The role of an Insurance Agent is pivotal in safeguarding individuals and businesses against unforeseen risks and financial losses. This profession involves assessing clients’ needs, providing tailored insurance solutions, and guiding them through the claims process. In today’s market, where uncertainties abound—from health crises to natural disasters—insurance agents play a crucial role in helping clients navigate complex insurance products. This article will explore how to craft an effective resume for aspiring insurance agents, highlighting key skills, achievements, and strategies to stand out in this competitive field.

- Insurance Agent resume examples

- How to format a Insurance Agent resume

- How to write your Insurance Agent resume experience

- How to list your hard skills and soft skills on your resume

- How to list your certifications and education on your resume

- How to write your Insurance Agent resume summary or objective

- Additional sections for a Insurance Agent resume

- Key takeaways for writing a professional Insurance Agent resume

- Frequently Asked Questions

Insurance Agent resume examples

Insurance Agent resume examples serve as valuable resources for job seekers aiming to create effective resumes tailored to the insurance industry. These examples highlight key skills, accomplishments, and formatting that resonate with hiring managers. By studying these models, candidates can better understand how to present their qualifications and experiences, ultimately improving their chances of landing interviews and securing positions in this competitive field.

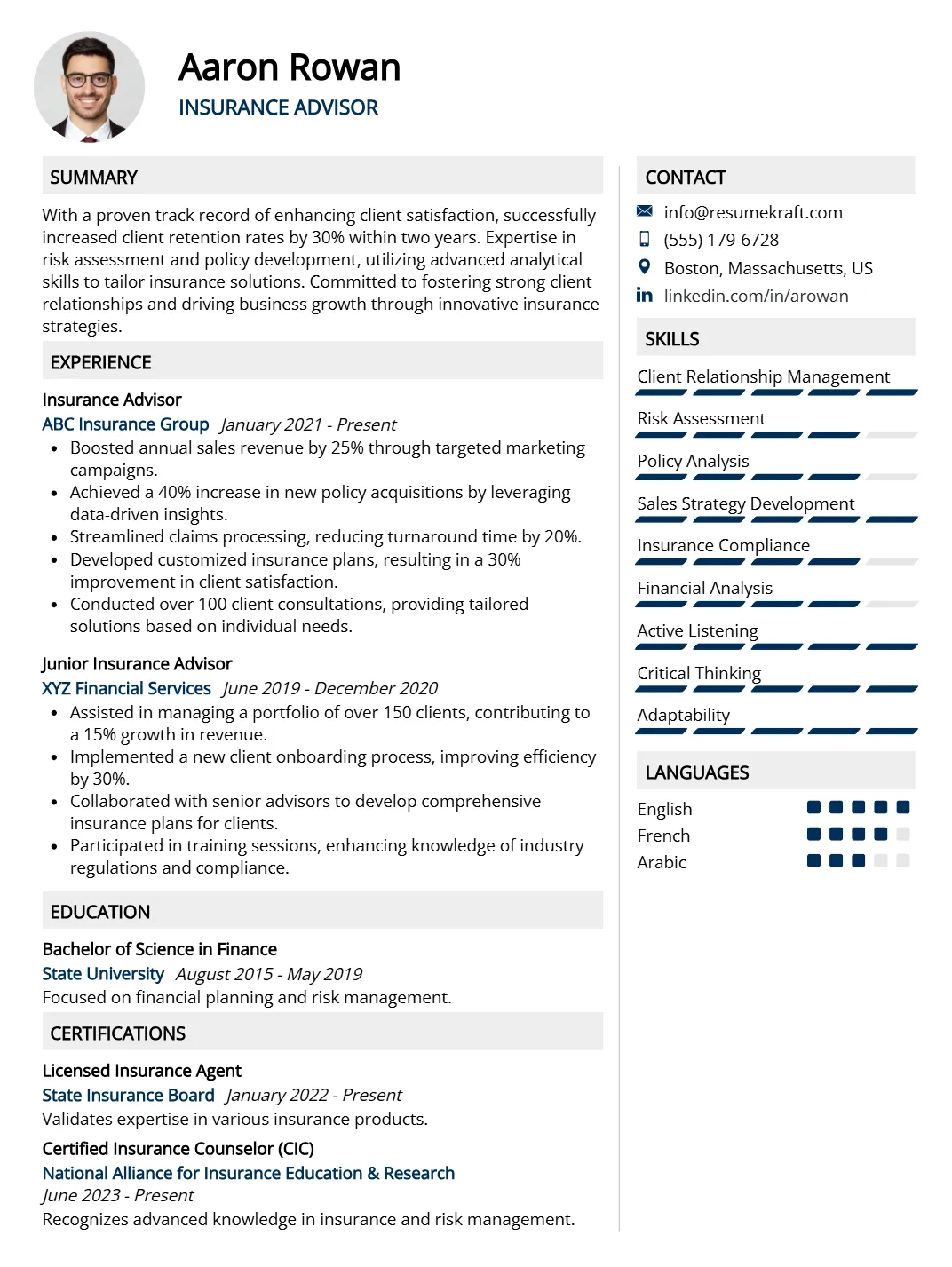

Insurance Advisor Resume

Why This Resume Works

This resume effectively positions the candidate for the Insurance Advisor role by prominently showcasing key skills such as Client Relationship Management and Risk Assessment, essential for building trust and evaluating clients’ needs. The structured format highlights relevant experience, including five years in insurance advisory roles, ensuring clarity and readability. It incorporates industry-specific keywords that enhance ATS compatibility. Additionally, strategic presentation of achievements related to sales growth and compliance reinforces the candidate’s suitability, making a compelling case for their expertise in the insurance field.

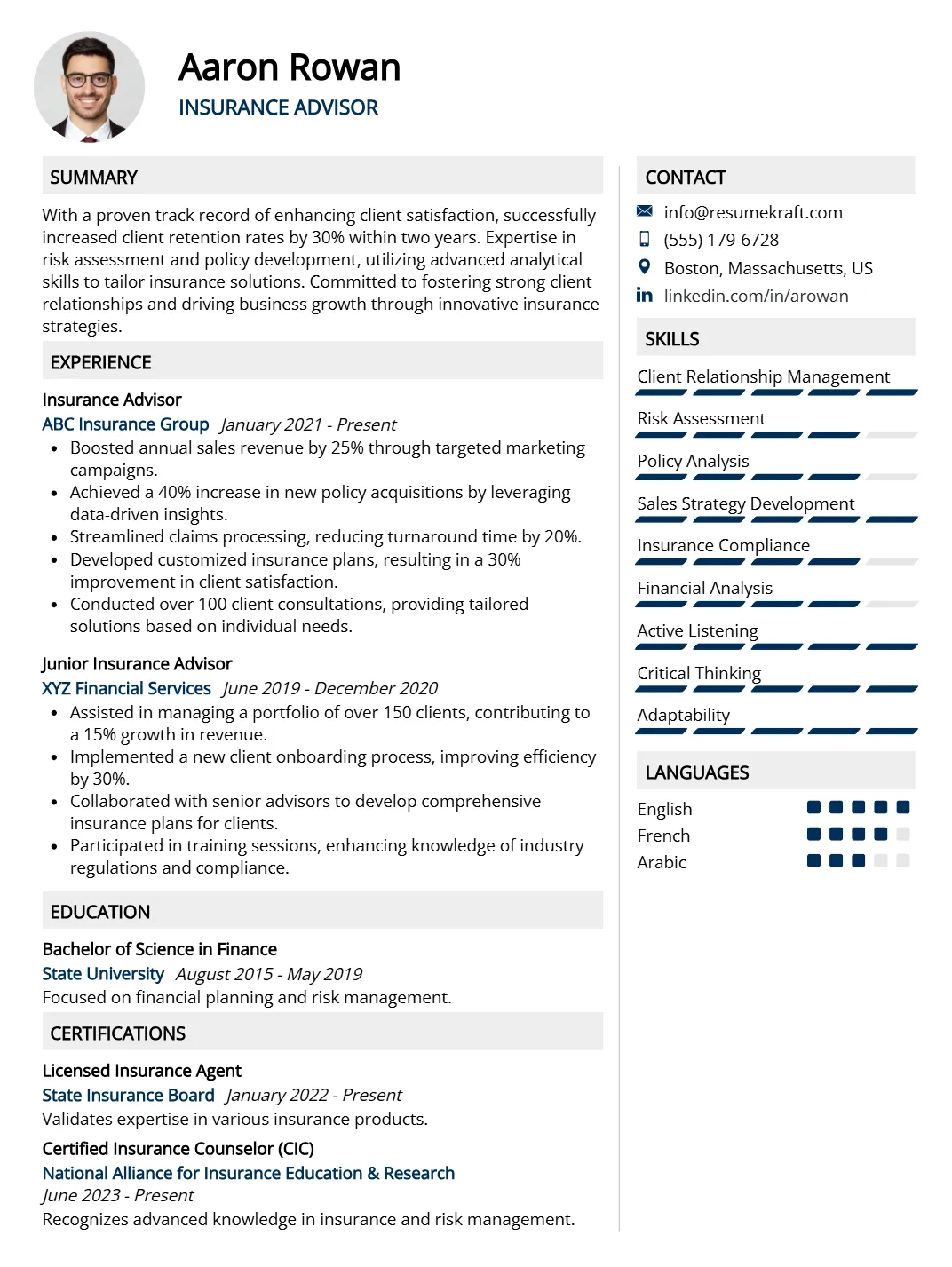

Insurance Agent Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills and experience for the Insurance Agent position, showcasing expertise in Customer Relationship Management and Risk Assessment. The clear format emphasizes key achievements, such as successful lead generation and sales strategy development, making it easy for hiring managers to identify qualifications. Additionally, the use of industry-specific keywords ensures ATS compatibility, enhancing visibility during the screening process. Overall, this strategic presentation aligns well with the demands of the insurance industry, positioning the candidate as a strong applicant.

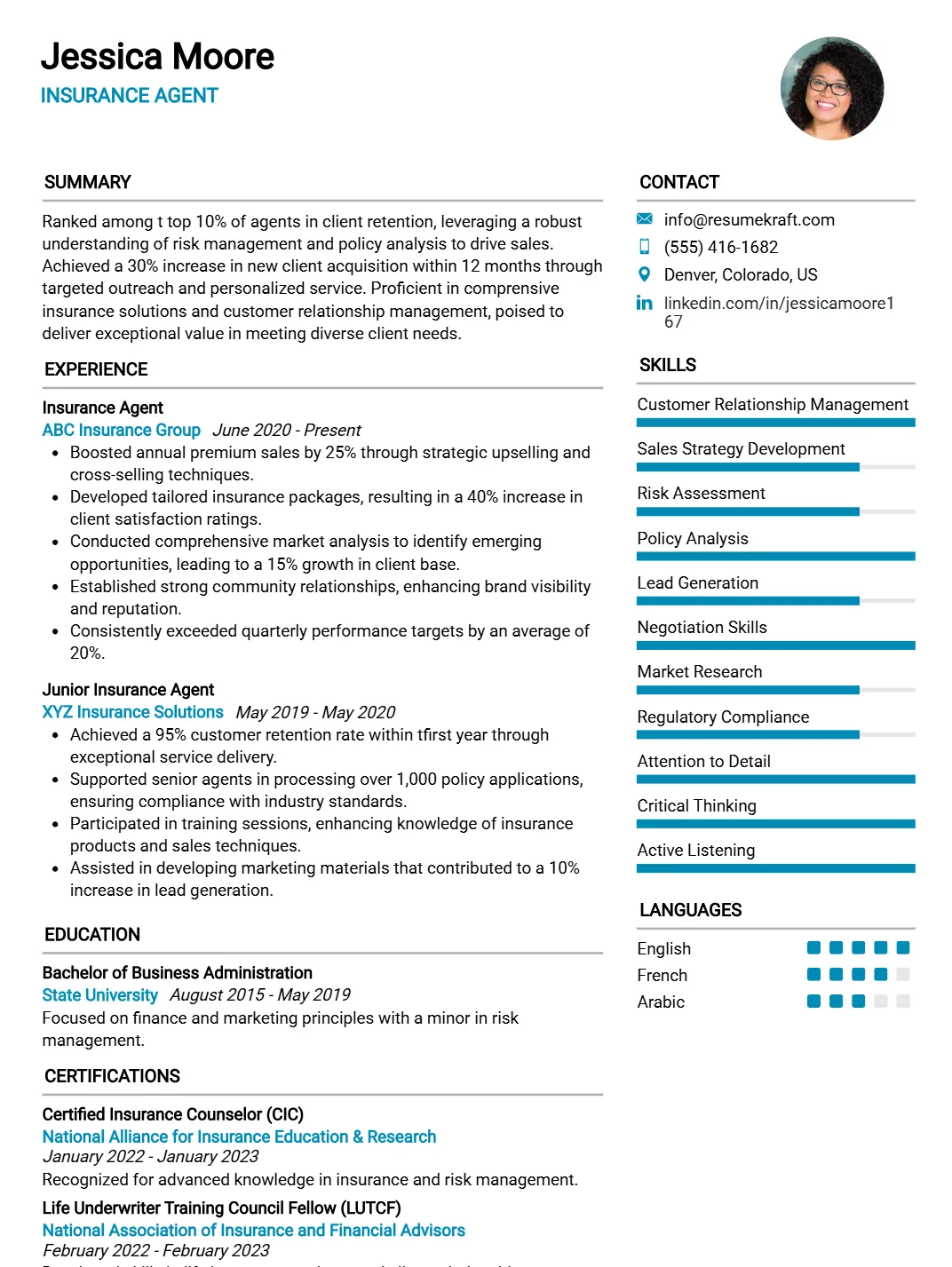

Insurance Sales Representative Resume

Why This Resume Works

This resume effectively targets the Insurance Sales Representative position by highlighting key skills such as Sales Strategy Development and Customer Relationship Management, which are crucial for success in this role. With four years of relevant experience, it presents a clear career progression that enhances credibility. The structured format ensures easy readability for hiring managers and is ATS-friendly, featuring industry-specific keywords. Additionally, strategic presentation of achievements showcases measurable results in sales and customer retention, making the candidate stand out in a competitive field.

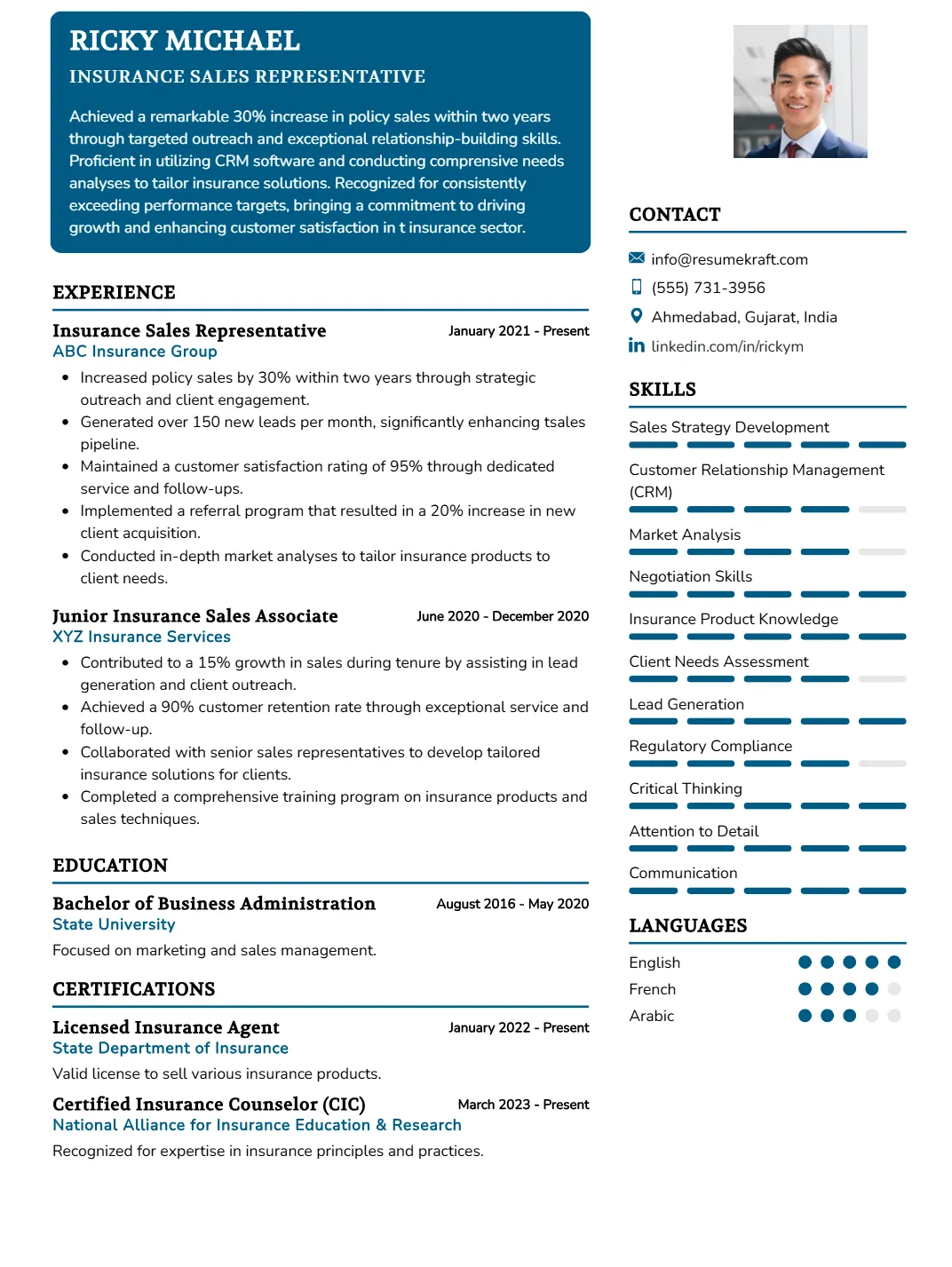

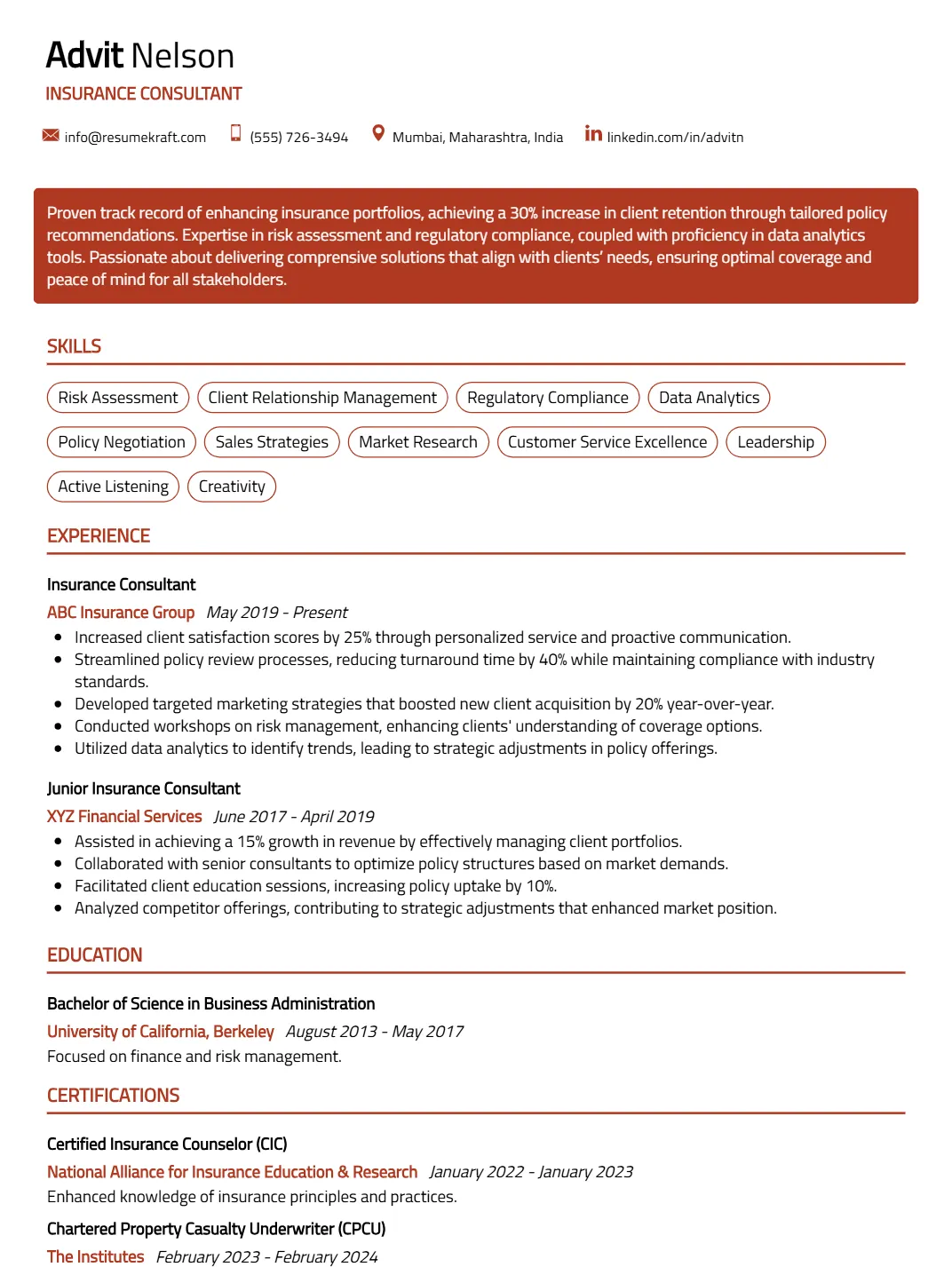

Insurance Consultant Resume

Why This Resume Works

This resume effectively highlights the candidate’s extensive experience in insurance consulting, showcasing eight years of relevant roles. The emphasis on key skills such as Risk Assessment and Policy Negotiation aligns perfectly with the Insurance Consultant position. Its clear format enhances readability, making it easy for hiring managers to identify qualifications quickly. Additionally, the use of industry-specific keywords ensures ATS compatibility, maximizing visibility during initial screenings.

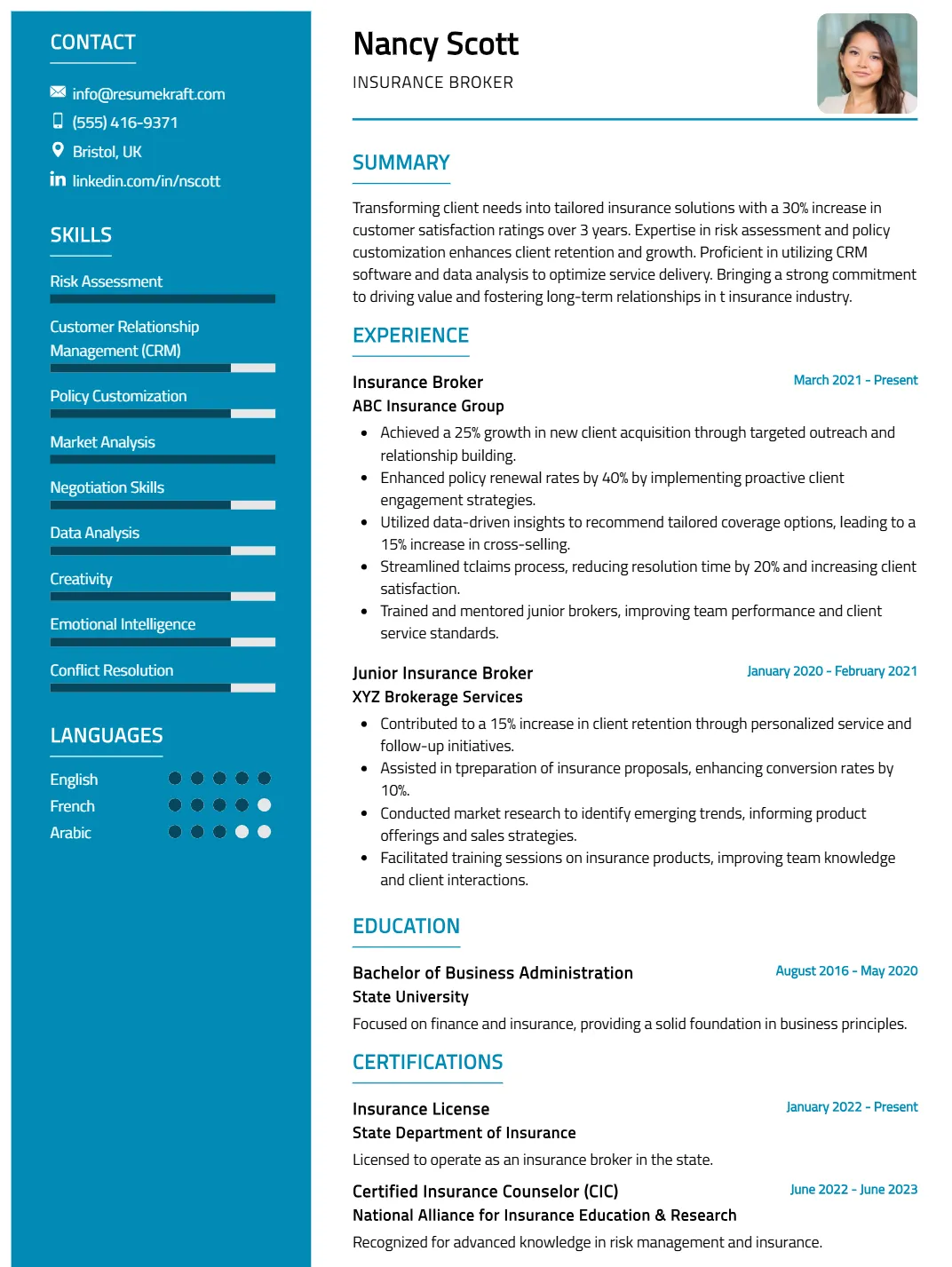

Insurance Broker Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills and experience for the Insurance Broker position, showcasing expertise in risk assessment and customer relationship management. The clear format emphasizes key competencies like policy customization and negotiation skills, making it easy for hiring managers to identify qualifications. Its structure is ATS-friendly, ensuring optimal compatibility with industry-specific software. Additionally, strategic presentation of achievements underscores the candidate’s successful market analysis and client satisfaction rates, positioning them as a strong contender in the competitive insurance field.

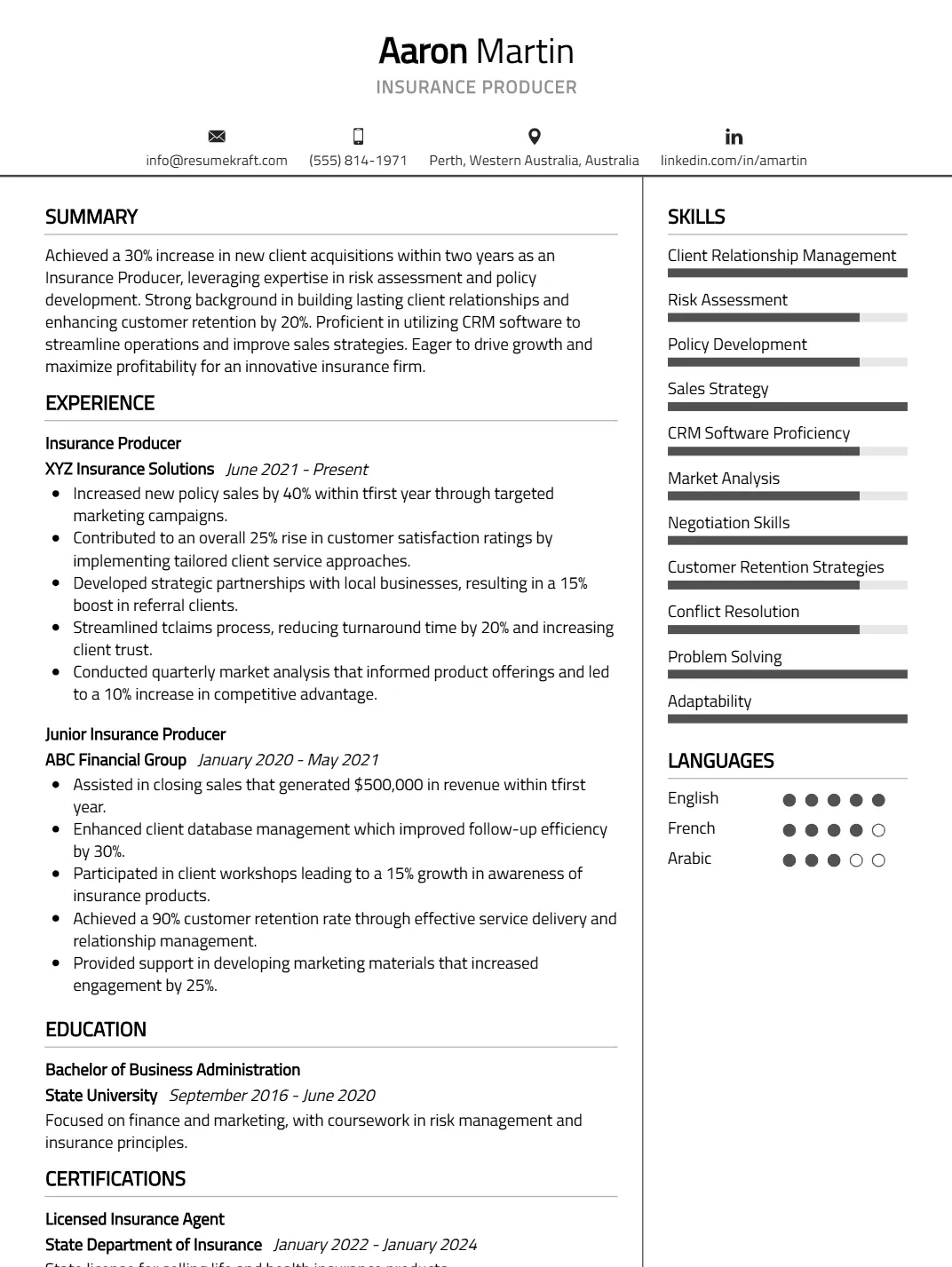

Insurance Producer Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills and experience for an Insurance Producer role, showcasing expertise in client relationship management, risk assessment, and sales strategy. The structured format emphasizes key achievements, making it easy for hiring managers to identify qualifications. Its alignment with ATS requirements ensures that essential keywords related to the insurance industry are included. By presenting a robust background with five years of progressive experience, the resume strategically positions the candidate as a strong contender for this position.

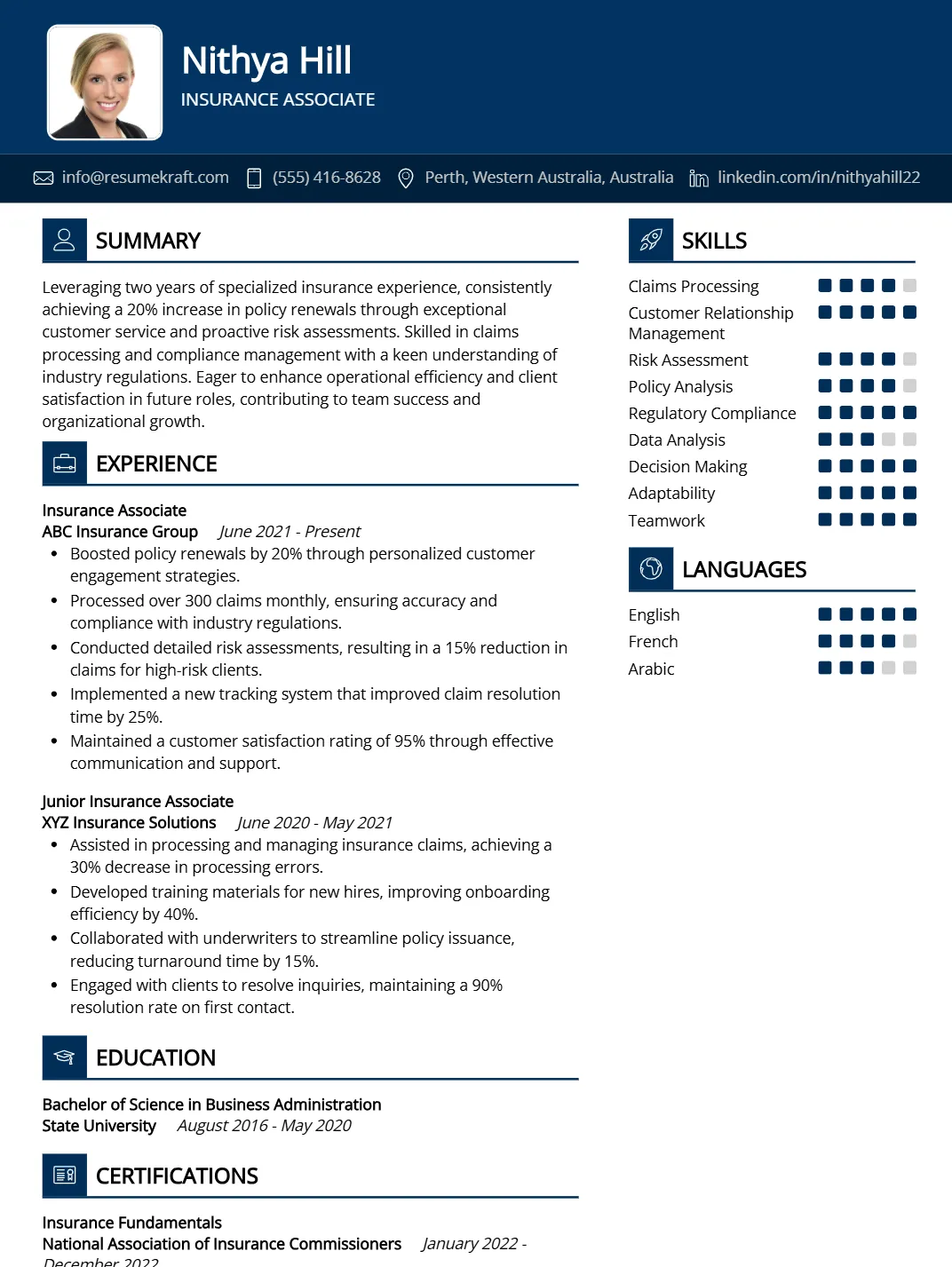

Insurance Associate Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills such as claims processing and risk assessment, which are crucial for an Insurance Associate role. With approximately five years of experience in similar positions, the structured format clearly outlines their progression, making it easy for hiring managers to assess qualifications. The use of industry-specific keywords ensures ATS compatibility, while the strategic presentation of achievements showcases measurable contributions, enhancing the candidate’s appeal to potential employers within the insurance sector.

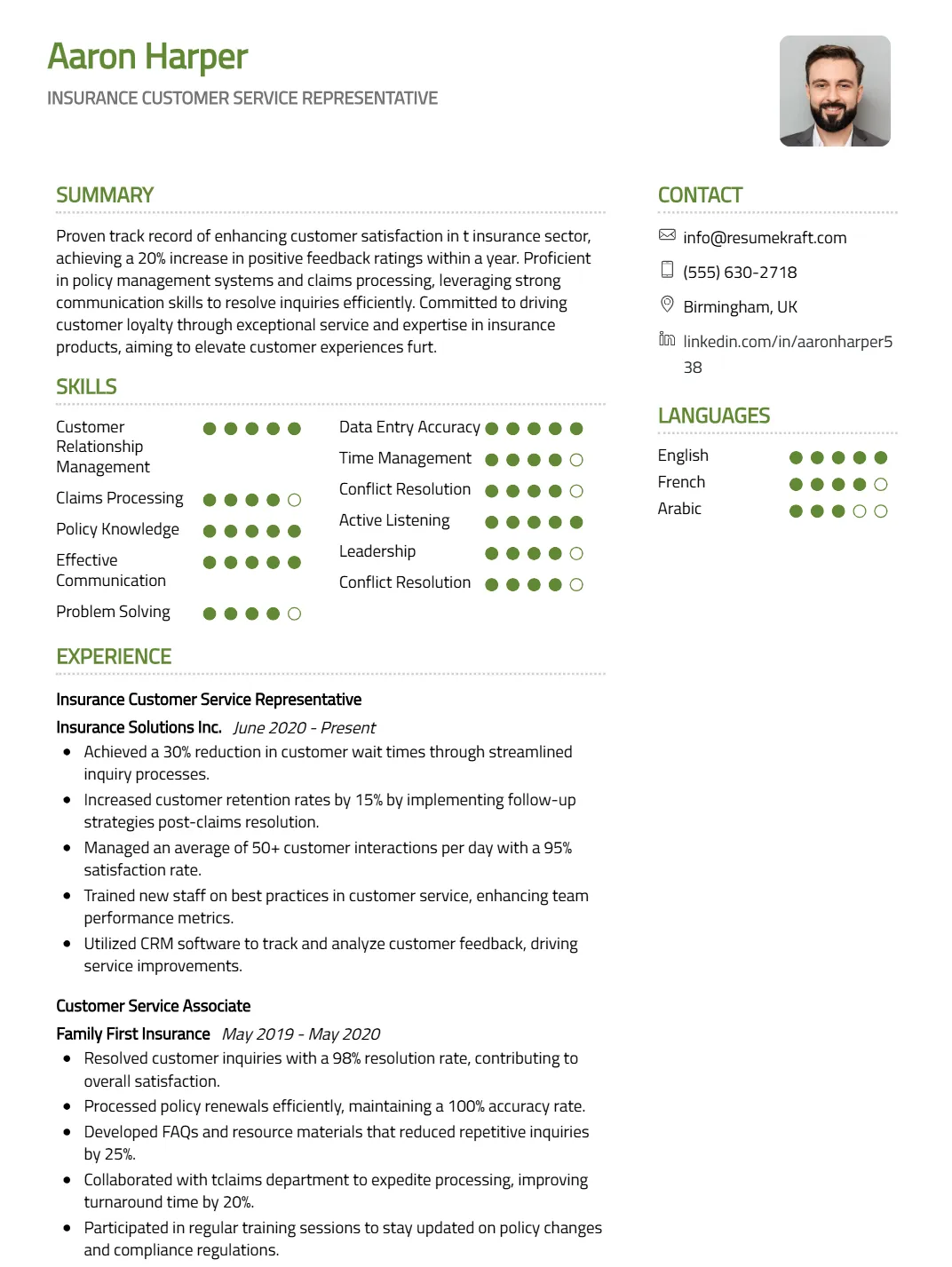

Insurance Customer Service Representative Resume

Why This Resume Works

This resume effectively highlights the candidate’s extensive experience as an Insurance Customer Service Representative, showcasing six years of relevant roles. Key skills such as Customer Relationship Management and Claims Processing align perfectly with the job requirements, emphasizing their expertise in effective communication and problem-solving. The structured format enhances readability, ensuring quick access to vital information for recruiters. Additionally, the use of industry-specific keywords boosts ATS compatibility, while strategically presented achievements demonstrate a proven track record in enhancing customer satisfaction and handling complex inquiries effectively.

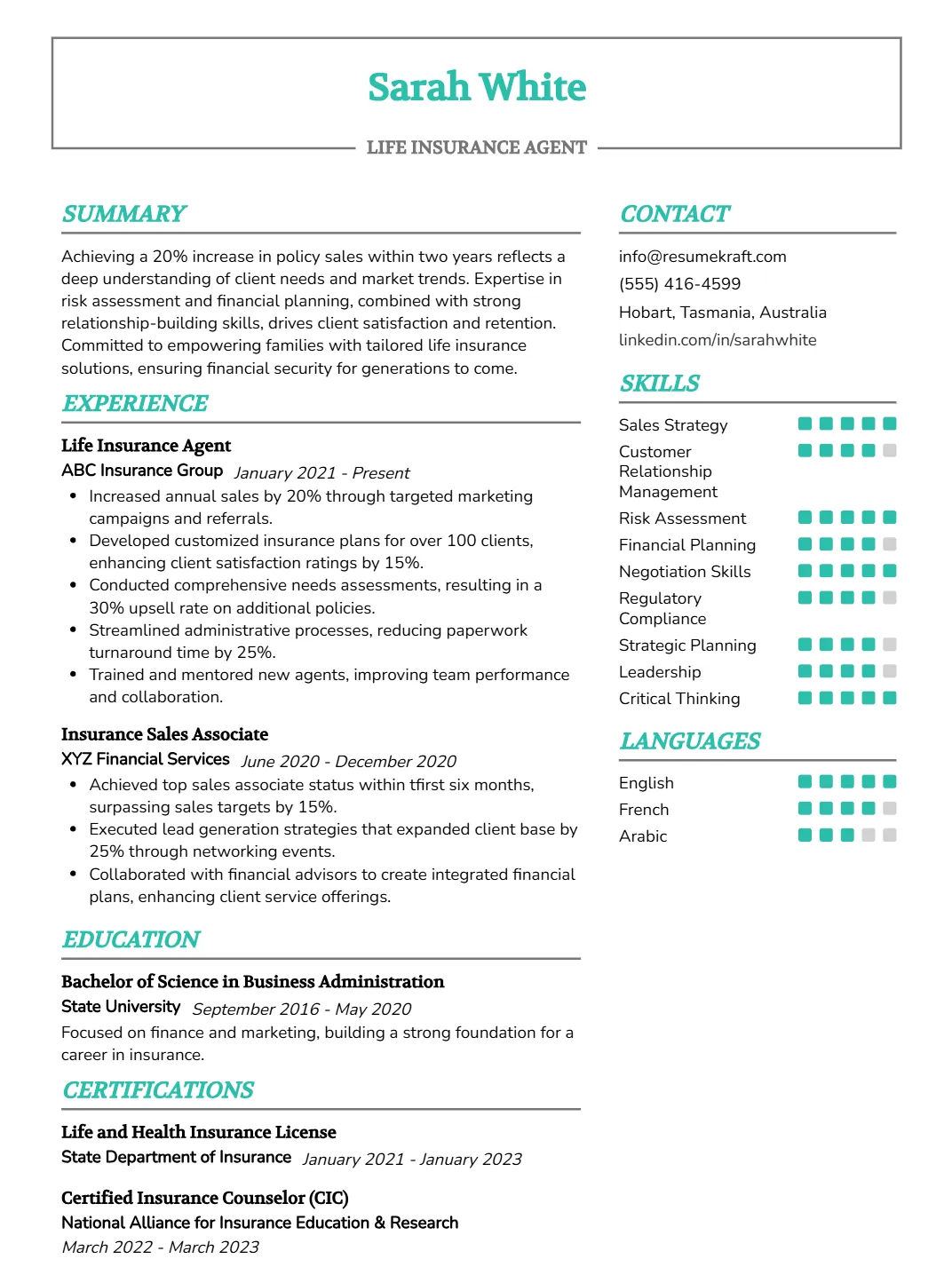

Life Insurance Agent Resume

Why This Resume Works

This resume effectively positions the candidate for a Life Insurance Agent role by highlighting key skills such as Sales Strategy, Customer Relationship Management, and Risk Assessment, which are vital in this field. The structured format enhances readability, facilitating quick assessment by hiring managers. Additionally, it includes industry-specific keywords to ensure ATS compatibility. The candidate’s four years of relevant experience, coupled with strategic presentations of achievements like successful sales metrics, demonstrate their capability and effectiveness in driving results within the life insurance sector.

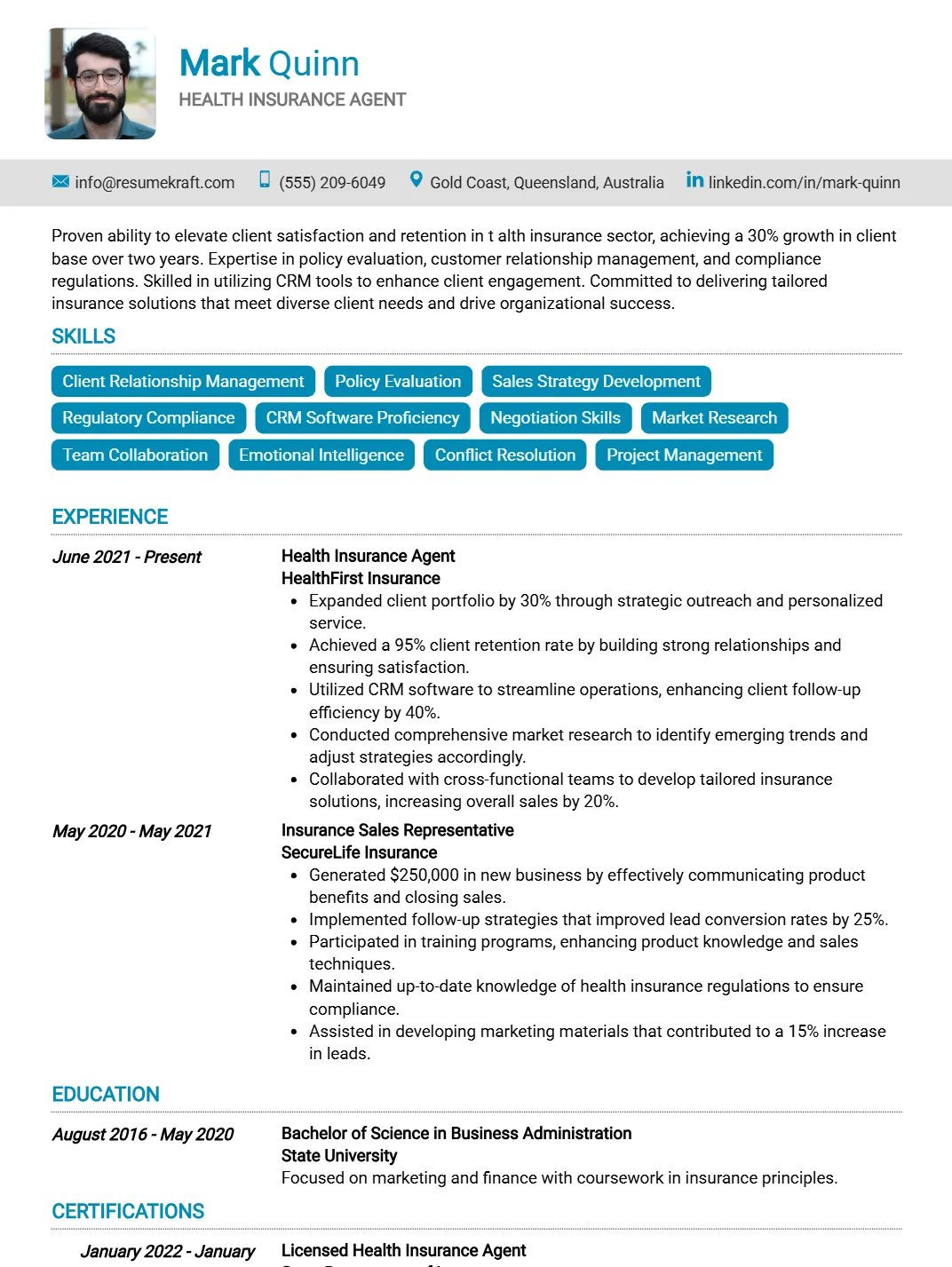

Health Insurance Agent Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant experience and key skills tailored for a Health Insurance Agent position. With five years in the field, it emphasizes client relationship management and policy evaluation, crucial for building trust in insurance sales. The structured format and clear headers enhance readability, making it ATS-compatible by incorporating industry-specific keywords. Additionally, strategic presentation of achievements showcases the candidate’s proficiency in sales strategy development and regulatory compliance, addressing core responsibilities of the role while demonstrating tangible success.

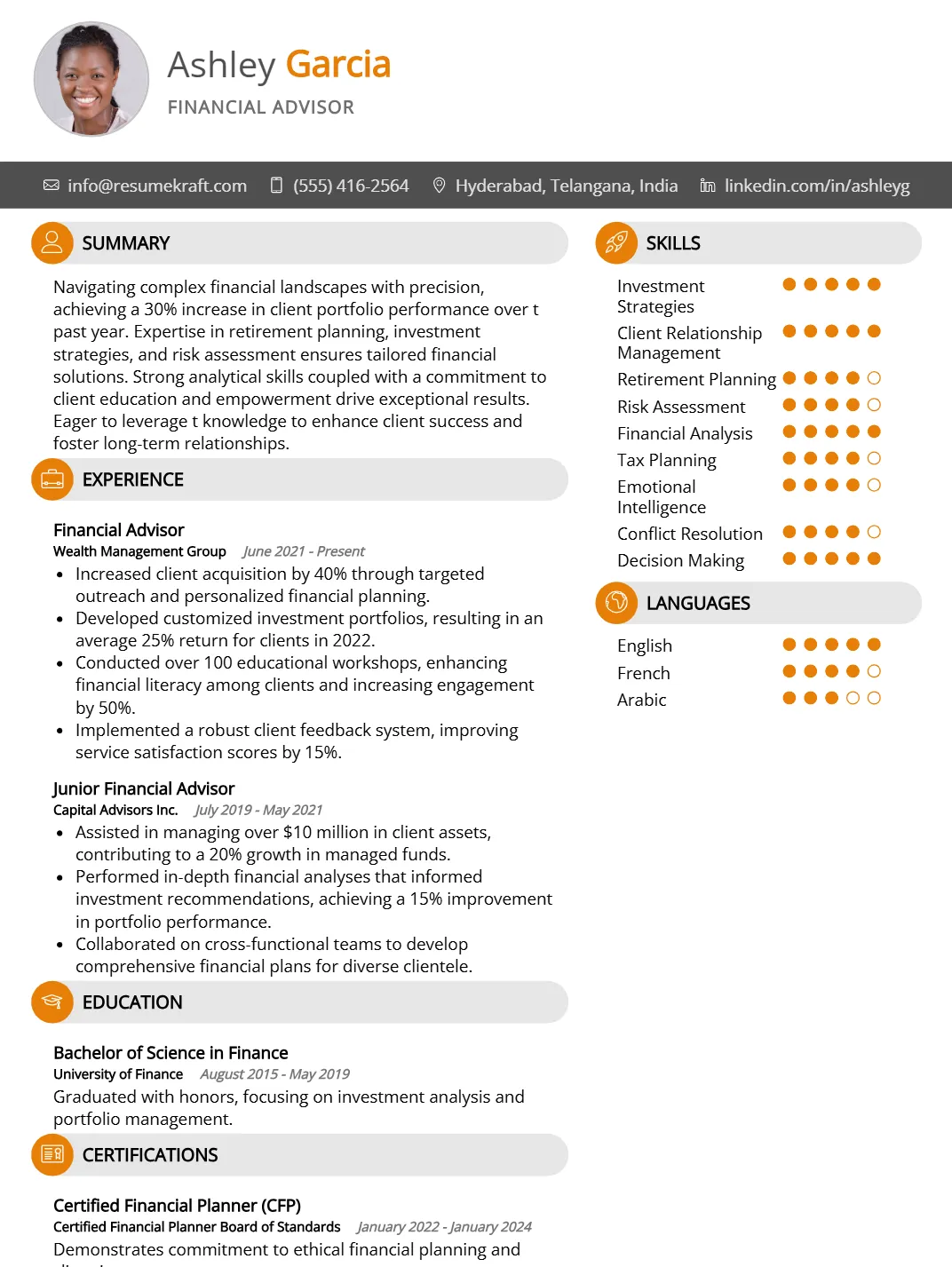

Financial Advisor Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills, such as Investment Strategies and Client Relationship Management, which are crucial for a Financial Advisor role. With approximately six years of experience in both Financial Advisor and Junior Financial Advisor positions, it showcases a progressive career path. The clear format enhances readability, ensuring key information stands out for hiring managers. Additionally, the use of industry-specific keywords improves ATS compatibility, while strategically presented achievements demonstrate tangible results that resonate with potential clients and employers alike.

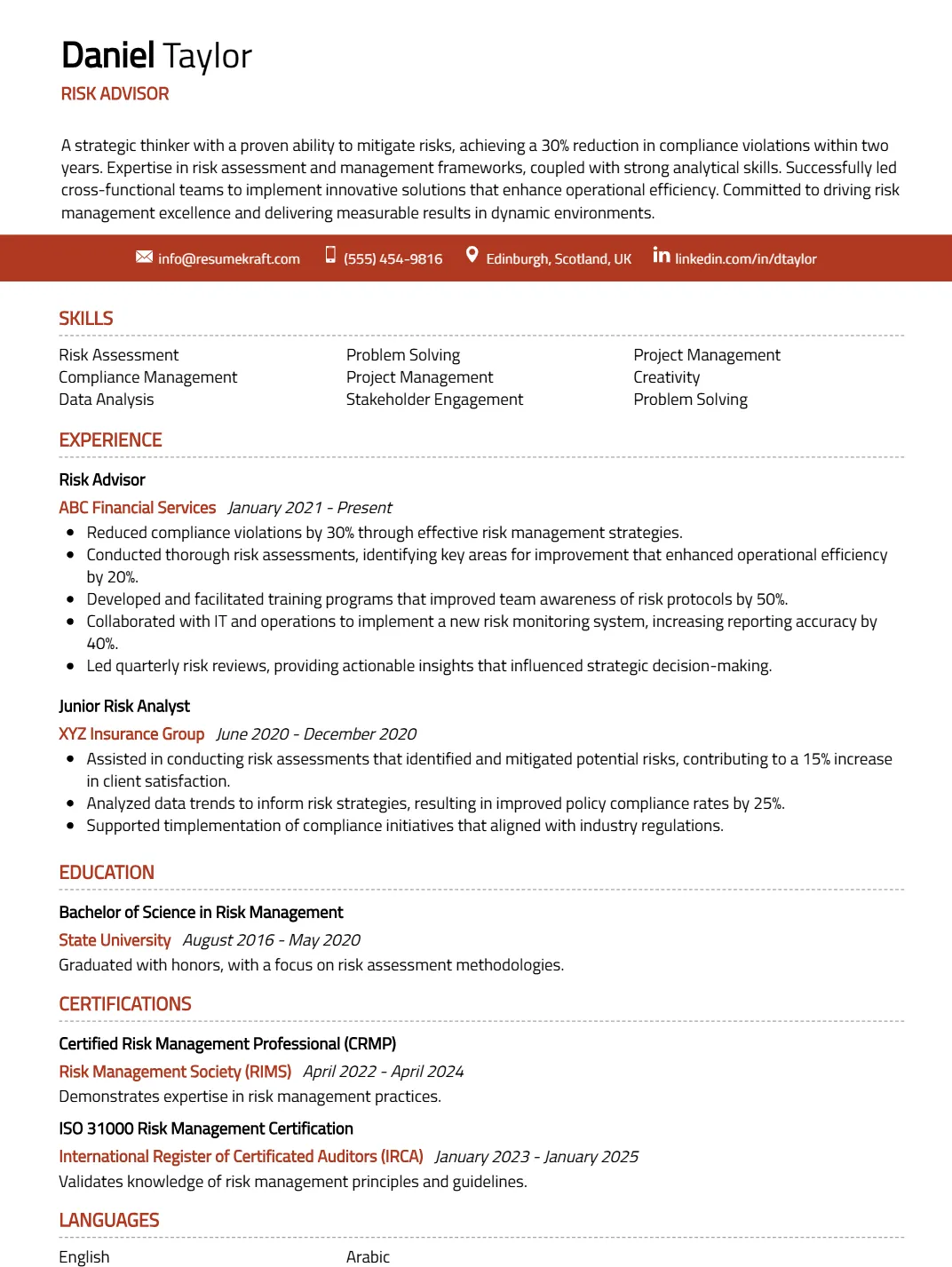

Risk Advisor Resume

Why This Resume Works

This resume effectively showcases the candidate’s qualifications for a Risk Advisor position by highlighting key skills like Risk Assessment and Compliance Management, crucial for this role. Their four years of relevant experience as a Risk Advisor and Junior Risk Analyst demonstrate a solid foundation in the field. The structured format enhances readability, while the use of industry-specific keywords ensures ATS compatibility. Additionally, strategic presentation of achievements underscores their problem-solving and project management capabilities, making them a compelling choice for potential employers in risk management.

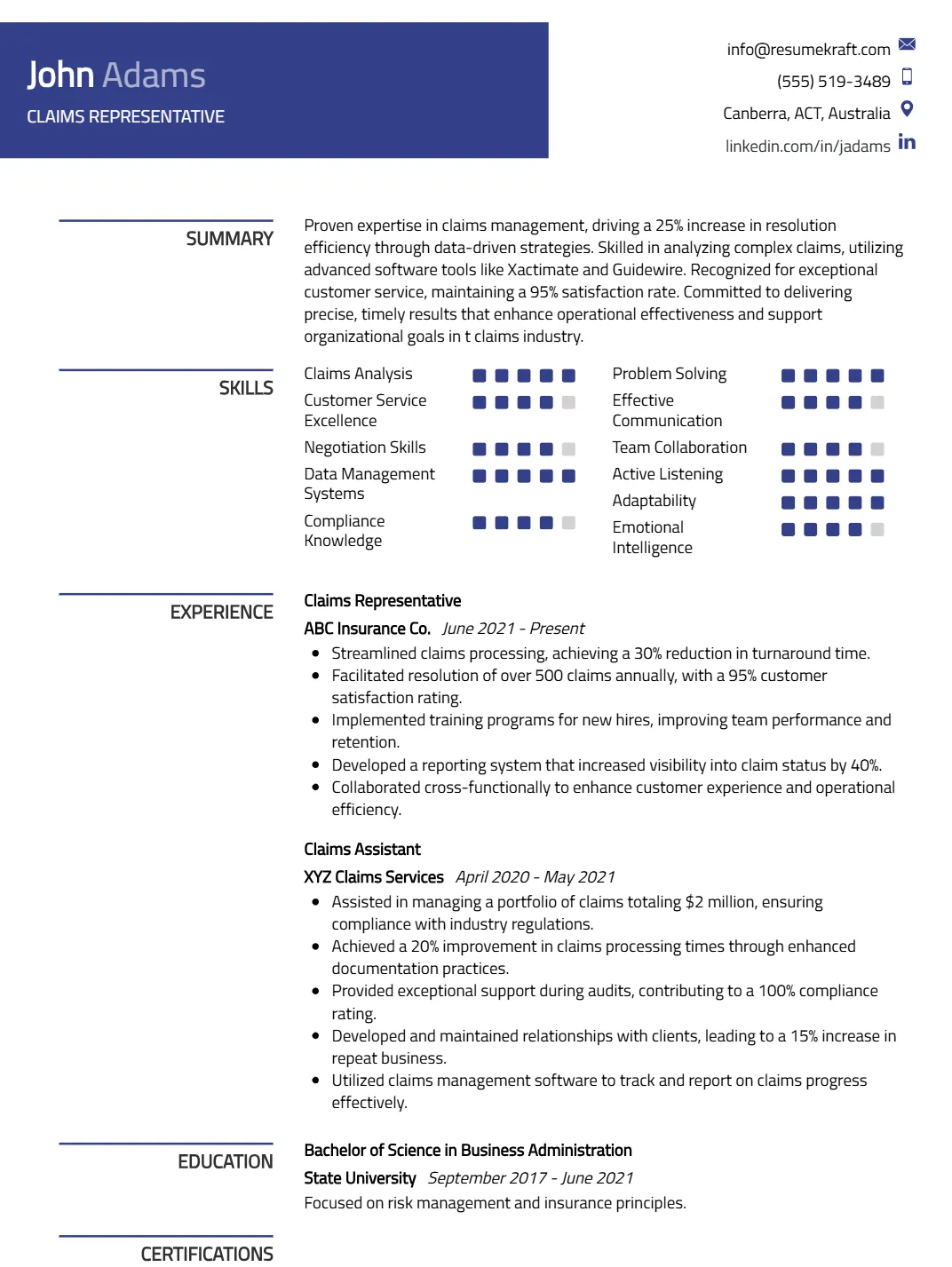

Claims Representative Resume

Why This Resume Works

This resume effectively showcases the candidate’s qualifications for a Claims Representative position by highlighting relevant key skills such as claims analysis and negotiation. With approximately five years of experience in similar roles, the structured format clearly outlines their expertise in customer service and compliance knowledge. The use of industry-specific keywords ensures ATS compatibility, maximizing visibility to recruiters. Additionally, strategic presentation of achievements demonstrates measurable impact in previous positions, reinforcing the candidate’s potential value to prospective employers in the claims field.

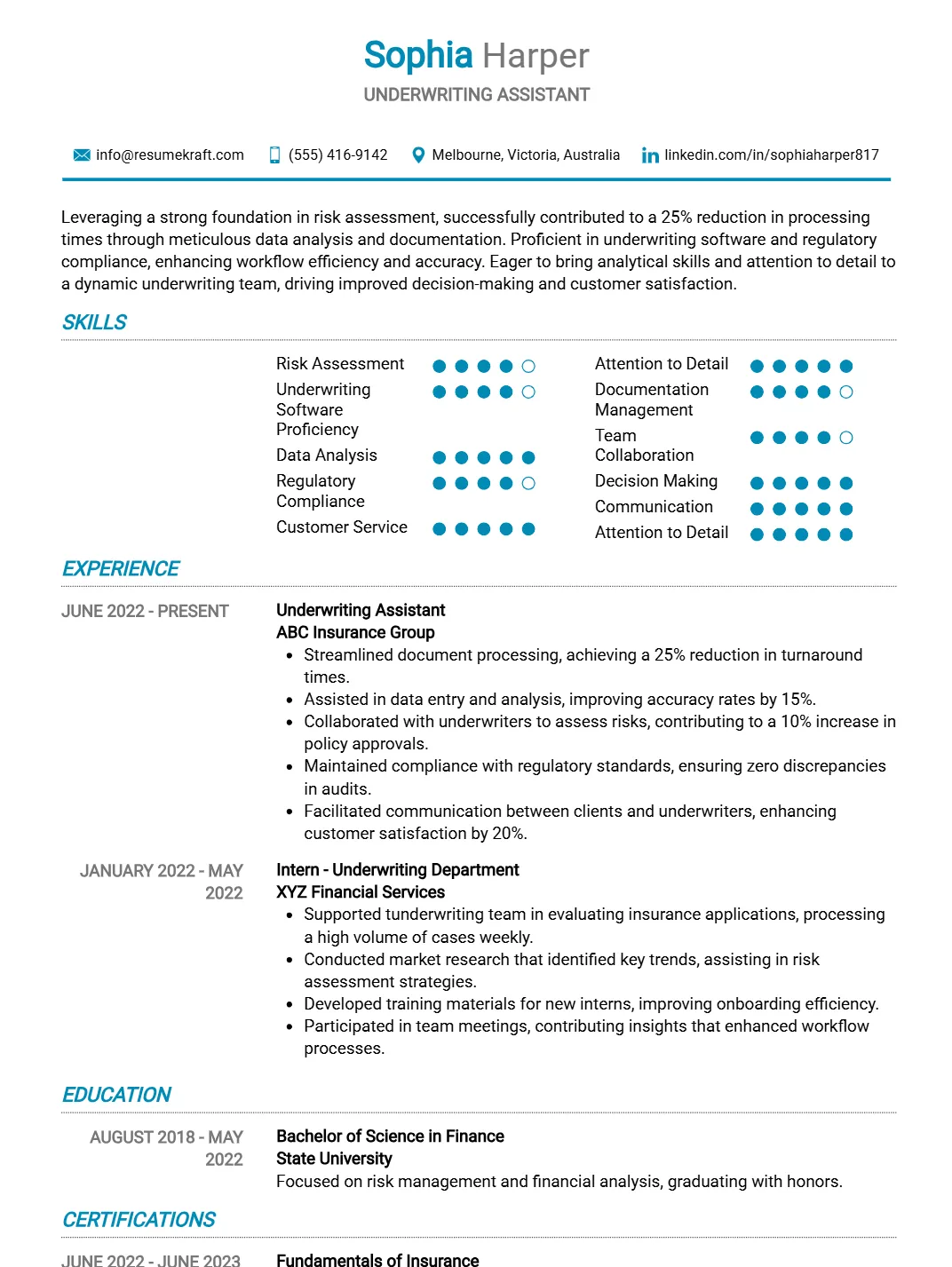

Underwriting Assistant Resume

Why This Resume Works

This resume effectively highlights the candidate’s relevant skills, such as risk assessment and underwriting software proficiency, which are crucial for an Underwriting Assistant. Their three years of targeted experience demonstrate a solid foundation in the field. The structured format allows easy navigation, emphasizing key competencies that align with industry standards. Additionally, the use of specific keywords ensures ATS compatibility, enhancing visibility to potential employers.

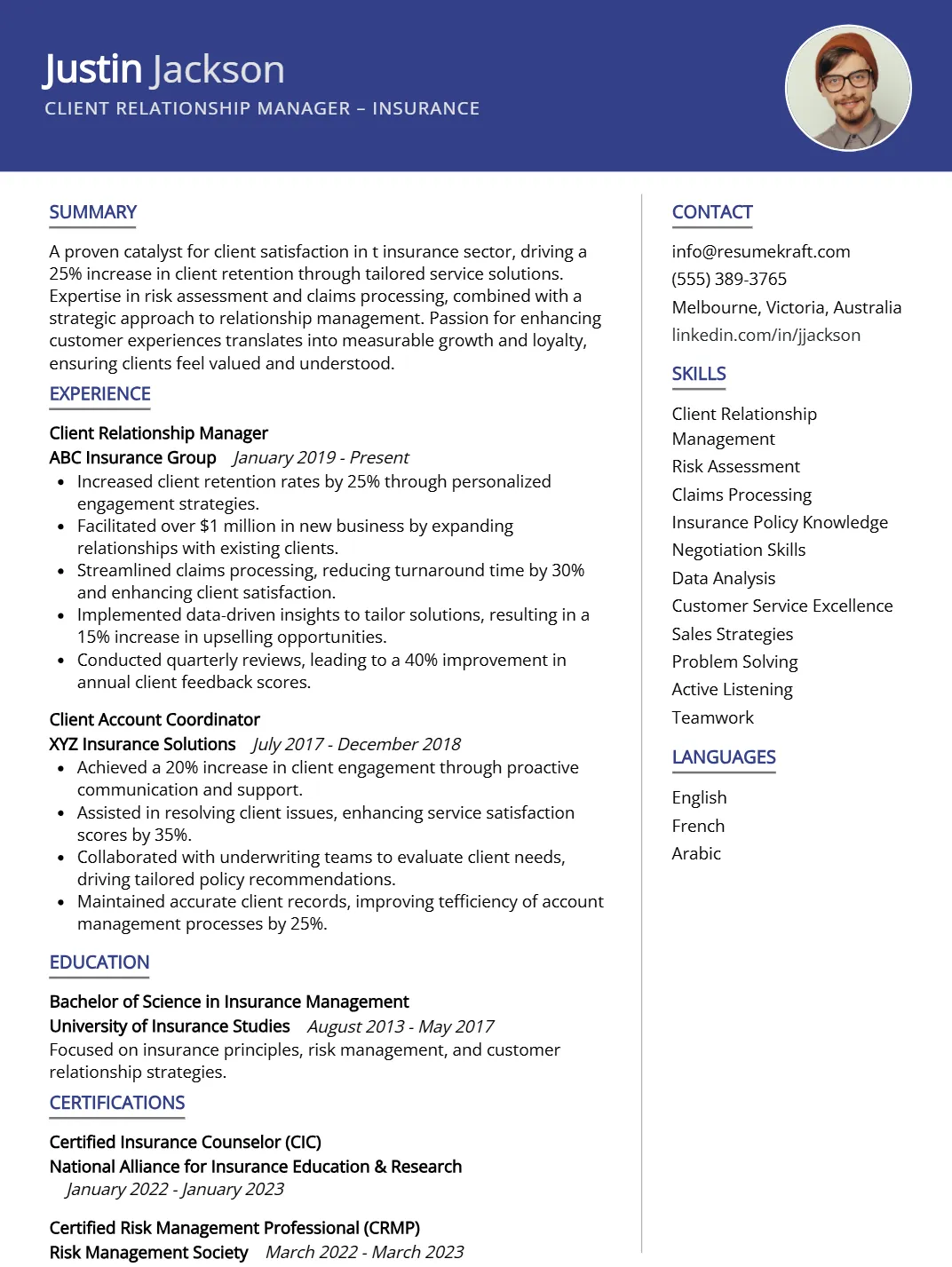

Client Relationship Manager – Insurance Resume

Why This Resume Works

This resume effectively showcases the candidate’s relevant skills and experience for the Client Relationship Manager – Insurance position. The inclusion of key competencies like risk assessment and negotiation skills aligns perfectly with industry demands. Its structured format highlights seven years of progressive experience, enhancing clarity and readability. Additionally, the use of industry-specific keywords ensures ATS compatibility, increasing visibility to hiring managers. Strategic presentation of achievements such as successful claims processing reinforces the candidate’s capability to excel in managing client relationships within the insurance sector.

How to format a Insurance Agent resume

Proper formatting is crucial for an Insurance Agent resume, as it enhances readability and showcases your professionalism. A well-structured resume format can significantly influence potential employers, making it easier for them to identify your qualifications and suitability for the role.

- Use a clean, professional font like Arial or Times New Roman in 10-12 point size to ensure your resume is easy to read. Consistency in font choice enhances the overall presentation.

- Organize your resume into clear sections: Contact Information, Summary, Experience, Skills, and Education. This structure allows hiring managers to quickly locate pertinent information about your qualifications.

- Highlight relevant experience with bullet points, focusing on achievements and metrics. Use action verbs to convey your contributions effectively, making your resume stand out to potential employers.

- Keep margins between 0.5 to 1 inch to create a balanced layout. This spacing prevents your resume from looking crowded while ensuring all content is easily accessible.

- Limit your resume to one page, especially if you have less than 10 years of experience. A concise format helps maintain the reader’s attention and highlights your most relevant qualifications.

How to write your Insurance Agent resume experience

Effectively presenting work experience on an Insurance Agent resume is essential, as it showcases your ability to generate sales, manage client relationships, and navigate complex insurance products. Employers seek candidates who can demonstrate a proven track record of success, as well as skills in customer service and problem-solving that align with the demands of the role.

A well-structured experience section highlights relevant achievements using quantifiable metrics, making it easier for hiring managers to assess your capabilities. This section should not only detail your previous roles but also emphasize your contributions and impact within those positions, helping you stand out among other applicants.

Worked at an insurance company for several years. Helped clients with policies and claims.

Increased client retention by 30% over two years by providing tailored insurance solutions and proactive claims support, resulting in $500K in new policy sales.

How to list your hard skills and soft skills on your resume

In the competitive field of insurance, showcasing both hard and soft skills on your resume is crucial for standing out to potential employers. Hard skills reflect your technical knowledge and proficiency in specific areas, such as underwriting and policy analysis, while soft skills highlight your interpersonal abilities, such as communication and empathy. A balanced combination of both types of skills not only enhances your effectiveness in the role but also demonstrates your ability to connect with clients and colleagues alike.

Hard Skills:

- Policy Underwriting: Evaluating risks and determining appropriate coverage levels.

- Claims Processing: Managing and resolving insurance claims efficiently.

- Risk Assessment: Analyzing data to identify potential risks for clients.

- Regulatory Compliance: Ensuring adherence to state and federal insurance laws.

- Customer Relationship Management (CRM): Utilizing software to track client interactions.

- Financial Analysis: Interpreting financial data to recommend suitable products.

- Market Research: Conducting analysis to identify trends and customer needs.

- Product Knowledge: Understanding various insurance products and their benefits.

- Sales Strategy Development: Creating plans to effectively sell insurance products.

- Data Entry: Accurately inputting client information into databases.

- Presentation Skills: Effectively presenting information to clients and stakeholders.

- Negotiation: Skillfully negotiating terms and rates with clients and underwriters.

- Policy Renewal Management: Overseeing the renewal process for existing clients.

- Technical Proficiency: Familiarity with insurance software and tools.

- Claims Investigation: Conducting thorough investigations to validate claims.

Soft Skills:

- Communication: Clearly conveying information to clients and colleagues.

- Empathy: Understanding and addressing client concerns with compassion.

- Problem-Solving: Identifying solutions to challenges faced by clients.

- Time Management: Efficiently managing multiple tasks and deadlines.

- Adaptability: Adjusting to changes in regulations and market conditions.

- Team Collaboration: Working effectively with colleagues to achieve common goals.

- Customer Service Orientation: Prioritizing client satisfaction in all interactions.

- Persuasiveness: Convincing clients of the benefits of specific insurance products.

- Attention to Detail: Ensuring accuracy in documentation and policy details.

- Integrity: Maintaining honesty and ethical conduct in all dealings.

- Networking: Building relationships with clients and industry professionals.

- Active Listening: Fully understanding client needs and concerns before responding.

- Conflict Resolution: Effectively managing disputes to reach satisfactory outcomes.

- Self-Motivation: Taking initiative to drive personal and professional growth.

- Creativity: Thinking outside the box to develop innovative insurance solutions.

- Stress Management: Maintaining composure under pressure and during busy periods.

How to list your certifications and education on your resume

When presenting certifications and education on an Insurance Agent resume, it’s crucial to prioritize relevant qualifications that demonstrate your expertise in the field. Include any insurance licensing, such as a property and casualty license or life and health license, as these are often required. Additionally, consider listing other relevant certifications like Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU), which can enhance your credibility.

In terms of educational qualifications, a degree in business, finance, or a related field is beneficial. Clearly format this section, using bullet points for clarity, and be sure to include the institution’s name, degree obtained, and graduation date to provide a comprehensive view of your educational background.

Got my degree and some licenses. I have a lot of insurance experience.

Bachelor of Science in Business Administration, State University, 2020. Licensed Insurance Agent (Property & Casualty, Life & Health), Certified Insurance Counselor (CIC).

How to write your Insurance Agent resume summary or objective

A strong resume summary or objective is crucial for an Insurance Agent position as it provides a snapshot of your qualifications and career goals. A summary is best for candidates with extensive experience, highlighting key achievements and skills, while an objective is ideal for entry-level candidates, focusing on career aspirations and how they align with the role.

Looking for an insurance job to gain experience. I have some skills in sales and customer service, and I hope to succeed in this field.

Results-driven insurance agent with over 5 years of experience in sales and customer relationship management. Proven track record of exceeding sales targets by 30% while maintaining high customer satisfaction ratings.

Additional sections for a Insurance Agent resume

Including additional sections in your Insurance Agent resume can set you apart from the competition by showcasing your unique qualifications, skills, and experiences. These sections can provide a more comprehensive view of your capabilities and enhance your appeal to potential employers.

- Certifications: Highlighting relevant certifications, such as Life Insurance License or Property and Casualty License, demonstrates your professional credibility and compliance with industry regulations, giving employers confidence in your expertise.

- Professional Affiliations: Listing memberships in organizations like the National Association of Insurance Agents showcases your commitment to the industry and can suggest a network of professional connections that may benefit your role.

- Awards and Recognition: Including any awards or accolades received for sales performance or customer service excellence illustrates your proven track record and dedication to achieving high standards in your work.

- Volunteer Experience: Detailing volunteer roles related to financial literacy or community service shows your initiative and passion for helping others, which can resonate well with clients and employers alike.

- Skills: Incorporating a dedicated skills section with specific abilities like negotiation, customer service, and risk assessment can help hiring managers quickly identify your strengths and assess your fit for the role.

Key takeaways for writing a professional Insurance Agent resume

- Highlight specific sales achievements and metrics, such as policy sales or client retention rates, to demonstrate your effectiveness as an Insurance Agent.

- Utilize industry-specific keywords in your resume to improve visibility and match the requirements outlined in job descriptions.

- Consider using resume templates that cater specifically to the insurance industry for a polished and professional appearance.

- Showcase your knowledge of insurance products and regulations, as well as any relevant certifications, to strengthen your candidacy.

- Leverage an ai resume builder to streamline the creation process, ensuring your resume is well-structured and tailored to the insurance sector.

Frequently Asked Questions

How long should my Insurance Agent resume be?

Your Insurance Agent resume should ideally be one page, especially if you have less than 10 years of experience. This concise format allows you to effectively highlight your skills, achievements, and relevant experience without overwhelming potential employers. However, if you have extensive experience or credentials, a two-page resume may be acceptable. Always ensure that every section is relevant to the insurance industry and tailored to the specific position you are applying for.

What is the best format for a Insurance Agent resume?

The best format for an Insurance Agent resume is the reverse-chronological format. This structure emphasizes your work history, showcasing your most recent positions first, which is essential in the fast-paced insurance industry. Include sections for contact information, a professional summary, work experience, education, and relevant certifications. Use clear headings and bullet points for easy readability, ensuring that key achievements and skills stand out to hiring managers quickly.

What should I highlight on my Insurance Agent resume to stand out?

To stand out, highlight your sales achievements, client retention rates, and any specialized insurance knowledge you possess. Include metrics that demonstrate your success, such as the number of policies sold or revenue generated. Additionally, emphasize your communication and customer service skills, as these are crucial in building client relationships. Certifications, such as CPCU or CLU, can also set you apart, showcasing your commitment to professional development in the insurance field.

What are some ways to quantify my experience on my Insurance Agent resume?

Quantifying your experience can significantly enhance your resume’s impact. Include metrics such as the number of clients you managed, total premiums sold, percentage growth in your book of business, or sales targets achieved. For example, you might say, “Increased client base by 30% over two years” or “Achieved 150% of sales targets in 2022.” These specific figures provide tangible evidence of your success and capabilities, making your resume more compelling to potential employers.