Understanding the Role of an Investment Banker

As financial landscapes continually evolve, the role of an Investment Banker remains integral to shaping the economic trajectory of businesses and individuals alike. This position requires a unique blend of financial acumen, strategic thinking, and the ability to navigate complex markets. In this article, we’ll delve into the multifaceted role of an Investment Banker, exploring the responsibilities, job requirements, and essential skills that define success in this dynamic field.

Key Responsibilities of an Investment Banker

An Investment Banker plays a pivotal role in financial transactions, providing valuable insights, strategic advice, and facilitating deals. Here are some of the key responsibilities associated with this role:

- Structuring and executing financial transactions, such as mergers and acquisitions, capital raising, and initial public offerings (IPOs).

- Conducting in-depth financial analysis and due diligence to assess the feasibility and risks of investment opportunities.

- Building and maintaining relationships with clients, understanding their financial goals, and providing tailored financial solutions.

- Staying abreast of market trends, economic indicators, and regulatory changes to provide informed advice to clients.

- Negotiating terms and conditions of deals, working closely with legal and regulatory teams to ensure compliance.

- Creating detailed financial models to evaluate the potential outcomes of various financial strategies.

- Advising clients on risk management strategies and financial planning to optimize their investment portfolios.

The dynamic nature of these responsibilities requires an Investment Banker to possess a strong foundation in finance, excellent analytical skills, and the ability to thrive in high-pressure environments.

Job Requirements for Aspiring Investment Bankers

Becoming a successful Investment Banker involves meeting certain educational and professional requirements. Here’s a comprehensive list of qualifications and skills typically sought in candidates for this role:

- A Bachelor’s or Master’s degree in Finance, Business Administration, or a related field, demonstrating a solid understanding of financial principles.

- Extensive knowledge of financial markets, investment strategies, and a keen awareness of global economic trends.

- Experience in financial analysis and modeling, showcasing the ability to interpret complex financial data.

- Strong communication and interpersonal skills, essential for building and maintaining client relationships.

- Negotiation skills and the ability to work collaboratively with diverse teams and stakeholders.

- Analytical mindset and attention to detail, crucial for conducting thorough financial assessments and due diligence.

- Adaptability and resilience, as the financial landscape is subject to rapid changes and uncertainties.

Obtaining relevant certifications, such as Chartered Financial Analyst (CFA) or Certified Investment Banking Professional (CIBP), can further enhance a candidate’s profile in the competitive job market.

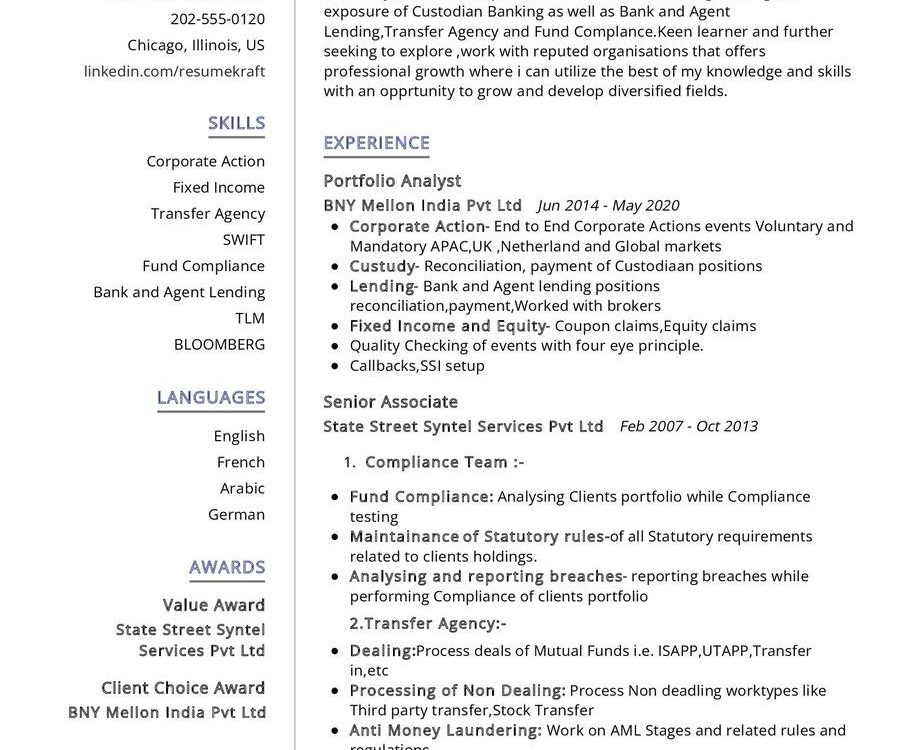

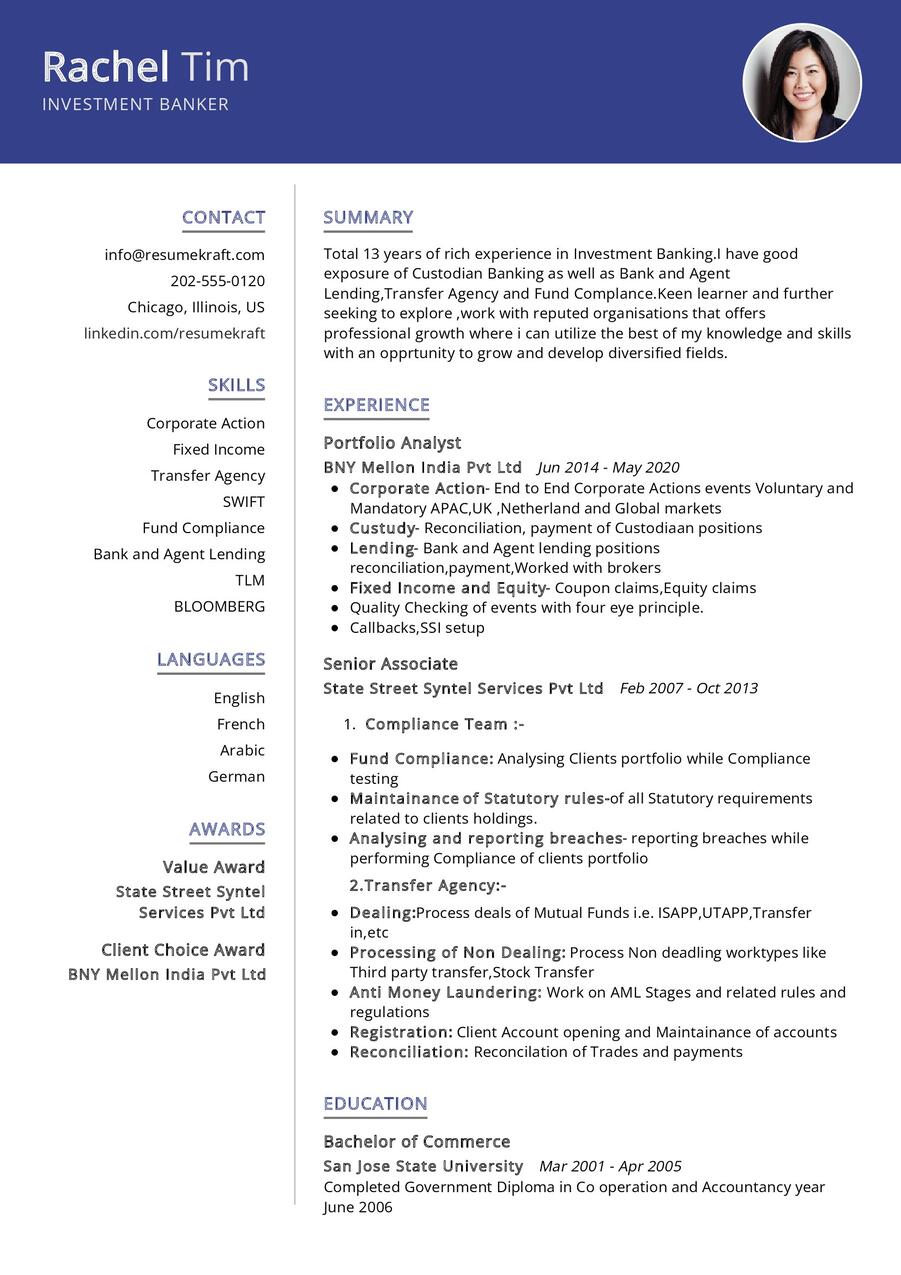

Crafting a Strong Investment Banker CV

Your CV is the gateway to showcasing your qualifications and experiences as an Investment Banker. Here are some tips to create a compelling resume that stands out:

- Highlight your educational background and relevant degrees, emphasizing any specialized coursework or projects.

- Showcase your experience in financial analysis and modeling, detailing specific projects and their impact.

- Quantify your achievements using metrics, demonstrating the tangible results of your financial strategies.

- Include any relevant certifications or professional development courses you’ve completed to showcase continuous learning.

- Tailor your CV for the specific job, aligning your skills and experiences with the requirements outlined in the job description.

Each section of your CV should tell a story of your journey, skills, and achievements as an Investment Banker.

Investment Banker CV Summary Examples

Your CV summary serves as the opening statement of your professional story. Here are some examples to inspire your summary:

- “Results-oriented Investment Banker with a proven track record in executing successful mergers and acquisitions, bringing a strategic and analytical approach to financial transactions.”

- “Dedicated Investment Banker with expertise in capital raising and financial modeling, recognized for optimizing client portfolios and delivering exceptional financial solutions.”

- “Experienced Investment Banker with a comprehensive understanding of global financial markets, adept at navigating complexities to drive successful deals.”

Your CV summary should provide a snapshot of your achievements, skills, and the unique value you bring as an Investment Banker.

Building the Experience Section of Your Investment Banker CV

The experience section of your CV is the core narrative of your professional journey. Here are examples to guide you in detailing your experiences:

- “Led high-profile merger negotiations, resulting in a 30% increase in market share for the client company.”

- “Executed successful capital raising initiatives, securing $50 million in funding for a client’s expansion project.”

- “Provided strategic financial advice to clients, resulting in a 15% improvement in their overall investment portfolio performance.”

Each experience should highlight your contributions, showcasing your ability to drive successful financial outcomes.

Education Section for Your Investment Banker CV

Your educational background is a crucial element of your CV. Here’s how you can present your academic achievements:

- Master of Business Administration (MBA) in Finance, XYZ University, 2019.

- Bachelor of Science in Business Administration, Major in Finance, ABC University, 2016.

- Chartered Financial Analyst (CFA) Certification, 2020.

Your education section should highlight your academic qualifications and any relevant certifications that contribute to your expertise as an Investment Banker.

Key Skills for Your Investment Banker CV

Your skill set is a crucial aspect of your CV, showcasing the tools you bring to the table. Here are essential soft and hard skills for an Investment Banker:

Soft Skills:

- Financial analysis and modeling, demonstrating proficiency in interpreting complex financial data.

- Effective communication, vital for building and maintaining client relationships.

- Negotiation skills, crucial for securing favorable terms in financial transactions.

- Adaptability and resilience, essential for navigating the dynamic financial landscape.

Hard Skills:

- Knowledge of financial markets, investment strategies, and global economic trends.

- Experience in financial analysis and modeling, with a focus on quantitative and qualitative assessments.

- Proficiency in relevant financial software and tools, such as Bloomberg or financial modeling software.

- Strategic thinking, necessary for providing valuable insights and advice to clients.

Each skill listed should reflect your ability to excel in the role of an Investment Banker.

Common Mistakes to Avoid When Writing Your Investment Banker CV

Avoiding common pitfalls is crucial in crafting a CV that captures attention. Here are some mistakes to steer clear of:

- Avoid a one-size-fits-all approach; tailor your CV to match the specific requirements of the job you’re applying for.

- Highlight achievements, not just responsibilities, to provide depth to your professional narrative.

- Include a well-crafted cover letter to complement your CV, seizing the opportunity to connect with potential employers.

- Communicate complex financial concepts in a clear and concise manner, avoiding unnecessary jargon.

- Thoroughly proofread your CV to maintain a professional image and eliminate any errors.

Avoiding these mistakes ensures your CV is authentic, compelling, and tailored to the expectations of potential employers.

Key Takeaways for Your Investment Banker CV

As you conclude crafting your Investment Banker CV, keep these key points in mind:

- Emphasize your financial achievements and the tangible impact of your strategies on clients and organizations.

- Highlight your expertise in financial analysis, modeling, and market trends to demonstrate your value as an Investment Banker.

- Detail any strategic initiatives you’ve led, showcasing your ability to navigate complexities and drive successful outcomes.

- Include a section on continuous learning, highlighting any certifications or professional development courses you’ve undertaken.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Investment Banker job interview.