The role of a Claims Adjuster is pivotal in the insurance industry, serving as the bridge between policyholders and insurers. These professionals assess claims, investigate circumstances, and determine the validity of requests for compensation, ensuring fair treatment for all parties involved. In today’s job market, where the demand for reliable insurance services continues to grow, Claims Adjusters play a critical role in maintaining trust and transparency. This article will guide you through the essential components of a standout resume for this important profession, highlighting key skills and strategies to help you succeed in securing a position as a Claims Adjuster.

- Claims Adjuster resume examples

- How to format a Claims Adjuster resume

- How to write your Claims Adjuster resume experience

- How to list your hard skills and soft skills on your resume

- How to list your certifications and education on your resume

- How to write your Claims Adjuster resume summary or objective

- Additional sections for a Claims Adjuster resume

- Key takeaways for writing a professional Claims Adjuster resume

- Frequently Asked Questions

Claims Adjuster resume examples

Claims Adjuster resume examples serve as valuable resources for job seekers aiming to craft effective resumes tailored to this specific role. By analyzing these examples, candidates can gain insights into the key skills, accomplishments, and formatting techniques that resonate with employers. This understanding helps job seekers highlight their qualifications and present themselves as strong contenders in a competitive job market.

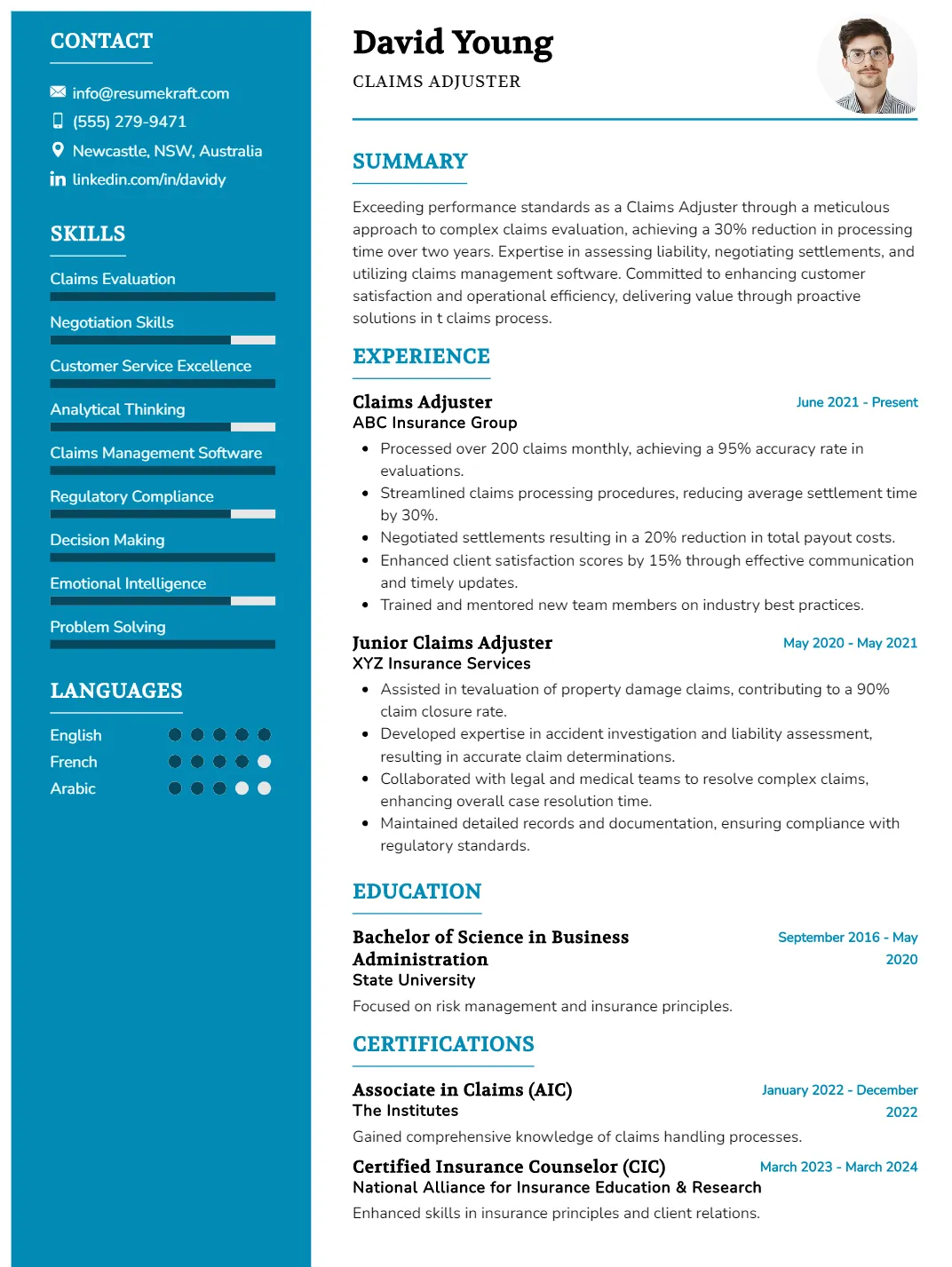

Claims Adjuster

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills and experience for a Claims Adjuster position, showcasing five years in roles directly tied to claims evaluation and negotiation. The structured format emphasizes key competencies like analytical thinking and customer service excellence, making it easy for hiring managers to scan. Its ATS-friendly design includes industry-specific keywords, ensuring visibility in applicant tracking systems. Additionally, strategic presentation of achievements demonstrates quantifiable success in claims management, reinforcing the candidate’s qualifications for this role.

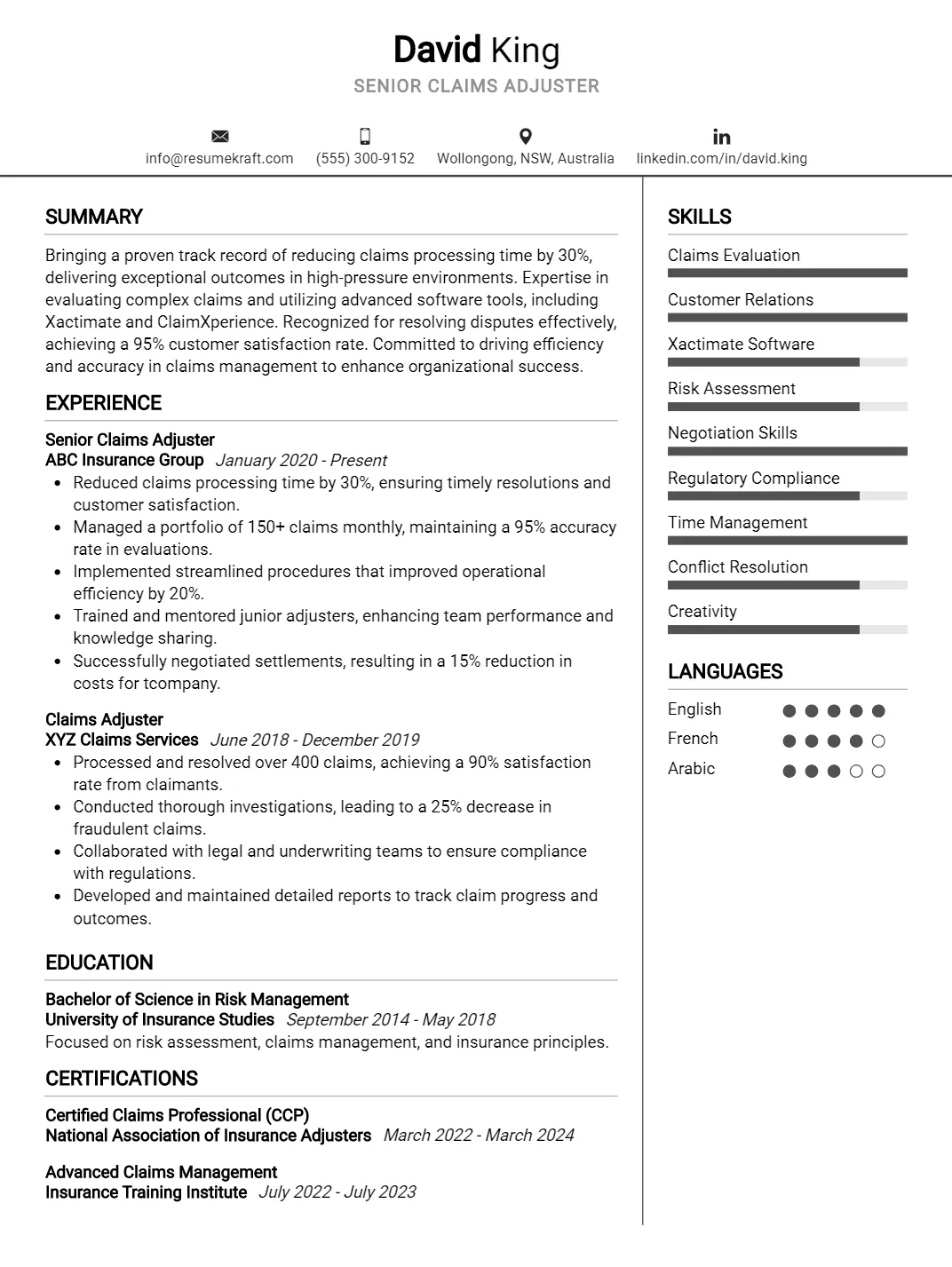

Senior Claims Adjuster

Why This Resume Works

This resume effectively positions the candidate for a Senior Claims Adjuster role by showcasing relevant skills such as claims evaluation and risk assessment, essential for assessing complex claims. With six years of progressive experience, it demonstrates a solid foundation in customer relations and negotiation skills critical to the position. The structured format highlights key achievements clearly, making it easy for hiring managers to identify qualifications. Additionally, the inclusion of industry-specific keywords ensures ATS compatibility, enhancing the chances of selection in automated screenings.

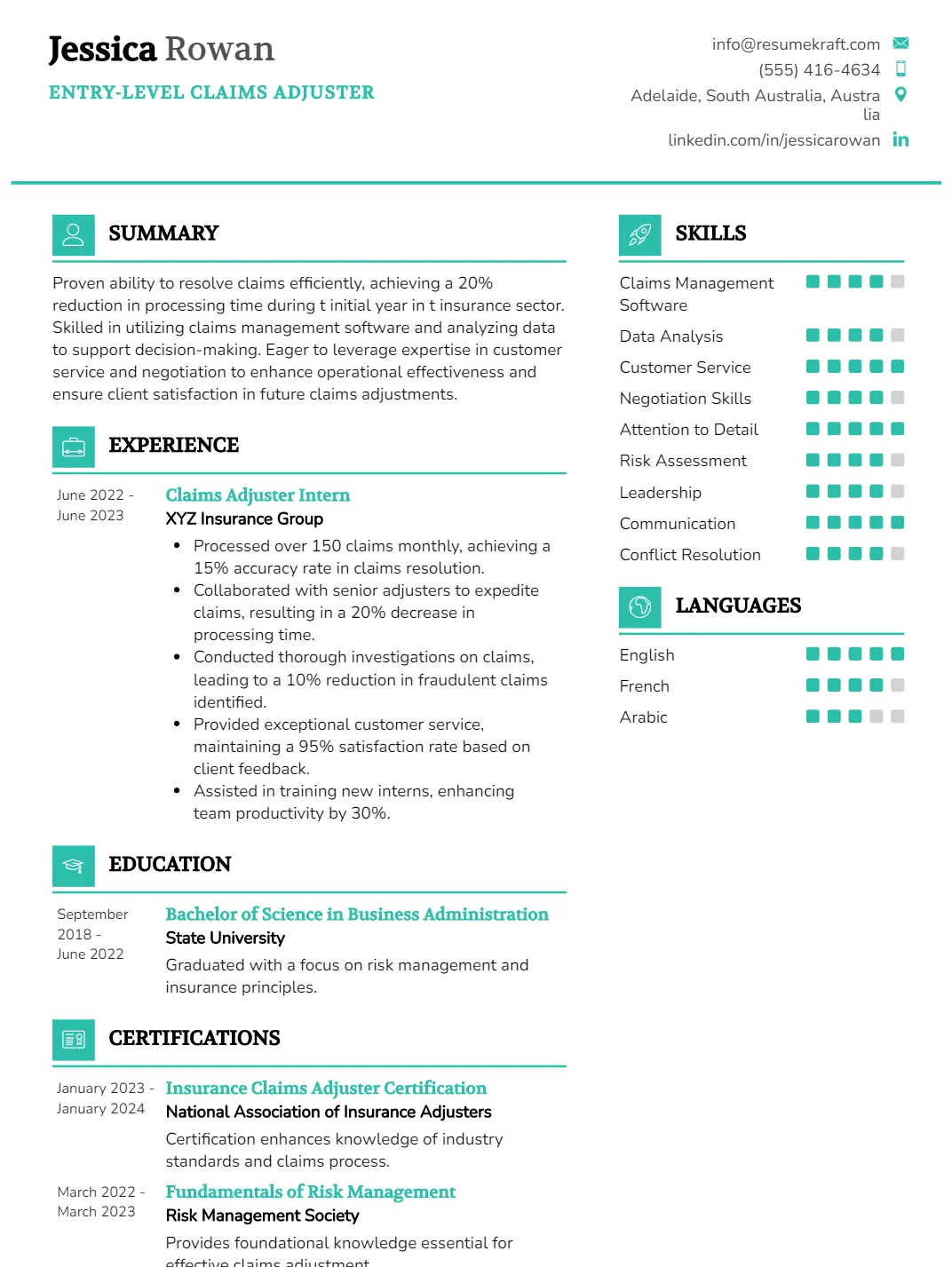

Entry-Level Claims Adjuster

Why This Resume Works

This resume effectively showcases the candidate’s relevant skills, such as Claims Management Software and Data Analysis, aligning perfectly with the Entry-Level Claims Adjuster position. The structured format highlights key experiences like a Claims Adjuster Internship, emphasizing practical exposure in the field. Its ATS-friendly layout ensures compatibility with industry standards by incorporating targeted keywords. Additionally, the strategic presentation of achievements demonstrates their ability to deliver results in customer service and negotiation, making this resume particularly compelling for employers seeking entry-level talent.

Claims Adjuster with Specialization in Property and Casualty

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills and experience as a Claims Adjuster with Specialization in Property and Casualty. Key skills like claim investigation, policy analysis, and negotiation are prominently featured, aligning with industry requirements. The structured format enhances readability, ensuring that hiring managers can quickly identify qualifications. Additionally, the use of industry-specific keywords improves ATS compatibility. By strategically showcasing achievements related to customer service and data analysis, this resume positions the candidate as a strong fit for the role.

Claims Adjuster from a Financial Analyst Background

Why This Resume Works

This resume effectively positions the candidate for a Claims Adjuster role by highlighting relevant skills such as Data Analysis and Risk Assessment, which are crucial for evaluating claims. The structure is clear and professional, ensuring easy readability for hiring managers. Its ATS compatibility is strengthened through the inclusion of industry-specific keywords like “Claims Management” and “Regulatory Compliance.” Additionally, strategic presentation of achievements from both financial analysis and claims adjustment showcases the candidate’s unique ability to blend financial insight with claims expertise, making them a standout.

Commercial Insurance Claims Adjuster

Why This Resume Works

This resume effectively highlights the candidate’s relevant experience as a Commercial Insurance Claims Adjuster and Claims Assistant, showcasing five years in the field. The inclusion of key skills such as Claims Management and Negotiation aligns closely with the job requirements, enhancing its appeal. Its clear format and structured layout facilitate quick readability, while ensuring ATS compatibility through strategic keyword usage. Additionally, the presentation of achievements emphasizes customer service excellence and regulatory compliance, crucial for success in this industry, further strengthening the candidate’s profile.

Medical Claims Adjuster

Why This Resume Works

This resume effectively positions the candidate for a Medical Claims Adjuster role by showcasing relevant skills such as claims processing and regulatory compliance, essential for accurately assessing claims. With approximately five years of experience, including a prior role as a Claims Assistant, it highlights a solid foundation in policy interpretation and data analysis. The structured format enhances readability, ensuring ATS compatibility with industry-specific keywords. Strategic presentation of achievements emphasizes the candidate’s impact on efficiency and customer service, further aligning with the job requirements.

Claims Adjuster Manager

Why This Resume Works

This resume effectively highlights the candidate’s extensive experience in claims management, showcasing a clear progression from Claims Adjuster to Claims Adjuster Manager over eight years. The inclusion of key skills like regulatory compliance and data analysis aligns perfectly with industry demands. Its structured format enhances readability, making it ATS-compatible by incorporating relevant keywords. Furthermore, strategically presented achievements illustrate the candidate’s leadership and customer service excellence, demonstrating their capability to drive team performance and improve claims processing outcomes, essential for this managerial role.

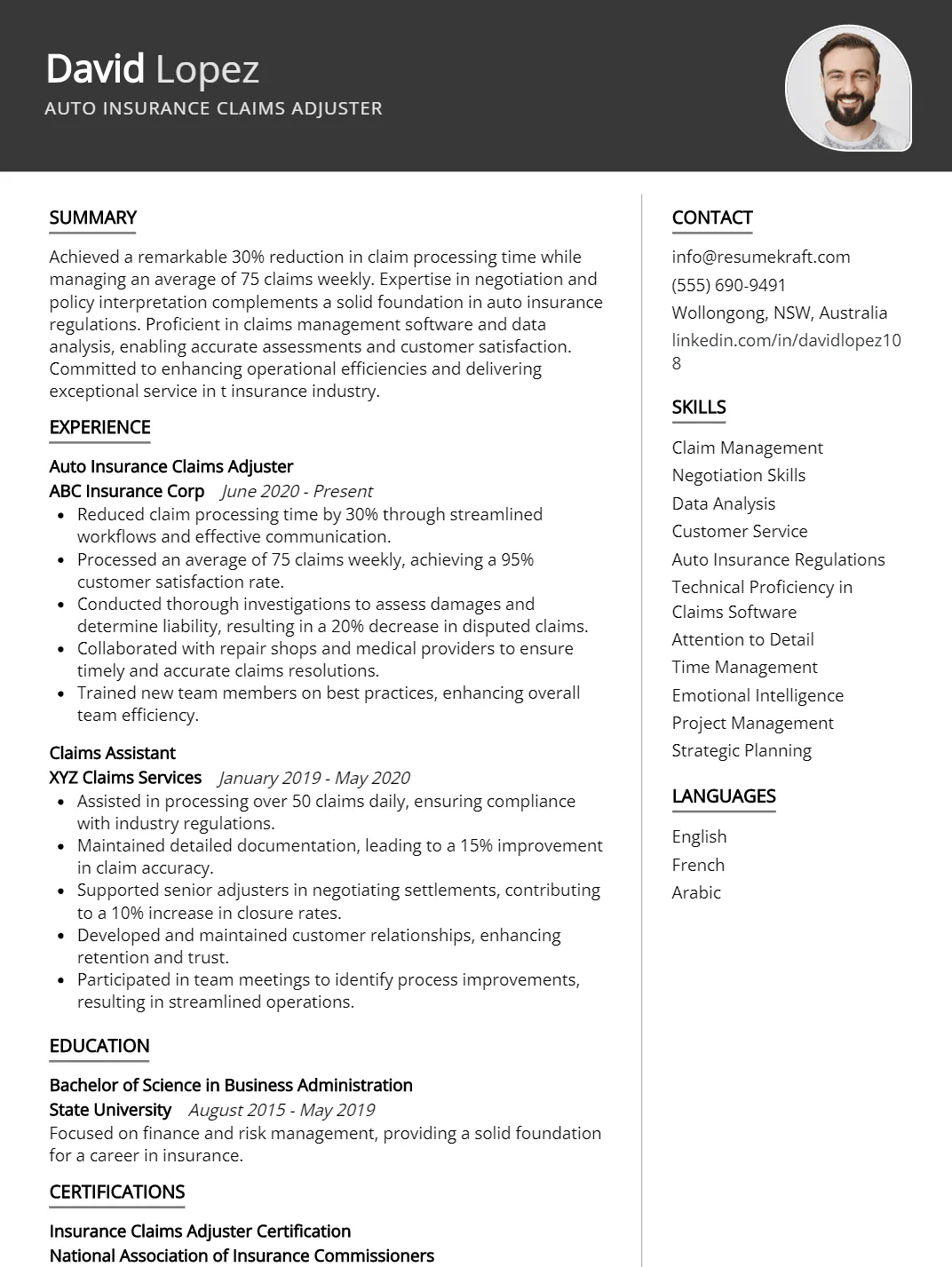

Auto Insurance Claims Adjuster

Why This Resume Works

This resume effectively positions the candidate for an Auto Insurance Claims Adjuster role by highlighting key skills such as claim management and negotiation, essential for resolving disputes. With six years of relevant experience, the structured format clearly showcases progression from Claims Assistant to Adjuster, enhancing credibility. The use of industry-specific keywords ensures ATS compatibility, improving visibility in applicant tracking systems. Additionally, strategic presentation of achievements demonstrates their impact on claim resolutions and customer satisfaction, making this resume compelling for hiring managers in the auto insurance.

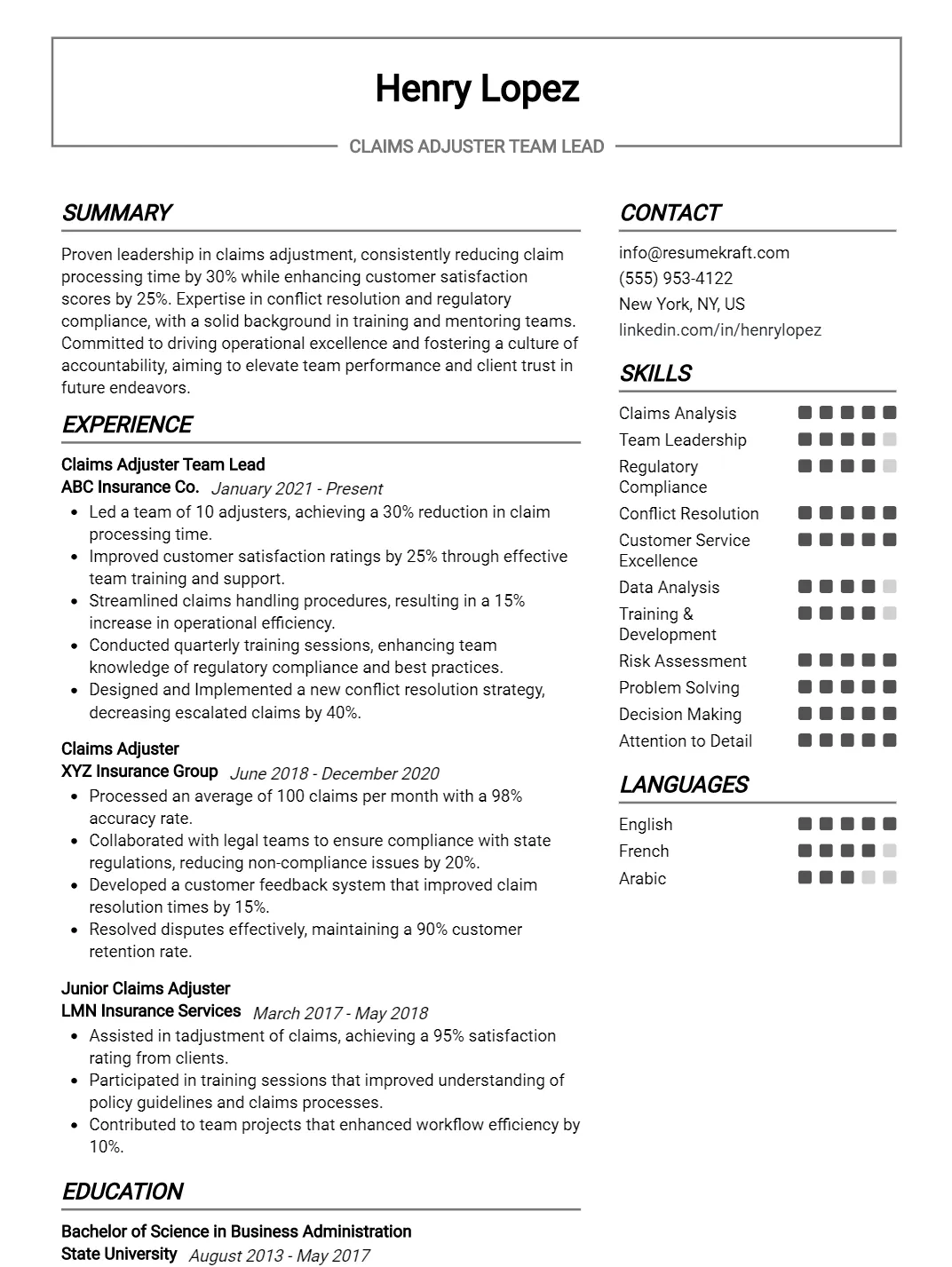

Claims Adjuster Team Lead

Why This Resume Works

This resume effectively positions the candidate for a Claims Adjuster Team Lead role by highlighting relevant skills such as claims analysis and team leadership, directly aligned with job requirements. The structured format enhances readability, ensuring key experiences are easily identifiable, while ATS compatibility is addressed through strategic keyword usage. Additionally, the presentation of achievements in conflict resolution and customer service excellence demonstrates the candidate’s impact in prior roles, making them a compelling choice for optimizing claims processes and leading a team successfully.

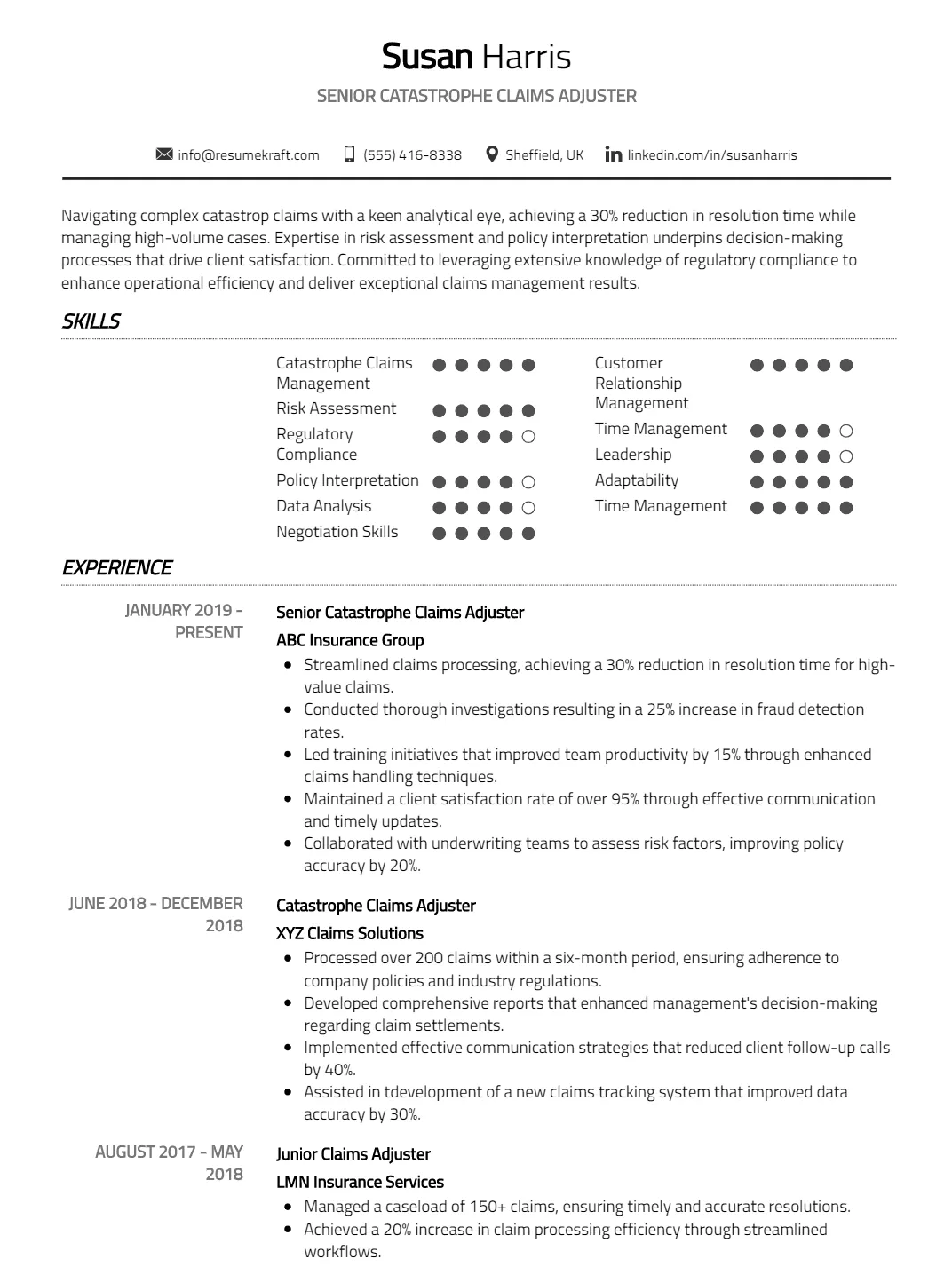

Senior Catastrophe Claims Adjuster

Why This Resume Works

This resume effectively positions the candidate for a Senior Catastrophe Claims Adjuster role by highlighting relevant skills such as catastrophe claims management and risk assessment, aligned with seven years of progressive experience in the field. The clear format enhances readability, ensuring key qualifications stand out. Moreover, it is likely optimized for Applicant Tracking Systems (ATS) through the strategic use of industry-specific keywords. Additionally, the presentation of quantifiable achievements underscores the candidate’s ability to manage complex claims, making them an ideal fit for this position.

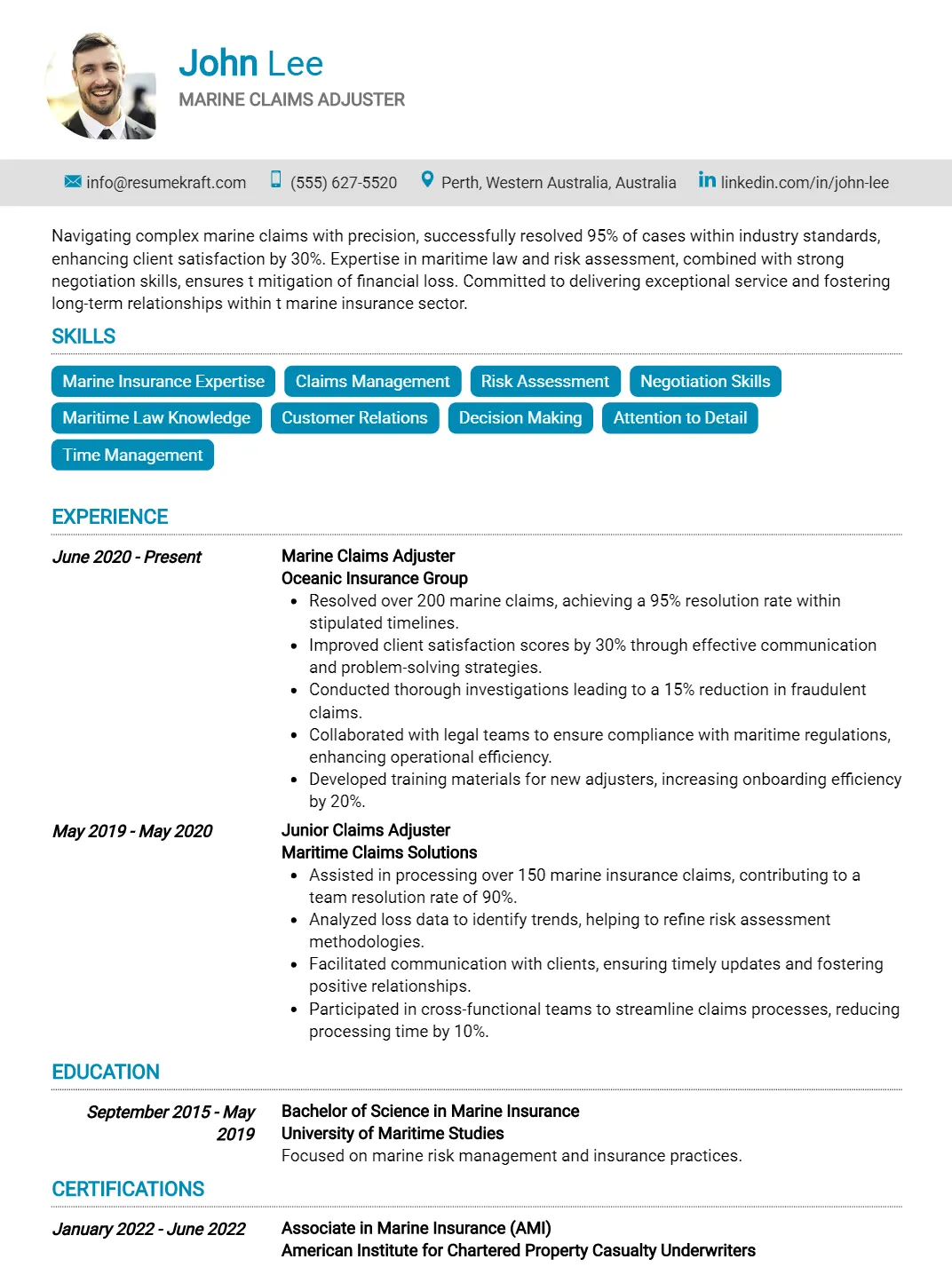

Marine Claims Adjuster

Why This Resume Works

This resume effectively highlights the candidate’s specialized skills in marine insurance, claims management, and maritime law, directly aligning with the Marine Claims Adjuster position. With six years of relevant experience, it emphasizes negotiation skills and risk assessment capabilities crucial for this role. The structured format enhances readability, making key qualifications easily identifiable for hiring managers. Additionally, by incorporating industry-specific keywords, the resume ensures compatibility with Applicant Tracking Systems (ATS), while strategically showcasing achievements that resonate with marine insurance challenges.

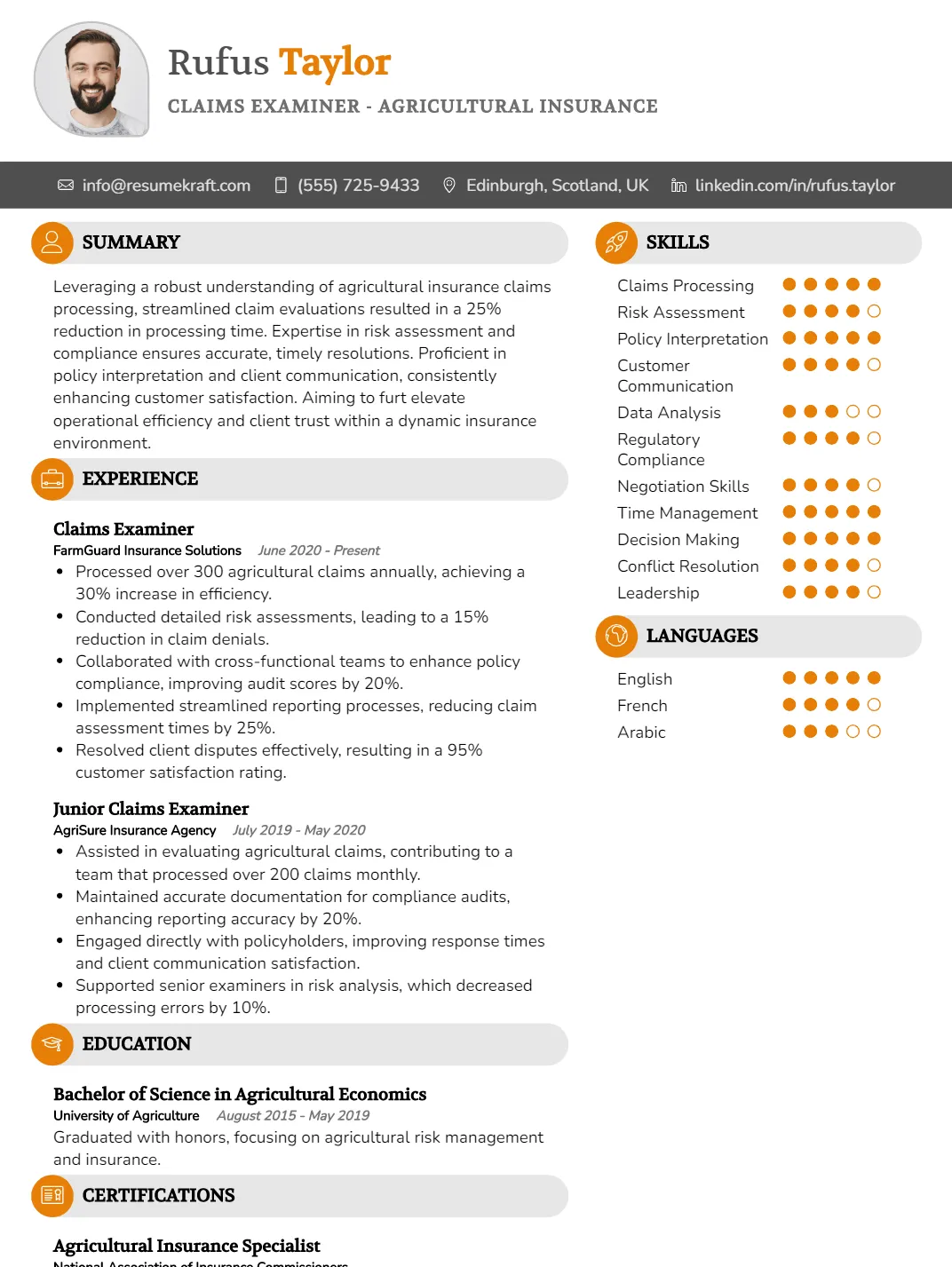

Claims Examiner – Agricultural Insurance

Why This Resume Works

This resume effectively highlights the candidate’s six years of experience as a Claims Examiner, emphasizing key skills such as claims processing and risk assessment crucial for agricultural insurance. Its clear structure and organized format enhance readability, making it easy for hiring managers to identify relevant qualifications. By incorporating industry-specific keywords, the resume ensures ATS compatibility, increasing its chances of passing initial screenings. Additionally, strategic presentation of achievements showcases the candidate’s contributions to policy interpretation and data analysis, aligning perfectly with the demands of the role.

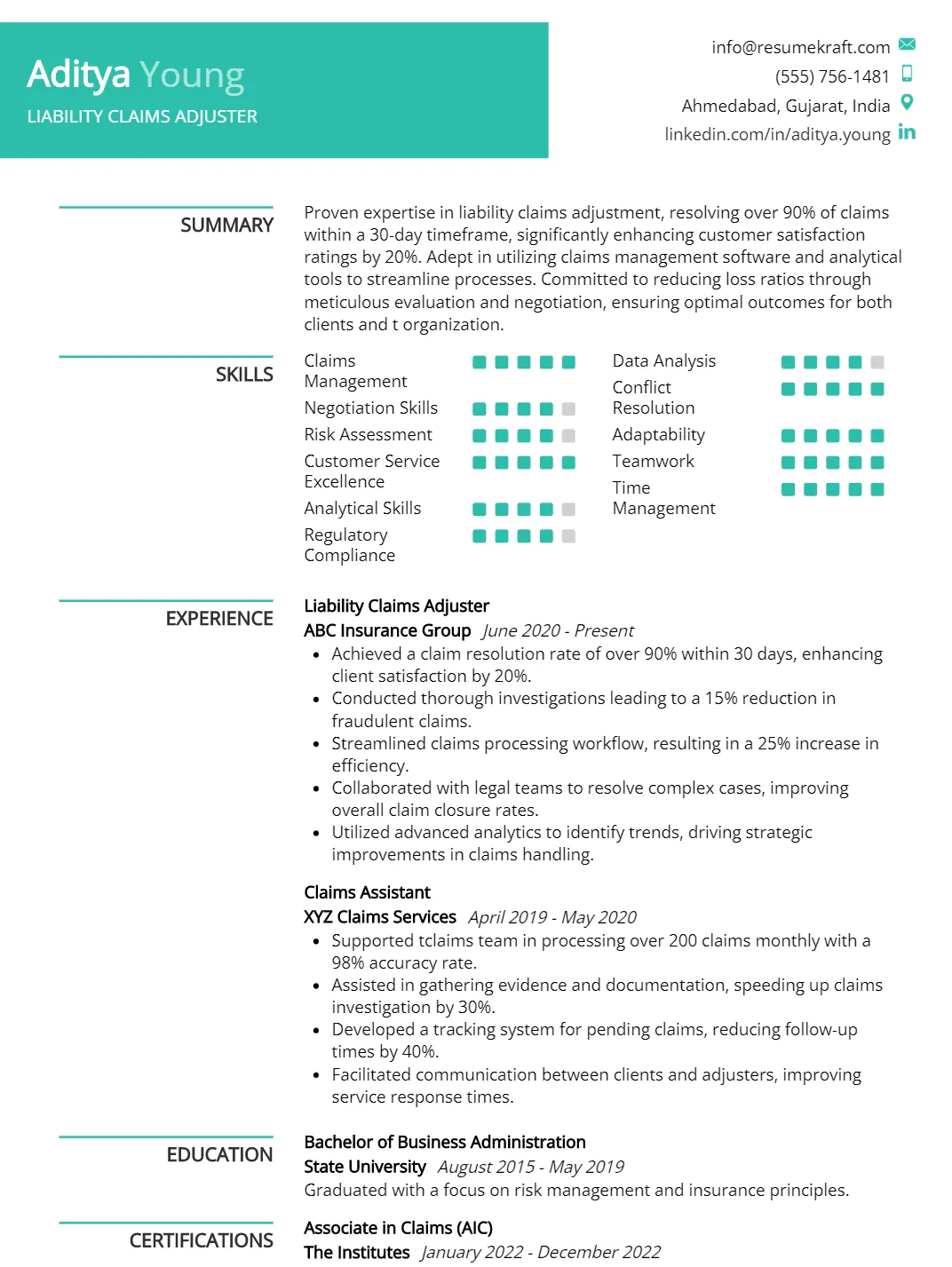

Liability Claims Adjuster

Why This Resume Works

This resume effectively showcases the candidate’s suitability for a Liability Claims Adjuster position through a clear emphasis on relevant skills such as claims management and negotiation. With six years of experience in liability claims, the structured format highlights key achievements that demonstrate analytical expertise and customer service excellence. Additionally, the use of industry-specific keywords ensures ATS compatibility, enhancing visibility to employers. Overall, the strategic presentation aligns well with the demands of the role, making it a compelling choice for hiring managers.

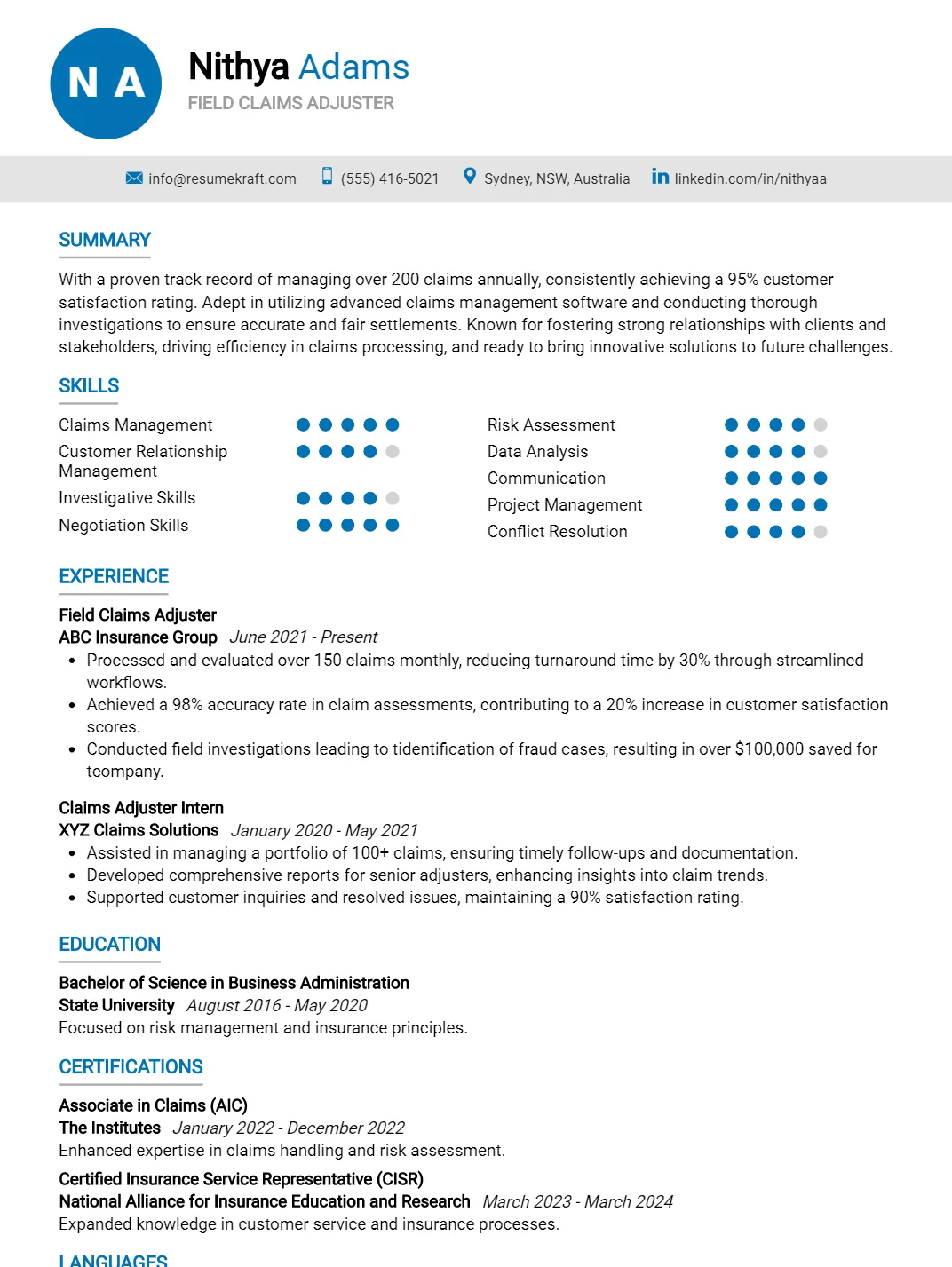

Field Claims Adjuster

Why This Resume Works

This resume effectively showcases the candidate’s suitability for a Field Claims Adjuster position by highlighting relevant skills such as claims management and risk assessment, directly aligned with job requirements. With five years of experience in field claims adjusting and an internship, it demonstrates both practical expertise and growth in the field. The structured format enhances readability, ensuring clarity for hiring managers and ATS systems. Additionally, strategic presentation of achievements underscores the candidate’s negotiation skills and customer relationship management, key attributes in this profession.

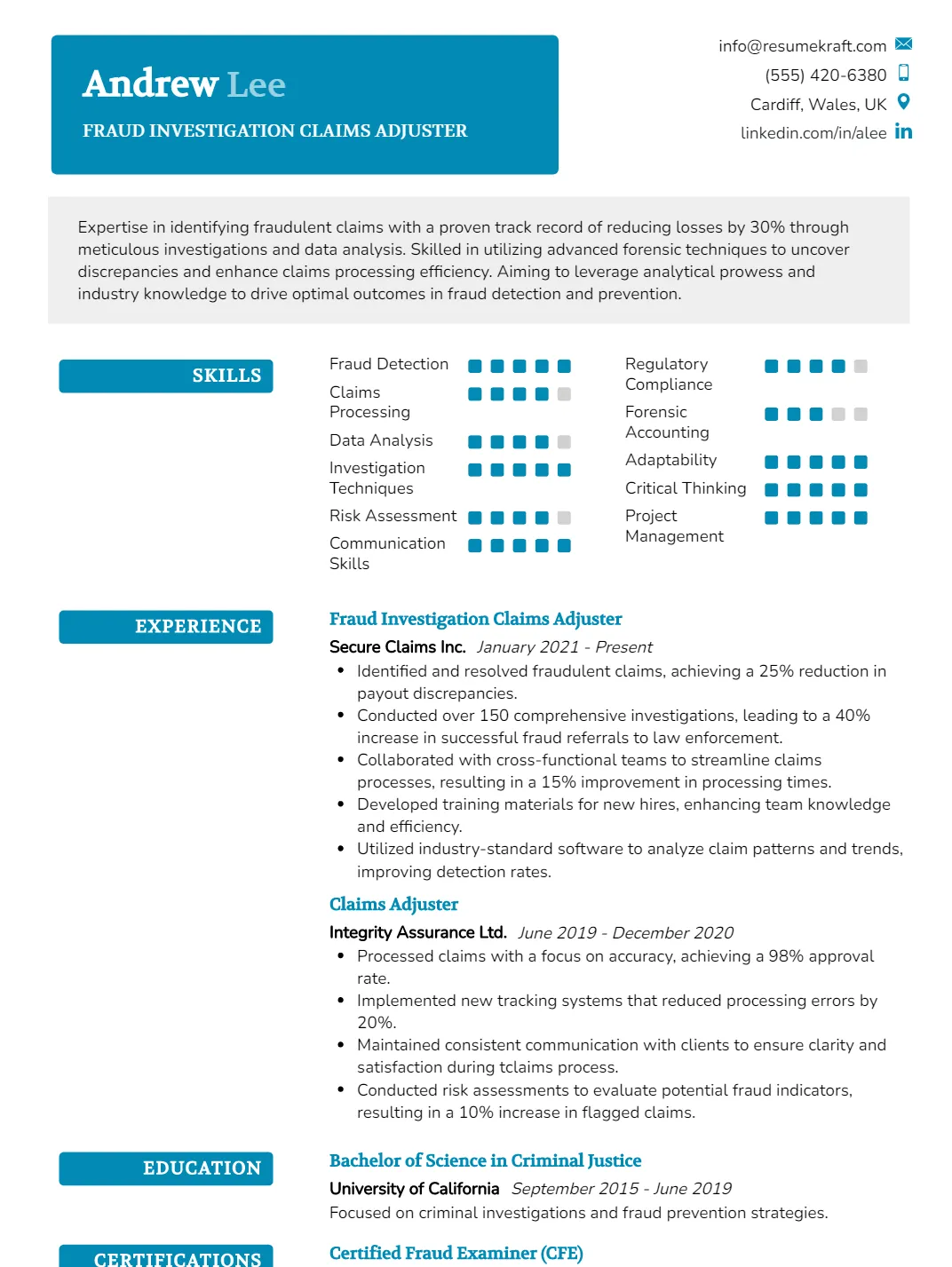

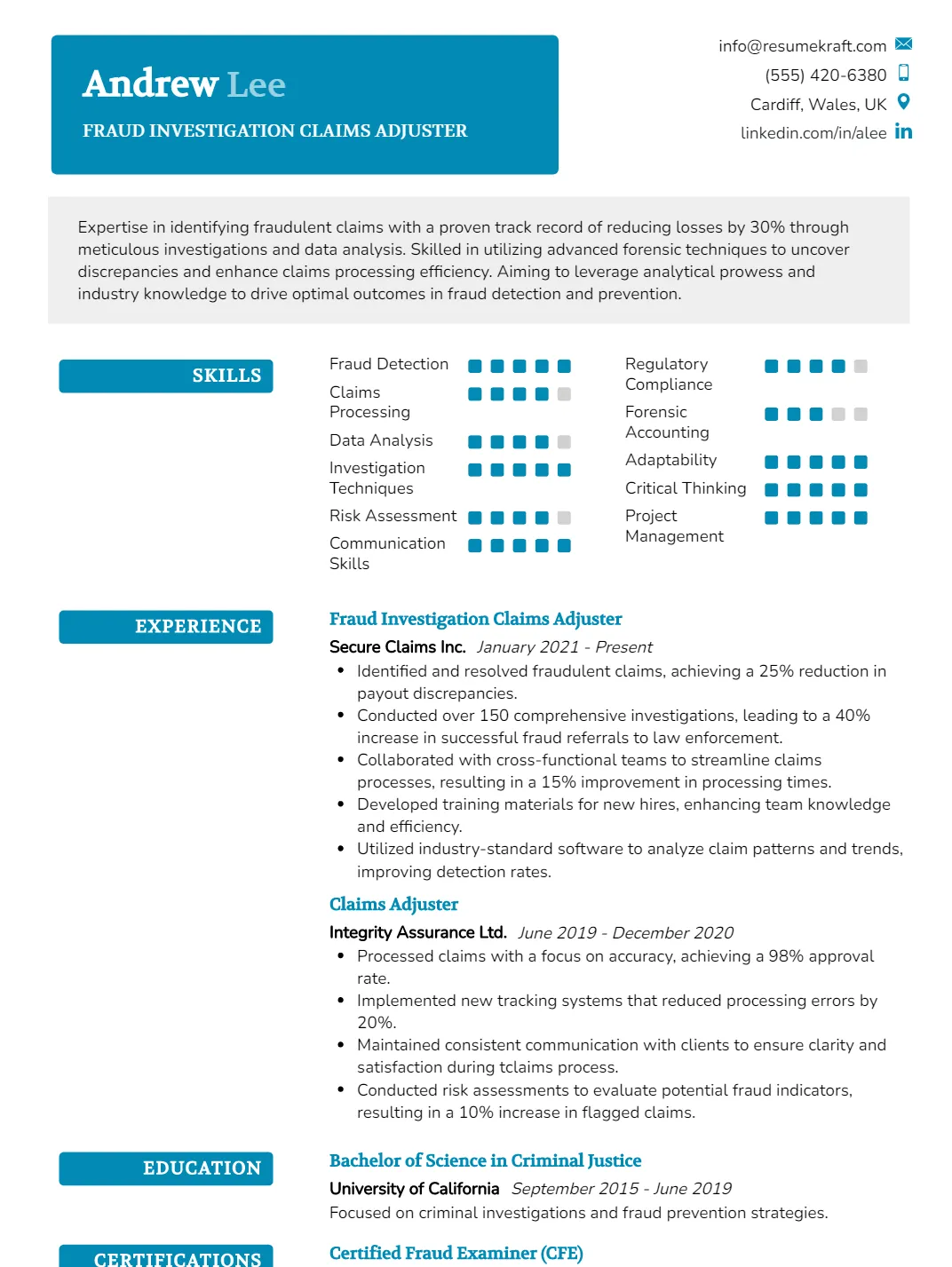

Fraud Investigation Claims Adjuster

Why This Resume Works

This resume effectively showcases the candidate’s relevant skills and experience tailored for a Fraud Investigation Claims Adjuster position. The clear emphasis on fraud detection, claims processing, and data analysis directly aligns with industry demands. Its structured format enhances readability, allowing hiring managers to quickly identify key qualifications. Additionally, the use of industry-specific keywords ensures ATS compatibility, increasing visibility during screenings. By highlighting measurable achievements in previous roles, the resume strategically demonstrates proven success in fraud investigations, making it compelling for potential employers.

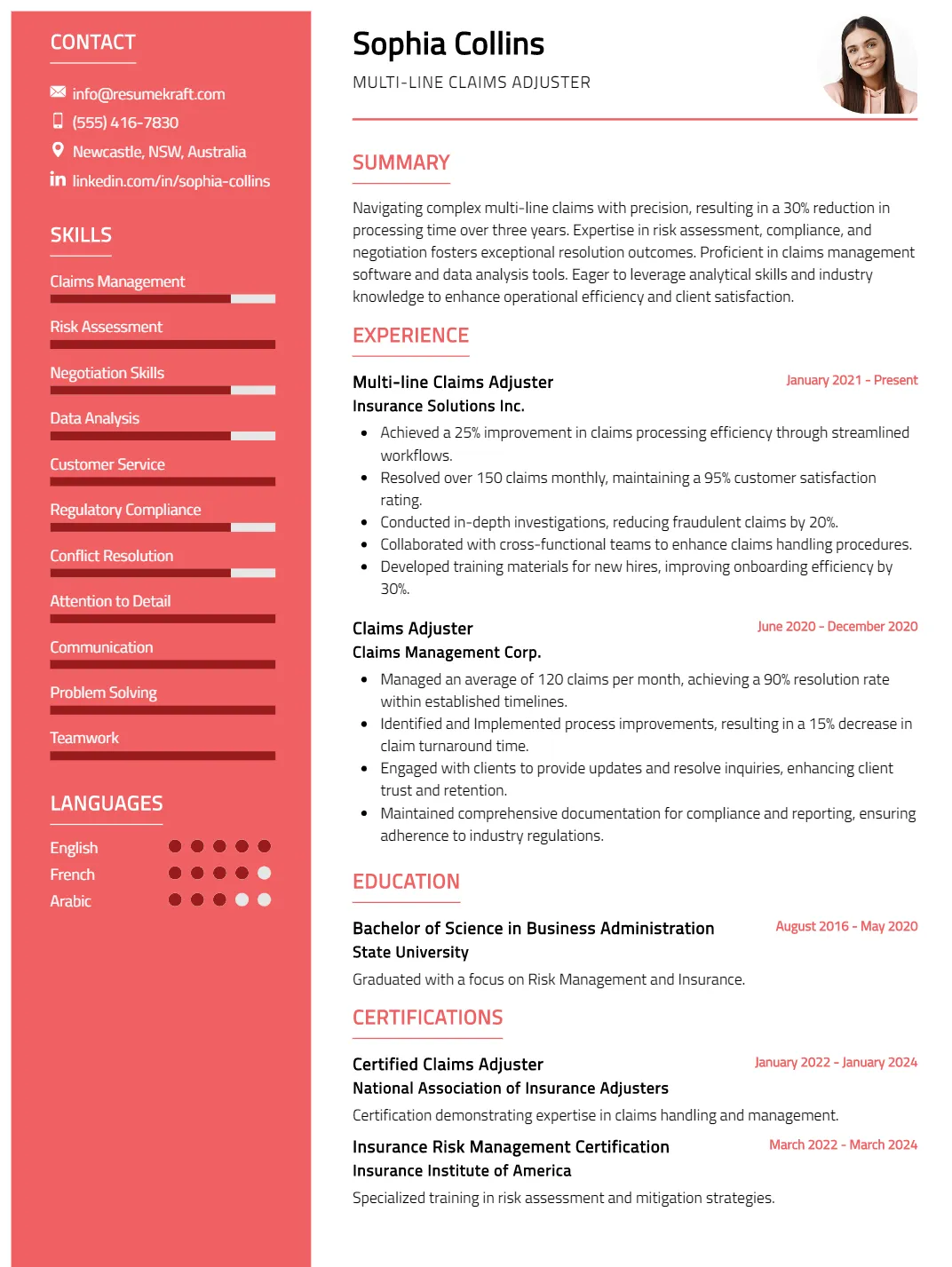

Multi-line Claims Adjuster

Why This Resume Works

This resume effectively highlights the candidate’s relevant experience as a Multi-line Claims Adjuster, emphasizing key skills such as claims management and negotiation. Its clear format enhances readability, ensuring quick assessment by hiring managers. The inclusion of industry-specific keywords boosts ATS compatibility, increasing the chances of passing automated screenings. Furthermore, strategic presentation of achievements showcases measurable impacts in prior roles, demonstrating the candidate’s value to potential employers in the claims adjustment field. Overall, it positions them as a strong contender for the position.

How to format a Claims Adjuster resume

Proper formatting for a Claims Adjuster resume is crucial as it enhances readability and ensures that your qualifications stand out. A well-structured resume format can effectively highlight your expertise in assessing claims and managing complex cases.

- Use a clear, professional font such as Arial or Times New Roman, sized between 10-12 points, to ensure easy readability and a polished appearance.

- Organize sections logically, starting with your contact information, followed by a summary, skills, work experience, and education to guide the reader through your qualifications.

- Utilize bullet points to present your achievements and responsibilities clearly, allowing hiring managers to quickly grasp your key contributions and skills relevant to claims adjusting.

- Incorporate consistent spacing and margins throughout your resume, ensuring that it appears neat and professional, making it easier for the reader to navigate.

- Highlight relevant certifications and licenses in a dedicated section, using bold text to draw attention to these qualifications that are essential for a Claims Adjuster role.

How to write your Claims Adjuster resume experience

Effectively presenting your work experience on a Claims Adjuster resume is essential, as this section showcases your relevant skills and accomplishments in handling claims. Employers look for specific achievements and metrics that demonstrate your ability to investigate, evaluate, and negotiate claims successfully, which can set you apart from other candidates.

To make a strong impression, focus on quantifiable results and specific responsibilities you’ve undertaken in previous roles. Highlight your expertise in various types of claims and your proficiency in using industry-related software. This not only illustrates your hands-on experience but also shows that you understand the intricacies of the claims process.

Worked on claims and helped customers. Responsible for ensuring claims were processed.

Processed and resolved over 300 property damage claims annually, achieving a 95% customer satisfaction rating and reducing average processing time by 20% through efficient investigation and negotiation techniques.

How to list your hard skills and soft skills on your resume

In the competitive field of claims adjusting, showcasing both hard and soft skills on your resume is crucial for standing out to potential employers. Hard skills demonstrate your technical expertise and knowledge specific to the industry, while soft skills highlight your interpersonal abilities and adaptability in various situations. A well-rounded resume that reflects both skill sets can significantly improve your chances of landing an interview and succeeding in this role.

Hard Skills:

- Claims Processing: Proficient in evaluating and processing insurance claims efficiently.

- Insurance Regulations: Knowledgeable about state and federal insurance laws.

- Risk Assessment: Ability to analyze risks associated with claims and determine validity.

- Estimating Damages: Skilled at calculating repair and replacement costs for damaged property.

- Data Analysis: Competent in analyzing data to identify trends in claims processing.

- Negotiation: Experienced in negotiating settlements with claimants and service providers.

- Policy Interpretation: Capable of interpreting complex insurance policies and coverage options.

- Report Writing: Proficient in drafting clear and concise claims reports.

- Computer Proficiency: Familiar with claims management software and database systems.

- Field Investigation: Experienced in conducting field visits to gather evidence and assess damages.

- Documentation Review: Skilled at reviewing and verifying claim documentation for accuracy.

- Customer Service: Knowledge of best practices for providing excellent customer support.

- Technical Proficiency: Ability to use various digital tools for claims analysis and reporting.

- Fraud Detection: Trained in identifying potential fraudulent claims through investigation.

- Time Management: Efficient in managing multiple claims simultaneously and meeting deadlines.

Soft Skills:

- Communication: Strong verbal and written communication skills for effective interactions.

- Empathy: Ability to understand and relate to claimants’ situations and emotions.

- Problem-Solving: Skilled at identifying issues and developing practical solutions.

- Attention to Detail: Meticulous in reviewing claims to ensure accuracy and completeness.

- Critical Thinking: Capable of analyzing situations and making informed decisions.

- Adaptability: Flexible in adjusting to changes in policies or claim circumstances.

- Teamwork: Collaborative approach to working with other adjusters and departments.

- Conflict Resolution: Proficient in managing disputes and finding mutually agreeable solutions.

- Organization: Highly organized in managing documentation and claims processes.

- Interpersonal Skills: Strong ability to build relationships with clients and colleagues.

- Persuasion: Aptitude for influencing others during negotiations and discussions.

- Patience: Ability to remain calm and patient when dealing with challenging situations.

- Time Management: Proficient in prioritizing tasks to meet tight deadlines.

- Self-Motivation: Driven to achieve goals and maintain high performance standards.

- Cultural Competency: Understanding and respecting diverse backgrounds and perspectives.

How to list your certifications and education on your resume

When presenting certifications and education on a Claims Adjuster resume, it’s essential to highlight relevant qualifications clearly and concisely. Focus on degrees in fields such as finance, business administration, or insurance, as they directly relate to the role. Additionally, include certifications like the Chartered Property Casualty Underwriter (CPCU) or Associate in Claims (AIC), which demonstrate your expertise and commitment to the profession.

List your education and certifications in reverse chronological order, starting with the most recent achievements. Clearly state the institution, the degree or certification earned, and the year of completion. This approach ensures that potential employers can quickly assess your qualifications and how they align with their needs.

Graduated college and got some certificates. Not sure when.

Bachelor of Science in Business Administration, University of XYZ, 2021; CPCU Certification, 2022.

How to write your Claims Adjuster resume summary or objective

A strong resume summary or objective is crucial for a Claims Adjuster position as it provides a snapshot of your qualifications and career goals. A well-crafted summary highlights your relevant experience and skills, allowing hiring managers to quickly assess your fit for the role. Conversely, an objective statement can be beneficial for entry-level candidates, focusing on their career aspirations and eagerness to contribute to the organization.

Seeking a job in claims adjusting where I can use my skills. I have some experience and hope to learn more about the industry.

Detail-oriented Claims Adjuster with 5 years of experience in evaluating claims and negotiating settlements. Proven track record of reducing claims costs by 20% while maintaining high customer satisfaction ratings.

Additional sections for a Claims Adjuster resume

Including additional sections in a Claims Adjuster resume can significantly enhance its impact by showcasing relevant skills, certifications, and accomplishments. These sections provide potential employers with a deeper understanding of your qualifications and commitment to the field.

- Certifications: Highlighting industry-specific certifications, such as the Chartered Property Casualty Underwriter (CPCU) or Associate in Claims (AIC), demonstrates your expertise and commitment to professional development in insurance and claims management.

- Technical Skills: Listing technical skills, such as proficiency in claims management software or data analysis tools, shows your ability to efficiently process claims and utilize technology to improve workflows and accuracy.

- Professional Affiliations: Membership in professional organizations like the National Association of Independent Insurance Adjusters (NAIIA) indicates your engagement with the industry and your dedication to staying informed about best practices and trends.

- Notable Achievements: Including quantifiable achievements, such as reducing claims processing time by 20% or increasing customer satisfaction scores, helps illustrate your effectiveness and impacts in past roles, setting you apart from other candidates.

- Continuing Education: Showcasing relevant courses or workshops attended can indicate your commitment to staying current with industry changes, regulations, and best practices, which is crucial for a successful career in claims adjusting.

Key takeaways for writing a professional Claims Adjuster resume

- Highlight relevant certifications and licenses, such as CPCU or AIC, to demonstrate your expertise and commitment to the claims adjusting profession.

- Use action verbs and quantify achievements to showcase your impact, such as “resolved 200+ claims annually with a 95% customer satisfaction rate.”

- Tailor your resume for each application by including keywords from the job description, ensuring that your skills align with employer expectations.

- Consider using resume templates designed for claims adjusters to maintain professionalism while effectively displaying your qualifications and experiences.

- Leverage an ai resume builder to streamline the writing process, ensuring a polished and optimized document that highlights your strengths as a claims adjuster.

Frequently Asked Questions

How long should my Claims Adjuster resume be?

Your Claims Adjuster resume should ideally be one page long, especially if you have less than 10 years of experience. This length allows you to present your qualifications, skills, and accomplishments in a clear, concise manner. If you have extensive experience or relevant credentials that necessitate a second page, ensure that every detail is pertinent to the role you’re applying for. Focus on making each section impactful and relevant to capture the hiring manager’s attention effectively.

What is the best format for a Claims Adjuster resume?

The best format for a Claims Adjuster resume is a reverse-chronological format. This structure allows you to showcase your work experience in order of most recent first, highlighting your career progression and relevant skills effectively. Start with a strong summary statement, followed by your professional experience, education, and any certifications. Using clear headings and bullet points will enhance readability, making it easier for hiring managers to quickly assess your qualifications and suitability for the role.

What should I highlight on my Claims Adjuster resume to stand out?

To stand out as a Claims Adjuster, highlight your relevant skills such as analytical thinking, negotiation, and attention to detail. Include any specialized knowledge in specific types of claims, like property or liability. It’s also beneficial to showcase your achievements, such as successfully resolving a high volume of claims or reducing processing time. Additionally, emphasize any certifications or training that demonstrate your commitment to the field, as these can set you apart from other candidates.

What are some ways to quantify my experience on my Claims Adjuster resume?

Quantifying your experience on your Claims Adjuster resume can significantly enhance its impact. Use specific metrics, such as the number of claims processed monthly or the percentage of claims resolved within a certain timeframe. For example, you could state, “Managed 100 claims per month with a 95% resolution rate.” Additionally, mention any cost savings achieved or improvements in processing time to illustrate your effectiveness. These figures provide tangible evidence of your contributions and help employers gauge your potential value.