What is the Role of a Personal Banker?

In today’s dynamic financial landscape, the role of a Personal Banker holds significant importance in helping individuals manage their finances effectively. A Personal Banker serves as a trusted advisor to clients, offering a range of banking products and services tailored to meet their financial needs and goals. Let’s explore the multifaceted role of a Personal Banker and the impact they have on their clients’ financial well-being.

What are the Personal Banker Job Requirements?

Becoming a successful Personal Banker requires a combination of education, skills, and personal attributes. Here are the key requirements to excel in this role:

- A Bachelor’s degree in Finance, Economics, Business Administration, or a related field, providing a strong foundation in financial principles.

- Excellent communication and interpersonal skills to build rapport with clients and understand their financial objectives.

- Knowledge of banking products and services, including savings accounts, loans, credit cards, and investment options.

- Ability to analyze financial data and provide personalized recommendations based on clients’ financial situations.

- Demonstrated sales and customer service experience, with a focus on meeting or exceeding targets.

- Strong attention to detail and organizational skills to manage client accounts and documentation accurately.

Continued education and training in financial services can further enhance a Personal Banker’s qualifications and career prospects.

What are the Responsibilities of a Personal Banker?

The role of a Personal Banker encompasses a wide range of responsibilities aimed at providing exceptional service to clients and helping them achieve their financial goals. Here are the primary duties of a Personal Banker:

- Building and maintaining relationships with clients, understanding their financial needs, and recommending suitable banking solutions.

- Assisting clients with account openings, loan applications, and other banking transactions, ensuring compliance with regulatory requirements.

- Educating clients on various banking products and services, including interest rates, fees, and terms and conditions.

- Identifying opportunities to cross-sell or upsell additional banking products based on clients’ financial goals and preferences.

- Providing financial advice and guidance to clients, addressing questions or concerns related to budgeting, saving, investing, and debt management.

- Monitoring account activity and proactively reaching out to clients to discuss changes in their financial situations or recommend adjustments to their banking strategy.

- Collaborating with other banking professionals, such as loan officers, investment advisors, and branch managers, to deliver comprehensive financial solutions to clients.

By fulfilling these responsibilities with diligence and integrity, Personal Bankers play a vital role in helping individuals achieve financial success.

Personal Banker Resume Writing Tips

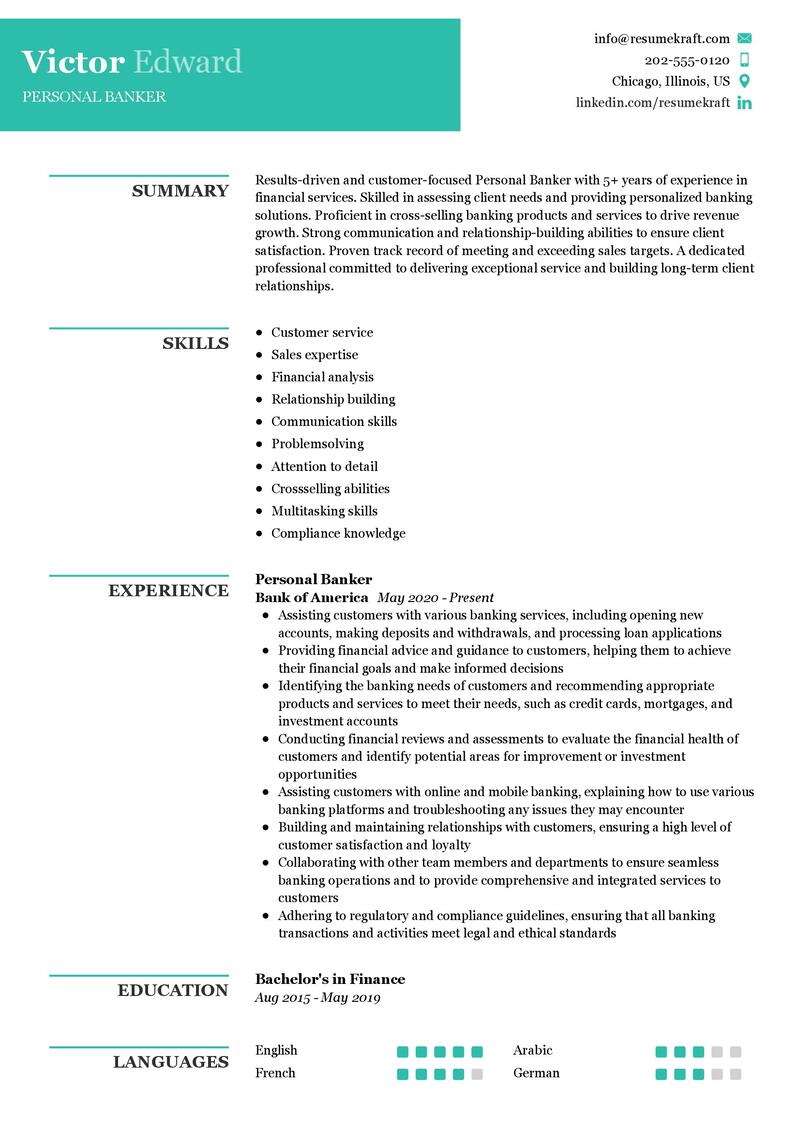

Crafting a compelling resume is essential for showcasing your qualifications and experience as a Personal Banker. Here are some tips to help you create an effective resume:

- Highlight your customer service skills and experience, emphasizing your ability to build rapport with clients and provide personalized financial advice.

- Quantify your achievements, such as exceeding sales targets, increasing client retention rates, or receiving positive feedback from satisfied clients.

- Include relevant keywords related to banking and finance to optimize your resume for applicant tracking systems (ATS).

- Tailor your resume to the specific job you’re applying for, highlighting relevant skills and experiences that align with the job description.

- Proofread your resume carefully to ensure it is free of errors and presents a professional image to potential employers.

By following these tips, you can create a resume that effectively showcases your qualifications and stands out to hiring managers in the banking industry.

Personal Banker Resume Summary Examples

Your resume summary is the first impression you make on potential employers, so it’s essential to make it impactful and concise. Here are some examples of effective resume summaries for Personal Bankers:

- “Dedicated Personal Banker with 5+ years of experience delivering personalized banking solutions to clients. Proven track record of exceeding sales targets and providing exceptional customer service.”

- “Results-driven Personal Banker with a passion for helping clients achieve their financial goals. Strong communication skills and a deep understanding of banking products and services.”

- “Experienced Personal Banker skilled in building relationships and providing tailored financial advice. Committed to delivering excellent service and helping clients make informed financial decisions.”

Each of these resume summaries highlights the candidate’s relevant experience and attributes, making them stand out to potential employers in the banking industry.

Create a Strong Experience Section for Your Personal Banker Resume

Your experience section is where you can showcase your accomplishments and demonstrate your value as a Personal Banker. Here are some examples of how to effectively highlight your experience:

- “Managed a portfolio of 200+ clients, exceeding sales targets by 20% and achieving a 95% client satisfaction rating.”

- “Led training sessions for new hires on banking products and services, improving team knowledge and performance.”

- “Implemented a client referral program that resulted in a 30% increase in new account openings.”

By providing specific examples of your achievements and contributions, you can showcase your effectiveness as a Personal Banker and stand out to potential employers.

Sample Education Section for Your Personal Banker Resume

Your education background provides important context for your qualifications as a Personal Banker. Here’s how you can format your education section:

- Bachelor of Business Administration in Finance, XYZ University, Graduated 2015.

- Associate Degree in Banking and Financial Services, ABC College, Graduated 2012.

- Financial Industry Regulatory Authority (FINRA) Series 6 and 63 Licenses, 2017.

These educational achievements demonstrate your commitment to the field of banking and finance and enhance your credibility as a Personal Banker.

Personal Banker Skills for Your Resume

As a Personal Banker, you need a combination of technical skills and personal attributes to excel in your role. Here are some essential skills to include on your resume:

Soft Skills:

- Customer service and relationship-building skills

- Excellent communication and interpersonal skills

- Problem-solving and decision-making abilities

- Attention to detail and accuracy

- Ability to work independently and as part of a team

Hard Skills:

- Knowledge of banking products and services

- Proficiency in financial analysis and risk assessment

- Understanding of regulatory compliance and banking regulations

- Sales and marketing skills

- Computer literacy, including proficiency in banking software and Microsoft Office

By highlighting these skills on your resume, you can demonstrate your ability to meet the demands of the Personal Banker role effectively.

Common Mistakes to Avoid When Writing a Personal Banker Resume

When crafting your Personal Banker resume, be mindful of these common mistakes that can diminish its effectiveness:

- Using vague or generic language that doesn’t showcase your specific achievements or qualifications.

- Overemphasizing technical skills at the expense of interpersonal skills and customer service abilities.

- Failing to tailor your resume to the specific job you’re applying for, resulting in a lack of relevance to the employer’s needs.

- Neglecting to proofread your resume for errors in spelling, grammar, or formatting, which can detract from your professionalism.

By avoiding these mistakes, you can create a polished and professional resume that effectively highlights your qualifications as a Personal Banker.

Key Takeaways for Your Personal Banker Resume

As you craft your Personal Banker resume, keep these key points in mind to maximize your chances of success:

- Focus on showcasing your customer service skills and ability to build strong relationships with clients.

- Quantify your achievements and highlight specific examples of your success in meeting sales targets or exceeding client expectations.

- Tailor your resume to the specific job you’re applying for, emphasizing relevant skills and experiences that align with the employer’s needs.

- Proofread your resume carefully to ensure it is free of errors and presents a professional image to potential employers.

By following these guidelines, you can create a compelling resume that effectively showcases your qualifications and experience as a Personal Banker, setting you apart from other applicants in the competitive job market.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Personal Banker job interview.