Portfolio Manager is a tool that helps investors track and manage their investment portfolios. It provides a way to view all of your investments in one place, see how they are performing, and make changes to your portfolio if necessary. Portfolio Manager can be used by both individual investors and financial advisors. If you are working with a financial advisor, they may have a specific portfolio manager that they recommend you use. Otherwise, there are many different portfolio managers available, both online and offline.

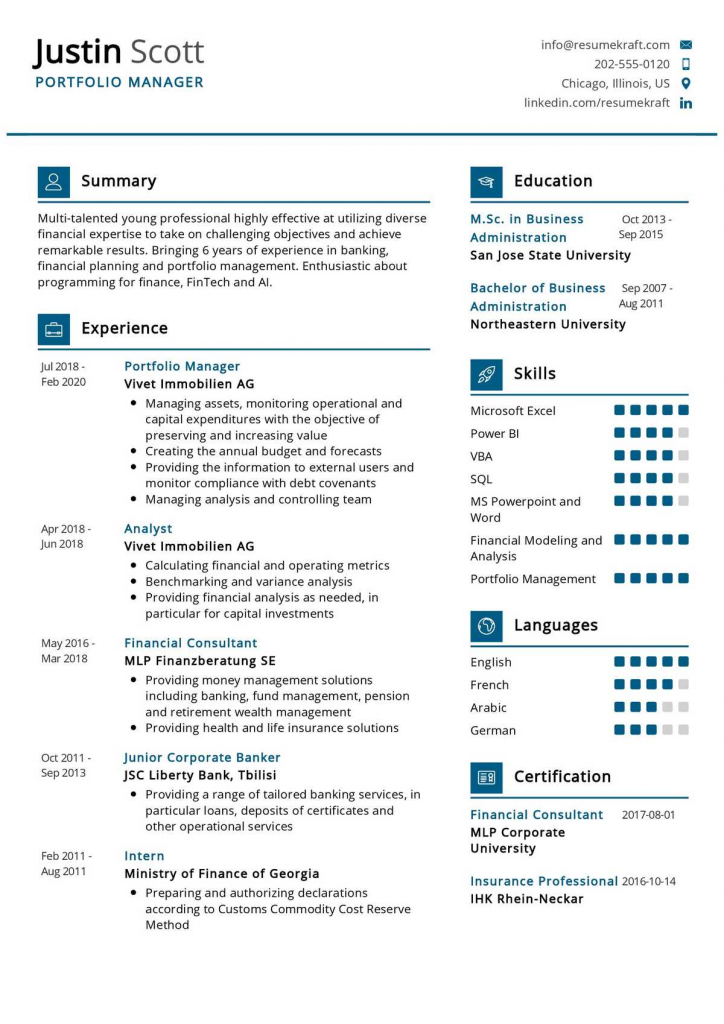

How to list Portfolio Manager Skills on resume:

The skills section of your resume is where you can highlight your skills as they relate to portfolio management. Some skills that are relevant to this field include asset allocation, investment selection, portfolio rebalancing, and risk management. If you have experience with specific portfolio management software, such as Morningstar or Bloomberg, be sure to mention this as well.

Some tips for listing portfolio management skills on your resume include:

- Use bullet points to list your skills

- Use action words such as “managed,” “analyzed,” and “assessed”

- Include both hard and soft skills

- Tailor your skills list to the specific job you are applying for

- Highlight your skills in your cover letter as well

Top 10 Portfolio Manager Resume Skills:

1. Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to balance risk and return, and it can be a complex process. However, it is an important skill for portfolio managers to understand.

2. Investment Selection

Investment selection is the process of choosing which investments to include in your portfolio. This can be a difficult task, as there are many different factors to consider. However, it is important to choose investments that are aligned with your goals and risk tolerance.

3. Portfolio Rebalancing

Portfolio rebalancing is the process of periodically adjusting the mix of assets in your portfolio. This is done in order to maintain your desired asset allocation and risk level. Rebalancing can be a complex process, and it is important to understand how it works before attempting it.

4. Risk Management

Risk management is the process of identifying, assessing, and managing risk. It is an important skill for portfolio managers to have, as they must be able to identify and manage the risks associated with their portfolios.

5. Financial Analysis

Financial analysis is the process of reviewing financial statements and other data to assess the financial health of a company. This is an important skill for portfolio managers, as they must be able to identify companies that are financially healthy and have a good chance of success.

6. Economic Analysis

Economic analysis is the process of reviewing economic data to assess the health of the economy. This is an important skill for portfolio managers, as they must be able to identify companies that are likely to be affected by economic conditions.

7. Portfolio Theory

Portfolio theory is the study of how to optimize portfolios for maximum return. It is an important skill for portfolio managers to understand, as it can help them make better decisions about how to allocate their assets.

8. Mathematical Modeling

Mathematical modeling is the process of using mathematical equations to describe a system. This is an important skill for portfolio managers, as they often use mathematical models to analyze data and make decisions about investments.

9. Statistical Analysis

Statistical analysis is the process of reviewing data to identify trends and relationships. This is an important skill for portfolio managers, as they often use statistics to make decisions about investments.

10. Excel

Excel is a software program that is commonly used for data analysis. It is an important skill for portfolio managers to know how to use, as it can be a valuable tool for analyzing data and making decisions about investments.

Jobs That Demand Portfolio Manager Skills:

1. Investment Analyst

An investment analyst is responsible for researching and analyzing investment opportunities. They use their skills in asset allocation, investment selection, and financial analysis to make recommendations to their clients.

2. Financial Analyst

A financial analyst is responsible for reviewing financial statements and other data to assess the financial health of a company. They use their skills in financial analysis and economic analysis to make recommendations to their clients.

3. Research Analyst

A research analyst is responsible for researching and analyzing companies and industries. They use their skills in financial analysis and statistical analysis to make recommendations to their clients.

4. Fund Manager

A fund manager is responsible for managing a fund. They use their skills in asset allocation, investment selection, and portfolio rebalancing to make decisions about how to invest the fund’s assets.

5. Portfolio Manager

A portfolio manager is responsible for managing a portfolio of investments. They use their skills in asset allocation, investment selection, and portfolio rebalancing to make decisions about how to allocate the assets in the portfolio.