A Claims Associate plays a critical role in the insurance industry, tasked with reviewing and processing insurance claims to ensure fair and timely settlements. If you’re reading this article, you’re likely gearing up for an interview for a Claims Associate position and want to be as prepared as possible. Well, you’ve come to the right place. In this comprehensive guide, we’ve compiled a list of the top 17 interview questions you may encounter, complete with explanations and sample answers to help you nail that interview.

The hiring process for a Claims Associate often includes a detailed interview to assess your skills, professionalism, and suitability for the role. Knowing the kinds of questions you might be asked can give you a significant advantage. So, without further ado, let’s get into it.

- Top 17 Claims Associate Interview Questions and Answers

- 1. Can you explain what the role of a Claims Associate entails?

- 2. Why did you decide to pursue a career as a Claims Associate?

- 3. Describe a time when you had to deal with a challenging situation at work.

- 4. How do you prioritize your workload?

- 5. What steps do you take to ensure accurate claim processing?

- 6. How do you stay updated with insurance laws and regulations?

- 7. Describe your experience with claims management software.

- 8. How do you handle confrontational or irate claimants?

- 9. Explain the importance of documentation in claims processing.

- 10. How do you ensure you meet deadlines in a high-pressure environment?

- 11. How would you handle a situation where you suspect insurance fraud?

- 12. What qualities make you a good fit for the Claims Associate role?

- 13. Can you discuss your experience with team collaboration in a professional setting?

- 14. How do you handle confidential information?

- 15. Describe your approach to customer service.

- 16. How do you maintain work-life balance while meeting job expectations?

- 17. Are you willing to undergo further training and development?

- Conclusion

Top 17 Claims Associate Interview Questions and Answers

1. Can you explain what the role of a Claims Associate entails?

The role of a Claims Associate goes beyond just paperwork; it involves analytical skills to evaluate the validity of a claim, negotiation skills to settle cases, and customer service skills to interact with claimants. Understanding the breadth of this role is essential for any potential candidate.

Sample Answer

“A Claims Associate serves as a mediator between the insurance company and the insured party. The role involves receiving and evaluating insurance claims, determining the validity, coordinating with various departments, and ultimately settling the claim in a fair and timely manner.”

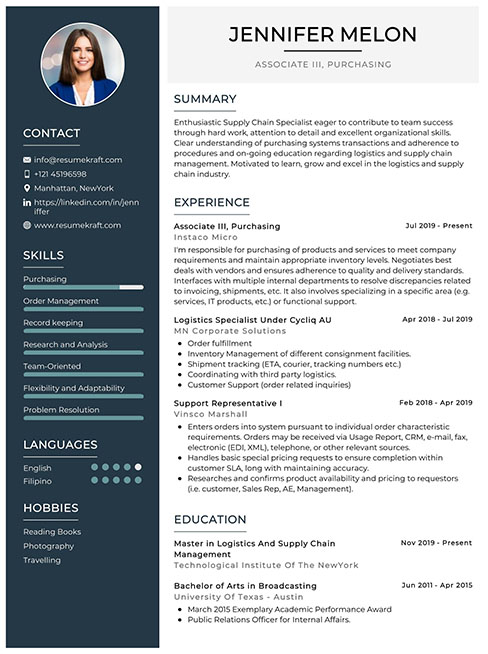

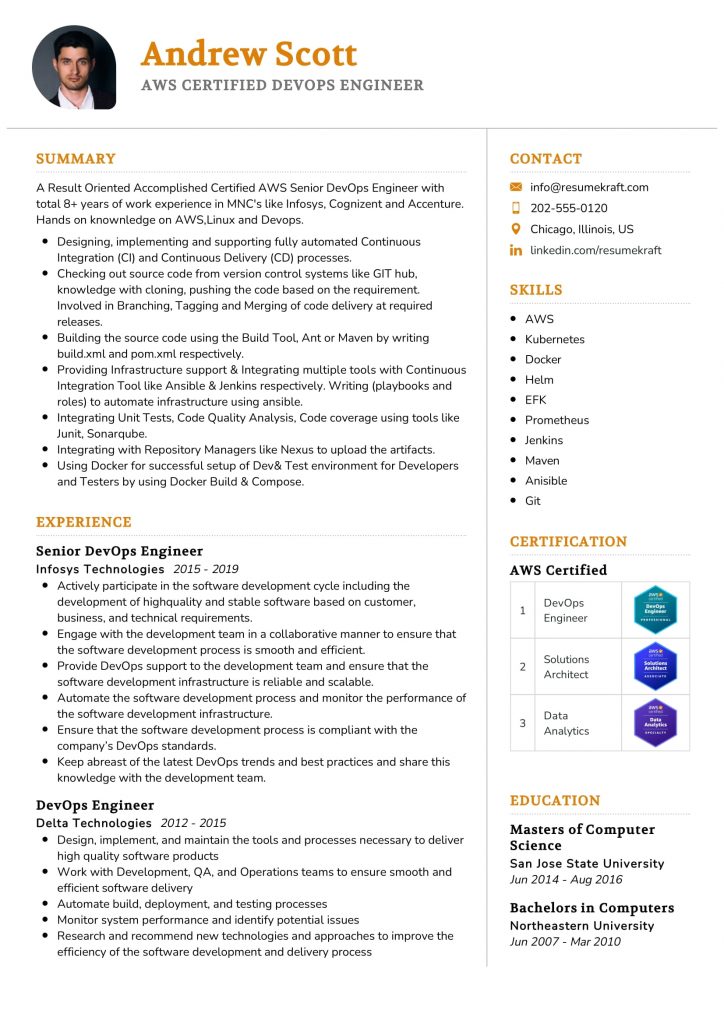

Build your resume in just 5 minutes with AI.

2. Why did you decide to pursue a career as a Claims Associate?

This question is aimed at understanding your motivation behind choosing this specific career path. It also gives the interviewer an idea of whether you are passionate about the role.

Sample Answer

“I have always been interested in roles that combine analytical skills with customer service. Being a Claims Associate allows me to utilize my strengths in analyzing data and problem-solving, while also having the satisfaction of helping people during stressful times.”

3. Describe a time when you had to deal with a challenging situation at work.

Being a Claims Associate can be stressful, dealing with emotionally charged situations. Your ability to maintain composure and arrive at a solution is being tested here.

Sample Answer

“In my previous role, I handled a case where the claimant was extremely emotional due to a recent accident. I made sure to approach the situation with sensitivity and empathy while maintaining professionalism to ensure that all protocols were followed.”

4. How do you prioritize your workload?

Claims Associates often deal with multiple claims simultaneously, each at different stages of processing. This question assesses your organizational and time-management skills.

Sample Answer

“I start my day by reviewing all the pending tasks and categorizing them based on urgency and importance. I use a digital task manager to keep track of deadlines and set reminders. This way, I can manage my workload effectively without overlooking any details.”

5. What steps do you take to ensure accurate claim processing?

Accuracy is crucial in claim processing to avoid costly errors. This question examines your attention to detail and your understanding of the importance of accuracy in this role.

Sample Answer

“I double-check all the entered data and cross-reference it with the documents provided. I also keep a checklist for each type of claim to ensure that all required steps are followed. If there’s any doubt, I consult with my team or supervisor for clarification.”

6. How do you stay updated with insurance laws and regulations?

The insurance industry is subject to frequent changes in laws and regulations. This question assesses your willingness and methods for staying current.

Sample Answer

“I subscribe to industry publications and follow reputable websites. I also attend webinars and workshops that offer updates on legal changes affecting the insurance claims process.”

7. Describe your experience with claims management software.

Familiarity with claims management software is usually an essential aspect of the role. If you have experience, great; if not, express your willingness to learn.

Sample Answer

“I have experience using ClaimCenter for claim processing, which has features for tracking, reporting, and managing tasks. While I am comfortable using it, I am open to learning new software that your company might be using.”

8. How do you handle confrontational or irate claimants?

Dealing with unhappy or confrontational claimants is not uncommon in this role. Your interpersonal skills are being assessed here.

Sample Answer

“I remain calm and listen actively to understand the root of their frustration. I then explain the situation and the steps we can take to resolve the issue. Maintaining professionalism while showing empathy often helps defuse tense situations.”

9. Explain the importance of documentation in claims processing.

Documenting every step of the claims process is crucial for various reasons, including legal compliance and internal audits. Your understanding of this is being gauged through this question.

Sample Answer

“Documentation serves as a written record for each step in the claims process, ensuring transparency and aiding in case reviews or audits. It also helps in resolving disputes and provides legal protection for both the company and the claimant.”

10. How do you ensure you meet deadlines in a high-pressure environment?

Meeting deadlines is crucial, especially in scenarios involving time-sensitive claims. This question

aims to understand your time management and stress-handling skills.

Sample Answer

“I use a combination of task lists, digital reminders, and time-blocking techniques to ensure I meet deadlines. When the pressure is high, I stay focused by taking short breaks to clear my mind, ensuring higher efficiency.”

11. How would you handle a situation where you suspect insurance fraud?

This question assesses your integrity, ethical standing, and knowledge of procedures related to combating fraud within the insurance industry.

Sample Answer

“In cases where I suspect insurance fraud, I would immediately escalate the matter to my supervisor and follow the internal protocols for fraud detection. Accurate documentation and collaboration with the fraud investigation team are crucial in such scenarios.”

12. What qualities make you a good fit for the Claims Associate role?

This question provides an opportunity for you to align your skills and qualities with the job requirements, thus showcasing why you’re the best fit for the role.

Sample Answer

“I believe my analytical skills, attention to detail, and ability to work under pressure make me a strong fit for this role. Additionally, my excellent communication skills help me interact effectively with claimants, which is crucial for customer satisfaction.”

13. Can you discuss your experience with team collaboration in a professional setting?

Working as a Claims Associate often involves collaborating with other departments like finance, legal, and customer service. Your teamwork skills are being evaluated here.

Sample Answer

“In my previous role, team collaboration was vital, especially when dealing with complex cases. We would often have inter-departmental meetings to discuss the best course of action, and I always found that a collective approach led to more effective problem-solving.”

14. How do you handle confidential information?

Confidentiality is a significant aspect of any insurance-related job. Your understanding of its importance and commitment to maintaining it is being tested here.

Sample Answer

“I understand the critical nature of confidentiality in the insurance industry. I always follow company protocols for handling confidential information and ensure that it is only shared with authorized individuals as per the need-to-know basis.”

15. Describe your approach to customer service.

Good customer service can turn a potentially negative experience, like filing a claim, into a positive one. Here, your interpersonal skills and understanding of good customer service are being examined.

Sample Answer

“My approach to customer service is built on active listening and empathy. I strive to understand the claimant’s situation thoroughly and guide them through the claims process as smoothly as possible, keeping them informed at each step.”

16. How do you maintain work-life balance while meeting job expectations?

The insurance industry can be demanding, and work-life balance is crucial for long-term job satisfaction and performance. Your perspective on this matter is what this question aims to uncover.

Sample Answer

“I believe in the importance of work-life balance for overall well-being. I maintain it by strictly adhering to a well-planned schedule and by ensuring that I allocate time for personal activities and relaxation, even during busy periods.”

17. Are you willing to undergo further training and development?

Continuous learning is essential in staying updated with the ever-changing landscape of insurance claims. Your willingness to undergo further training is being evaluated here.

Sample Answer

“Absolutely, I’m open to further training and development. I believe that ongoing learning is crucial for both personal and professional growth. I’m particularly interested in courses or workshops that cover the latest trends and legal aspects of insurance claims.”

Conclusion

Navigating the interview process for a Claims Associate position can be a daunting task. But with this guide featuring the top 17 interview questions and answers, you’ll walk into that interview room well-prepared and confident. Remember, the key to acing any interview is preparation and practice. So read through these questions and craft your own well-thought-out answers to set yourself up for success.

Remember to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.