What is the Role of an Operational Risk Supervisor?

In the intricate world of finance and business operations, the role of an Operational Risk Supervisor stands out as a beacon of vigilance and foresight. These professionals are the sentinels, ensuring that organizations navigate the treacherous waters of operational risks with agility and precision. Let’s dive deeper into understanding the pivotal role of an Operational Risk Supervisor in today’s dynamic business landscape.

An Operational Risk Supervisor is tasked with identifying, assessing, and mitigating risks that arise from internal processes, systems, and external events. Their primary objective is to ensure that the organization’s operations are in line with risk appetite and regulatory requirements. They work closely with various departments, fostering a culture of risk awareness and ensuring that risk management strategies are effectively implemented.

What are the Operational Risk Supervisor Job Requirements?

Being an Operational Risk Supervisor is no small feat. It requires a blend of technical expertise, analytical prowess, and leadership skills. Here’s a closer look at the essential requirements for this role:

- A Bachelor’s or Master’s degree in Finance, Business Administration, or a related field, laying the foundation for a career in risk management.

- Deep understanding of operational risk concepts, tools, and methodologies.

- Experience in risk assessment, mitigation strategies, and regulatory compliance.

- Strong analytical and problem-solving skills, crucial for identifying and addressing potential risks.

- Excellent communication skills, vital for liaising with different departments and presenting risk reports.

- Leadership qualities, essential for guiding teams and fostering a risk-aware culture.

Additional certifications, such as the Certified in Risk Management Assurance (CRMA) or the Financial Risk Manager (FRM), can further bolster one’s credentials in the field.

What are the Responsibilities of an Operational Risk Supervisor?

The responsibilities of an Operational Risk Supervisor are as diverse as they are crucial. They play a pivotal role in safeguarding the organization’s assets, reputation, and sustainability. Here’s a snapshot of their key responsibilities:

- Developing and implementing the operational risk management framework and strategy.

- Conducting risk assessments to identify vulnerabilities and potential threats.

- Collaborating with various departments to ensure risk mitigation measures are in place.

- Monitoring and reporting on risk exposures, ensuring they are within the organization’s risk appetite.

- Staying updated with regulatory changes and ensuring compliance.

- Leading and mentoring the operational risk team, fostering a culture of continuous learning and improvement.

Each responsibility underscores the importance of the Operational Risk Supervisor in ensuring the organization’s resilience and long-term success.

Operational Risk Supervisor Resume Writing Tips

Creating a compelling resume is akin to crafting a narrative – a story of your professional journey, achievements, and aspirations. Here are some tailored tips to help you create a standout Operational Risk Supervisor resume:

- Highlight your experience in operational risk management, emphasizing projects where you made a tangible difference.

- Detail your expertise in risk assessment tools and methodologies.

- Include any risk management certifications or courses you’ve undertaken.

- Showcase your leadership experiences, especially instances where you’ve led teams or initiatives.

- Personalize your resume for the specific role, ensuring it aligns with the job description.

Operational Risk Supervisor Resume Summary Examples

Your resume summary is the gateway to your professional story. It should encapsulate your expertise, achievements, and value proposition. Here are some examples to inspire you:

- “Operational Risk Supervisor with over 8 years of experience in risk assessment and mitigation. Proven track record in developing robust risk management frameworks and leading cross-functional teams.”

- “Dedicated Operational Risk Supervisor with a keen eye for detail. Expert in regulatory compliance and risk reporting. Adept at fostering a risk-aware culture across departments.”

- “Experienced Operational Risk Supervisor with a passion for safeguarding organizational assets and reputation. Skilled in risk analytics and strategy implementation.”

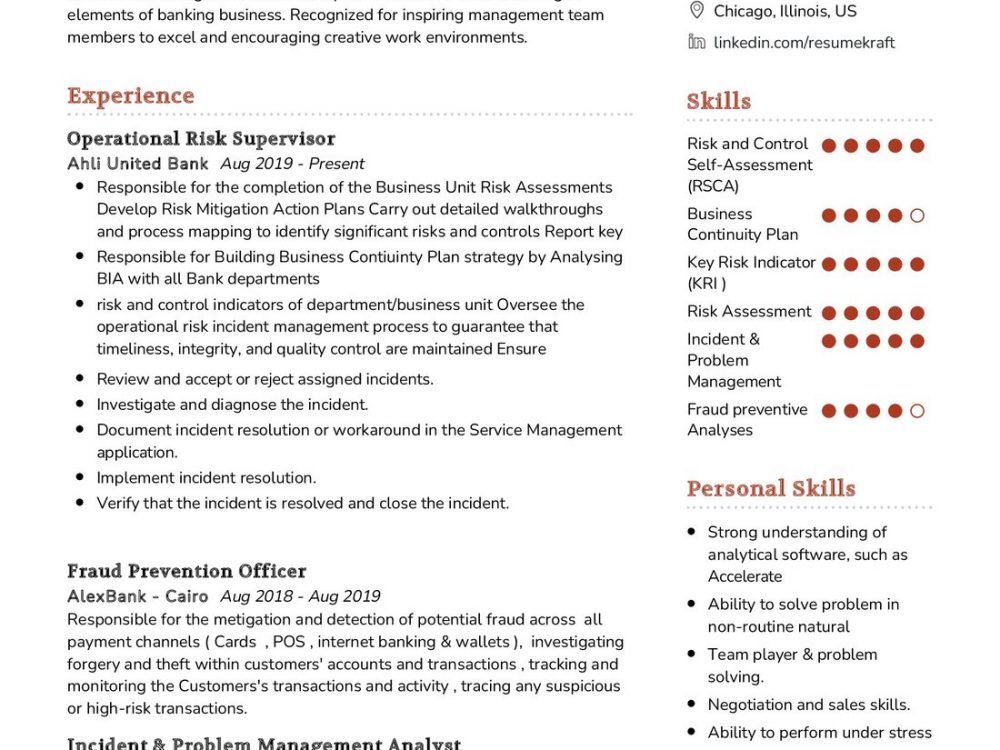

Create a Strong Experience Section for Your Operational Risk Supervisor Resume

The experience section is the heart of your resume, showcasing your journey and the milestones achieved. Here are some examples to guide you:

- “Led the development of a comprehensive operational risk framework, resulting in a 25% reduction in risk incidents over two years.”

- “Collaborated with the IT department to implement risk mitigation technologies, enhancing system security and data integrity.”

- “Conducted quarterly risk training sessions, elevating the organization’s risk awareness and response capabilities.”

Operational Risk Supervisor Skills for Your Resume

Skills are the tools that you bring to the table. For an Operational Risk Supervisor, these skills are a blend of technical expertise and soft skills. Here’s a breakdown:

Soft Skills:

- Leadership and team management

- Communication and interpersonal abilities

- Problem-solving and analytical thinking

- Attention to detail and precision

- Adaptability and resilience

Hard Skills:

- Risk assessment and mitigation

- Regulatory compliance

- Risk reporting and analytics

- Operational risk frameworks and tools

- Stakeholder management

Most Common Mistakes to Avoid When Writing an Operational Risk Supervisor Resume

While crafting your resume, it’s essential to be aware of common pitfalls. Here are some mistakes to steer clear of:

- Using a generic template that doesn’t highlight your unique value proposition.

- Overloading your resume with jargon, making it less accessible to non-technical recruiters.

- Not aligning your resume with the specific job description, missing out on showcasing your fit for the role.

- Ignoring the importance of proofreading, which can lead to avoidable errors.

Key Takeaways for Your Operational Risk Supervisor Resume

As we wrap up, let’s summarize the essentials for crafting a compelling Operational Risk Supervisor resume:

- Emphasize your expertise in operational risk management, showcasing your achievements and impact.

- Highlight your leadership experiences, underscoring your ability to lead teams and initiatives.

- Personalize your resume for the specific role, ensuring alignment with the job description.

- Include any certifications or courses that bolster your credentials in the field.

Finally, remember to utilize the plethora of resources available at AI Resume Builder, Resume Design, and other sections on Resumekraft.com to enhance your application and prepare for the Operational Risk Supervisor job interview.

With these insights, you’re well-equipped to craft a resume that resonates with your professional journey and aspirations. Best wishes on your job search!