The Role of a Bank Teller

Bank Tellers play a crucial role in the banking industry, serving as the frontline representatives of financial institutions. Their responsibilities encompass a wide range of tasks aimed at providing efficient and customer-friendly services. Let’s explore in detail the multifaceted role of a Bank Teller and what it takes to excel in this position.

What are the Job Requirements for Bank Tellers?

Becoming a Bank Teller requires meeting certain job requirements and possessing specific skills to handle the demands of the role effectively. Here’s a breakdown of the prerequisites for aspiring Bank Tellers:

- A high school diploma or equivalent educational qualification, showcasing basic literacy and numeracy skills.

- Strong communication abilities, both verbal and written, essential for interacting with customers and colleagues.

- Attention to detail, as Bank Tellers deal with financial transactions that require precision and accuracy.

- Basic computer proficiency, including knowledge of common banking software and applications.

- Customer service experience or skills, ensuring a positive experience for clients during their banking interactions.

- Ability to work in a fast-paced environment while maintaining professionalism and composure.

While prior experience in banking or finance can be advantageous, it is not always a mandatory requirement for entry-level Bank Teller positions.

Responsibilities of a Bank Teller

The role of a Bank Teller encompasses a variety of responsibilities aimed at providing efficient and accurate banking services to customers. Here are some of the key duties performed by Bank Tellers:

- Processing routine banking transactions, including deposits, withdrawals, and check cashing.

- Assisting customers with inquiries regarding their accounts, products, and services offered by the bank.

- Handling currency and coins, ensuring proper balancing of cash drawers at the beginning and end of each shift.

- Promoting and cross-selling bank products such as savings accounts, loans, and credit cards to customers.

- Verifying customer identities and ensuring compliance with regulatory requirements, such as Know Your Customer (KYC) guidelines.

- Resolving customer issues and complaints in a timely and professional manner, striving to achieve customer satisfaction.

- Adhering to security procedures and protocols to safeguard the bank’s assets and prevent fraud.

Bank Tellers serve as the face of the bank, playing a vital role in building and maintaining positive relationships with customers.

Bank Teller Resume Writing Tips

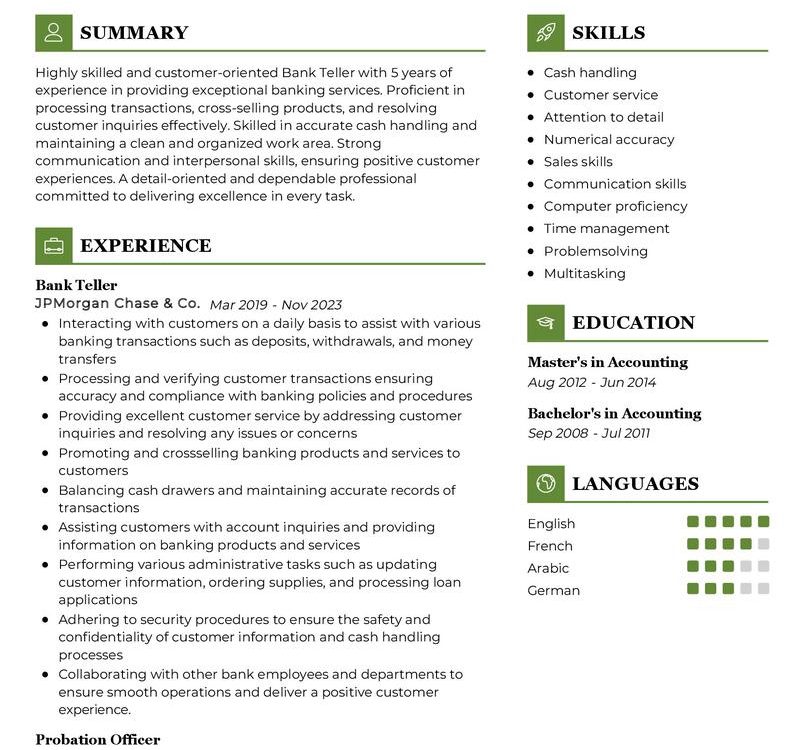

Crafting a compelling resume is essential for aspiring Bank Tellers to showcase their skills and qualifications effectively. Here are some tips to create an impactful Bank Teller resume:

- Include relevant work experience, highlighting any customer service or cash handling roles.

- Emphasize your communication skills and ability to work in a team-oriented environment.

- Showcase any additional certifications or training related to banking or financial services.

- Quantify your achievements where possible, such as exceeding sales targets or resolving customer issues efficiently.

- Customize your resume for each job application, tailoring your qualifications to match the specific requirements of the position.

A well-crafted resume can significantly increase your chances of landing a Bank Teller position.

Bank Teller Resume Summary Examples

Your resume summary serves as an introduction to your qualifications and experience as a Bank Teller. Here are some examples of effective resume summaries:

- “Customer-focused Bank Teller with 3 years of experience in processing financial transactions and providing exceptional service to clients.”

- “Detail-oriented Bank Teller with a proven track record of accuracy in handling cash transactions and resolving customer inquiries efficiently.”

- “Results-driven Bank Teller with a strong sales acumen and a passion for delivering personalized banking solutions to customers.”

Each summary should succinctly highlight your key strengths and qualifications for the role of a Bank Teller.

Experience Section for Your Bank Teller Resume

Your experience section should provide detailed examples of your responsibilities and accomplishments as a Bank Teller. Here are some sample entries:

- “Processed an average of 50 customer transactions per day, maintaining a high level of accuracy and efficiency.”

- “Received commendation from management for resolving a complex customer issue, resulting in increased customer satisfaction.”

- “Consistently met or exceeded monthly sales targets for bank products, contributing to overall branch performance.”

Each experience listed should demonstrate your skills and contributions as a Bank Teller.

Education Section for Your Bank Teller Resume

While formal education requirements for Bank Tellers are minimal, including your educational background can still be beneficial. Here’s how you can list your education:

- High School Diploma, XYZ High School, Graduated 20XX.

- Associate Degree in Business Administration, ABC Community College, Graduated 20XX.

Even if your education is not directly related to banking, it still demonstrates your commitment to learning and your ability to meet academic requirements.

Bank Teller Skills for Your Resume

Bank Tellers require a diverse skill set to perform their duties effectively. Here are some essential skills for Bank Tellers:

Soft Skills:

- Excellent communication skills

- Attention to detail

- Customer service orientation

- Problem-solving abilities

- Ability to work under pressure

Hard Skills:

- Cash handling and counting

- Knowledge of banking procedures and regulations

- Basic accounting skills

- Computer proficiency

- Sales and cross-selling abilities

Each skill is essential for performing the duties of a Bank Teller effectively and efficiently.

Common Mistakes to Avoid When Writing a Bank Teller Resume

When crafting your Bank Teller resume, it’s important to avoid common mistakes that could diminish your chances of success. Here are some pitfalls to watch out for:

- Exaggerating skills or experience

- Using generic or clichéd language

- Neglecting to customize your resume for each job application

- Failing to proofread for errors or typos

- Omitting relevant experience or skills

Avoiding these mistakes can help ensure that your Bank Teller resume stands out to potential employers.

Key Takeaways for Your Bank Teller Resume

As you create your Bank Teller resume, keep these key points in mind:

- Highlight your customer service skills and ability to handle financial transactions accurately.

- Showcase your communication abilities and attention to detail.

- Quantify your achievements and include specific examples of your successes as a Bank Teller.

- Customize your resume for each job application to align with the specific requirements of the position.

By following these guidelines, you can create a standout Bank Teller resume that effectively highlights your qualifications and experiences.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Bank Teller job interview.