What Should Be Included In A Banking Services Officer Resume?

A Banking Services Officer is responsible for providing excellent customer service, managing accounts, and handling deposits and withdrawals. When writing a resume for this position, it is important to highlight your key skills and experience that demonstrate your ability to perform these duties.

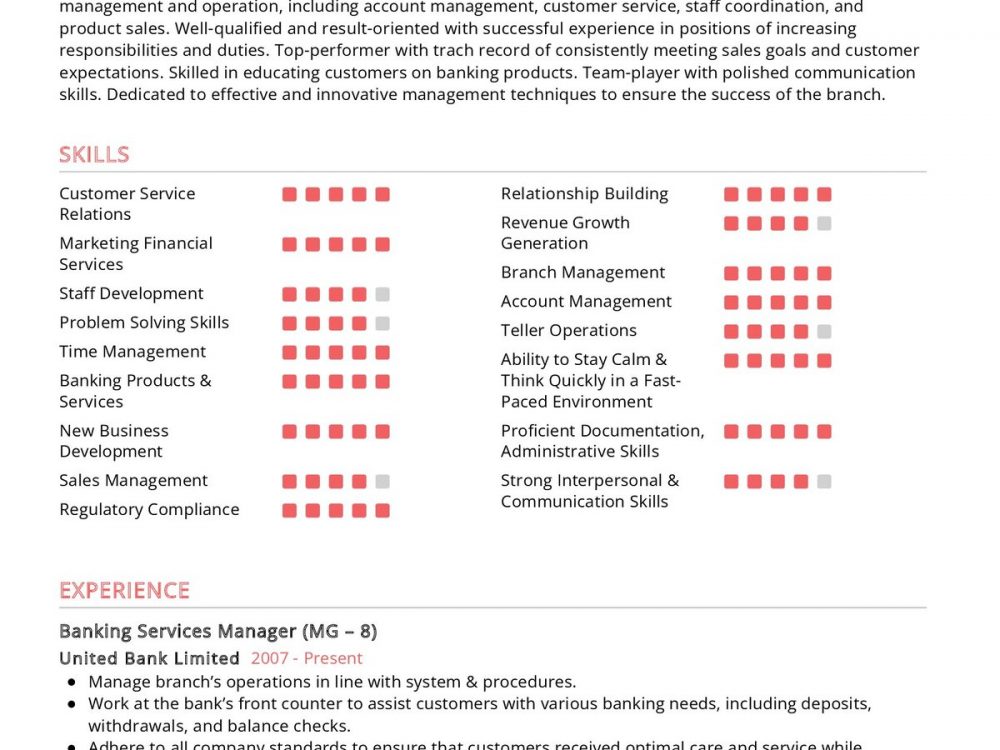

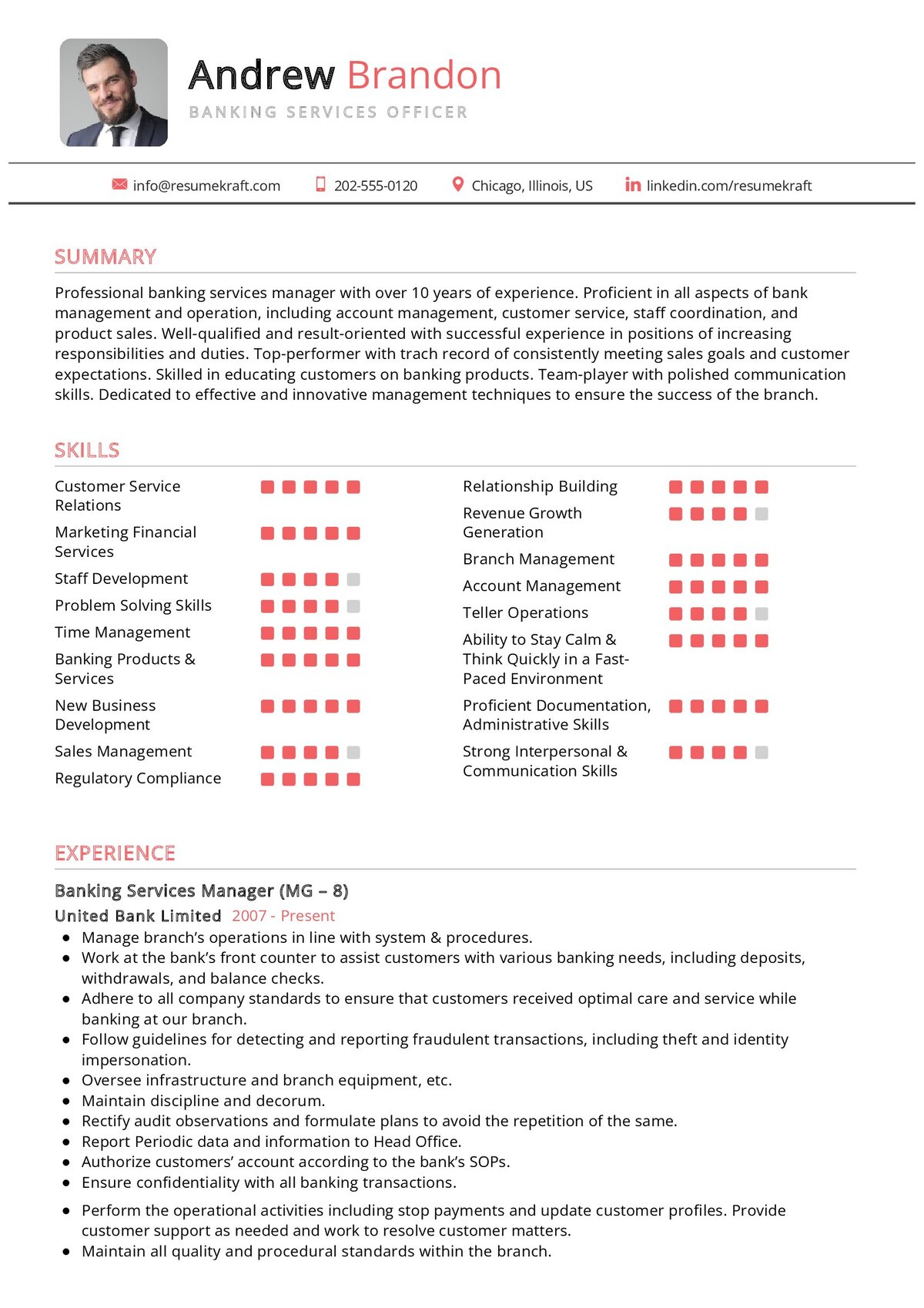

To begin, make sure to include a professional summary that outlines your qualifications and highlights your best qualities as a Banking Services Officer. This should be followed by a section that details your professional experience. Provide a detailed list of duties and accomplishments from your past positions and make sure to tailor the information to the job requirements.

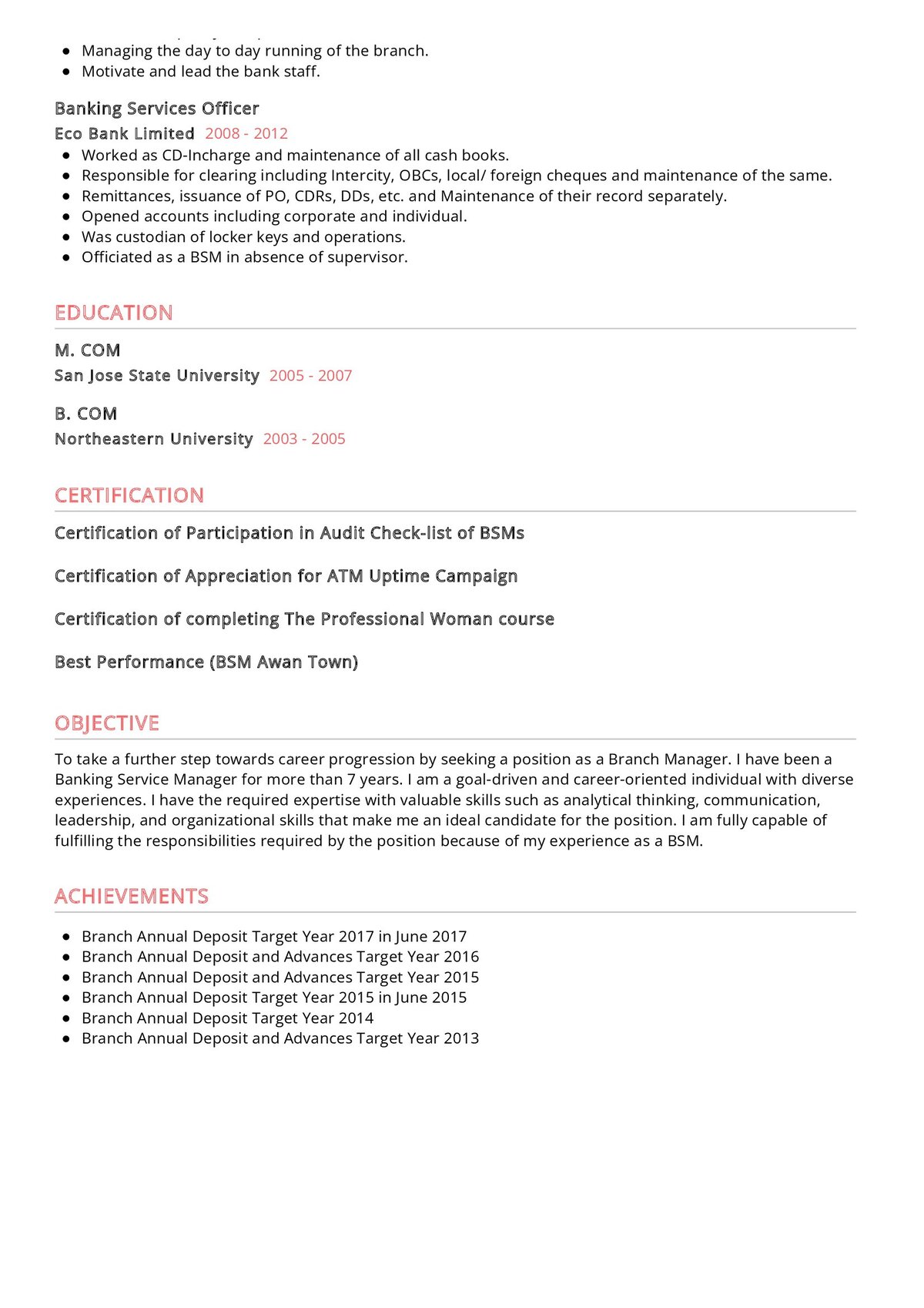

Include a section that outlines your education and any certifications you may have. Be sure to include any honors or awards that demonstrate your knowledge and skill level in the banking field.

Finally, list your technical skills and other qualifications such as foreign language fluency and any special training that you may have completed. Make sure that all of this information is pertinent to the job for which you are applying.

By following these guidelines, you can ensure that your Banking Services Officer resume will be effective and help you stand out from the competition.

What Skills Should I Put On My Resume For Banking Services Officer?

When you are looking to become a Banking Services Officer, it is important to make sure that you put all the necessary skills that you have on your resume. This will help you stand out from the other applicants and increase your chances of getting the job.

The most important skills to include on your resume for a Banking Services Officer position are attention to detail, problem-solving and customer service skills. Attention to detail is essential in this role, as you will be dealing with customers, processing documents and transactions and keeping accurate records. Problem-solving skills are also essential, as you will often be required to solve customer problems and offer solutions. Finally, excellent customer service skills are a must, as you will often be the first point of contact for customers and will need to provide them with a positive experience.

In addition to these core skills, experience with financial software, such as Microsoft Excel and QuickBooks, is also valuable. Understanding complex financial data and being able to interpret it correctly is also important. If you have experience with foreign currencies or international banking, this could also be an advantage.

Finally, excellent communication and interpersonal skills are highly desirable. You will need to be able to explain complex information to customers in a way that is easy to understand and relate to, as well as being able to work well with colleagues and other banking staff.

By making sure that you include all the necessary skills on your resume for a Banking Services Officer position, you can increase your chances of being hired. Showcasing your attention to detail, problem-solving skills, customer service skills and financial skills will ensure that you stand out from the competition and make you a more attractive candidate.

What Is The Job Description Of The Banking Services Officer?

The job of a Banking Services Officer is an important one in the banking industry. It involves the management of a variety of financial services and products for clients and customers in a bank. Banking Services Officers may oversee customer accounts, offer advice on financial products, process and analyze loan applications, handle deposits, and manage other duties related to banking services. They must also be knowledgeable about banking regulations and laws, and understand customer service practices.

The job of a Banking Services Officer requires a great deal of responsibility, as they must be capable of meeting tight deadlines and ensuring that all customer transactions are accurate and secure. They must be able to solve complex problems, remain current with banking trends, and handle customer inquiries in a courteous and timely manner.

Banking Services Officers must be able to multitask and possess excellent communication, organizational, and interpersonal skills. They must also have a thorough knowledge of financial systems and products and be able to explain them in a clear and concise manner. A bachelor’s degree in finance or a related field is often required for this position.

It is important for Banking Services Officers to stay current on new developments in the banking industry and be able to proactively address customer needs. They must also have strong problem-solving skills and be able to take initiative when needed. A Banking Services Officer should also have a professional and friendly demeanor when dealing with customers and be able to work independently and as part of a team.

What Is A Good Objective For A Banking Services Officer Resume?

When writing a resume for a banking services officer position, it is important to have a clear and concise objective statement. This statement should be tailored to the specific position you are applying for and should provide the hiring manager with an understanding of your qualifications and goals. An effective banking services officer resume objective statement should focus on the essential skills and qualifications that you possess and that make you a good fit for the role.

When crafting an objective statement for your banking services officer resume, it is important to include the company name and the position you are applying for. This will allow the hiring manager to see that you have taken the time to customize your resume for the job. Additionally, you should highlight any relevant qualifications or certifications you possess that are related to the job or that make you a strong candidate for the position.

It is also important to include any past experience you have in the banking services industry that is related to the job you are applying for. This will demonstrate to the hiring manager that you have the necessary knowledge and expertise to fulfill the duties of the role. Finally, you should include a short sentence that conveys your enthusiasm for the job and your motivation to succeed in the role.

By including a clear and concise objective statement in your banking services officer resume, you can demonstrate to the hiring manager that you are the ideal candidate for the job. Keep in mind that you should customize your objective statement for each specific position you are applying for and that you should include your key qualifications and past experience that are relevant to the role. Doing so will ensure that your resume stands out and that you have the best chance of getting the job.

What Are The Career Prospects In The Banking Services Officer?

A Banking Services Officer is responsible for providing customer service to clients at a financial institution. This can include answering questions, providing information about account activity, and helping clients open and manage accounts. Banking Services Officers also handle transactions, such as deposits and withdrawals. This job is ideal for those who enjoy interacting with clients and providing a high level of customer service.The career prospects for a Banking Services Officer are excellent.

This career is expected to experience a steady growth in the next few years. With the introduction of new technology and customer service initiatives, the demand for Banking Services Officers is only expected to increase. With experience, you may even be able to move up the ranks to a managerial or executive position.

The salary of a Banking Services Officer may vary depending on the institution they work for and their experience level. It is common for a Banking Services Officer to earn a competitive wage and benefits package, including medical and dental coverage. Additionally, many employers offer tuition reimbursement, paid vacation, and other educational and career-oriented opportunities.

If you have an interest in finance and customer service, becoming a Banking Services Officer may be a great career path for you. In this role, you will be able to help customers with their financial needs and make sure their accounts are secure and managed properly. With experience and dedication, you can take advantage of the career prospects in this field and enjoy a lucrative salary and benefits package.

Key Takeaways for an Banking Services Officer resume

Writing a resume for an Banking Services Officer role is a complicated task, but with the right guidance, it can be easier. When creating or updating a resume for this role, there are a few key takeaways to keep in mind.

- First, emphasize any experience you have working in a banking or financial services environment. It’s essential that a Banking Services Officer have a thorough understanding of the banking and financial services industry, so be sure to highlight any past positions that demonstrate your familiarity with this sector. Additionally, include any certifications or qualifications that you have obtained in the banking or financial services field.

- Secondly, demonstrate your customer service skills and your ability to work with customers. Banking services officers are responsible for providing customer service and helping customers with their banking needs. Be sure to emphasize your ability to interact with customers, respond to inquiries, and provide solutions to problems.

- Thirdly, highlight your knowledge of banking products and services. As a banking services officer, you will be responsible for assisting customers in making the best decisions about their banking options. You should be able to explain the benefits and drawbacks of different banking products and services, such as savings accounts, checking accounts, mortgages, and credit cards.

- Fourthly, discuss your experience with financial regulations and procedures. Banking services officers must be familiar with the regulations and procedures that guide their work. This can include anything from the Federal Reserve System to the Uniform Commercial Code. Show that you have the knowledge and skills to ensure compliance with banking regulations.

- Finally, show off your problem-solving and analytical skills. As a Banking Services Officer, it’s important to be able to analyze data, identify trends, and make decisions based on the information you have. Make sure to showcase any past positions that required you to use these skills and any technical skills you have.

By following these key takeaways, you will be able to create a successful resume for the Banking Services Officer role. By emphasizing your experience in the banking and financial services industry, demonstrating your customer service and problem-solving skills, and showing off your technical skills, you will be able to create a resume that will help you stand out from other applicants.