Are you looking for a compliance officer job? Here we have the best recommended professional compliance officer resume example. You don’t have to start writing from scratch. Just click “Edit Resume” and modify it with your details. Update the template fonts and colors have the best chance of landing your dream job.

Compliance Officer Resume Sample

Jessica Stewart

COMPLIANCE OFFICER

jessica.stewart@hotmail.com

1-202-555-0114

San Diego, California

linkedin.com/in/jessica

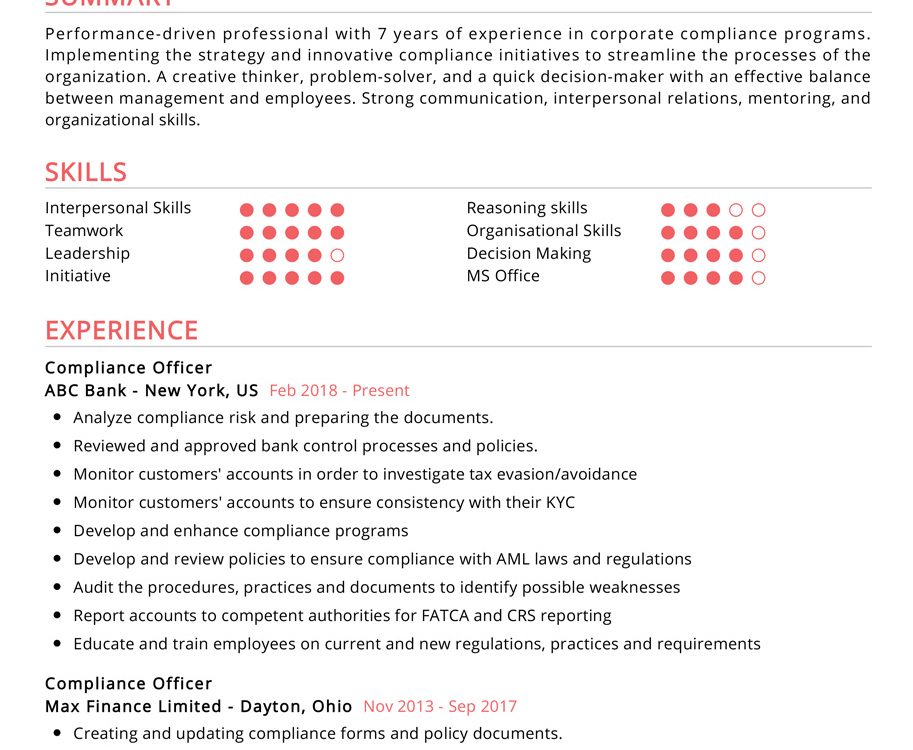

SUMMARY

Performance-driven professional with 7 years of experience in corporate compliance programs.

Implementing the strategy and innovative compliance initiatives to streamline the processes of the

organization. A creative thinker, problem-solver, and a quick decision-maker with an effective balance

between management and employees. Strong communication, interpersonal relations, mentoring, and

organizational skills.

SKILLS

- Interpersonal Skills

- Teamwork

- Leadership

- Initiative

- Reasoning skills

- Organizational Skills

- Decision Making

- MS Office

EXPERIENCE

Compliance Officer

ABC Bank – New York, US Feb 2018 – Present

- Analyze compliance risk and preparing the documents.

- Reviewed and approved bank control processes and policies.

- Monitor customers’ accounts in order to investigate tax evasion/avoidance

- Monitor customers’ accounts to ensure consistency with their KYC

- Develop and enhance compliance programs

- Develop and review policies to ensure compliance with AML laws and regulations

- Audit the procedures, practices and documents to identify possible weaknesses

- Report accounts to competent authorities for FATCA and CRS reporting

- Educate and train employees on current and new regulations, practices and requirements

Compliance Officer

Max Finance Limited – Dayton, Ohio Nov 2013 – Sep 2017

- Creating and updating compliance forms and policy documents.

- Reviewed and authorized all types of proxies issued by individuals and entities

- Generated daily screening reports on existing and new customers

- Arranging meetings to discuss and update compliance issues.

- Audited FATCA documents and KYC forms

- Monitored customers’ accounts’ activities to ensure consistency with their KYCs

- Followed-up with branches on updating customers’ KYCs based on the risk-based approach

- Trained employees on current and new regulations, practices and requirements

Assistant Marketing Manager

Broad Way – San Diego, California Jul 2009 – Aug 2010

- Monitored institution compliance

- Provided Bank Insurance products

- Got involved in client relationships

- Prepared brochures of the products

- Prepared marketing plans

- Focused on alternate distribution channels

EDUCATION

Masters of Business Administration (Finance)

MNT Business School – New York, US Oct 2019 – Present

Bachelor’s Degree in Business Studies

Michigan State University – East Lansing, US Sep 2005 – Jul 2008

CERTIFICATION

Relationship Selling Strategies For Retail Banking (Workshop)

Starmanship & Associates 2013-02-11

Two days workshop (Feb 10 & 11, 2013)

Customer Due Diligence (e-Learning)

Standard Chartered 2018-11-08

Trade-Based Money Laundering (e-Learning)

Standard Chartered 2018-11-08

LANGUAGES

- English

- French

- German

- Italian

Career Expert Tips:

- Always make sure you choose the perfect resume format to suit your professional experience.

- Ensure that you know how to write a resume in a way that highlights your competencies.

- Check the expert curated popular good CV and resume examples

Compliance Officer Resume with Writing Guide

The Senior Compliance Officer Resume is the little black dress of your career. It’s perfect for any occasion, it looks good on you, and it does all the talking for you. The resume speaks to your experience, skills, and personality — while other candidates might be wasting their time applying for jobs that aren’t a good fit for them or sending out cookie cutter resumes with minimal effort.

Compliance Officer Resume Writing Guide:

- Work experience.

Start with a few bullet points describing your main areas of expertise. In about two sentences, tell us why we need you. - Education and training.

Include bullet points describing your degree(s), certifications, and continuing education or training from the past three years. Be sure to include language from the job posting that indicates applicable knowledge, skills, and experience you may have gained through these courses. - Additional information.

Include additional information that can’t be found elsewhere in your resume, such as whether you’re bilingual and/or fluent in a foreign language, or whether you have recent military experience, or if you’re a member of any professional organizations. - Work habits and skills.

Use bullet points to describe your positive work habits, motivational skills, and professional ethics as they pertain to the job. Include specific examples of your performance on the job — like an instance when you had to handle a difficult customer, or how you had to lead a team of ten people towards a common goal. - Professional affiliations/community service/volunteer experience/other activities.

Include any relevant information that may tie you to interesting projects, groups, or other organizations. For example, if you were a member of a church youth group for six years and served six years as an intern in the local hospital, include them in the write up under “Additional information.” - Additional experience.

If you have other relevant experience (and are comfortable sharing it), be sure to mention it here. - References.

Include a list of five references (three professional and two personal). If you have connections that can help us get more details about the job, or if you know someone that we should call for an interview, make sure to include them here too. - Cover letters/resume categories and submission guidelines.

Include a link to the job posting you found to see if there is any supplementary information or instructions for how to submit your resume. If there are, follow their instructions exactly.

Compliance Officer Responsibilities:

- Experienced with federal and state laws.

- Good verbal and written communication skills.

- Demonstrated ability to organize, prioritize and multitask.

- Must have terrific analytical skills

- Strong interpersonal skills to work well with others within the organization.

- Proven experience with Microsoft Office Suite (Word, Excel).

- Excellent customer service demeanor when answering phones or running computer systems during business hours or at weekend/evening hours as needed in compliance duties for which they were hired into position.

- Knowledge of relevant regulations and compliance guidelines.

- Proficient in the use of software applications such as SAP, Peoplesoft and other ERP systems used by financial institutions.

- Ability to work independently in a fast-paced environment, and in a team oriented atmosphere with people from different backgrounds, cultures and ethnicities while maintaining adherence to the organization’s policies, procedures and values.

- Commitment to the organizations mission, vision and values.

- Physical requirements include full range of motion with the ability to sit, stand and walk for long periods of time. Ability to lift and carry up to 25 lbs when necessary, ability to multi-task, work under pressure with attention to detail and deadlines.

Top 10 Must-have Compliance Officer Skills:

- Following Directions: A compliance officer is a corporate official responsible for making sure the company’s policies and procedures are followed to the letter. As such, it is essential that the compliance officer be detail-oriented, a good listener, and able to effectively communicate with all levels of employees.

- Analytical Skills: The ability to find patterns and trends in data sets would be an extremely valuable quality for any compliance officer. Being able to present information in an organized, compelling way would be of great use.

- Effective Communication: Ability to communicate with different kinds of people at a glance, written and verbal, is a must-have skill for any compliance official. This can be done in person or over the telephone, and is something that most compliance officers are required to do on a daily basis.

- Administrative Skills: If there is one thing that most bureaucrats must possess, it is the ability to follow through on completing tasks efficiently and effectively. The ability to be organized, handle multiple projects at once, and meet deadlines are all important qualities that a compliance officer must have.

- Detail-oriented: Compliance officers work in an environment where every little thing matters. The slightest mistake could be the difference between a multimillion-dollar lawsuit for negligence or thousands of dollars in fines from the government. As such, one must be able to follow through on tasks without error and to perform his or her job with absolute precision; something that requires detailed attention to detail.

- Flexibility: Compliance officers are often required to work long hours depending on the situation. The ability to work under pressure and with deadlines is a must for any compliance official.

- Complete Commitment: It is essential that a compliance officer display commitment to whatever task they are performing, as well as the company he or she works for. The ability to work effectively without supervision, and to be able to meet deadlines are both essential qualities of any compliance officer; something that can only be achieved with complete commitment.

- Organization: A compliance officer’s whole world is filled with paperwork and reports that need to be completed on a regular basis. It is essential that this person have an incredible ability to come up with creative, efficient ways of completing tedious tasks.

- Time Management: The ability to complete tasks efficiently and effectively is extremely important for any compliance officer, especially when the deadline is approaching quickly. The ability to manage time well is a must-have skill for any compliance official.

- Integrity: A successful compliance officer can only work effectively in an environment where there is trust and integrity. A compliant official will have no problem following orders as long as they are coming from a trustworthy source, especially when the situation calls for it.

Tips to write a Compliance Officer Resume Summary:

A validated summary identifies you as an expert and highlights your accomplishments that could lead to a new job. Your summary should be a one-to-two page overview of your relevant experience, education, achievements and skills. When writing a summary, think about the type of company you are applying for. Your summary should show how your experience adds value to the position you are applying to.

Tips:

- Begin your summary with the objective of the position you are interviewing for.

- Examples of a strong summary include:

- “Demonstrated ability to communicate in a clear, yet concise manner”

- “Has extensive experience in XYZ company”

- Include a reference to your education at the bottom of your resume. You will be asked to list your degrees, certification or training, and affiliations throughout the interview process.

How to write a Compliance Officer Cover Letter:

A cover letter is an important part of the job application process because it provides you with the opportunity to address your potential employer directly and communicate any information that may strengthen your candidacy.

Tips:

- Follow the generic rules for cover letter writing.

- Use a cover letter to communicate any information that is not included elsewhere in the application package but that may be useful to the hiring manager, such as a request for a meeting with the employer or information about related job experience.

- Focus on what is relevant about you and your qualifications for the specific job opening you are applying for; avoid restating everything in your resume. This helps to demonstrate why you are qualified for the job and gives your application a personal touch.

- Proofread your cover letter very carefully. Typos and grammatical errors will be held against you and could result in your application being disregarded.

Key Takeaways:

- Describe your experience, strengths and skills in a concise way.

- Focus on your best accomplishments and most recent projects.

- Include specific job skills (e.g., specific certifications or licenses) in order to show experience and skill.

- Highlight any relevant knowledge, particularly in the financial industry.

- Tailor your resume to fit the job description and requirements for the position you are applying for.