Exploring the Role of a Credit Risk Analyst

As the financial landscape continues to evolve, the role of a Credit Risk Analyst has become increasingly vital in the world of banking and finance. This position is not just about crunching numbers; it’s about safeguarding the financial health of organizations and ensuring they make informed lending decisions. In this comprehensive guide, we’ll delve deep into the multifaceted role of a Credit Risk Analyst, a profession that demands a keen eye for detail, strong analytical skills, and a deep understanding of financial markets.

Credit Risk Analyst Job Requirements

Stepping into the role of a Credit Risk Analyst requires meeting a series of stringent requirements. It’s a journey that demands a blend of education, skills, and experience. Let’s explore the prerequisites that one needs to fulfill to excel as a Credit Risk Analyst:

- A Bachelor’s degree in Finance, Economics, or a related field, showcasing a strong foundation in financial principles.

- An understanding of financial markets and instruments, including loans, bonds, and derivatives.

- Proficiency in statistical analysis and risk modeling, skills vital in assessing creditworthiness.

- Strong communication skills to convey complex financial insights to both technical and non-technical stakeholders.

- Attention to detail, a trait that ensures accuracy in assessing and mitigating credit risk.

- Experience in financial analysis, preferably in roles related to credit assessment or risk management.

- Knowledge of regulatory requirements and compliance in the financial industry.

- Adaptability and the ability to work in a fast-paced environment where financial markets are dynamic.

Securing additional certifications such as Chartered Financial Analyst (CFA) or Certified Credit Risk Analyst (CCRA) can enhance your profile in the competitive job market.

Responsibilities of a Credit Risk Analyst

The role of a Credit Risk Analyst is multifaceted, involving a combination of financial analysis, risk assessment, and strategic decision-making. Let’s unravel the core responsibilities that define this role, each contributing to the overall financial stability of an organization:

- Evaluating Credit Applications: Credit Risk Analysts assess credit applications from individuals, businesses, or other financial institutions. They analyze financial statements, credit scores, and other relevant data to determine creditworthiness.

- Risk Assessment: They identify potential risks associated with lending decisions, including credit risk, market risk, and operational risk. This involves conducting thorough risk analysis and stress testing.

- Portfolio Management: Credit Risk Analysts monitor and manage the organization’s loan portfolio. They track the performance of loans, identify early warning signs of potential defaults, and recommend risk mitigation strategies.

- Regulatory Compliance: Ensuring compliance with financial regulations is a crucial aspect of the role. Credit Risk Analysts stay updated on regulatory changes and ensure that lending practices adhere to legal requirements.

- Communication and Reporting: They communicate their findings and recommendations to senior management and stakeholders. This includes preparing detailed credit risk reports and presentations.

- Continuous Monitoring: Credit Risk Analysts continuously monitor the financial health of borrowers and the overall economic environment to make informed decisions and adjustments to lending strategies.

- Risk Mitigation: They develop and implement risk mitigation strategies, which may include setting credit limits, collateral requirements, and loan pricing.

Each responsibility comes with its own set of challenges and opportunities for making a significant impact on the financial well-being of an organization.

Credit Risk Analyst Resume Writing Tips

Your resume is your ticket to landing a rewarding job as a Credit Risk Analyst. To create a standout resume that highlights your qualifications and skills effectively, consider the following tips:

- Quantify Achievements: Use specific numbers and metrics to quantify your accomplishments. For example, mention how you reduced credit losses by a certain percentage or how you improved the accuracy of risk assessments.

- Highlight Industry Knowledge: Emphasize your understanding of the financial industry, including any specific sectors or markets you are knowledgeable about.

- Showcase Software Skills: If you have expertise in using financial analysis software or risk modeling tools, make sure to mention them in your resume.

- Detail Regulatory Knowledge: Mention your familiarity with financial regulations and your ability to ensure compliance in your previous roles.

- Tailor Your Resume: Customize your resume for each job application. Highlight relevant skills and experiences that align with the specific requirements of the position.

Your resume should not only be a reflection of your qualifications but also a compelling narrative of your ability to excel in the role of a Credit Risk Analyst.

Credit Risk Analyst Resume Summary Examples

Your resume summary is your opportunity to make a strong first impression. Craft a summary that encapsulates your skills, experience, and value as a Credit Risk Analyst:

- “Experienced Credit Risk Analyst with a proven track record in assessing credit applications and developing risk mitigation strategies. Adept at using data-driven insights to make informed lending decisions.”

- “Detail-oriented Credit Risk Analyst with expertise in financial analysis and risk modeling. Strong communicator skilled at presenting complex financial information to diverse audiences.”

- “Results-driven Credit Risk Analyst with a deep understanding of regulatory compliance and a commitment to maintaining the financial stability of organizations. Experienced in portfolio management and risk assessment.”

Your resume summary should make recruiters eager to learn more about your qualifications.

Create a Strong Experience Section for Your Credit Risk Analyst Resume

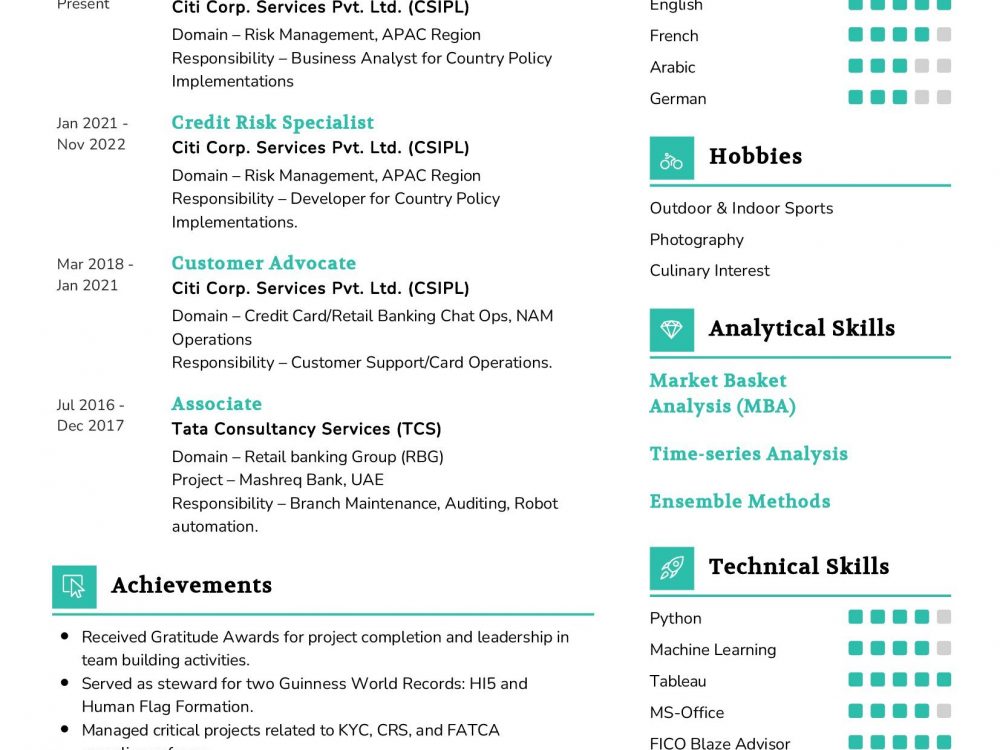

Your experience section is the heart of your resume, where you narrate your career journey and highlight your achievements. Here are some examples to guide you in creating a compelling experience section:

- “Led a team of analysts in conducting in-depth credit risk assessments, resulting in a 15% reduction in non-performing loans for the organization.”

- “Developed and implemented a credit scoring model that improved the accuracy of credit decisions, reducing default rates by 10%.”

- “Collaborated with regulatory compliance teams to ensure adherence to financial regulations and conducted internal audits to identify and rectify compliance issues.”

Your experience section should tell the story of your career, highlighting your key contributions and successes.

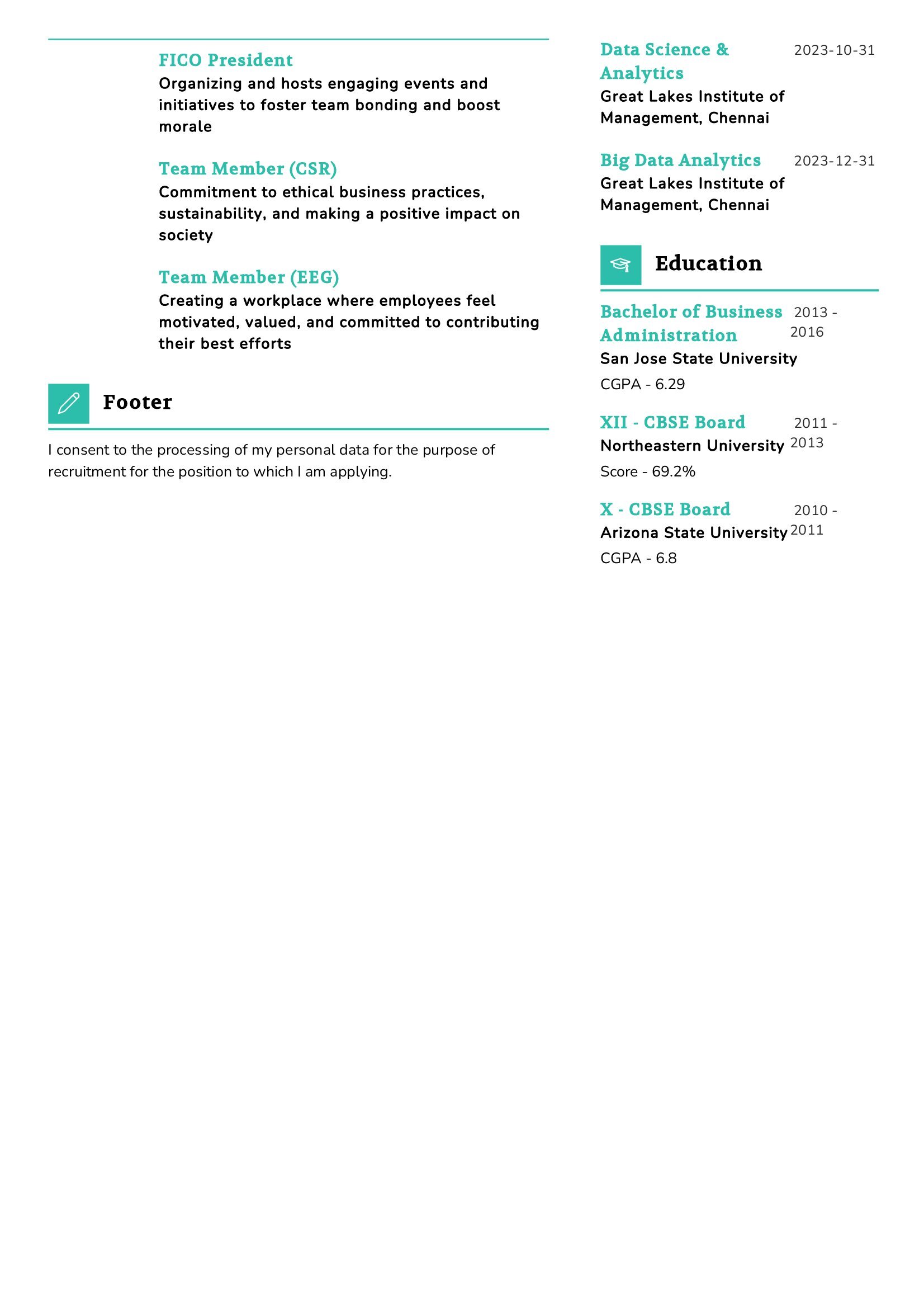

Education Section for Your Credit Risk Analyst Resume

Your educational background is a vital component of your resume, showcasing your foundation of knowledge in finance and related fields. Here’s how you can present your educational milestones:

- Bachelor of Science in Finance, XYZ University, a comprehensive education in financial principles and analysis, 2016.

- Master of Business Administration (MBA) with a specialization in Risk Management, ABC Business School, a program tailored to develop expertise in risk assessment and management, 2018.

- Chartered Financial Analyst (CFA) certification, a recognition of advanced knowledge in finance and investment management, 2020.

Your education section serves as evidence of your commitment to developing the skills necessary for success as a Credit Risk Analyst.

Credit Risk Analyst Skills for Your Resume

Your skill set as a Credit Risk Analyst is your toolkit for making informed lending decisions and managing risk effectively. Here are the essential skills that a Credit Risk Analyst should possess:

Soft Skills:

- Analytical Thinking: The ability to analyze complex financial data and draw meaningful insights.

- Attention to Detail: The skill of thoroughly reviewing financial documents and identifying potential risks.

- Communication: Effective communication, both written and verbal, to convey financial insights to stakeholders.

- Problem-Solving: The capacity to identify and solve financial challenges and mitigate risks.

- Adaptability: The ability to adapt to changing market conditions and regulations.

Hard Skills:

- Financial Analysis: Proficiency in financial statement analysis, credit scoring, and risk modeling.

- Regulatory Knowledge: Understanding of financial regulations and compliance requirements in the industry.

- Data Analysis: Competence in using data analysis tools and software for risk assessment.

- Portfolio Management: Skills in managing a portfolio of loans and assessing portfolio performance.

- Statistical Modeling: The ability to develop and use statistical models to predict credit risk.

Each skill in your arsenal equips you to excel in the role of a Credit Risk Analyst, making sound lending decisions and safeguarding the financial health of organizations.

Common Mistakes to Avoid When Writing a Credit Risk Analyst Resume

Creating a compelling resume is essential to stand out in the competitive job market. Avoid these common mistakes that can hinder your chances of landing your dream job as a Credit Risk Analyst:

- Generic Resumes: Using a one-size-fits-all approach and not tailoring your resume to the specific job requirements.

- Lack of Metrics: Failing to quantify your achievements and relying solely on job descriptions without showcasing your impact.

- Neglecting Cover Letter: Ignoring the opportunity to include a well-crafted cover letter that highlights your motivation and suitability for the role.

- Overloading with Jargon: Using excessive technical jargon that may alienate non-technical recruiters or HR professionals.

- Failure to Proofread: Submitting a resume with grammatical or spelling errors that can diminish your professional image.

Avoiding these mistakes ensures that your resume effectively communicates your qualifications and skills as a Credit Risk Analyst.

Key Takeaways for Your Credit Risk Analyst Resume

As we conclude this comprehensive guide to crafting a standout Credit Risk Analyst resume, here are key takeaways to keep in mind:

- Quantify Achievements: Use numbers and metrics to showcase your impact and achievements in previous roles.

- Customize Your Resume: Tailor your resume for each job application, emphasizing relevant skills and experiences.

- Show Regulatory Knowledge: Highlight your understanding of financial regulations and your ability to ensure compliance.

- Use Clear Communication: Write a clear and concise resume that effectively conveys your qualifications to both technical and non-technical readers.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Credit Risk Analyst job interview.