A bank officer is a professional who works in a bank and is responsible for various financial transactions. Officers are usually required to have a bachelor’s degree in finance or a related field, and many have several years of experience working in the banking industry. The duties of a bank officer vary depending on the size and type of bank, but typically include supervising tellers, approving loans and lines of credit, and managing the bank’s daily operations. Larger banks may also have officers who specialize in areas such as human resources, marketing, or information technology.

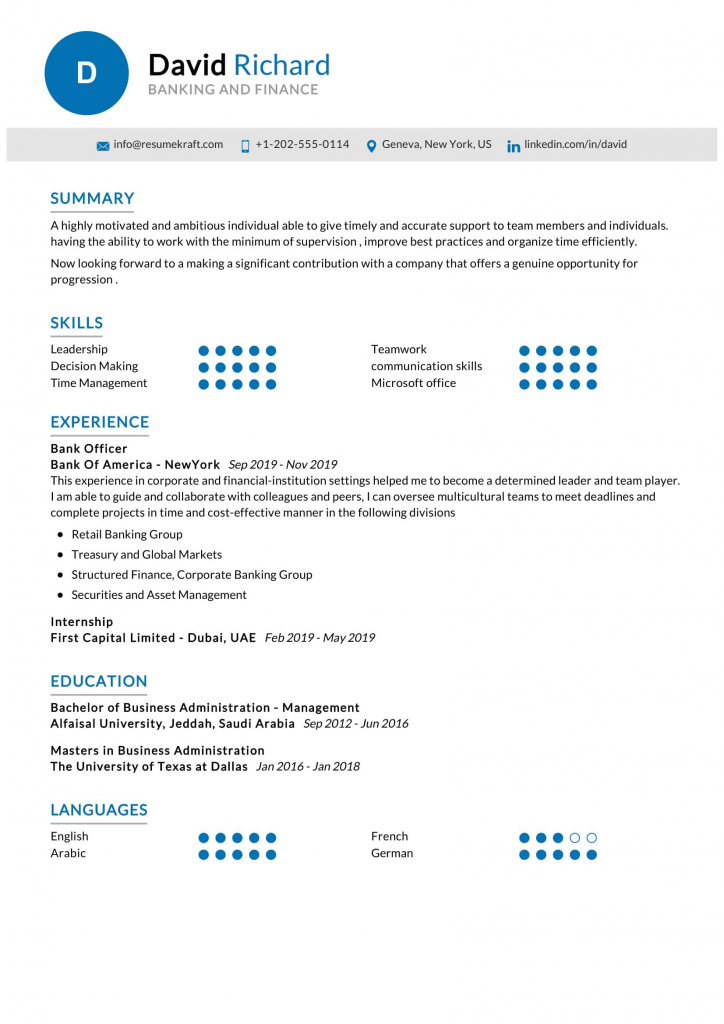

How to list Bank Officer Skills on resume:

One way to list your skills on your resume is to create a separate skills section. This section can be located near the top of your resume, underneath your contact information, or at the end of your resume, after your work experience and education sections.

In your skills section, you should list both your hard skills and soft skills. Hard skills are specific, measurable, and tangible skills that you have acquired through experience or education. Examples of hard skills include computer programming, bookkeeping, and project management. Soft skills, on the other hand, are interpersonal skills that are more difficult to quantify. Examples of soft skills include communication, teamwork, and customer service.

## Top 20 Bank Officer Resume Skills:

- Financial analysis

- Loan processing

- Financial reporting

- Regulatory compliance

- Credit analysis

- Risk management

- Asset management

- Portfolio management

- Investment management

- Wealth management

- Financial planning

- Estate planning

- Tax planning

- Retirement planning

- Insurance planning

- Cash management

- Treasury management

- Credit management

- Risk assessment

- Fraud prevention

Jobs That Demand Bank Officer Skills:

- Commercial banker

- Investment banker

- Retail banker

- Private banker

- Corporate banker

- Commercial lending officer

- Mortgage loan officer

- Consumer loan officer

- Credit analyst

- Financial analyst