Unlocking Success: The Role of a Tax Consultant

In the dynamic landscape of finance, the position of a Tax Consultant holds paramount importance. This role seamlessly merges technical expertise with a strategic mindset, guiding businesses through the intricacies of taxation. Let’s delve into the multifaceted world of a Tax Consultant, a professional who plays a pivotal role in ensuring financial compliance and optimization.

What Does a Tax Consultant Do?

A Tax Consultant is a financial maestro responsible for providing expert advice on tax-related matters to businesses and individuals. Their role extends beyond crunching numbers; they are the architects of financial strategies that minimize tax liabilities while ensuring compliance with ever-evolving tax laws.

As the fiscal landscape continues to evolve, the Tax Consultant becomes the compass, navigating clients through the complex terrain of tax codes and regulations. Their expertise goes beyond mere calculations; they offer insights into legal implications, risk management, and opportunities for financial growth.

Job Requirements for a Tax Consultant

The journey to becoming a Tax Consultant involves meeting specific prerequisites, a path that demands a blend of education, experience, and a knack for analytical thinking. Here are the key requirements:

- A Bachelor’s or Master’s degree in Accounting, Finance, or a related field, demonstrating a strong foundation in financial principles.

- Deep knowledge of tax laws, codes, and regulations, with a focus on staying abreast of updates and changes.

- Proven experience in tax consulting or related roles, showcasing a track record of successfully navigating complex financial scenarios.

- Strong analytical and problem-solving skills, honed through real-world challenges in the financial domain.

- Excellent communication skills to convey complex tax concepts in a clear and understandable manner to clients.

- Attention to detail, a critical trait to ensure accuracy in tax calculations and documentation.

Additional certifications such as Certified Public Accountant (CPA) or Chartered Tax Adviser (CTA) can elevate your profile in the competitive job market.

Responsibilities of a Tax Consultant

The role of a Tax Consultant is a tapestry of responsibilities, each thread intricately woven to create a financial masterpiece. Here are the core responsibilities that define this role:

- Conducting thorough reviews of clients’ financial records to identify potential tax-saving opportunities.

- Providing expert advice on tax planning, ensuring clients optimize their financial positions within legal boundaries.

- Preparing and filing accurate tax returns, adhering to deadlines and compliance requirements.

- Assessing the financial impact of various business decisions and proposing tax-efficient strategies.

- Guiding clients through tax audits, acting as a liaison between them and tax authorities.

- Staying informed about changes in tax laws and regulations, and advising clients on necessary adjustments to their financial strategies.

- Collaborating with other financial professionals to offer comprehensive financial solutions to clients.

Each responsibility is a brushstroke, contributing to the financial masterpiece that a Tax Consultant creates for their clients.

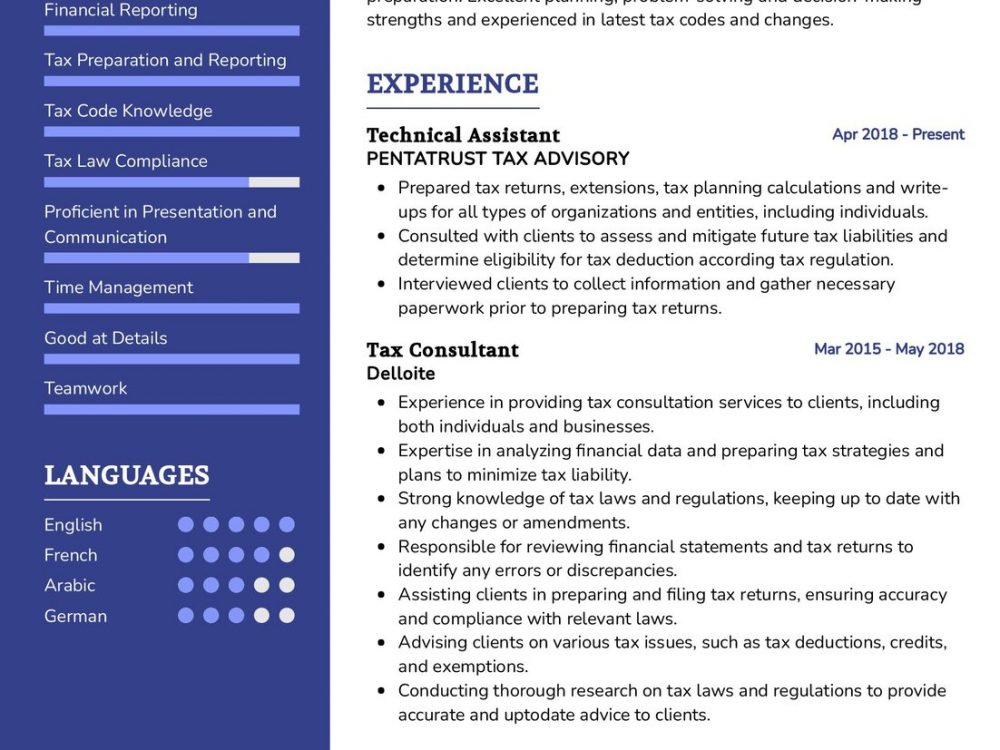

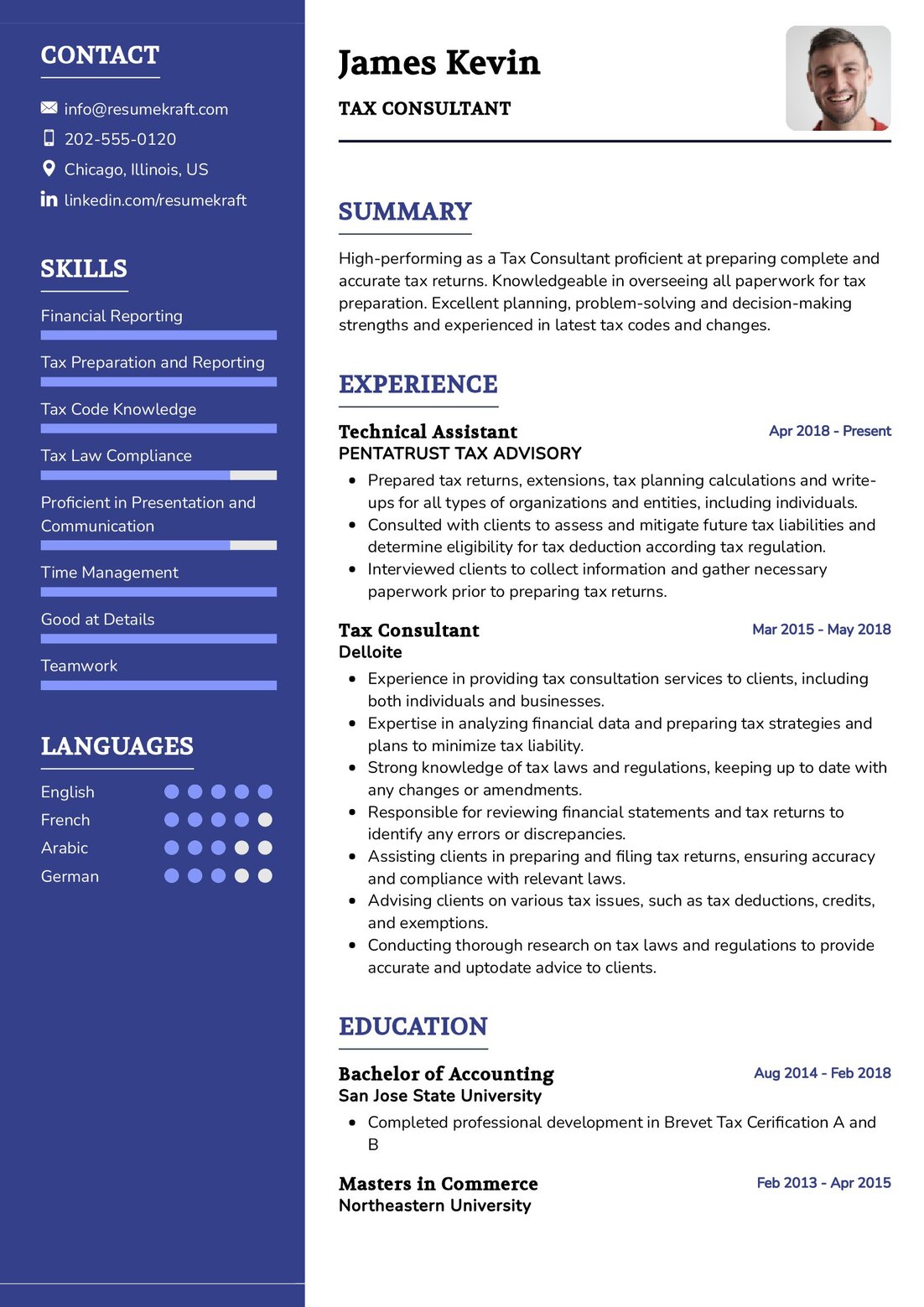

Writing an Outstanding Tax Consultant Resume

Your resume is the gateway to opportunities in the competitive field of tax consulting. Crafting a standout resume requires attention to detail and a strategic approach. Here are tips to help you create a compelling Tax Consultant resume:

- Highlight specific examples where your tax strategies led to significant savings for clients.

- Showcase your experience in handling diverse tax scenarios, from individual returns to complex corporate tax structures.

- Quantify your achievements with specific numbers, such as the percentage of tax reduction achieved for a particular client.

- Include relevant certifications and training to demonstrate your commitment to professional development.

- Customize your resume for each application, emphasizing the skills and experiences most relevant to the specific job.

Your resume is not just a document; it’s your personal financial portfolio, showcasing your skills and accomplishments in the world of tax consulting.

Crafting a Powerful Tax Consultant Resume Summary

Your resume summary is the opening statement that sets the tone for the reader. Craft a powerful summary that encapsulates your expertise and value. Here are some examples:

- “Results-oriented Tax Consultant with a proven track record of saving clients millions in tax liabilities through strategic planning and meticulous compliance.”

- “Experienced Tax Consultant specializing in corporate tax structures, adept at navigating complex regulatory landscapes to maximize financial benefits for clients.”

- “Detail-oriented Tax Consultant with a passion for helping individuals and businesses optimize their tax positions while ensuring full compliance with tax laws.”

Your summary is the first impression you make; make it impactful and memorable.

Building Your Tax Consultant Resume Experience Section

Your experience section is the heart of your resume, narrating the story of your journey as a Tax Consultant. Here are examples to guide you:

- “Led a team of tax professionals in a high-pressure environment, resulting in a 15% increase in overall client satisfaction.”

- “Developed and implemented tax strategies that resulted in a 25% reduction in clients’ tax liabilities, contributing to the company’s reputation for excellence.”

- “Guided clients through successful tax audits, demonstrating a deep understanding of tax laws and meticulous record-keeping.”

Your experiences are the chapters of your career story, showcasing your ability to navigate challenges and deliver results.

Educational Achievements for Your Tax Consultant Resume

Your educational background is the foundation of your expertise. Highlight your academic achievements to reinforce your qualifications:

- Master of Business Administration in Finance, XYZ University, 2015.

- Bachelor of Science in Accounting, ABC University, 2012.

- Certified Public Accountant (CPA), 2016.

Your education is the backbone of your professional journey, showcasing your commitment to excellence in the field of finance.

Key Skills for a Tax Consultant Resume

Your skill set is the toolkit that empowers you to excel in the world of tax consulting. Here are the essential skills for a Tax Consultant:

Soft Skills:

- Analytical thinking and problem-solving, crucial for navigating complex tax scenarios.

- Communication skills, both written and verbal, to convey tax concepts clearly to clients and team members.

- Attention to detail, ensuring accuracy in tax calculations and compliance documentation.

- Time management, crucial for meeting tax filing deadlines and managing multiple client portfolios.

- Client relationship management, fostering trust and long-term partnerships.

Hard Skills:

- Proficiency in tax software and accounting tools for accurate calculations and financial analysis.

- Knowledge of current tax laws, codes, and regulations, staying informed about changes and updates.

- Financial modeling, a skill that aids in assessing the impact of financial decisions on tax positions.

- Strategic tax planning, developing effective strategies to minimize tax liabilities for clients.

- Risk management, evaluating potential tax risks and proposing mitigating strategies.

Each skill is a tool in your arsenal, empowering you to provide exceptional tax consulting services.

Common Mistakes to Avoid When Writing a Tax Consultant Resume

Avoiding common pitfalls is crucial in crafting a resume that stands out. Here are mistakes to steer clear of:

- Avoid using generic language; tailor your resume to showcase your unique skills and experiences.

- Don’t just list job duties; highlight your achievements and the impact of your work on clients or the organization.

- Never underestimate the importance of a cover letter; use it as an opportunity to connect with potential employers on a personal level.

- Balance technical details; avoid overwhelming your resume with jargon, ensuring it remains accessible to a diverse audience.

- Proofread meticulously; typos and errors can detract from your professional image.

Steer clear of these pitfalls to create a resume that effectively communicates your expertise and value as a Tax Consultant.

Key Takeaways for Your Tax Consultant Resume

As you craft your Tax Consultant resume, keep these key points in mind:

- Highlight your ability to save clients money through strategic tax planning.

- Showcase your experience in diverse tax scenarios, from individual returns to complex corporate structures.

- Quantify your achievements with specific numbers to demonstrate the tangible impact of your work.

- Customize your resume for each application, emphasizing the most relevant skills and experiences.

Your resume is your personal financial narrative, showcasing your skills, experiences, and commitment to excellence in tax consulting. Best of luck on your journey to unlocking new opportunities!

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Tax Consultant job interview.