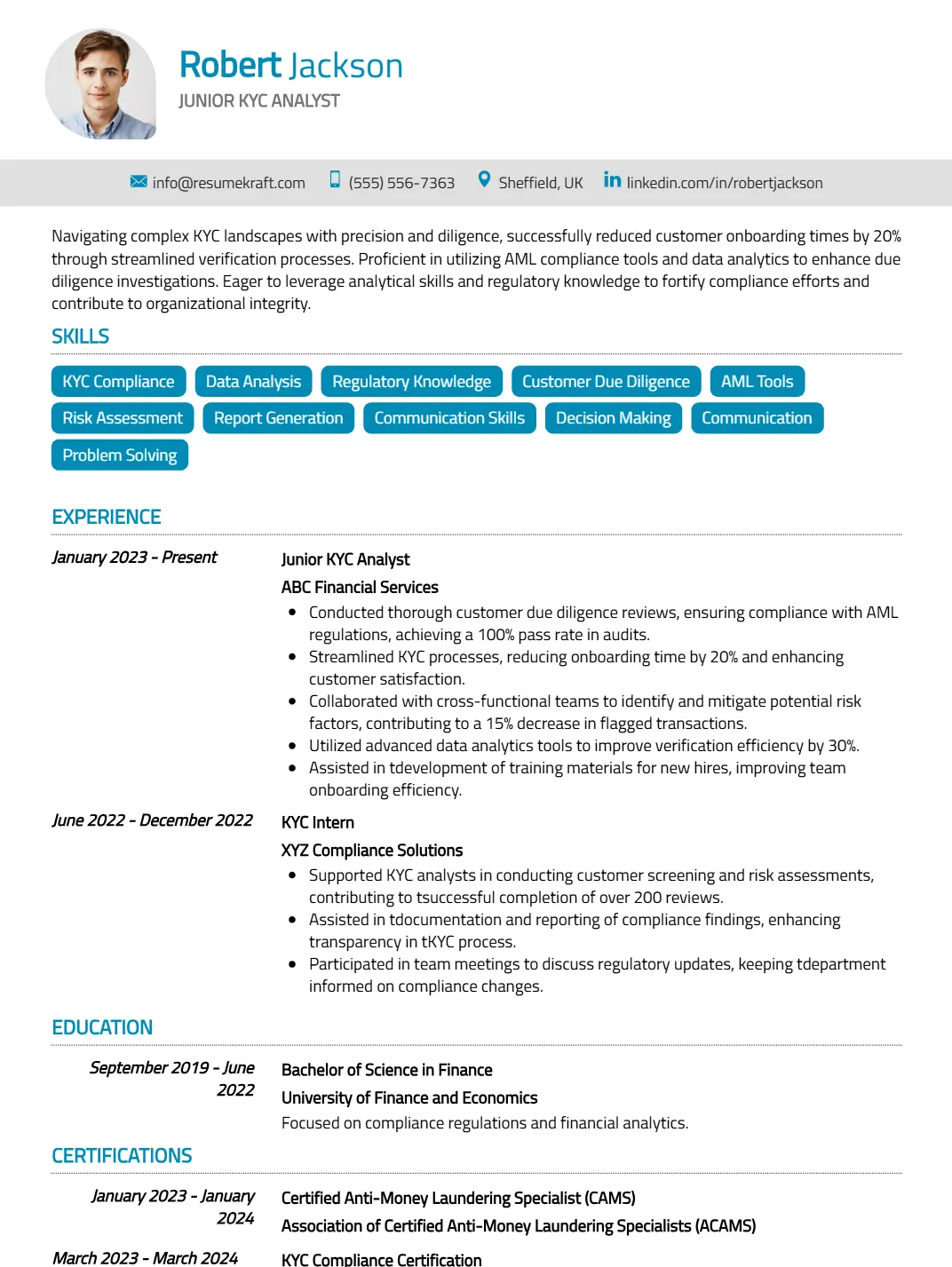

Junior KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for a Junior KYC Analyst role by highlighting essential skills such as KYC Compliance and Data Analysis, which are critical in this field. With approximately two years of relevant experience, including a prior internship, it demonstrates practical knowledge of customer due diligence and AML tools. The clear format enhances readability and aligns with industry standards, while strategic keyword placement ensures ATS compatibility. Additionally, showcasing specific achievements reinforces the candidate’s capability to contribute meaningfully in compliance and regulatory contexts.

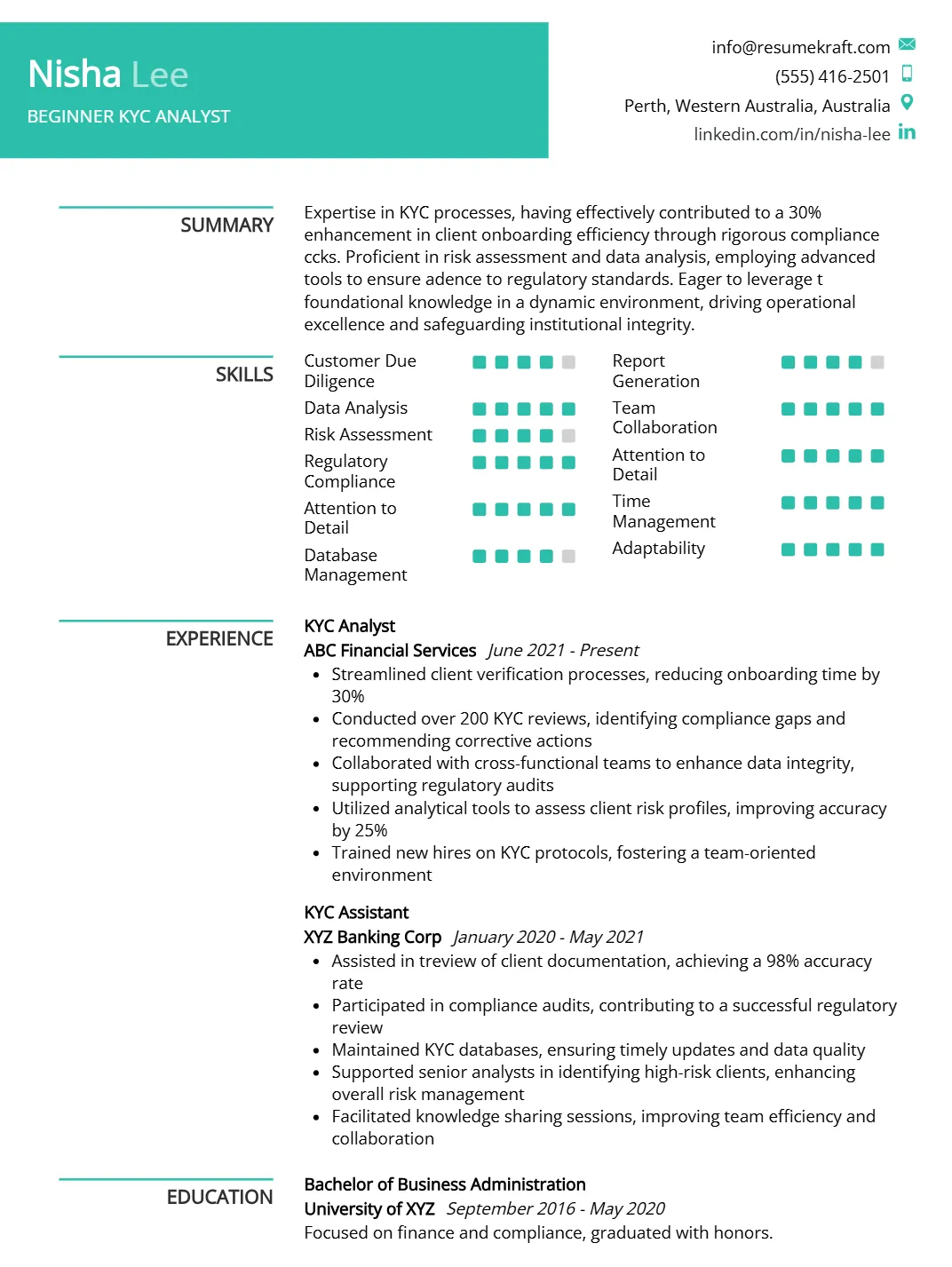

Beginner KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for a Beginner KYC Analyst role by showcasing relevant skills such as Customer Due Diligence and Risk Assessment, which are crucial in this field. With approximately five years of experience as a KYC Analyst and Assistant, the structured format highlights key accomplishments that align with industry expectations. The use of specific keywords enhances ATS compatibility, ensuring visibility to employers. Overall, the attention to detail in presentation reinforces the candidate’s suitability for compliance-focused roles within financial institutions.

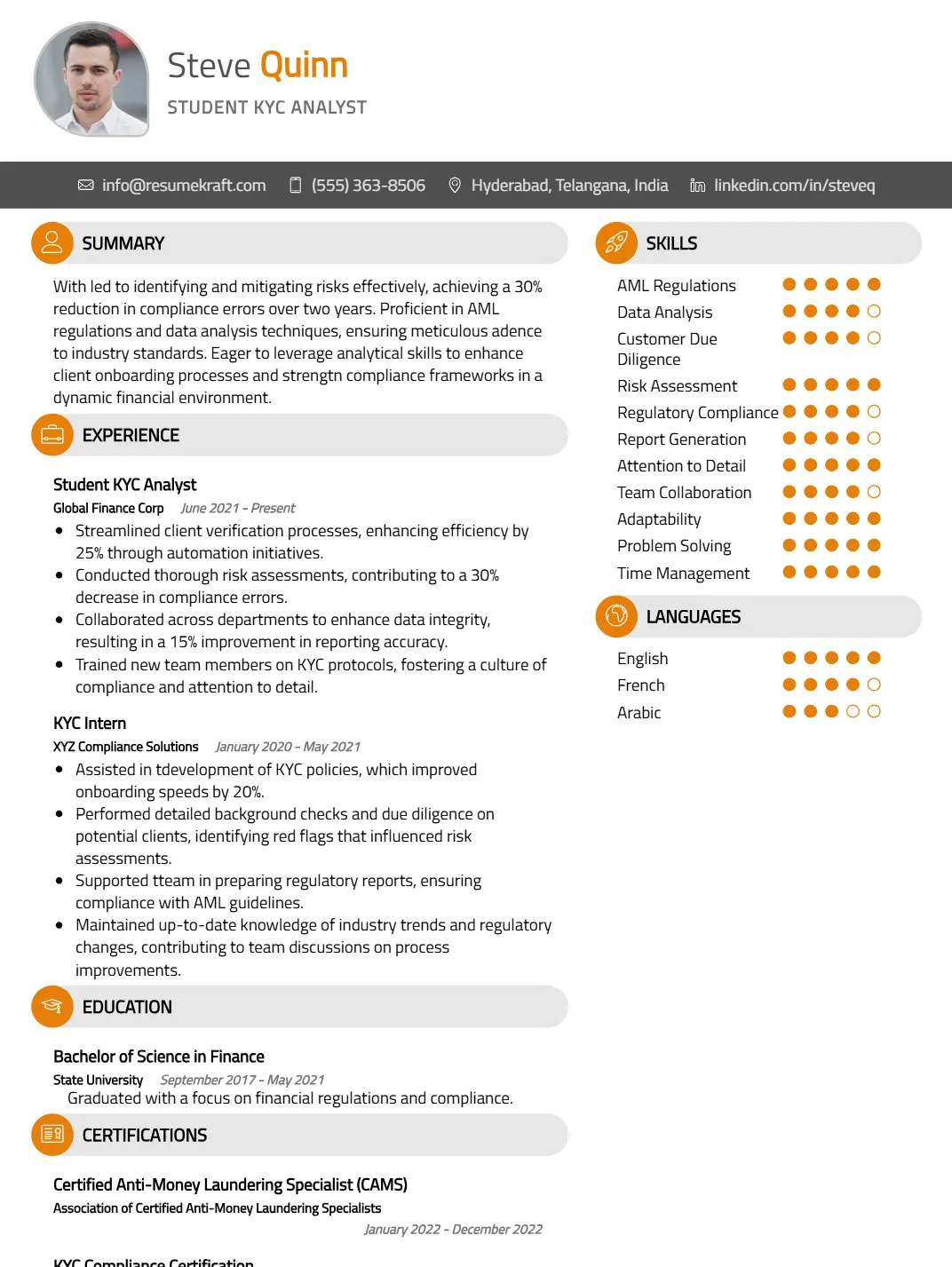

Student KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for a Student KYC Analyst role by highlighting essential skills such as AML Regulations and Customer Due Diligence, aligning perfectly with industry requirements. The structured format enhances readability, making it easy for hiring managers to identify relevant experience from five years in KYC-related roles. Additionally, the use of keywords ensures ATS compatibility, increasing visibility in applicant tracking systems. Strategic presentation of achievements underscores the candidate’s impact on risk assessment and regulatory compliance, further strengthening their fit for the position.

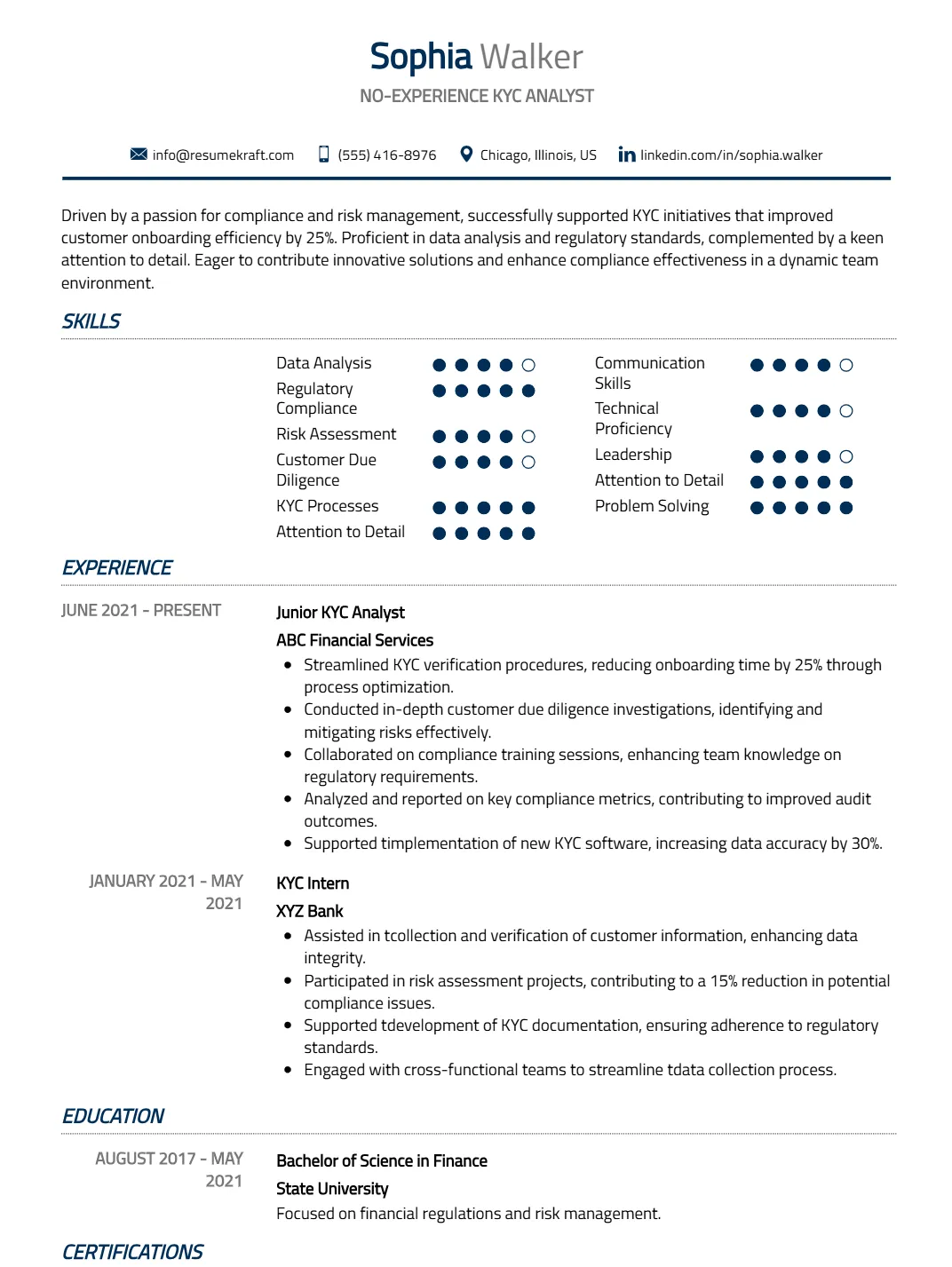

No-Experience KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for a No-Experience KYC Analyst role by highlighting relevant skills such as Data Analysis, Regulatory Compliance, and Customer Due Diligence. The structured format emphasizes their experience as a Junior KYC Analyst and KYC Intern, showcasing four years in the field. Its clear layout enhances ATS compatibility, ensuring key terms are easily recognized. Moreover, the strategic presentation of achievements related to risk assessment demonstrates practical contributions, making the candidate an appealing fit for compliance-focused employers.

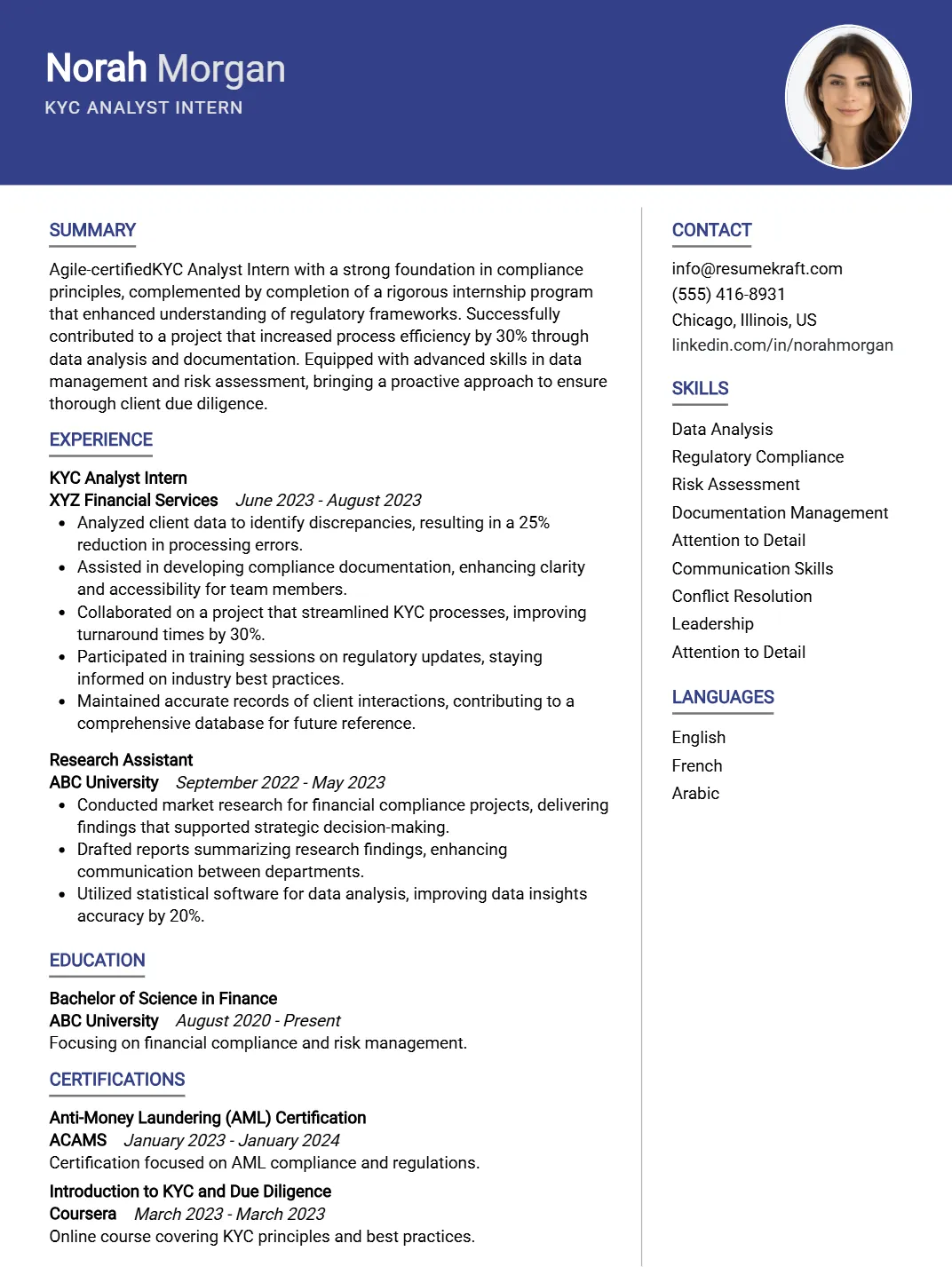

KYC Analyst Intern Resume

Why This Resume Works

This resume effectively showcases the candidate’s suitability for a KYC Analyst Intern position by highlighting relevant skills such as Data Analysis and Regulatory Compliance, essential for evaluating customer identities. The structured format emphasizes experience in KYC analysis and research, demonstrating practical application of these skills. It is optimized for ATS compatibility, using industry keywords to enhance visibility. Additionally, the strategic presentation of achievements underscores attention to detail and risk assessment capabilities, making it compelling for potential employers in the KYC field.

KYC Analyst Fresher Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills, such as KYC Compliance and AML Regulations, which are crucial for a KYC Analyst Fresher position. The inclusion of an internship and experience as a Compliance Assistant demonstrates practical exposure to industry standards. Its clear format enhances readability and emphasizes key competencies, making it ATS-friendly. Additionally, the strategic presentation of achievements, like successful client due diligence projects, directly addresses what matters in this field, positioning the candidate favorably against competitors.

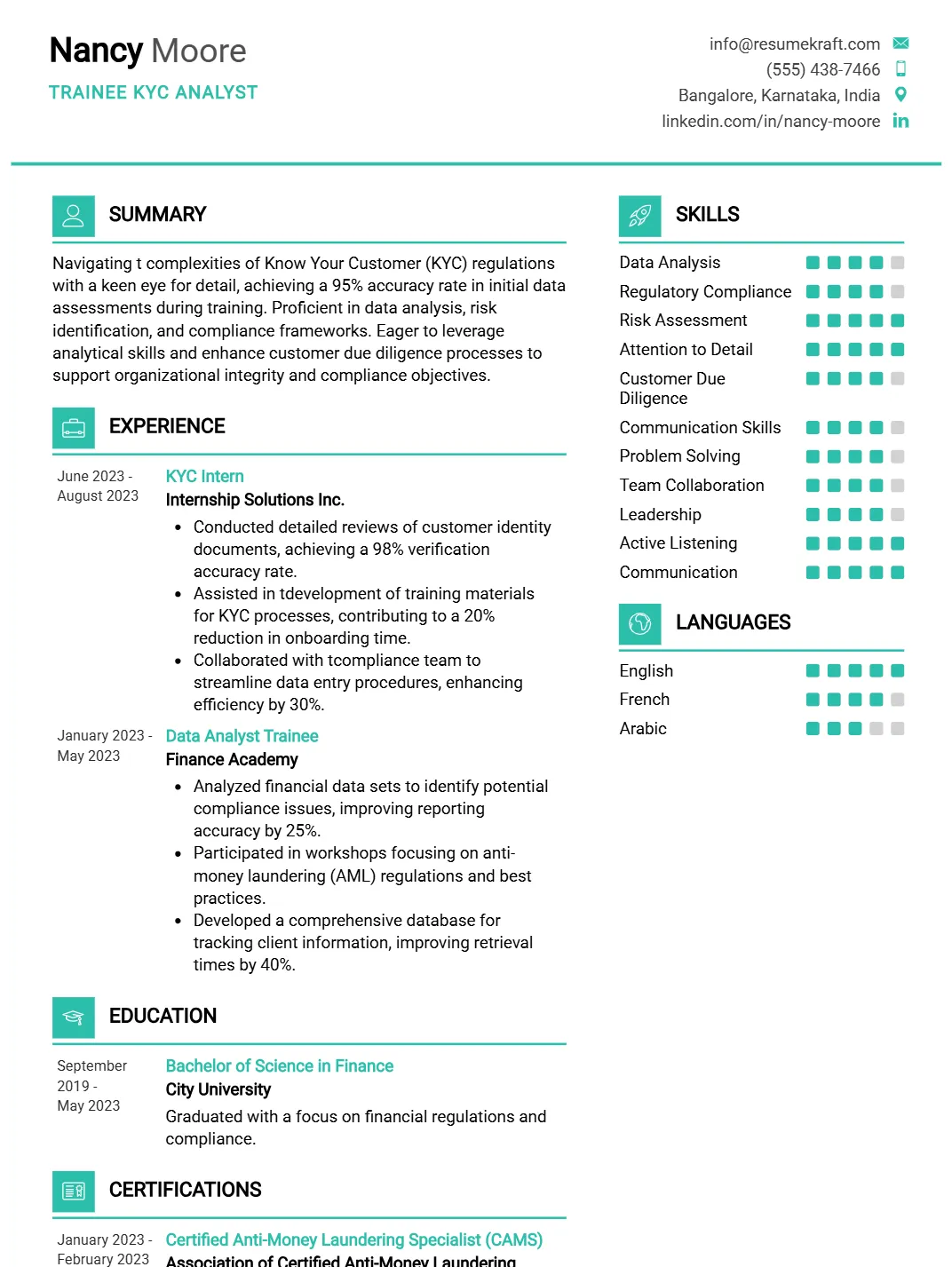

Trainee KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for a Trainee KYC Analyst role by highlighting relevant skills such as Data Analysis and Regulatory Compliance, essential for performing thorough customer due diligence. The structured format ensures clarity, allowing hiring managers to easily identify key experiences like KYC Intern and Data Analyst Trainee. Additionally, it incorporates industry-specific keywords for ATS compatibility, increasing visibility in applicant tracking systems. Strategic presentation of achievements related to risk assessment further demonstrates the candidate’s readiness to contribute in this critical field.

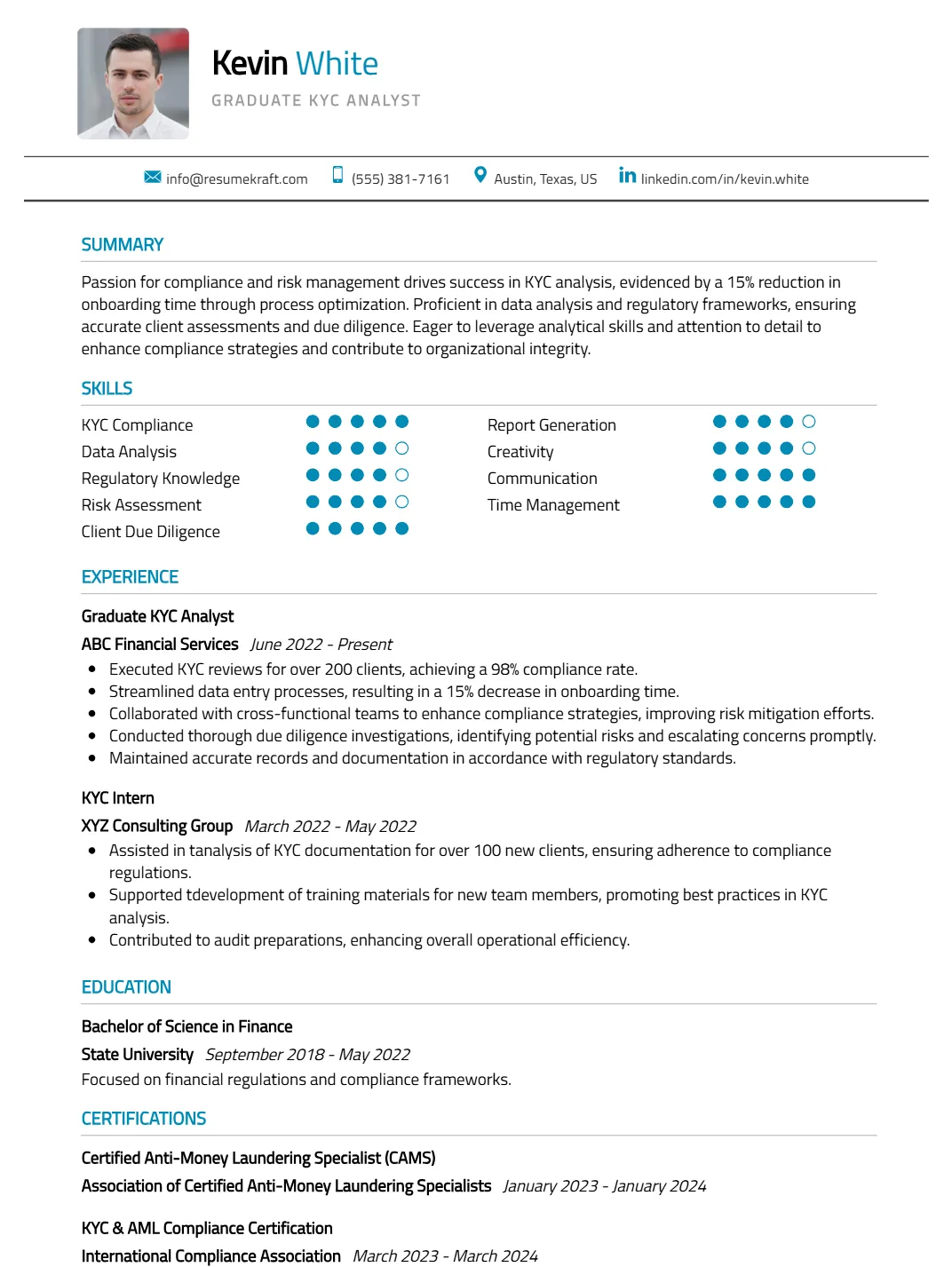

Graduate KYC Analyst Resume

Why This Resume Works

This resume effectively highlights the applicant’s relevant skills and experience for a Graduate KYC Analyst position, showcasing expertise in KYC compliance, data analysis, and regulatory knowledge. The structured format emphasizes key qualifications while promoting ATS compatibility through the use of industry-specific keywords. Additionally, the inclusion of targeted achievements demonstrates a solid understanding of risk assessment and client due diligence, making the candidate an appealing choice for employers seeking proficiency in maintaining compliance and managing financial risks within their organization.

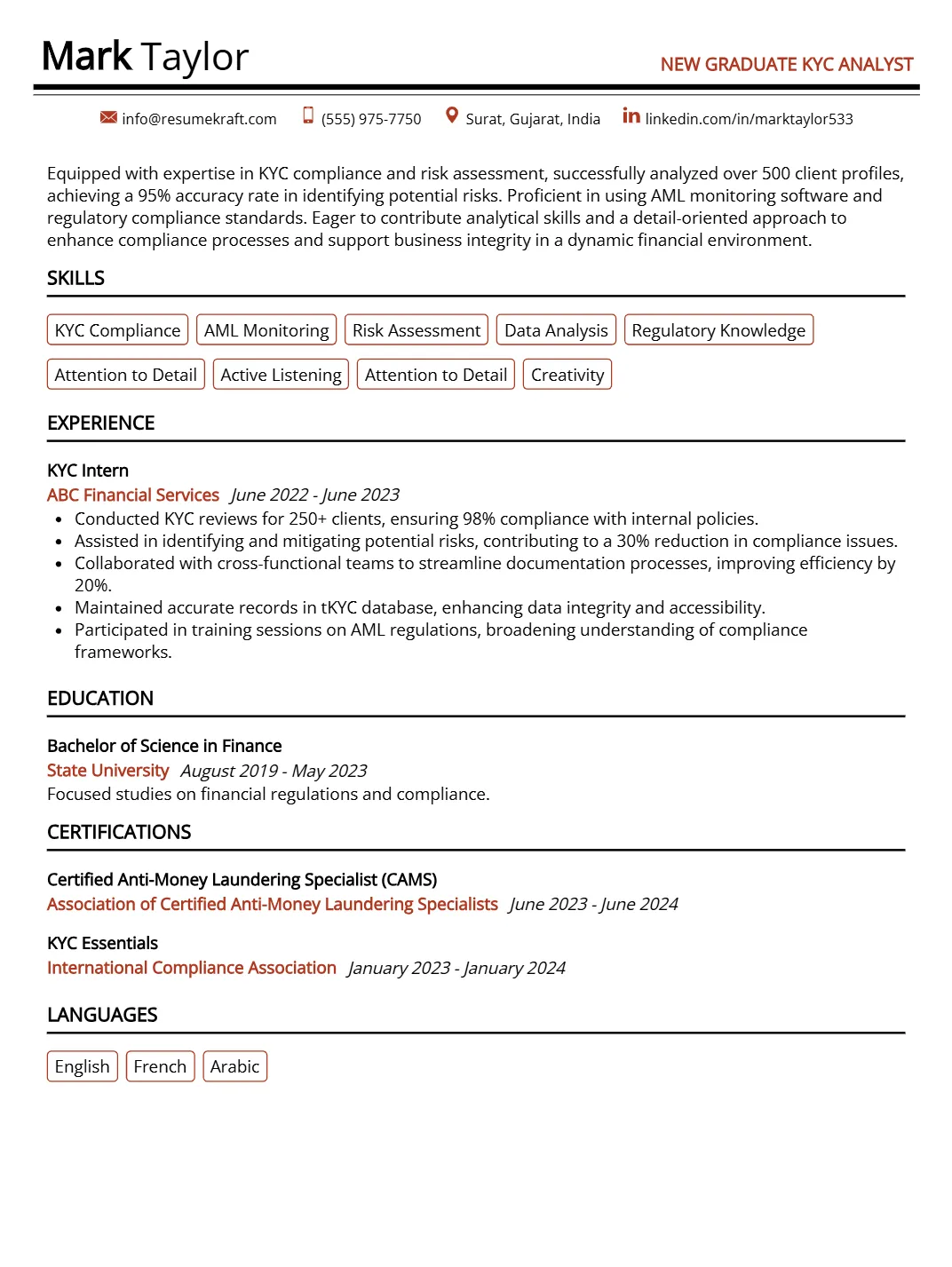

New Graduate KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for a New Graduate KYC Analyst role by highlighting relevant skills such as KYC Compliance and AML Monitoring, directly aligning with industry expectations. The structured format emphasizes key experiences, including a year-long KYC internship, showcasing practical knowledge in risk assessment and regulatory compliance. Its strategic use of keywords ensures ATS compatibility, increasing visibility to recruiters. Additionally, presenting quantifiable achievements demonstrates the candidate’s impact in prior roles, making them a compelling choice for potential employers in the field.

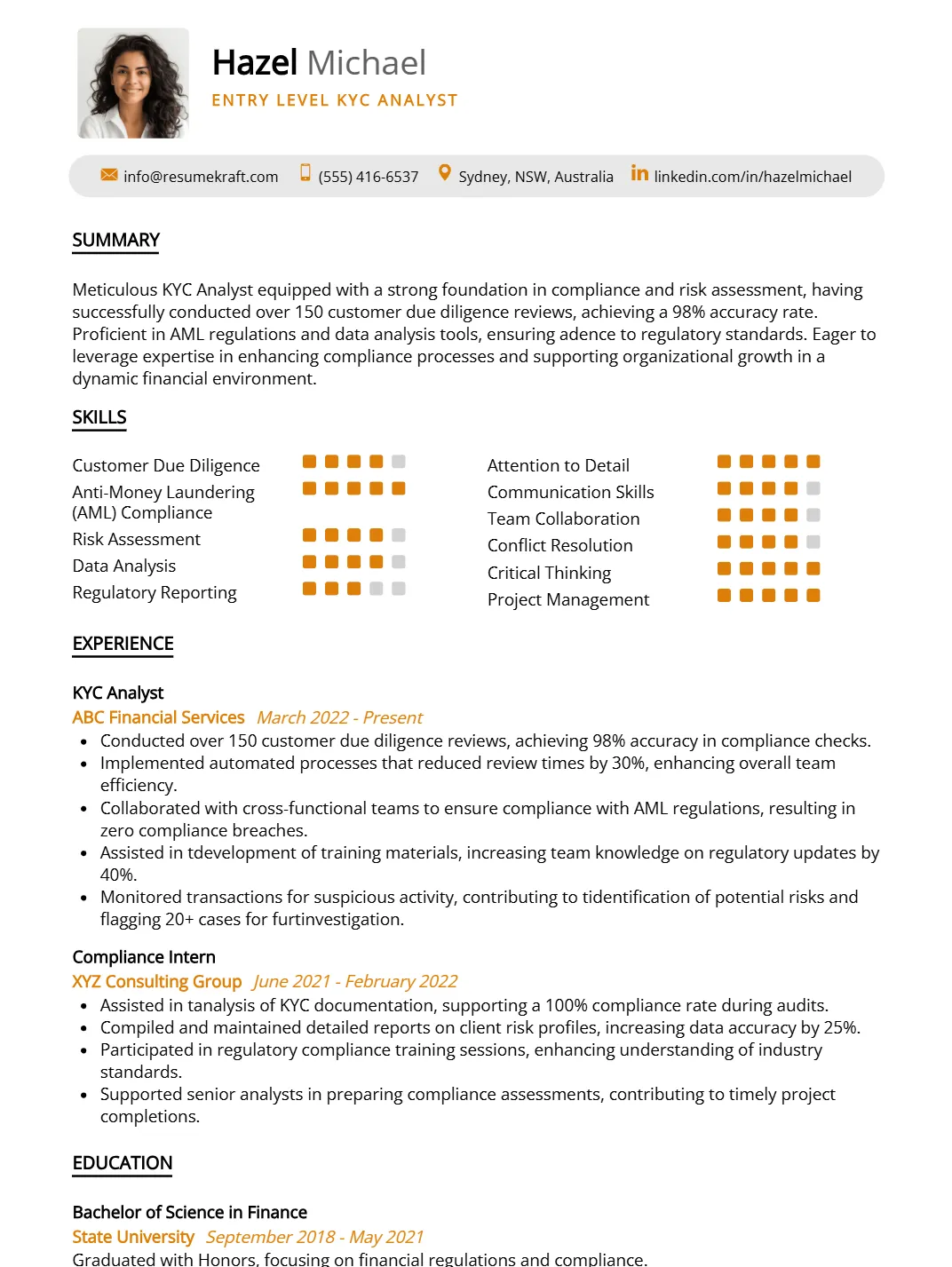

Entry level KYC Analyst Resume

Why This Resume Works

This resume effectively positions the candidate for an Entry Level KYC Analyst role by highlighting relevant skills such as Customer Due Diligence and Anti-Money Laundering compliance, directly aligning with job requirements. The structured format ensures clarity, making it easy for hiring managers to identify key qualifications. Additionally, the use of industry-specific keywords enhances ATS compatibility, increasing visibility to recruiters. Strategic presentation of achievements in risk assessment and regulatory reporting further demonstrates the candidate’s readiness to contribute meaningfully in this field.

Fresher KYC Analyst resume format

A well-structured resume format is crucial for fresh graduates seeking KYC Analyst positions, as it enhances readability and showcases their qualifications effectively. A strong first impression can set the tone for potential employers, making it essential to master the nuances of resume presentation.

- Use a clean, professional layout with clear headings and consistent font styles to ensure your resume is easy to navigate. This helps employers quickly find relevant information about your skills and qualifications.

- Start with a concise summary that highlights your educational background and any relevant coursework or projects related to KYC analysis. This gives recruiters immediate insight into your qualifications.

- Organize your resume into distinct sections such as Education, Skills, and Projects. This structure allows you to present your academic achievements and relevant experiences in a logical and organized manner.

- Prioritize your most relevant skills and experiences at the top of each section. This ensures that hiring managers see your most pertinent qualifications first, even if your work experience is limited.

- Utilize bullet points for clarity and brevity when describing projects or coursework. This format helps break down information into digestible pieces, making it easier for recruiters to scan your resume quickly.

Fresher KYC Analyst resume with no experience

Freshers without professional experience can still craft a compelling KYC Analyst resume by highlighting their academic projects, relevant coursework, and any volunteer activities. For instance, coursework in finance, law, or data analysis can showcase your understanding of regulatory frameworks and analytical skills. Additionally, detailing personal projects or case studies related to customer due diligence can demonstrate your initiative and ability to apply theoretical knowledge in practical scenarios.

Furthermore, transferable skills gained from group projects, leadership roles in student organizations, or volunteer experiences can be invaluable. Emphasize your attention to detail, communication skills, and ability to work under pressure, as these qualities are crucial for a KYC Analyst role and can set you apart from other candidates.

I am a recent graduate looking for a job in KYC. I haven’t worked anywhere, but I’m eager to learn.

Completed a detailed academic project analyzing AML regulations, developing strong analytical and research skills. Volunteered as a data entry assistant, improving attention to detail and accuracy in handling sensitive information.

How to list your hard skills and soft skills on your fresher resume

As a fresher applying for a KYC Analyst position, highlighting both hard and soft skills is crucial for standing out in a competitive job market. New graduates can leverage their academic knowledge, online courses, certifications, and personal projects to showcase relevant skills. By demonstrating a solid understanding of compliance frameworks and analytical techniques, along with interpersonal skills such as communication and problem-solving, freshers can effectively convey their readiness to contribute to the organization.

Hard Skills for Fresher KYC Analyst:

- KYC Regulations: Understanding of AML laws and compliance requirements.

- Data Analysis: Ability to analyze customer data for risk assessment.

- Excel Proficiency: Competency in using formulas and functions for data management.

- SQL: Basic knowledge of querying databases for data retrieval.

- Report Writing: Skills in preparing clear and concise compliance reports.

- Risk Management: Understanding of risk assessment techniques and methodologies.

- Customer Due Diligence: Knowledge of processes for evaluating customer profiles.

- Financial Analysis: Ability to analyze financial statements and transactions.

- Research Skills: Proficient in conducting background checks and investigations.

- Attention to Detail: Ability to identify discrepancies in customer information.

- Document Management: Skills in organizing and maintaining compliance documentation.

- Data Entry: Proficient in accurately entering and updating customer information.

- Software Tools: Familiarity with KYC and compliance software solutions.

- Online Learning: Certifications in KYC/AML from reputable platforms.

- Presentation Skills: Ability to present findings and recommendations effectively.

Soft Skills for Entry-Level KYC Analyst:

- Analytical Thinking: Strong ability to evaluate data and identify trends.

- Communication: Excellent verbal and written communication skills.

- Problem Solving: Ability to approach challenges with a solution-oriented mindset.

- Team Collaboration: Skills in working effectively within a team environment.

- Adaptability: Flexibility in adjusting to changing regulations and processes.

- Time Management: Capacity to prioritize tasks and meet tight deadlines.

- Ethical Judgment: Commitment to maintaining the highest ethical standards.

- Interpersonal Skills: Ability to build rapport with stakeholders and clients.

- Critical Thinking: Evaluating situations carefully to make informed decisions.

- Self-Motivation: Initiative in pursuing additional learning and development.

- Attention to Detail: Diligence in ensuring accuracy in all tasks.

- Conflict Resolution: Skills in managing disagreements constructively.

- Organizational Skills: Ability to keep work processes and documentation in order.

- Curiosity: Eagerness to learn and stay updated on industry trends.

- Resilience: Ability to handle pressure and maintain performance under stress.

- Customer Focus: Commitment to meeting the needs and expectations of clients.

How to list your education and certifications on your fresher resume

Freshers can effectively present their education on a KYC Analyst resume by emphasizing relevant coursework, academic projects, and certifications. Highlight subjects such as finance, data analysis, and compliance, along with any projects that involved risk assessment or customer due diligence. Mention notable achievements, like top grades or presentations, to demonstrate your dedication and understanding of the field.

Incorporating specific projects showcases practical application of your knowledge. If you completed a project analyzing customer data for compliance, detail your role and the skills you used. This approach not only highlights your education but also makes your resume more compelling, showing that you are equipped with the necessary skills for the role despite limited professional experience.

Graduated with a degree in Business. Took some finance classes.

Bachelor of Business Administration, XYZ University, 2023. Relevant coursework includes Financial Analysis, Risk Management, and Data Analytics. Completed a capstone project analyzing customer behavior for compliance, resulting in a presentation that received recognition from faculty.

How to write your fresher KYC Analyst resume summary or objective

A strong resume summary or objective is crucial for freshers applying for a KYC Analyst position, as it provides an immediate snapshot of their potential and enthusiasm. Entry-level candidates should highlight relevant skills, such as analytical abilities and attention to detail, alongside their eagerness to learn. A summary is best suited for those with some experience or relevant projects, while an objective works well for freshers to outline their career goals and aspirations in the role.

Looking for a job as a KYC Analyst. I have some skills in finance and want to learn more.

Enthusiastic recent graduate with a strong foundation in finance and compliance, eager to leverage analytical skills and attention to detail as a KYC Analyst to ensure regulatory adherence and enhance client relationships.

Additional sections for a fresher KYC Analyst resume

Incorporating additional resume sections can significantly enhance a fresher KYC Analyst candidate’s profile by highlighting their potential, learning ability, and relevant experiences. These sections can effectively showcase skills and dedication, making them stand out despite limited professional experience.

- Projects: Detail relevant academic or personal projects that involved data analysis, compliance, or research. Highlighting these projects demonstrates practical application of skills and a proactive approach to learning.

- Volunteer Work: Include any volunteer experiences that showcase transferable skills like teamwork, problem-solving, and communication. This section reflects your character and commitment, making you a more appealing candidate.

- Certifications: List any KYC, AML, or compliance-related certifications, even if they are self-paced online courses. This indicates your initiative to learn and stay updated with industry standards, which is crucial for KYC roles.

- Academic Achievements: Mention any relevant honors, scholarships, or awards received during your studies. This showcases your dedication to academics and your ability to excel in challenging environments, which is appealing to employers.

- Skills Section: Highlight key skills such as attention to detail, analytical thinking, and proficiency in data management tools. These skills are essential for a KYC Analyst and demonstrate your readiness for the role.

Key takeaways for writing a professional fresher KYC Analyst resume

- Highlight relevant coursework and projects related to compliance and risk management to showcase your understanding of KYC processes.

- Utilize resume templates designed for KYC Analyst positions to ensure your format is professional and tailored to the industry.

- Emphasize transferable skills such as analytical thinking and attention to detail, which are crucial for success in KYC roles.

- Include any internships, volunteer work, or part-time roles that demonstrate your ability to handle sensitive information and maintain confidentiality.

- Consider using an ai resume builder to create a polished resume that effectively presents your qualifications and skills.

Frequently Asked Questions for Fresher KYC Analyst Resumes

How long should my fresher KYC Analyst resume be?

Your resume should ideally be one page long, especially as a fresher KYC Analyst. This length allows you to present your skills, education, and any relevant projects or internships clearly and succinctly. Focus on including only the most pertinent information that demonstrates your capability for the role. Remember, hiring managers often have limited time to review resumes, and a concise, focused document will make it easier for them to see your potential quickly.

What is the best format for a fresher KYC Analyst resume?

The best format for your resume as a fresher KYC Analyst is the chronological format, which emphasizes your education and relevant skills at the top. Start with your contact information, followed by a strong objective statement tailored to the KYC field. Next, list your educational background, emphasizing any courses related to finance, law, or compliance. Finally, include a skills section that highlights analytical abilities, attention to detail, and familiarity with KYC processes, even if gained through academic projects.

How can I make my fresher KYC Analyst resume stand out without work experience?

To stand out as a fresher KYC Analyst, focus on showcasing your relevant skills and academic achievements. Highlight coursework that pertains to compliance, finance, or data analysis and include any internships, volunteer experiences, or academic projects that demonstrate your analytical and problem-solving abilities. Additionally, consider obtaining certifications in KYC or related fields, as these can help differentiate you from other candidates and show your commitment to the profession.

What should I include in my fresher KYC Analyst resume if I have no relevant experience?

If you have no relevant experience, emphasize your educational background, particularly any coursework or projects related to KYC, compliance, finance, or data analysis. Include soft skills such as attention to detail, strong communication, and analytical thinking. You can also mention any relevant certifications or online courses that demonstrate your commitment to learning about KYC processes. Lastly, consider adding internships, volunteer work, or part-time jobs that highlight transferable skills applicable to the KYC Analyst role.