Exploring the Role of a Certified Financial Planner

As the financial landscape continues to evolve, the role of a Certified Financial Planner (CFP) has become increasingly crucial in helping individuals navigate the complexities of personal finance. A harmonious blend of financial expertise and interpersonal skills, a CFP plays a pivotal role in guiding clients towards financial success. Let’s delve deeper into the multifaceted responsibilities and qualifications that define the role of a Certified Financial Planner.

Job Requirements for a Certified Financial Planner

Becoming a Certified Financial Planner is a journey that demands a strong educational foundation, technical proficiency, and a commitment to ethical financial practices. Let’s explore the key requirements that one must fulfill to embrace the role of a CFP:

- A Bachelor’s or Master’s degree in Finance, Accounting, Economics, or a related field, showcasing a strong foundation in financial principles.

- Attainment of the Certified Financial Planner (CFP) designation through completion of the required education, examination, and work experience.

- Proven experience in financial planning, demonstrating the ability to analyze clients’ financial situations and develop comprehensive plans tailored to their goals.

- Excellent communication and interpersonal skills to understand clients’ needs, explain complex financial concepts, and build long-term relationships.

- Adherence to ethical standards and a commitment to maintaining client confidentiality and trust.

- Proficiency in financial planning software and tools, staying updated with industry trends and regulations.

- Ability to stay organized and work with attention to detail in managing clients’ financial portfolios.

Continued professional development and obtaining additional certifications in specialized areas of financial planning can further enhance a CFP’s profile in the competitive financial industry.

Responsibilities of a Certified Financial Planner

The role of a Certified Financial Planner is a dynamic blend of financial acumen, client relationship management, and regulatory compliance. Let’s uncover the core responsibilities that define this role:

- Conducting comprehensive financial assessments for clients, considering their goals, risk tolerance, and financial situation.

- Developing and presenting personalized financial plans, encompassing budgeting, investments, retirement, and estate planning.

- Guiding clients through complex financial decisions, providing education and insights to empower them in making informed choices.

- Monitoring and adjusting clients’ financial plans in response to life changes, market conditions, and regulatory updates.

- Staying abreast of tax laws, investment strategies, and economic trends to provide timely and accurate advice to clients.

- Building and maintaining strong client relationships through effective communication and trust-building efforts.

- Ensuring compliance with industry regulations and ethical standards in all financial planning activities.

Each responsibility comes with its own set of challenges and learning, shaping a CFP into a trusted advisor for their clients.

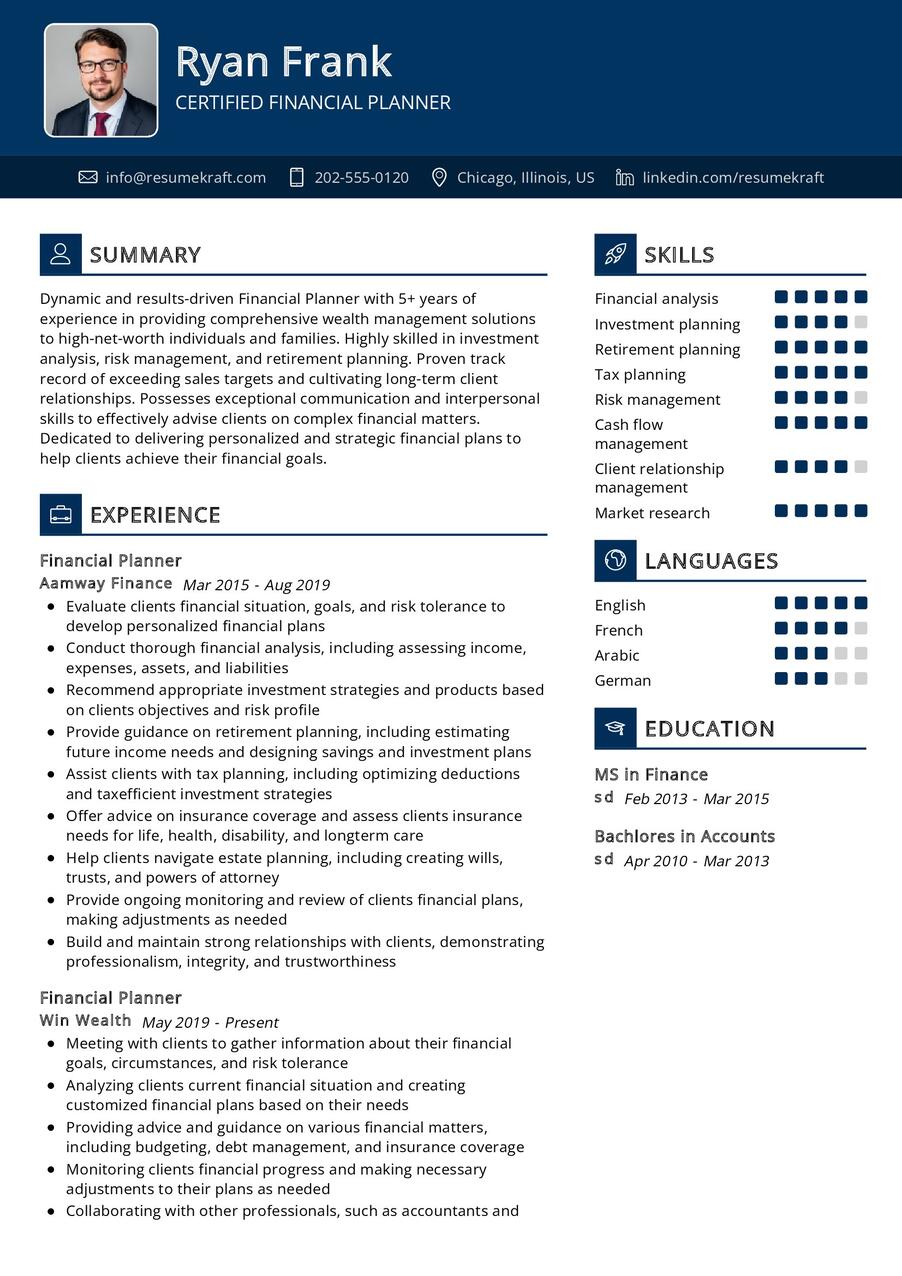

Certified Financial Planner Resume Writing Tips

Crafting a resume as a Certified Financial Planner is an opportunity to showcase your unique blend of financial expertise and interpersonal skills. Here are some tips to help you create a compelling resume:

- Highlight your CFP designation prominently, emphasizing your commitment to professional excellence.

- Showcase specific examples of successful financial plans you have developed for clients, quantifying the impact of your advice where possible.

- Detail your communication skills, emphasizing your ability to explain complex financial concepts in a clear and understandable manner.

- Include any additional certifications or specialized training that enhances your skills in areas such as tax planning, estate planning, or investment management.

- Personalize your resume for each application, aligning your skills and experiences with the specific requirements of the job.

Your resume is a reflection of your expertise and commitment to helping clients achieve their financial goals.

Certified Financial Planner Resume Summary Examples

Your resume summary is the gateway to presenting your unique value as a Certified Financial Planner. Craft a powerful summary that encapsulates your experience and strengths:

- “Certified Financial Planner with a passion for empowering clients through comprehensive financial planning. Over a decade of experience in creating tailored strategies that drive financial success.”

- “Dedicated CFP with a track record of guiding clients through diverse financial landscapes. Proven ability to navigate complexities and deliver results-driven financial plans.”

- “Experienced Certified Financial Planner committed to excellence in financial advisory. Adept at building trust and fostering long-term client relationships.”

Your summary should serve as a compelling introduction, enticing potential employers to explore your detailed experiences further.

Create a Strong Experience Section for Your Certified Financial Planner Resume

Your experience section is the heart of your resume, providing a detailed narrative of your journey as a Certified Financial Planner. Here are some examples to guide you:

- “Led financial planning initiatives for a diverse client base, resulting in a 15% average increase in clients’ investment portfolios.”

- “Developed and implemented personalized retirement plans, contributing to a 20% improvement in clients’ overall financial well-being.”

- “Navigated clients through market volatility, showcasing a proactive approach that preserved and enhanced their wealth during economic downturns.”

Each experience should highlight your impact, showcasing your ability to provide valuable financial guidance in various scenarios.

Education Section for Your Certified Financial Planner Resume

Your educational background is a testament to your commitment to excellence in the field of finance. List your educational milestones in a clear and organized manner:

- Master of Business Administration in Finance, XYZ University, a comprehensive program enhancing financial analysis and strategic planning skills, 2015.

- Bachelor of Science in Accounting, ABC University, the foundation of your financial expertise, 2012.

- Certified Financial Planner (CFP), a prestigious designation symbolizing your commitment to ethical and professional financial planning, 2017.

Each educational qualification is a stepping stone, reinforcing your knowledge and expertise as a Certified Financial Planner.

Key Skills for a Certified Financial Planner Resume

Your skill set as a Certified Financial Planner is a diverse toolkit that includes both technical and interpersonal abilities. Let’s list down the essential skills for a CFP:

Soft Skills:

- Communication and interpersonal skills, fostering strong client relationships.

- Problem-solving abilities, guiding clients through financial challenges.

- Attention to detail, ensuring accuracy in financial analyses and plans.

- Adaptability and resilience, navigating uncertainties in the financial landscape.

- Client-focused approach, understanding and addressing clients’ unique financial goals.

Hard Skills:

- Financial planning and analysis, creating comprehensive plans tailored to clients’ needs.

- Investment management, optimizing clients’ portfolios for growth and risk management.

- Tax planning, ensuring clients benefit from tax-efficient strategies.

- Estate planning, guiding clients in preserving and transferring wealth.

- Regulatory compliance, adhering to industry standards and ethical practices.

Each skill is a tool, contributing to your effectiveness as a Certified Financial Planner.

Common Mistakes to Avoid When Writing a Certified Financial Planner Resume

Avoiding common pitfalls in your resume is crucial for presenting yourself as a competent Certified Financial Planner. Let’s explore mistakes to steer clear of:

- Using generic language, failing to showcase your unique strengths and experiences.

- Focusing solely on technical skills, neglecting the importance of effective communication and relationship-building.

- Omitting quantifiable achievements, missing an opportunity to demonstrate the tangible impact of your financial guidance.

- Overlooking the importance of industry-specific certifications, such as the CFP designation.

- Ignoring the cover letter, a valuable tool for expressing your passion for financial planning and your alignment with the company’s values.

Avoiding these mistakes will help you craft a resume that stands out and effectively communicates your value as a Certified Financial Planner.

Key Takeaways for Your Certified Financial Planner Resume

As we conclude this in-depth guide, let’s recap the key points to keep in mind while crafting your Certified Financial Planner resume:

- Emphasize your commitment to professional development, showcasing your CFP designation prominently.

- Showcase your ability to create personalized financial plans, detailing specific examples of successful client outcomes.

- Highlight your communication skills, as effective client interaction is integral to success as a Certified Financial Planner.

- Include relevant certifications and training, demonstrating your commitment to staying updated with industry standards.

Armed with these insights and tips, you are now ready to craft a resume that effectively communicates your expertise and positions you as a valuable Certified Financial Planner in the competitive financial industry. Best of luck!

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Certified Financial Planner job interview questions.