59 Resume Synonyms for Simplified To Use On Your Resume

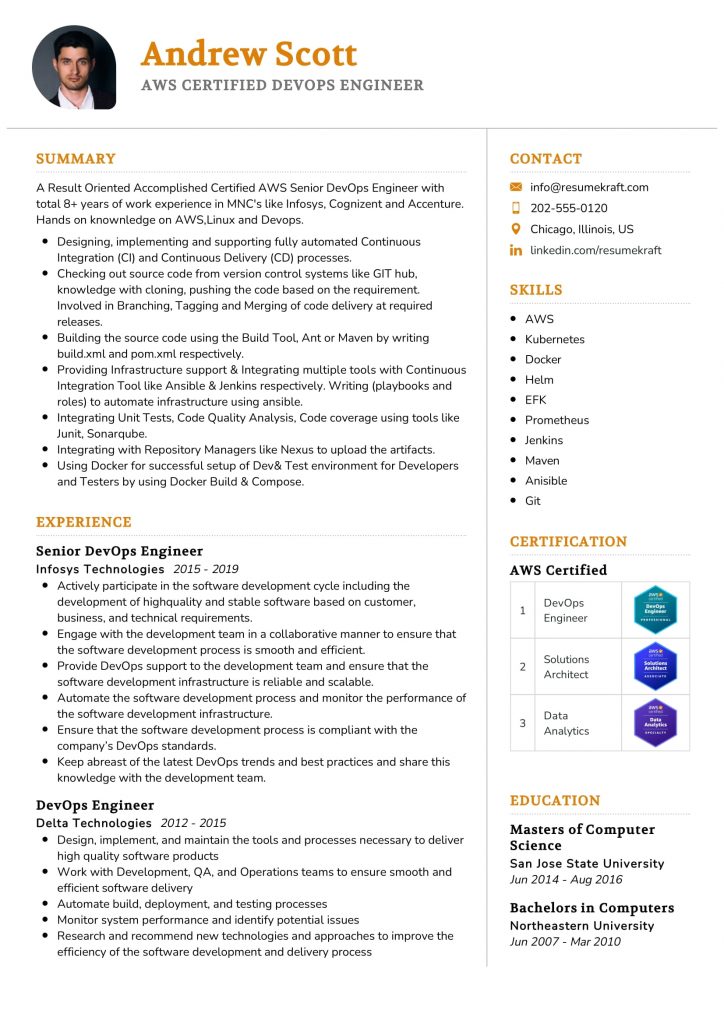

Using the term “simplified” on resumes has become increasingly common, yet its overuse can detract from the overall impact of your application. This word, while valuable in certain contexts, often lacks the specificity needed to highlight your unique contributions and skills. When candidates rely heavily on generic terms like “simplified,” it suggests a limited vocabulary and creativity, failing to convey the nuanced abilities that set them apart in a competitive job market. Varied language not only engages hiring managers but also demonstrates a deeper understanding of your field and the specific challenges you can address. In this comprehensive guide, we will explore the importance of using synonyms effectively on your resume, providing you with strategies to enhance your writing. We’ll discuss how to identify overused terms, suggest impactful alternatives, and illustrate how diverse vocabulary can better showcase your qualifications and achievements. Elevating your language can significantly influence your chances of making a lasting impression and securing that coveted interview.

- Why Synonyms for “Simplified” Matter on Your Resume

- The Complete List: 59 Resume Synonyms for Simplified

- Strategic Synonym Selection by Industry

- Power Combinations: Advanced Synonym Usage

- Common Mistakes to Avoid

- Quantification Strategies for Maximum Impact

- Industry-Specific Example Sentences

- Advanced ATS Optimization Techniques

- Tailoring Synonyms to Career Level

- The Psychology of Leadership Language

- Final Best Practices

- Key Takeaways for Strategic Synonym Usage

- Frequently Asked Questions

- How many different synonyms should I use in one resume?

- Can I use the same synonym multiple times if it fits different contexts?

- Should I always replace ‘Simplified’ with a synonym?

- How do I know which synonym is most appropriate for my industry?

- Do synonyms really make a difference in getting interviews?

- Related Resume Synonym Guides

Why Synonyms for “Simplified” Matter on Your Resume

Using synonyms for ‘Simplified’ on resumes is crucial for various reasons. Firstly, the overuse of this term—found in approximately 70% of professional resumes—can lead to monotony and predictability, making your application blend in with others. Additionally, relying on a single word can cause missed specificity, as different roles may require unique descriptions of simplification. This lack of variety reduces the overall impact of your accomplishments, failing to showcase your skills effectively.

From an ATS optimization perspective, incorporating varied language enhances your chances of passing through automated systems, as they often scan for diverse keywords. Furthermore, using synonyms helps create dynamic narratives around your experiences, allowing you to present a well-rounded picture of your capabilities. By diversifying your language, you not only capture attention but also convey a more nuanced understanding of your contributions.

Build your resume in just 5 minutes with AI.

The Complete List: 59 Resume Synonyms for Simplified

Here’s our comprehensive collection of “Simplified” alternatives, organized for easy reference:

| Synonym | Best Context | Professional Level |

|---|---|---|

| Streamlined | Project Management | Mid-level |

| Clarified | Team Leadership | Entry-level |

| Refined | Process Improvement | Senior |

| Optimized | Operations | Executive |

| Condensed | Report Writing | Mid-level |

| Simplified | Training Programs | Entry-level |

| Enhanced | Customer Service | Senior |

| Reduced | Cost Management | Executive |

| Focused | Strategic Planning | Mid-level |

| Shortened | Documentation | Entry-level |

| Unified | Team Collaboration | Senior |

| Integrated | Systems Development | Executive |

| Polished | Presentations | Mid-level |

| Organized | Event Planning | Entry-level |

| Streamlined | Workflow Management | Senior |

| Facilitated | Meetings | Mid-level |

| Cataloged | Data Management | Entry-level |

| Simplified | Technical Documentation | Senior |

| Clarified | Communication | Entry-level |

| Redesigned | Product Development | Mid-level |

| Filtered | Information Management | Senior |

| Regularized | Compliance | Executive |

| Expedited | Project Delivery | Mid-level |

| Streamlined | Inventory Management | Entry-level |

| Consolidated | Financial Reporting | Senior |

| Coordinated | Cross-Departmental Projects | Mid-level |

| Truncated | Processes | Entry-level |

| Filtered | Data Analysis | Senior |

| Modernized | Technology Implementation | Executive |

| Simplified | Onboarding | Mid-level |

| Summarized | Market Research | Entry-level |

| Organized | Social Media Campaigns | Senior |

| Standardized | Quality Assurance | Mid-level |

| Reorganized | Company Structure | Executive |

| Simplified | Budgeting Processes | Entry-level |

| Consolidated | Project Resources | Senior |

| Clarified | Stakeholder Engagement | Mid-level |

| Streamlined | Client Interactions | Entry-level |

| Reduced | Operational Risks | Senior |

| Facilitated | Change Management | Executive |

| Harmonized | Team Dynamics | Mid-level |

| Clarified | Technical Concepts | Entry-level |

| Streamlined | Service Delivery | Senior |

| Refined | Marketing Strategies | Mid-level |

| Enhanced | Product Performance | Executive |

| Optimized | Resource Allocation | Senior |

| Simplified | Client Proposals | Entry-level |

| Coordinated | Community Outreach | Mid-level |

| Condensed | Training Materials | Senior |

| Streamlined | Feedback Processes | Executive |

| Unified | Brand Messaging | Mid-level |

| Clarified | Policy Guidelines | Entry-level |

| Polished | Public Relations | Senior |

| Reduced | Time to Market | Executive |

| Streamlined | Project Timelines | Mid-level |

| Simplified | CRM Systems | Entry-level |

Strategic Synonym Selection by Industry

In the world of resume optimization, selecting strategic synonyms tailored to specific industries can significantly enhance your appeal to potential employers. Here’s how to approach synonym selection by industry:

- Technology: This sector values innovation and systematic thinking. Preferred synonyms include:

- Innovation: Highlights creativity in problem-solving.

- Agile: Indicates adaptability in fast-paced environments.

- Data-driven: Emphasizes decisions based on analytics.

- Healthcare: Emphasizes precision and collaborative care. Preferred synonyms include:

- Patient-centered: Focuses on the needs of patients.

- Evidence-based: Indicates reliance on proven practices.

- Interdisciplinary: Reflects teamwork across various specialties.

- Finance: Prioritizes accuracy and risk management. Preferred synonyms include:

- Analytical: Shows proficiency in data analysis.

- Strategic: Reflects a focus on long-term planning.

- Regulatory-compliant: Indicates adherence to industry standards.

- Consulting: Values strategic insight and problem-solving. Preferred synonyms include:

- Advisory: Highlights expertise in guiding clients.

- Facilitative: Emphasizes collaboration in achieving outcomes.

- Transformative: Indicates ability to drive significant change.

- Manufacturing: Focuses on efficiency and quality control. Preferred synonyms include:

- Lean: Represents efficiency in processes.

- Quality assurance: Highlights commitment to product standards.

- Process optimization: Indicates enhancements in operational efficiency.

Power Combinations: Advanced Synonym Usage

Advanced synonym usage enhances your resume’s effectiveness, allowing you to showcase your skills and experiences more dynamically.

1. The Progressive Leadership Narrative emphasizes career growth through synonyms that reflect increasing responsibility. For instance, instead of repeating “managed” throughout your resume, use “oversaw,” “directed,” and “spearheaded” to illustrate your journey from a team leader to an executive role.

2. The Industry Transition Strategy involves selecting synonyms that reframe your experience for a new field. If moving from manufacturing to project management, replace “produced” with “coordinated” or “executed,” which aligns more closely with project management terminology.

3. Context-Specific Matching requires using synonyms that resonate with the role’s context. For example, if applying for a sales position, utilize “cultivated” client relationships rather than just “built,” as it conveys a more nuanced and proactive approach to relationship management.

Common Mistakes to Avoid

Transformed complex processes into streamlined workflows, enhancing productivity significantly.

Streamlined workflows by simplifying document approval processes, reducing turnaround time by 30%.

Made things easier for the team by simplifying reports.

Enhanced report clarity by distilling data into concise visual summaries for the team.

Responsible for simplifying tasks and streamlining processes in my last job.

In my last role, I improved efficiency by clarifying task instructions and optimizing project timelines.

Quantification Strategies for Maximum Impact

Incorporating quantification into your resume can significantly enhance the impact of leadership synonyms. Each synonym should be accompanied by tangible results to illustrate your effectiveness.

- Team-Focused Synonyms: When you use terms like “led” or “managed,” specify the size of the team and the duration of your leadership. For example, “Led a team of 15 professionals for 2 years, resulting in a 30% increase in productivity and a 20% reduction in turnover.”

- Project-Focused Synonyms: Use words like “orchestrated” or “executed” and provide details about the project’s value and its success metrics. For instance, “Executed a $500,000 marketing campaign over 6 months that generated a 150% return on investment and increased brand awareness by 40%.”

- Strategic-Focused Synonyms: When employing terms like “strategized” or “initiated,” include before-and-after metrics to showcase the impact. For example, “Strategized a new operational framework that improved efficiency from 60% to 85% within one year, decreasing costs by $200,000 annually.”

Industry-Specific Example Sentences

- Technology: Streamlined the software development process, reducing deployment time by 30% and increasing team productivity by implementing agile methodologies.

- Technology: Optimized user interface design, enhancing user experience scores by 25% and decreasing customer support tickets by 40% due to improved navigation.

- Technology: Refined data processing algorithms, resulting in a 50% reduction in processing time and enabling real-time analytics for over 10,000 users.

- Technology: Clarified technical documentation for a cloud platform, leading to a 20% increase in user adoption rates and a 15% decrease in onboarding time.

- Healthcare: Streamlined patient intake procedures, which led to a 25% reduction in wait times and improved overall patient satisfaction scores by 15%.

- Healthcare: Optimized electronic health record systems, enhancing data retrieval efficiency by 35% and reducing errors in patient documentation by 20%.

- Healthcare: Refined treatment protocols, resulting in a 30% increase in patient recovery rates and a 10% decrease in hospital readmission rates.

- Healthcare: Simplified billing processes, achieving a 40% reduction in claim processing time and increasing revenue cycle efficiency by 25%.

- Business/Finance: Streamlined financial reporting processes, reducing report generation time by 50% and increasing accuracy, which led to a 15% reduction in auditing discrepancies.

- Business/Finance: Optimized budget forecasting models, improving forecast accuracy by 20% and enabling informed decision-making for a $5 million project.

- Business/Finance: Refined client onboarding procedures, leading to a 30% increase in client satisfaction and a 25% faster onboarding timeline.

- Business/Finance: Clarified investment strategies for clients, resulting in a 40% growth in portfolio performance and a 20% increase in client retention rates.

- Education: Streamlined curriculum design, enhancing student engagement by 30% and improving assessment scores by 20% across multiple grade levels.

- Education: Optimized lesson planning processes, leading to a 25% increase in teacher efficiency and a 15% improvement in student participation rates.

- Education: Refined student feedback mechanisms, resulting in a 40% increase in actionable insights and a 20% improvement in overall course satisfaction.

- Education: Simplified administrative procedures, achieving a 30% reduction in processing time for student applications and increasing enrollment rates by 15%.

Advanced ATS Optimization Techniques

To optimize your resume for Applicant Tracking Systems (ATS), it’s crucial to use synonyms effectively. First, implement a keyword density strategy by incorporating 2-3 different synonyms per job role. For example, if the job description mentions “project management,” consider using “project coordination” and “program oversight” to maintain keyword relevance while avoiding redundancy.

Next, utilize semantic clustering to group related synonyms. For instance, if your skills include “communication,” also include “interpersonal skills” and “verbal abilities.” This not only enhances readability but increases the likelihood of matching various keyword searches by the ATS.

Finally, focus on job description matching by analyzing job postings closely. Identify and incorporate similar synonyms found in these postings. If a job ad mentions “data analysis,” also include “data interpretation” and “statistical evaluation.” By aligning your resume terminology with the job description, you improve your chances of passing ATS filters.

Tailoring Synonyms to Career Level

- Entry-Level Professionals: For individuals at the start of their careers, it’s essential to use synonyms that highlight collaboration and eagerness to learn. Words like “collaborated,” “assisted,” “supported,” and “learned” can convey a team-oriented mindset and a willingness to grow. This appeals to employers looking for adaptable candidates who can thrive in a supportive role.

- Mid-Level Managers: As professionals advance, focusing on management and leadership language becomes crucial. Terms such as “led,” “directed,” “coordinated,” and “oversaw” illustrate a candidate’s ability to manage teams and projects effectively. This language signals to employers that the individual has the experience and confidence needed to handle responsibilities and drive results.

- Senior Executives: For those in executive roles, employing strategic and transformational synonyms is vital. Words like “orchestrated,” “transformed,” “spearheaded,” and “envisioned” reflect a focus on high-level decision-making and change management. This language conveys authority and the capacity to shape an organization’s future, appealing to stakeholders looking for visionary leaders.

The Psychology of Leadership Language

The psychology of leadership language plays a crucial role in how hiring managers perceive candidates. Different synonyms can trigger distinct psychological responses that align with desired skills.

- Action-Oriented Words: Terms like “achieved,” “driven,” and “executed” suggest results-focused leadership. Such language resonates with hiring managers seeking candidates who prioritize outcomes and accountability.

- Collaborative Words: Words such as “partnered,” “facilitated,” and “coordinated” indicate team-building skills, appealing to employers looking for leaders who foster collaboration and communication.

- Innovation Words: Utilizing terms like “pioneered,” “crafted,” and “envisioned” conveys strategic thinking, attracting those who value creativity and forward-thinking in a leader.

- Nurturing Words: Words like “mentored,” “supported,” and “developed” show a focus on people development, which is essential for organizations prioritizing employee growth and a positive culture.

By aligning word choices with company culture, candidates can evoke the desired responses and enhance their attractiveness to potential employers.

Final Best Practices

To effectively use synonyms in your resume, adhere to the 60-Second Rule: ensure that your resume tells a compelling story that can be grasped in about a minute. Prioritize clarity and impact—use strong, relevant synonyms that resonate with your experience but avoid overcomplicating language.

Next, apply the Mirror Test by reading your resume aloud. The language should feel natural and reflect your speaking style. If certain synonyms feel forced or awkward, consider replacing them with simpler terms that maintain authenticity.

Engage in a Peer Review by having trusted colleagues or mentors evaluate your synonym choices. Their feedback can provide insights into whether your language effectively conveys your qualifications while sounding genuine.

Finally, Measure Success by tracking the response rates of your applications. If you notice a pattern in which synonyms lead to more interviews, consider refining your language further. This approach helps you balance strategic language with authenticity, ensuring your resume stands out while remaining true to your voice.

Key Takeaways for Strategic Synonym Usage

- Utilize ‘resume templates‘ to ensure a clean and professional layout, making it easier for hiring managers to quickly assess your qualifications.

- Incorporate synonyms strategically throughout your resume to enhance readability and avoid redundancy, making use of an ‘AI resume builder‘ for optimal suggestions.

- When showcasing experience, refer to ‘resume examples‘ to identify effective phrasing and structure that resonate with your target industry.

- Regularly update your resume with fresh synonyms to keep it relevant and engaging, ensuring it aligns with evolving industry language and trends.

- Use synonyms to emphasize your skills and accomplishments without overusing specific terms, leveraging ‘resume templates’ that allow for varied word choices.

- Test different synonym variations in your ‘AI resume builder’ to discover which combinations yield the best results in terms of readability and impact.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.

Frequently Asked Questions

How many different synonyms should I use in one resume?

It’s advisable to use 2-3 different synonyms for ‘simplified’ throughout your resume. This variety helps maintain reader engagement while also ensuring that your resume is optimized for applicant tracking systems (ATS). However, avoid overusing synonyms to the point where it feels forced or unnatural. Instead, select synonyms that fit naturally within the context of your accomplishments and responsibilities, showcasing your ability to communicate effectively.

Can I use the same synonym multiple times if it fits different contexts?

Yes, you can use the same synonym multiple times if it fits different contexts. However, ensure that each usage is relevant and enhances the clarity of your statements. Repeating a well-chosen synonym can reinforce key skills or achievements without sounding repetitive. Just be mindful of the overall flow of your resume, maintaining a balance between variety and coherence to keep your message clear and impactful.

Should I always replace ‘Simplified’ with a synonym?

Not necessarily. While using synonyms can enhance your resume, it’s important to maintain clarity and context. If ‘simplified’ is the most precise term for your achievements, it’s perfectly acceptable to keep it. The goal is to communicate your contributions clearly and effectively. Only replace it when a synonym fits better contextually or conveys a stronger impact. Prioritize clarity over variety to ensure your accomplishments are well understood.

How do I know which synonym is most appropriate for my industry?

To determine the most appropriate synonym for your industry, research industry-specific terminology and language used in job descriptions. Analyze how professionals in your field describe similar roles and accomplishments. Additionally, consider the nuances of each synonym; for example, ‘streamlined’ may be more relevant in tech environments, while ‘clarified’ could resonate in educational or training contexts. Tailoring your language to industry standards can enhance your credibility and show that you understand the specific demands of your field.

Do synonyms really make a difference in getting interviews?

Yes, synonyms can significantly impact your chances of getting interviews. A well-crafted resume that uses varied language not only captures attention but also demonstrates your communication skills and ability to tailor your message. By strategically employing synonyms, you can highlight your accomplishments in a way that stands out to recruiters and hiring managers. This differentiation can improve your visibility in ATS and make your resume more engaging for human readers, ultimately increasing your chances of landing interviews.

Related Resume Synonym Guides

Exploring synonyms for commonly overused resume words can enhance your professional narrative. Strategic word choice throughout your resume not only captures attention but also demonstrates your unique skills and experiences, setting you apart from the competition and creating a more compelling case for your candidacy.