What Should Be Included In A Insurance Underwriter Resume?

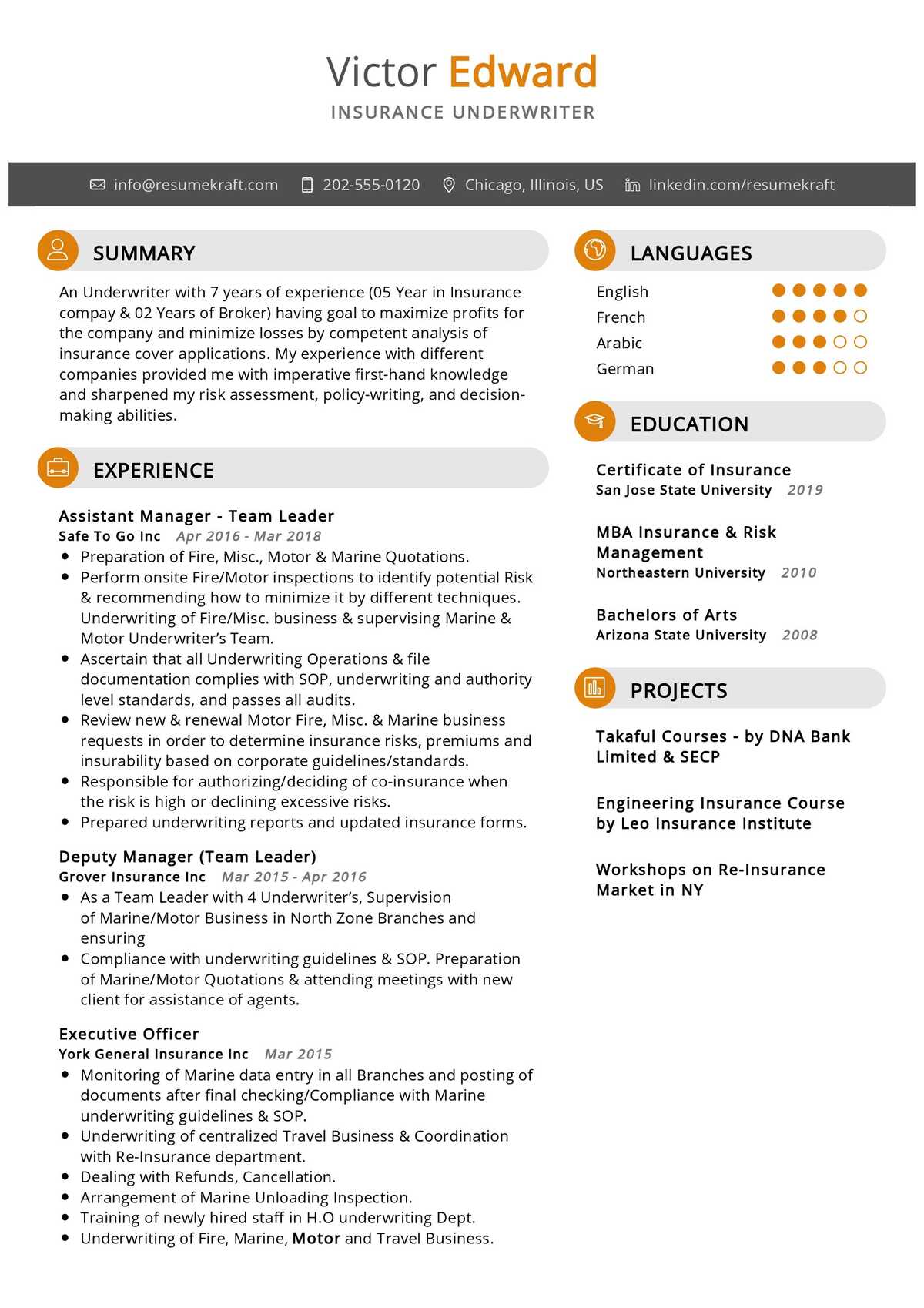

As an Insurance Underwriter, your resume should provide a detailed outline of your experience, skills, and qualifications. It should demonstrate the knowledge and expertise you have in the insurance industry. Your resume should also reflect your ability to assess risk and make sound decisions, as well as your ability to communicate effectively with clients and colleagues.

When crafting your Insurance Underwriter resume, you should start by emphasizing your educational background and career experience. Make sure to highlight any internships or professional certifications you may have, such as a Series 6 or Series 63 Insurance Underwriter license. This will demonstrate that you have the necessary qualifications to work in the insurance industry.

You should also include a list of your core competencies, such as risk assessment, policy writing, and sales. Include details about any specialized software or systems you are knowledgeable in, as well as any experience you have in customer service.

Your resume should also showcase your communication skills, as Insurance Underwriters must be able to effectively communicate with clients, agents, and colleagues. Include any successful plans you have created for assessing risk, as well as any successful cases you have handled.

When writing your resume, be sure to use clear, concise language and utilize active verbs. Use bullet points to break up large blocks of text and make sure to keep your resume to one page. Most importantly, it should be tailored to the specific job you are applying to. By following these tips, you can ensure your Insurance Underwriter resume is effective and successful.

What Skills Should I Put On My Resume For Insurance Underwriter?

A successful insurance underwriter resume should emphasize key skills and qualifications that employers are looking for in this profession. When crafting your resume, focus on the qualities that make you an excellent insurance underwriter.

When putting together your resume as an insurance underwriter, you’ll want to showcase your expertise in risk assessment, which includes analyzing and making decisions based on data. You should also highlight your knowledge of the insurance industry and its regulations. Excellent communication and customer service skills are also essential for this role, as is the ability to work independently. Your resume should highlight your strong organizational and time-management skills, as well as your problem-solving abilities.

You will also want to emphasize your IT skills. Insurance underwriters often use software to analyze and process data, and employers will be looking for individuals with a good understanding of these systems. It’s also important to demonstrate your ability to work in teams and collaborate with other departments or stakeholders.

Finally, make sure to include any relevant certifications or qualifications that demonstrate your expertise in the field. This could include professional certifications in insurance and risk management or specialized courses related to the job. When crafting your resume, make sure to highlight any skills and qualifications that make you a strong candidate for the insurance underwriter role.

What Is The Job Description Of The Insurance Underwriter?

An insurance underwriter is a professional who assesses the financial risk of offering insurance to individuals and businesses. They review applications and other documentation to determine the amount of coverage each applicant should receive and the terms of the coverage. Insurance underwriters also work with actuaries and other professionals in the insurance industry to develop the rates for different policies.

Underwriters must be knowledgeable about the insurance industry and the products offered by their companies. They must be able to analyze data and interpret financial statements. They must also be able to make sound decisions on the risk associated with each applicant and the terms of the coverage offered.

Underwriters must be detail oriented and have excellent communication and customer service skills. They must be able to explain the risks associated with different policies and answer any questions that customers may have. They must also be familiar with the laws and regulations that govern the insurance industry.

Underwriters must be organized and able to manage their time efficiently. They must be able to work independently and have the ability to make quick and accurate decisions. A successful underwriter will also have strong negotiation and problem solving skills.

The job of an insurance underwriter is important because they are responsible for ensuring that the insurance policies offered to customers are fair, accurate, and in compliance with the law. They are also responsible for making sure that the policies are cost-effective for both the customer and the company.

What Is A Good Objective For A Insurance Underwriter Resume?

When looking for a job as an insurance underwriter, it’s important to have an eye-catching resume. This can be done by writing a strong objective statement. Your objective should demonstrate your qualifications and skills, as well as your commitment to the position.

An effective objective statement for an insurance underwriter should emphasize your knowledge of risk evaluation, as well as your ability to analyze and review customer applications accurately. Make sure to include that you have experience with claims management, customer service, and financial analysis. Additionally, you can mention any certifications you have, such as a CPCU or CLU designation.

It’s also important to mention your commitment to the job and your ability to work independently. Your objective should express your desire to work in a fast-paced environment and your dedication to providing quality customer service. Additionally, you can mention any other relevant skills, such as problem solving or excellent written and verbal communication.

When writing an effective objective statement for an insurance underwriter, it’s important to keep it clear and concise. Make sure to include keywords from the job description as well. Your objective should be tailored to the job you’re applying for and should demonstrate your experience and qualifications.

What Are The Career Prospects In The Insurance Underwriter?

A career in insurance underwriting can be highly rewarding and bring a great deal of personal satisfaction to individuals. Insurance underwriting involves assessing the risks of potential policyholders and determining the rates they must pay for coverage. Insurance underwriters also make decisions regarding whether to issue a policy or not. Those who are successful in this field are highly analytical and possess excellent problem-solving skills.

The career prospects for an insurance underwriter are excellent. Insurance underwriters can find positions with insurance companies, banks, and financial services firms. They can also work for government agencies and private corporations. In addition, insurance underwriters can become independent contractors.

The salary for an insurance underwriter varies depending on the employer and the individual’s level of experience. Experienced insurance underwriters can earn in excess of $100,000 a year. An insurance underwriter’s job requires strong analytical and problem-solving skills. A successful insurance underwriter also needs to be well-versed in the field of insurance, as well as the legal and financial implications that come along with it.

In order to become an insurance underwriter, individuals must obtain the proper certification. It is important to note that certification requirements vary from state to state. Insurance underwriters must also keep up to date with changes in the industry and maintain a valid license.

In addition to the requirements mentioned above, insurance underwriters must also be able to communicate effectively with clients, understand their needs, and provide them with the best coverage available. An insurance underwriter must be able to work independently and handle conflicting situations. They must be patient and have the ability to make difficult decisions.

Overall, a career in insurance underwriting is a great opportunity for individuals who are looking for a challenging and rewarding profession.

Key Takeaways for an Insurance Underwriter resume

As an Insurance Underwriter, it is important to have an effective resume that showcases your relevant experience, qualifications, and skills. A well-crafted resume will be an important tool for landing a job in this field. Here are some key takeaways for developing an effective resume for an Insurance Underwriter position:

- Highlight Your Qualifications: Your resume should demonstrate that you have the necessary qualifications and skills to be successful in this role. Include information such as your degree, certifications, and any relevant courses that you have taken.

- Focus on Relevant Experience: Insurance Underwriting is a highly specialized field, so you should focus on highlighting experience that is directly related to the position. Include internships, apprenticeships, and other relevant experience.

- Demonstrate Your Skills: Insurance Underwriting requires an understanding of risk assessment and the ability to analyze data. Highlight any relevant skills such as those related to coding, data analysis, and financial analysis.

- Accomplishments: Include any relevant accomplishments on your resume. Showcase any awards or recognition that you have earned, such as success in sales or customer service.

- Professional Development: Show that you are committed to continuing your professional development by including any courses or seminars that you have taken to stay up to date on industry trends and changes.

By following these key takeaways, you can create an effective resume for an Insurance Underwriter position. A well-crafted resume will be an important tool for landing a job in this field.