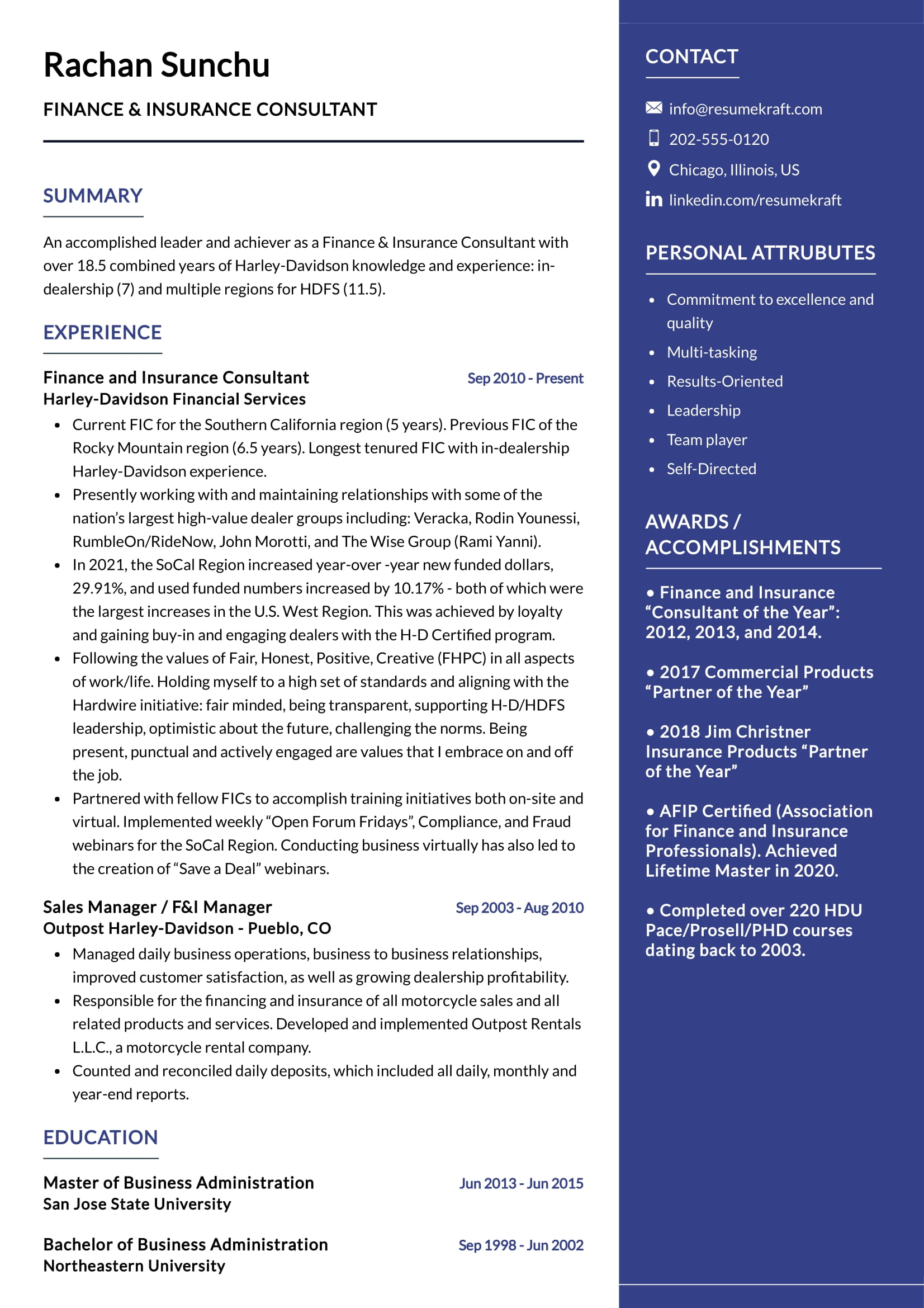

What Should Be Included In A Finance & Insurance Consultant Resume?

When writing a resume as a finance and insurance consultant, it’s important to include all the necessary information that a potential employer needs to know. This includes educational background, relevant work experience and certifications, as well as any specialized training or qualifications you may have.

Start your resume by including the most relevant information, such as your education and most recent work experience. Be sure to list any certifications or licenses that you have earned that are relevant to the position. If you have completed any specialized training or qualifications, include them here as well.

Next, provide a brief summary of your skills and experience in the field of finance and insurance consulting. This should highlight your experience in the field and any special skills you possess, such as familiarity with financial software or ability to decipher complex data.

Then list any relevant awards or honors that you have received for your work in finance and insurance. Include any professional associations or organizations that you are a member of, and mention any volunteer work you’ve done in the field, as this may be useful to potential employers.

Finally, provide references. Include the names, contact information, and relationship to you of at least three references who can speak to your abilities as a finance and insurance consultant

What Skills Should I Put On My Resume For Finance & Insurance Consultant?

.When writing a resume for a finance and insurance consultant, it is important to highlight your skills and experiences that make you a qualified candidate. Here are some of the skills that should be included on your resume:

- Financial Analysis and Reporting: Demonstrate your ability to conduct comprehensive financial analysis and create detailed financial reports.

- Risk Management: Showcase your experience with identifying, assessing, and mitigating risks associated with insurance policies.

- Insurance Coverage: Describe your understanding of different types of insurance coverage, including liability, property, and life insurance.

- Compliance Regulations: Highlight your knowledge of insurance laws and regulations, as well as your ability to ensure compliance with relevant codes and standards.

- Program Management: Showcase your ability to develop, manage, and implement insurance programs and solutions.

- Client Relations: Demonstrate your ability to build strong relationships with clients and ensure their satisfaction.

- Business Development: Describe your experience in working with clients to create new business opportunities and increase revenue.

By including these skills on your resume, you can effectively demonstrate your qualifications as a finance and insurance consultant and make a great impression on potential employers.

What Is The Job Description Of The Finance & Insurance Consultant?

A Finance & Insurance Consultant provides professional advice to companies or individuals about their financial, insurance and risk management needs. They are responsible for analyzing and evaluating the best options based on their clients’ current financial standing and long-term goals.

A Finance & Insurance Consultant typically works with a team of professionals including accountants, underwriters, and financial advisors. They analyze the client’s financial information, investigate different types of insurance options, and recommend a plan tailored to their client’s needs. They can also provide advice on topics such as retirement planning, investments, and debt management.

Finance & Insurance Consultants understand the complex nature of the financial industry and are able to provide clear and concise advice that takes into consideration their clients’ overall financial picture. They must be able to quickly assess a situation and explain the benefits of different choices in a way that is easy for their client to understand.

Finance & Insurance Consultants must stay up-to-date on the latest industry developments and regulations. They also must be able to build strong relationships and trust with their clients, as this is essential for any successful consulting venture.

What Is A Good Objective For A Finance & Insurance Consultant Resume?

A powerful objective statement is essential in a finance and insurance consultant resume. It is the first thing that employers look at and it should clearly explain what makes you a great asset. A good objective should emphasize your qualifications, skills, and experience in the field of finance and insurance.

For example, you may want to mention that you have a degree in finance and insurance, as well as several years of experience in the field. You can also describe any successful projects or initiatives that you have successfully completed in your previous roles. If you have strong technical skills, such as knowledge of different software applications, you should include this in your objective statement as well.

In addition, you should make sure that your objective statement clearly outlines the goals and objectives you have for the position. You should also express your desire to work with the company and describe why you are a strong candidate for the role. By crafting a strong, concise objective statement, you will be able to set yourself apart from other applicants and make a lasting impression on potential employers.

What Are The Career Prospects In The Finance & Insurance Consultant?

Finance and insurance consultants help businesses and individuals make sound financial decisions and manage their investments. This can include providing advice on insurance, investments, taxes, and more. With the ever-changing landscape of the financial world, having a consultant to guide you can be invaluable.

For those looking to pursue a career in finance and insurance consulting, the future is bright. The profession is expected to grow 11 percent by 2029, faster than the national average. This growth will bring more job opportunities for those with the right qualifications.

Finance and insurance consultants need to have a deep understanding of the financial markets, tax regulations, and the insurance industry. A bachelor’s degree in finance, economics, accounting, or a related field is generally required. It’s also important to have excellent communication skills, as consultants will regularly interact with clients.

Those who are able to demonstrate their expertise in the field can expect to be in high demand. In addition to working with individuals and businesses, many consultants also work with governments, helping them make smart financial decisions. With the right qualifications and experience, finance and insurance consultants can expect to see a bright future ahead.

Key Takeaways for an Finance & Insurance Consultant resume

Writing an effective finance and insurance consultant resume requires careful thought, planning and attention to detail. Here are some key takeaways to consider when crafting your resume:

- Highlight Your Expertise: Your resume should focus on illustrating your knowledge and experience in the finance and insurance sector. Demonstrate your proficiency in topics such as insurance policies and regulations, financial analysis, risk management, and more.

- Tailor Your Resume: Make sure to customize your resume for each and every job application. Showcase the skills and experiences that best fit the particular job you’re applying to.

- Make It Clear and Concise: Streamline your resume to ensure that it is easy to read and quickly conveys the relevant information to employers. Try to keep each section concise and focus on specific accomplishments.

- Choose a Professional Format: Select a resume format that is modern, clean and organized. Consider a professional layout and design, as this will make your resume look more professional.

- Include Keywords: Scan the job description for keywords and incorporate them into your resume. This will help show employers that you have the necessary skills and qualifications for the job