What is the Role of a Remisier?

Embarking on a career as a Remisier, also known as a stockbroker or commission broker, entails stepping into a dynamic and fast-paced world where one is constantly at the nexus of finance and client relations. A Remisier is essentially a self-employed agent affiliated with a brokerage firm, facilitating transactions in securities, such as shares and bonds, on behalf of clients while earning a commission on trades executed.

Being a Remisier is not just about understanding the stock market; it is about being a reliable guide to clients, helping them navigate the complex landscape of investments. It involves a deep understanding of market trends, financial instruments, and regulatory frameworks. Moreover, a Remisier needs to be adept at building and maintaining client relationships, offering personalized service, and providing insightful advice based on meticulous research and analysis.

What are the Remisier Job Requirements?

Aspiring to become a Remisier involves meeting a set of stringent requirements that ensure one is well-equipped to handle the responsibilities that come with the role. Let’s delve into the essential prerequisites for a career as a Remisier:

- A bachelor’s degree in finance, economics, or a related field, laying a solid foundation of knowledge in financial markets.

- Acquiring relevant licenses and certifications, such as the Securities Industry Essentials (SIE) exam in the USA, to operate legally in the securities industry.

- Proven experience in the financial sector, showcasing a deep understanding of market dynamics and financial instruments.

- Strong analytical skills, enabling the analysis of market trends and financial reports to provide informed advice to clients.

- Excellent communication and interpersonal skills, fostering strong relationships with clients based on trust and reliability.

- Self-motivation and a proactive approach, essential traits for a self-employed agent working on commission.

Additional qualifications, such as a master’s degree in finance or professional certifications, can further bolster one’s credentials and pave the way for a successful career as a Remisier.

What are the Responsibilities of a Remisier?

The role of a Remisier is multifaceted, encompassing a wide array of responsibilities that demand both financial acumen and a client-centric approach. Let’s explore the core responsibilities that define this role:

- Conducting market research and analysis to stay abreast of the latest trends and developments in the financial markets.

- Developing and managing a portfolio of clients, offering them personalized service and investment advice.

- Executing trades on behalf of clients, ensuring accuracy and adherence to regulatory guidelines.

- Providing clients with regular updates on the performance of their investments, fostering transparency and trust.

- Collaborating with other financial professionals, such as analysts and fund managers, to leverage expertise and offer clients the best possible advice.

- Engaging in continuous learning to enhance one’s knowledge and stay updated on the evolving financial landscape.

Each responsibility is a testament to the Remisier’s commitment to offering clients a service that is both professional and personalized, grounded in expertise and ethical conduct.

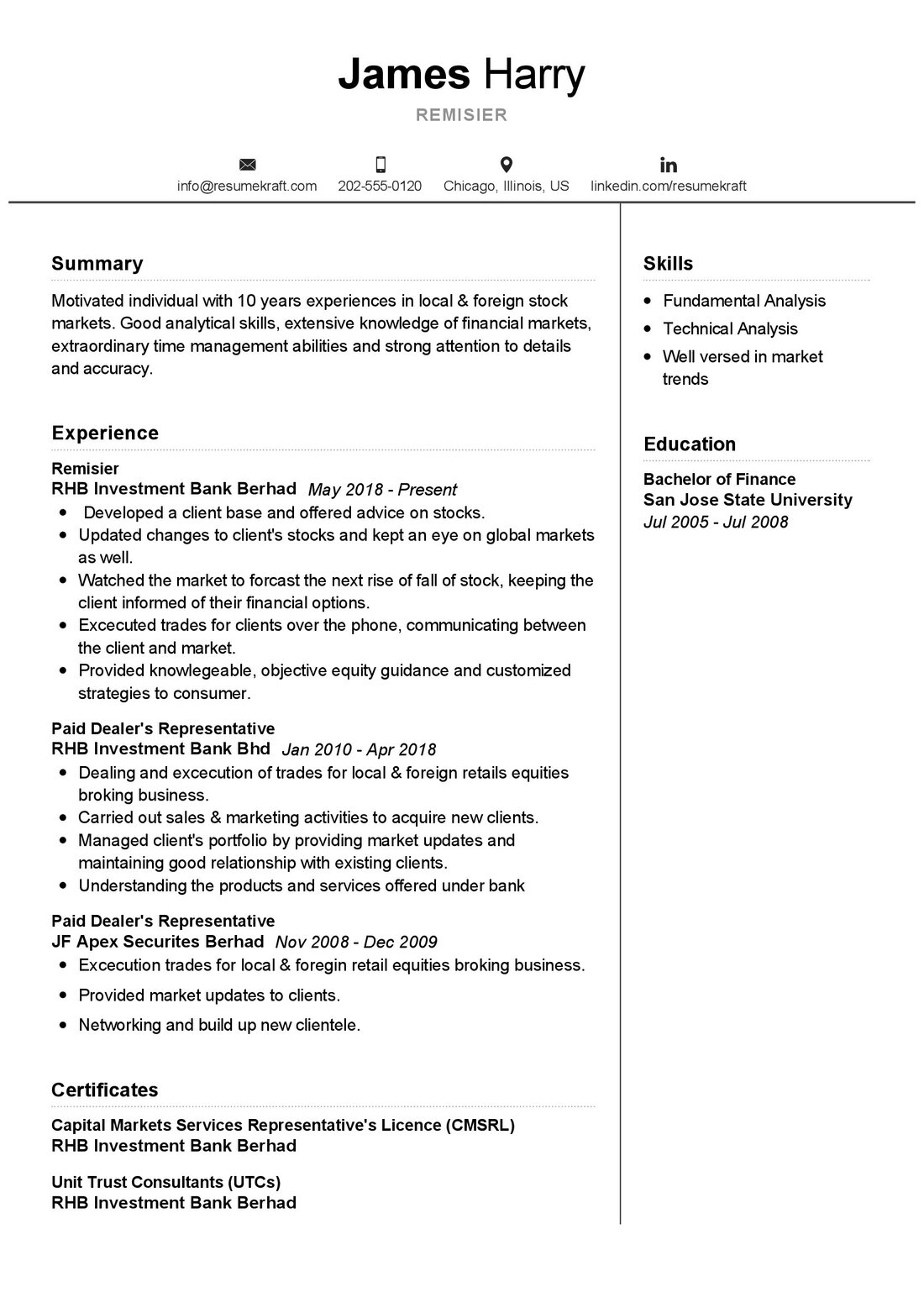

Remisier Resume Writing Tips

Creating a resume that effectively showcases your skills and experiences as a Remisier can be your ticket to landing your dream job. Here are some tips to craft a resume that stands out:

- Highlight your educational background in finance or related fields, showcasing a strong foundation in financial markets.

- Detail your experience in the financial sector, emphasizing roles where you demonstrated analytical skills and market understanding.

- List the licenses and certifications you hold, showcasing your legal eligibility to operate in the securities industry.

- Include examples of successful client relationships you have built, highlighting your client-centric approach.

- Provide evidence of your self-motivation and proactive approach, essential traits for a Remisier.

Remember to tailor your resume to the specific role you are applying for, emphasizing the skills and experiences most relevant to the job description.

Remisier Resume Summary Examples

Your resume summary is a concise introduction to your professional journey, offering potential employers a snapshot of your expertise and achievements. Here are some examples to inspire you:

- “Experienced Remisier with a strong background in financial market analysis and a proven track record of building successful client relationships.”

- “Detail-oriented Remisier with extensive knowledge of financial instruments and a commitment to providing clients with informed investment advice.”

- “Proactive Remisier with a knack for identifying investment opportunities and a history of achieving excellent returns for clients.”

Each summary should encapsulate your

unique strengths and experiences, offering a compelling introduction to your resume.

Create a Strong Experience Section for Your Remisier Resume

The experience section of your resume is where you delve deeper into your professional journey, offering detailed insights into your roles and achievements. Here’s how to create a strong experience section:

- Detail your roles in the financial sector, highlighting positions where you demonstrated market understanding and analytical skills.

- Provide examples of successful investment strategies you have devised, showcasing your financial acumen.

- List the client relationships you have managed, emphasizing your client-centric approach and ability to build trust.

- Include any collaborative projects with other financial professionals, showcasing your ability to work in a team and leverage expertise.

Remember to use quantifiable metrics to showcase your achievements, offering a tangible measure of your success.

Sample Education Section for Your Remisier Resume

Your educational background forms the bedrock of your career as a Remisier. In this section, detail your academic qualifications that have equipped you with the knowledge and skills necessary for this role. Here is a sample:

- Bachelor of Science in Finance, XYZ University, 2015

- Master of Business Administration (MBA), ABC Business School, 2018

- Certified Financial Analyst (CFA), 2020

Include any relevant certifications and courses that showcase your commitment to continuous learning and professional development.

Remisier Skills for Your Resume

Your skill set is a vital part of your resume, showcasing the abilities you bring to the role of a Remisier. Let’s categorize them into soft and hard skills:

Soft Skills:

- Excellent communication and interpersonal abilities

- Strong analytical and problem-solving skills

- Self-motivation and a proactive approach

- Attention to detail

- Client-centric approach

Hard Skills:

- Proficiency in financial analysis and market research

- Understanding of regulatory frameworks in the financial sector

- Experience with trading platforms and financial software

- Knowledge of financial instruments and investment strategies

- Ability to analyze financial reports and statements

Each skill you list should reflect your proficiency and readiness to excel in the role of a Remisier.

Most Common Mistakes to Avoid When Writing a Remisier Resume

As you craft your Remisier resume, avoid common mistakes that can hinder your chances of securing the job. Here are the pitfalls to steer clear of:

- Using a generic resume for all job applications, failing to tailor it to the specific role.

- Overloading your resume with industry jargon, making it inaccessible to recruiters who may not have a financial background.

- Listing job responsibilities without showcasing your achievements and the value you brought to previous roles.

- Failing to proofread your resume, resulting in typos and grammatical errors that can create a negative impression.

By avoiding these mistakes, you can create a resume that is both professional and compelling, showcasing your readiness for the role.

Key Takeaways for Your Remisier Resume

As we wrap up this guide, let’s recap the essential points to keep in mind while crafting your Remisier resume:

- Highlight your educational background, emphasizing degrees and certifications that showcase your expertise in finance.

- Detail your experience in the financial sector, providing examples of your achievements and the value you brought to previous roles.

- Include a skills section that showcases both your soft and hard skills, painting a comprehensive picture of your abilities.

- Steer clear of common resume mistakes, ensuring your resume is tailored, well-written, and free of errors.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Remisier job interview.

With this comprehensive guide, you are now equipped to craft a resume that truly reflects your journey, expertise, and readiness to step into the role of a Remisier. Remember, your resume is a canvas where you paint your professional narrative, a story of growth, learning, and dedication. Best of luck!