State Bank of India (SBI) is a prestigious banking and financial services company with a vast network of branches across the globe. Acquiring a position as a Branch Relationship Executive at SBI is a significant milestone, offering a golden opportunity to build a fulfilling career in banking. In this guide, we aim to prepare aspiring candidates by presenting an exhaustive list of SBI Branch Relationship Executive interview questions. Through this, we’ll provide an insight into the nature of the role, how you can land the job, and set the stage for a fruitful discussion on each interview question.

Branch Relationship Executives play a pivotal role in maintaining and nurturing the relationships between the bank and its customers. They are the frontline personnel, ensuring customer satisfaction and managing various banking services and products. This article is designed to assist you in navigating through the interview process and emerging successfully.

- Top 27 SBI Branch Relationship Executive Interview Questions and Answers

- 1. Can you give a brief overview of your background and experience?

- 2. Why are you interested in a Branch Relationship Executive position at SBI?

- 3. How do you handle customer complaints and ensure resolution?

- 4. Explain the significance of Customer Relationship Management (CRM) in banking.

- 5. How do you manage to stay organized and prioritize tasks?

- 6. Can you discuss a time when you successfully brought in new business?

- 7. How do you stay updated on the latest banking products and services?

- 8. Discuss an instance when you had to deal with a difficult customer and how you handled it.

- 9. How would you approach a customer to upsell a bank product?

- 10. How do you maintain confidentiality while handling sensitive customer information?

- 11. Can you elaborate on the role of a Branch Relationship Executive in enhancing customer experience?

- 12. How do you handle the pressure and manage stress in a fast-paced environment?

- 13. How would you contribute to achieving the branch’s sales targets?

- 14. Discuss your approach to resolving conflicts with colleagues or superiors.

- 15. Can you explain the importance of financial literacy in a Branch Relationship Executive’s role?

- 16. How do you ensure that you meet customer expectations consistently?

- 17. What strategies would you employ to retain high-value customers?

- 18. How do you stay motivated in a challenging and target-driven environment?

- 19. Can you discuss a time when you had to adapt to a significant change at the workplace?

- 20. What steps would you take to resolve a situation where a customer is dissatisfied with a bank policy?

- 21. How would you handle a situation where you have to decline a customer’s request?

- 22. Discuss your experience with cross-selling banking products and services.

- 23. How do you maintain a balance between achieving sales targets and ensuring customer satisfaction?

- 24. Can you explain the Anti-Money Laundering (AML) guidelines and their significance in banking?

- 25. How do you ensure compliance with banking regulations and policies in your day-to-day activities?

- 26. How would you assess a customer’s financial needs and recommend suitable banking products?

- 27. Can you provide an example of a time when you had to make a critical decision under pressure?

- Conclusion

Top 27 SBI Branch Relationship Executive Interview Questions and Answers

Let’s delve into the core of this guide – the top 27 interview questions and answers, tailored to equip you with the knowledge and confidence required to ace your interview at SBI.

1. Can you give a brief overview of your background and experience?

This opening question sets the tone for the interview and provides you with the opportunity to succinctly highlight your qualifications and experiences.

Sample Answer

“I hold a Bachelor’s degree in Business Administration, with a specialization in Finance. I have gained two years of experience working as a Relationship Executive at XYZ Bank, where I successfully managed client portfolios, addressed customer queries, and upsold bank products.”

2. Why are you interested in a Branch Relationship Executive position at SBI?

The interviewer aims to assess your motivation and whether you have a genuine interest in both the role and the institution.

Sample Answer

“SBI’s reputation for fostering employee growth and its commitment to customer satisfaction are the primary drivers behind my application. The bank’s values align with my career aspirations, and I am eager to contribute to strengthening client relationships and enhancing customer service standards.”

3. How do you handle customer complaints and ensure resolution?

This question evaluates your problem-solving and customer service skills, which are crucial for the role.

Sample Answer

“I approach customer complaints with empathy and patience. I listen attentively to understand their concerns, apologize for any inconvenience caused, and assure them of a swift resolution. I then take immediate action or escalate the issue to the relevant department, ensuring follow-up until resolution.”

4. Explain the significance of Customer Relationship Management (CRM) in banking.

CRM is pivotal in banking; this question tests your understanding of its importance in maintaining and improving customer relationships.

Sample Answer

“CRM is integral in banking for building and sustaining profitable customer relationships. It enables the bank to personalize services, address customer needs promptly, anticipate issues, and offer tailored solutions, thereby enhancing customer loyalty and satisfaction.”

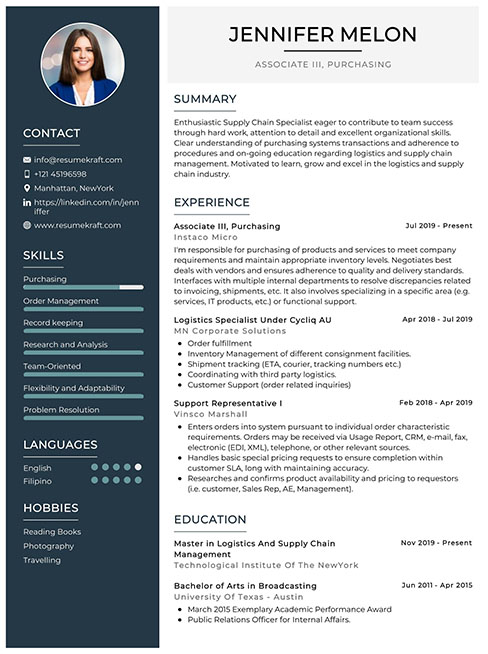

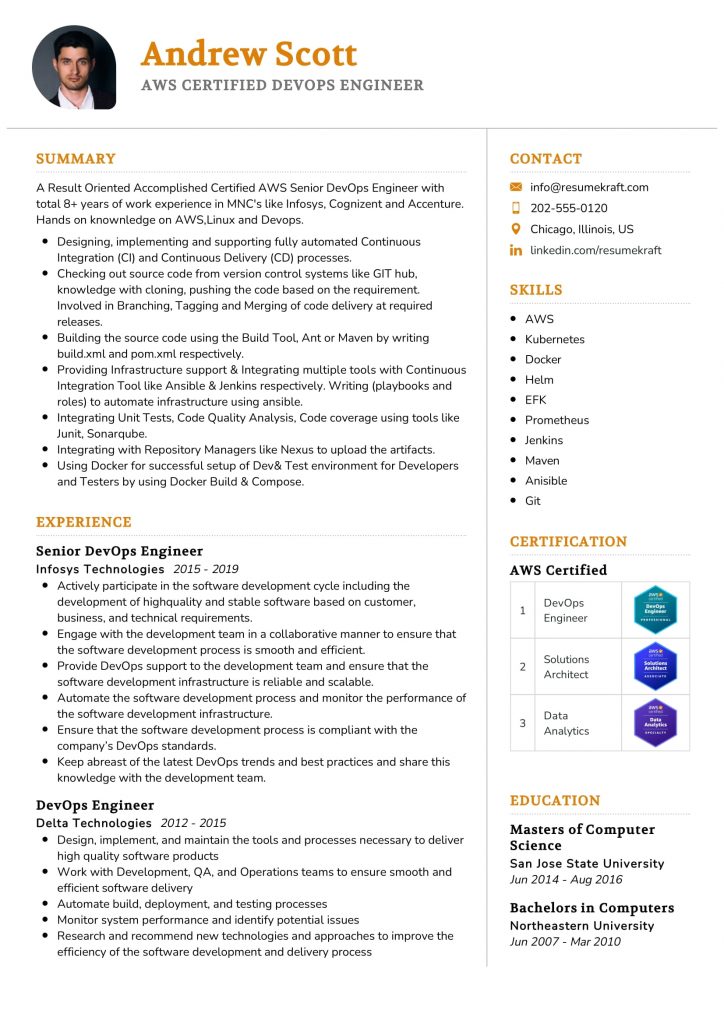

Build your resume in just 5 minutes with AI.

5. How do you manage to stay organized and prioritize tasks?

Organizational skills are paramount in handling the multifaceted responsibilities of a Branch Relationship Executive.

Sample Answer

“I utilize digital tools and maintain detailed to-do lists to stay organized. I prioritize tasks based on urgency and importance, allocate time slots for each task, and ensure that I revisit my schedule throughout the day to make adjustments as needed.”

6. Can you discuss a time when you successfully brought in new business?

This question assesses your sales skills and your ability to contribute to the bank’s growth.

Sample Answer

“At my previous job, I initiated a referral program where existing customers could refer potential clients. By engaging with current customers and encouraging referrals, I managed to bring in a substantial number of new accounts, contributing to the branch’s growth.”

7. How do you stay updated on the latest banking products and services?

Staying abreast of the latest offerings is essential for effectively managing relationships and upselling products.

Sample Answer

“I regularly review industry publications, attend webinars, participate in training sessions, and engage with colleagues to stay informed about the latest banking products, services, and market trends.”

8. Discuss an instance when you had to deal with a difficult customer and how you handled it.

Your response to this question will reveal your interpersonal skills and ability to maintain composure in challenging situations.

Sample Answer

“I once dealt with a customer who was upset about a service charge. I listened to their concerns, explained the bank’s policies, offered possible solutions, and managed to resolve the issue amicably, ensuring the customer left satisfied.”

9. How would you approach a customer to upsell a bank product?

Upselling is a key component of the role, and this question gauges your sales strategies and customer engagement skills.

Sample Answer

“I would first ensure a thorough understanding of the customer’s needs and financial situation. Based on this, I would introduce the product in a way that highlights its benefits and relevance to the customer, addressing any queries or concerns they might have.”

10. How do you maintain confidentiality while handling sensitive customer information?

Maintaining confidentiality is fundamental in banking; this question tests your understanding and commitment to this principle.

Sample Answer

“I adhere strictly to the bank’s policies and regulations regarding confidentiality. I only access customer information when necessary, do not disclose any details to unauthorized persons, and ensure secure storage and disposal of any sensitive documents.”

11. Can you elaborate on the role of a Branch Relationship Executive in enhancing customer experience?

Your understanding of the role’s impact on customer experience is assessed through this question.

Sample Answer

“A Branch Relationship Executive acts as a liaison between the bank and the customer, addressing queries, offering tailored solutions, and ensuring satisfaction. By maintaining strong relationships and delivering exceptional service, they play a pivotal role in enhancing the overall customer experience.”

12. How do you handle the pressure and manage stress in a fast-paced environment?

The ability to handle pressure and manage stress is vital in the banking sector, given the demanding nature of the job.

Sample Answer

“I maintain a positive mindset and stay organized to manage pressure effectively. I break tasks into manageable parts, prioritize, and stay focused. Additionally, I practice mindfulness and engage in regular physical activity to manage stress.”

13. How would you contribute to achieving the branch’s sales targets?

This question evaluates your understanding of the role’s contribution to achieving sales targets and your strategies to contribute effectively.

Sample Answer

“I would contribute by actively identifying and pursuing sales opportunities, maintaining strong relationships with existing customers, and seeking referrals. I would stay informed about the bank’s products and services to effectively upsell and cross-sell, ensuring I meet and exceed the assigned targets.”

14. Discuss your approach to resolving conflicts with colleagues or superiors.

Conflict resolution skills are essential in maintaining a harmonious work environment.

Sample Answer

“In case of a conflict, I would approach the concerned individual for a private discussion, listen to their perspective, and express my viewpoint respectfully. I believe in finding common ground and resolving issues amicably through open communication.”

15. Can you explain the importance of financial literacy in a Branch Relationship Executive’s role?

Financial literacy is fundamental for a Branch Relationship Executive; this question tests your understanding of its significance.

Sample Answer

“Financial literacy is crucial as it enables a Branch Relationship Executive to advise customers effectively, manage financial products, and contribute to the bank’s growth. It builds credibility, enhances customer trust, and is instrumental in delivering optimal financial solutions.”

16. How do you ensure that you meet customer expectations consistently?

Meeting customer expectations is central to the role; this question assesses your commitment to customer satisfaction.

Sample Answer

“I actively listen to customers to understand their needs and expectations. I maintain open communication, set clear expectations, and go the extra mile to deliver services promptly and efficiently, ensuring consistent customer satisfaction.”

17. What strategies would you employ to retain high-value customers?

Retaining high-value customers is pivotal for the bank’s profitability; this question evaluates your strategies in this regard.

Sample Answer

“I would employ personalized service, regular engagement, and tailored financial solutions to retain high-value customers. By understanding their needs, addressing concerns proactively, and offering exclusive benefits, I aim to build loyalty and ensure long-term relationships.”

18. How do you stay motivated in a challenging and target-driven environment?

Your motivation strategies in a demanding work environment are assessed through this question.

Sample Answer

“I stay motivated by setting clear goals, celebrating small victories, and focusing on the impact of my work. I view challenges as learning opportunities and stay driven by the prospect of contributing to the bank’s success and achieving personal growth.”

19. Can you discuss a time when you had to adapt to a significant change at the workplace?

Adaptability is a valued trait; this question assesses your ability to adjust to changes in the work environment.

Sample Answer

“When my previous employer implemented a new CRM system, I took the initiative to learn the new software quickly, adapt to the changes, and assist my colleagues in the transition, ensuring seamless customer service and operational efficiency.”

20. What steps would you take to resolve a situation where a customer is dissatisfied with a bank policy?

Resolving dissatisfaction related to bank policies can be challenging; this question gauges your problem-solving and communication skills.

Sample Answer

“I would listen empathetically, acknowledge the customer’s dissatisfaction, and explain the policy clearly. I would explore possible solutions or alternatives within the bank’s guidelines and escalate the issue if necessary, ensuring the customer feels heard and valued.”

21. How would you handle a situation where you have to decline a customer’s request?

Declining customer requests is sometimes inevitable; this question assesses your communication and customer service skills in such scenarios.

Sample Answer

“I would communicate the denial clearly and respectfully, providing a detailed explanation and offering alternative solutions or recommendations. I would ensure the customer understands the reasons behind the decision and feels valued despite the unfavorable outcome.”

22. Discuss your experience with cross-selling banking products and services.

Cross-selling is a key responsibility; this question evaluates your experience and strategies in this area.

Sample Answer

“I have successfully cross-sold various banking products by understanding customer needs, highlighting relevant benefits, and addressing concerns. By building trust and offering value, I managed to enhance customer satisfaction and contribute to revenue growth.”

23. How do you maintain a balance between achieving sales targets and ensuring customer satisfaction?

Balancing sales and satisfaction is crucial; this question gauges your ability to maintain this balance effectively.

Sample Answer

“I maintain a balance by focusing on the customer’s needs and offering products that align with their financial goals. By building relationships and ensuring value addition, I aim to achieve sales targets while maintaining high levels of customer satisfaction.”

24. Can you explain the Anti-Money Laundering (AML) guidelines and their significance in banking?

Knowledge of AML guidelines is essential; this question tests your understanding of these regulations and their importance.

Sample Answer

“AML guidelines are designed to prevent, detect, and report money laundering activities. They are significant in protecting the bank’s integrity, safeguarding the financial system, and combating illegal activities such as terrorism financing and fraud.”

25. How do you ensure compliance with banking regulations and policies in your day-to-day activities?

Compliance is fundamental in banking; this question assesses your commitment to adhering to regulations and policies.

Sample Answer

“I ensure compliance by staying updated on the latest regulations, participating in compliance training, and adhering strictly to the bank’s policies and procedures. I seek guidance when in doubt and report any discrepancies promptly to maintain the bank’s integrity.”

26. How would you assess a customer’s financial needs and recommend suitable banking products?

Assessing customer needs and recommending products is a key responsibility; this question evaluates your approach to this task.

Sample Answer

“I would assess a customer’s financial needs by conducting a thorough analysis of their financial status, goals, and risk tolerance. Based on this, I would recommend suitable banking products, explain their features and benefits, and address any queries or concerns.”

27. Can you provide an example of a time when you had to make a critical decision under pressure?

Decision-making under pressure is a vital skill; this question assesses your ability to make sound judgments in challenging situations.

Sample Answer

“When a customer faced a transaction issue close to closing time, I had to decide swiftly between escalating

the issue for next-day resolution or addressing it immediately. I chose the latter, resolved the issue promptly, and ensured customer satisfaction despite the pressure.”

Conclusion

Preparation is the key to succeeding in an SBI Branch Relationship Executive interview. By understanding the nature of the questions and formulating thoughtful responses, you can showcase your skills, experiences, and commitment to the role. This comprehensive guide aims to equip you with the necessary insights and confidence to navigate the interview process effectively and secure a rewarding position at State Bank of India.

Remember to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.