Understanding the Role of a Loan Officer

Loan officers play a crucial role in the financial landscape, helping individuals and businesses secure the funding they need to achieve their goals. This article delves into the multifaceted role of a loan officer, exploring their responsibilities, required skills, and tips for crafting a standout resume.

Job Requirements for Loan Officers

Becoming a loan officer requires a blend of education, skills, and experience. Here are the key requirements for aspiring loan officers:

- A Bachelor’s degree in finance, economics, business administration, or a related field.

- Strong understanding of financial principles and lending regulations.

- Excellent communication and interpersonal skills to interact with clients effectively.

- Attention to detail and analytical skills to assess loan applications.

- Ability to work under pressure and meet targets in a fast-paced environment.

Additionally, obtaining certifications such as the Mortgage Loan Originator (MLO) license can enhance credibility and job prospects in this field.

Responsibilities of Loan Officers

Loan officers have diverse responsibilities aimed at facilitating the lending process and ensuring positive outcomes for both borrowers and lenders. Here are some key responsibilities of loan officers:

- Evaluating loan applications, including reviewing financial documents and assessing creditworthiness.

- Guiding clients through the loan application process, explaining terms and conditions, and addressing any concerns.

- Collaborating with underwriters to determine loan approval or rejection based on established criteria.

- Negotiating loan terms and conditions with clients and lenders to achieve mutually beneficial agreements.

- Ensuring compliance with lending regulations and company policies to mitigate risks.

- Building and maintaining relationships with clients and referral sources to generate leads and expand the client base.

Successful loan officers demonstrate professionalism, integrity, and empathy in their interactions with clients, fostering trust and loyalty.

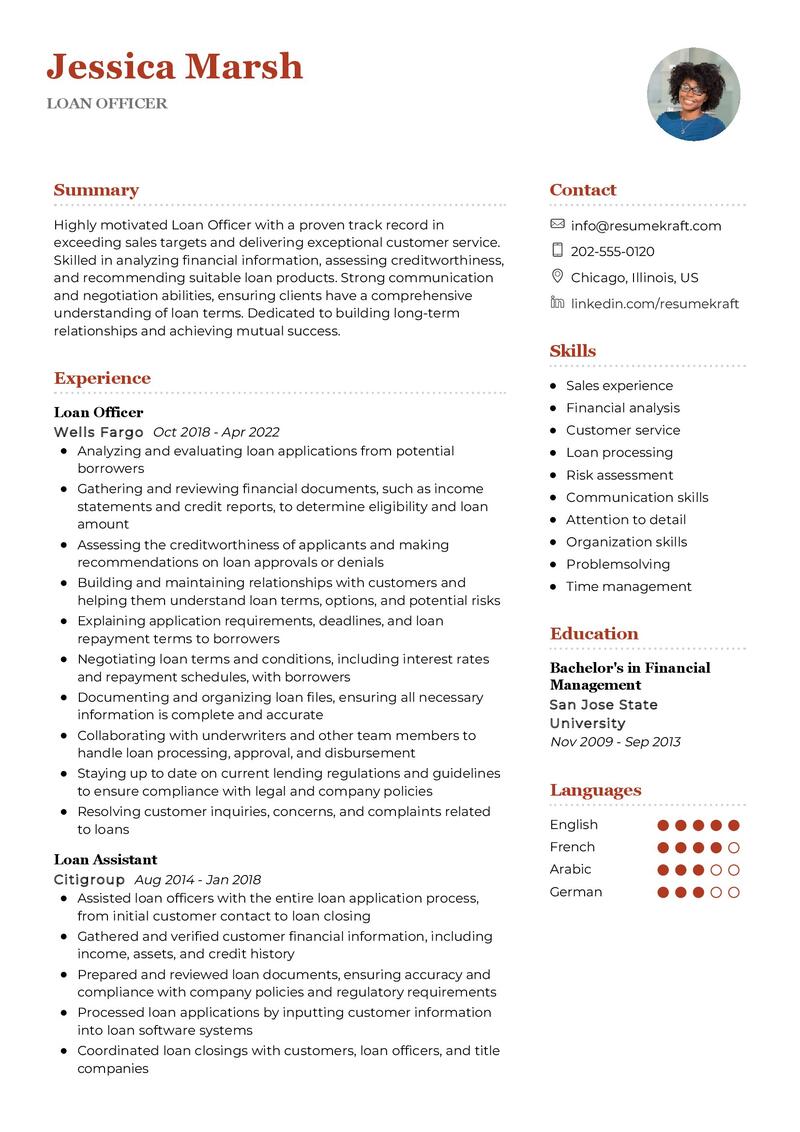

Writing a Standout Resume for Loan Officers

Crafting an impressive resume is essential for loan officers to showcase their qualifications and stand out in a competitive job market. Here are some tips for writing an effective resume:

- Highlight relevant experience in finance, banking, or customer service, emphasizing achievements and contributions.

- Showcase strong communication and negotiation skills, providing examples of successful client interactions and loan closures.

- Include relevant certifications and licenses, such as the MLO license or Certified Mortgage Banker (CMB) designation.

- Quantify achievements with metrics whenever possible, such as loan volume generated or customer satisfaction ratings.

- Customize your resume for each job application, tailoring your qualifications and accomplishments to match the job requirements.

A well-crafted resume can significantly increase your chances of securing interviews and landing your dream job as a loan officer.

Key Takeaways for Loan Officers

Aspiring loan officers should focus on developing a strong foundation in finance, communication, and customer service to succeed in this dynamic field. By acquiring the necessary skills, gaining relevant experience, and crafting an impressive resume, you can embark on a rewarding career as a loan officer.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the loan officer job interview.