What is the Role of a Virtual Accountant?

In the digital age, the role of a Virtual Accountant has become increasingly significant. Virtual Accountants are financial experts who offer their accounting services remotely, helping businesses manage their finances, taxes, and more, all from the comfort of their own space. They use advanced technology and software to provide accurate and timely financial advice and support to their clients, ensuring the financial health of the businesses they serve.

Virtual Accountants play a crucial role in budgeting, financial reporting, tax preparation, and offering strategic financial advice. They help businesses make informed financial decisions, contributing to their growth and success.

What are the Virtual Accountant Job Requirements?

Becoming a Virtual Accountant requires a combination of education, skills, and experience. Here are the basic requirements for this role:

- A bachelor’s degree in accounting or a related field to build a strong foundation in financial principles.

- Proficiency in accounting software and tools, ensuring accurate and efficient work.

- Strong communication skills to effectively interact with clients and convey financial information.

- Attention to detail and analytical skills to identify discrepancies and solve complex financial issues.

- Experience in accounting, showcasing a history of managing finances and solving real-world financial problems.

Certifications such as Certified Public Accountant (CPA) can further enhance your credibility and marketability in this field.

What are the Responsibilities of a Virtual Accountant?

A Virtual Accountant wears many hats, managing various aspects of a business’s finances. Here are some of the key responsibilities:

- Preparing financial statements, reports, and records by collecting, analyzing, and summarizing account information.

- Managing payroll, ensuring that employees are paid accurately and on time.

- Assisting with budget preparation and financial planning processes.

- Performing audits, ensuring adherence to standard requirements.

- Advising clients on tax filing and tax planning, helping them optimize their tax position.

- Offering financial advice, helping clients make informed decisions to achieve their financial goals.

Each responsibility requires a deep understanding of financial principles and a commitment to accuracy and integrity.

Virtual Accountant Resume Writing Tips

Creating a standout resume is your first step towards landing a Virtual Accountant role. Here are some tips to help you shine:

- Highlight your experience in accounting, showcasing your achievements and the impact you’ve made.

- Detail your proficiency in accounting software and tools, demonstrating your technical skills.

- Include any certifications or additional training you’ve completed, showing your commitment to professional development.

- Personalize your resume for the specific role, emphasizing the skills and experiences that make you the perfect fit.

Remember, your resume is your personal marketing tool, make it reflective of your skills and experiences.

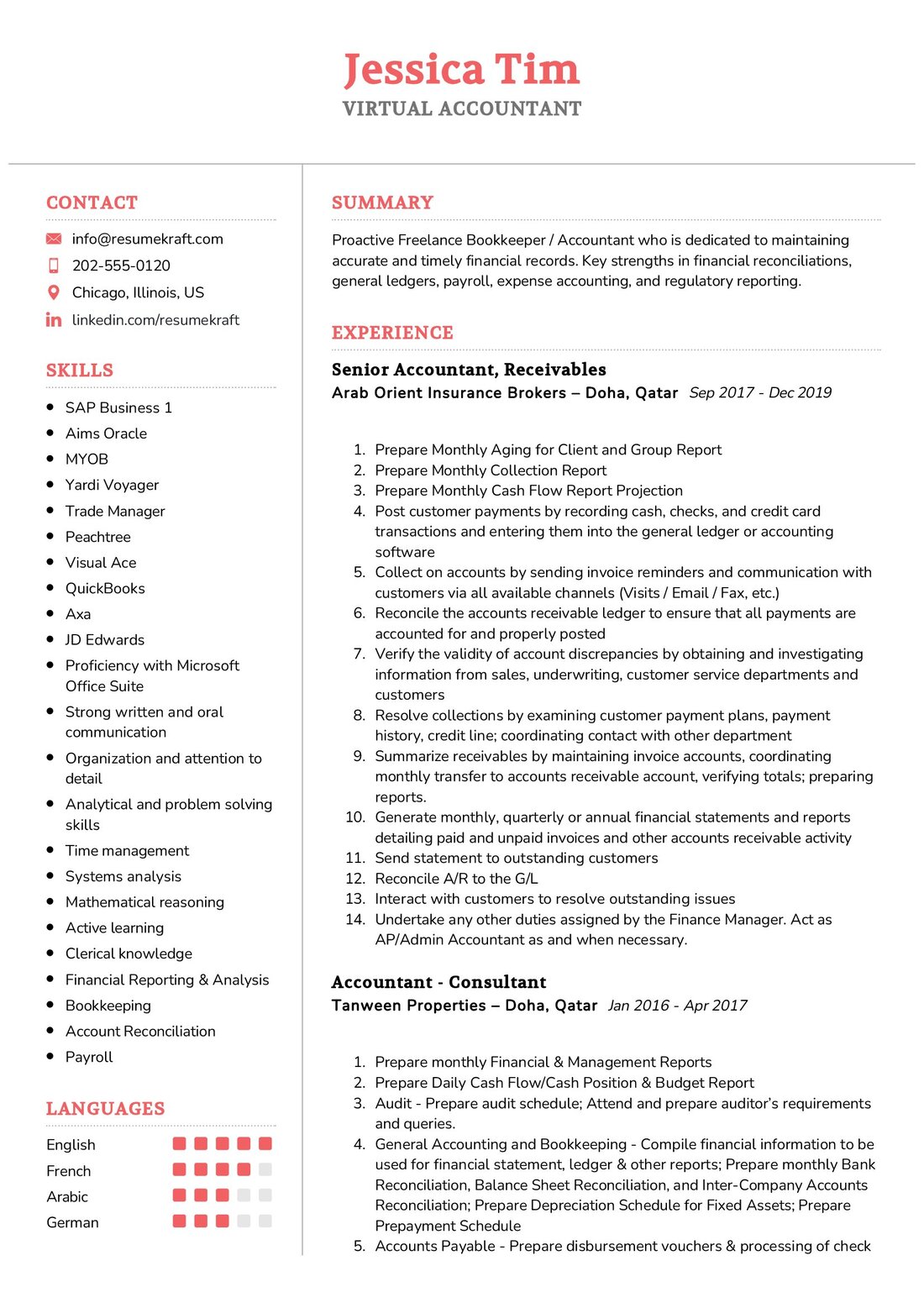

Virtual Accountant Resume Summary Examples

Your resume summary is a snapshot of your professional journey. Here are some examples to guide you:

- “Detail-oriented Virtual Accountant with 5+ years of experience in helping small businesses optimize their finances. Proficient in QuickBooks and tax planning.”

- “Certified Public Accountant with a passion for providing top-notch accounting services remotely. Expert in financial reporting, auditing, and budgeting.”

- “Proactive Virtual Accountant with a track record of improving financial processes and reducing discrepancies. Skilled in financial analysis and tax preparation.”

Each summary should be a reflection of your unique skills and experiences, tailored to the job you’re applying for.

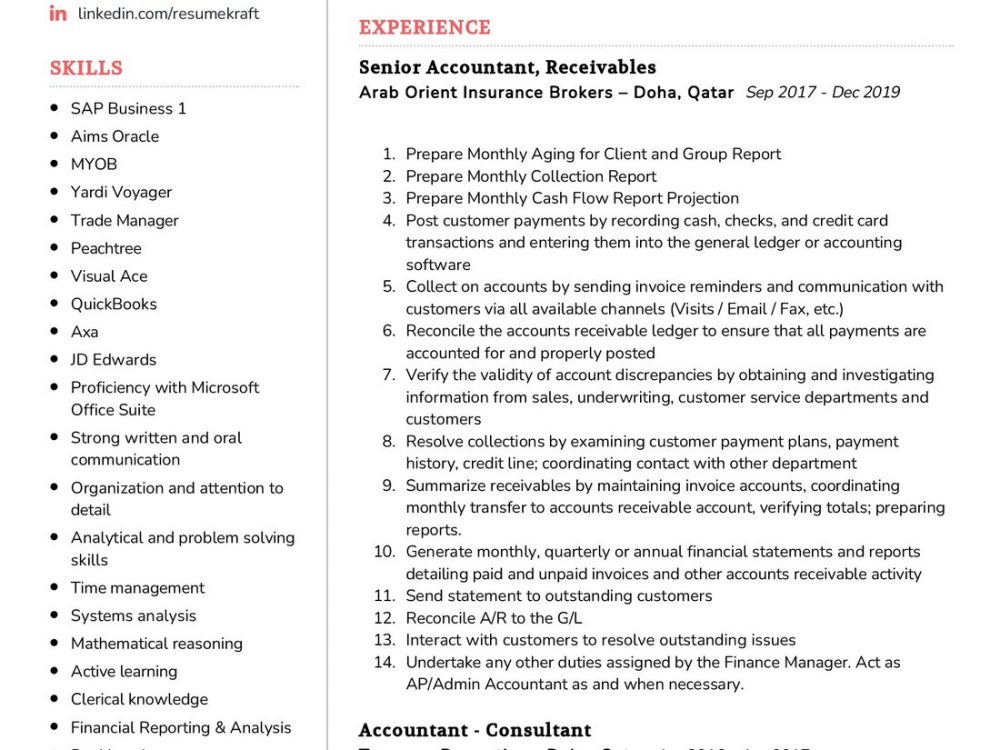

Create a Strong Experience Section for Your Virtual Accountant Resume

The experience section is the heart of your resume. Here’s how you can make it strong:

- “Managed finances for a small business, reducing discrepancies by 25% through detailed financial analysis.”

- “Assisted clients in tax planning, helping them save over $50,000 in taxes through strategic advice.”

- “Conducted audits for various clients, ensuring compliance with financial standards and regulations.”

Each experience is a testament to your skills and the value you bring to the table.

Sample Education Section for Your Virtual Accountant Resume

Your education section showcases your academic background. Here’s an example:

- Bachelor of Science in Accounting, XYZ University, 2015

- Certified Public Accountant (CPA), ABC Accounting Board, 2017

This section is a reflection of your academic achievements and any additional certifications that enhance your qualifications.

Virtual Accountant Skills for Your Resume

Listing your skills is a way to showcase your expertise. Here are some skills to include:

- Financial Reporting

- Tax Preparation

- Budgeting

- Auditing

- Financial Analysis

- Accounting Software Proficiency

- Communication

- Attention to Detail

- Problem Solving

- Time Management

Each skill is a reflection of your capabilities and your proficiency in the field of accounting.

Most Common Mistakes to Avoid When Writing a Virtual Accountant Resume

Avoiding common mistakes is crucial for creating a successful resume. Here are some pitfalls to steer clear of:

- Using a generic resume for every job application. Tailor your resume to each position to showcase your most relevant skills and experiences.

- Listing responsibilities without showcasing achievements. Use quantifiable achievements to demonstrate your impact.

- Ignoring the importance of a well-crafted cover letter. A cover letter complements your resume and provides additional information on why you’re the ideal candidate.

- Forgetting to proofread. Ensure your resume is free of typos and grammatical errors to make a professional impression.

Avoiding these mistakes will help your resume stand out and make a lasting impression.

Key Takeaways for Your Virtual Accountant Resume

As we conclude, remember these key takeaways:

- Personalize your resume for the specific Virtual Accountant role you’re applying for.

- Showcase your achievements and impact in your experience section.

- Highlight your proficiency in accounting software and tools.

- Include any certifications or additional training to enhance your qualifications.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Virtual Accountant job interview.

With these insights and resources, you are well on your way to crafting a resume that truly reflects your skills, experiences, and aspirations. Best of luck on your journey to becoming a successful Virtual Accountant!