Financial management skills are the ability to forecast, budget, and manage an organization’s financial resources. These skills are important for any organization, whether for-profit or nonprofit. Financial management skills include:

Top 20 Financial Management Skills for Your Resume

- Financial analysis

- Financial planning

- Financial reporting

- Budgeting

- Cash management

- Forecasting

- Risk management

- Tax planning

- Insurance planning

- Retirement planning

- Estate planning

- Investments

- Banking

- Real estate

- Business administration

- Accounting

- Economics

- Statistics

- Mathematics

- Financial modeling

Financial management is a process of planning, monitoring, and controlling of financial activities like acquisition and utilization of funds of a company. It helps in decision-making regarding investments, financing, and dividends. Financial management is one of the most important aspects of management.

A company has to raise funds to carry out its activities. The funds are required for long-term purposes like the purchase of land and buildings, long-term investments, and working capital. The company has to use the funds efficiently to generate profits. Financial management helps in planning and controlling the financial activities of the company.

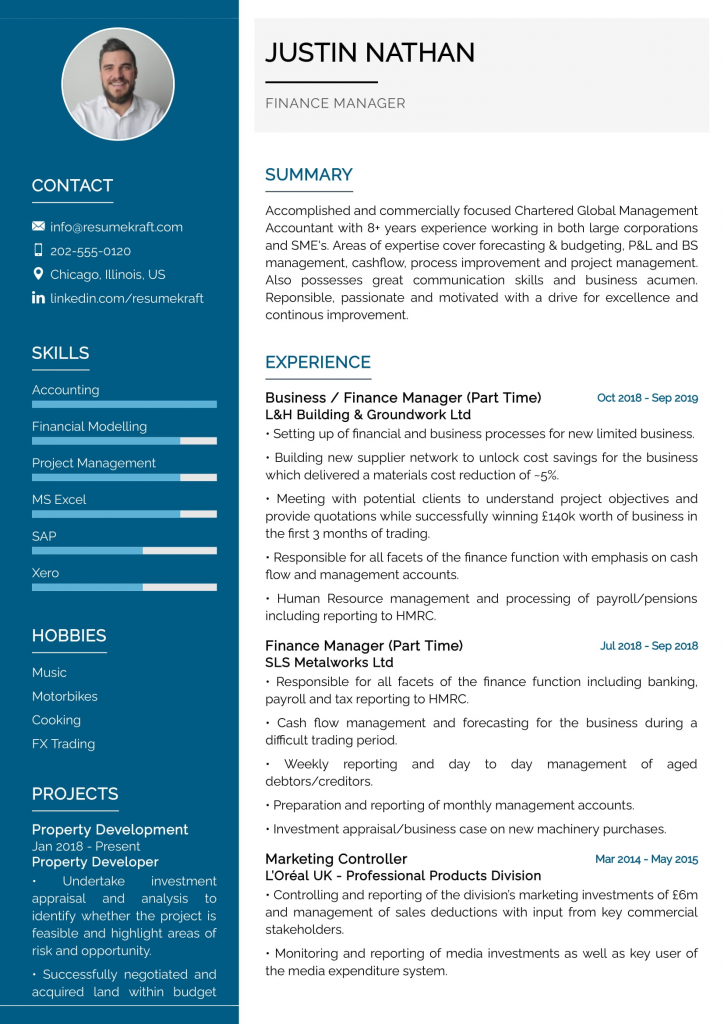

How to list Financial Management Skills on resume

- Keep it concise and relevant: When listing your financial management skills on your resume, make sure to keep it concise and relevant. There is no need to list every single skill you have, but rather focus on those that are most relevant to the position you are applying for.

- Highlight your strengths: When listing your financial management skills, be sure to highlight your strengths. If you have experience managing budgets, for example, make sure to list that prominently on your resume.

- Tailor your skills to the position: When listing your financial management skills, tailor them to the position you are applying for. If you are applying for a position that requires experience in financial analysis, for example, make sure to list that prominently on your resume.

- Use action words: When listing your financial management skills, use action words to describe them. For example, instead of simply listing “budgeting experience,” use phrases such as “created and managed budgets” or “successfully reduced expenses.”

- Be specific: When listing your financial management skills, be as specific as possible. For example, instead of simply listing “analytical skills,” mention specific software programs you are experienced in using, such as Excel or financial modeling software.

- Use numbers: When possible, use numbers to quantify your financial management skills. For example, instead of saying “managed a budget,” say “successfully managed a $1 million budget.”

- List relevant coursework: If you have relevant coursework in financial management, make sure to list it on your resume. This can be especially helpful if you are a recent graduate or have limited professional experience.

- List relevant certifications: If you have relevant certifications in financial management, make sure to list them on your resume. This can help you stand out from other candidates who do not have such credentials.

- List relevant professional associations: If you are a member of any professional associations related to financial management, make sure to list them on your resume. This can help you demonstrate your commitment to professional development in this field.

- Use a resume template: When creating your resume, be sure to use a professional template. This will help you ensure that your financial management skills are listed in an organized and effective manner.

Jobs That Demand Financial Management Skills:

- Financial Analyst

- Investment Banker

- Financial Planner

- Accountant

- Auditor

- Budget Analyst

- Credit Analyst

- Economist

- Real Estate Appraiser

- Tax Examiner

- Tax Preparer

- Insurance Underwriter

- Loan Officer

- Personal Financial Advisor

- Actuary

- Cost Estimator

- Financial Examiner

- Credit Counselor

- Financial Manager

- Credit Manager