Understanding the Role of a Credit Officer

As the financial landscape evolves, the role of a Credit Officer has become increasingly crucial in ensuring the stability and growth of financial institutions. This position requires a unique blend of financial acumen, risk assessment skills, and attention to detail. Let’s delve into the multifaceted role of a Credit Officer, exploring the key responsibilities, required qualifications, and effective ways to highlight your expertise in a Credit Officer CV.

Credit Officer CV Job Requirements

To embark on a successful career as a Credit Officer, one must meet specific qualifications and demonstrate a strong foundation in the financial domain. Crafting a compelling CV begins with understanding the key requirements for this role:

- A Bachelor’s degree in Finance, Accounting, or a related field, showcasing a solid understanding of financial principles.

- Proven experience in credit analysis, risk assessment, and financial statement evaluation.

- Knowledge of regulatory compliance and an understanding of the legal aspects of credit operations.

- Strong analytical and problem-solving skills, honed through hands-on experience in credit decision-making.

- Excellent communication skills, both written and verbal, to interact with clients and cross-functional teams.

- Familiarity with financial software and credit scoring models, demonstrating proficiency in technology-driven financial analysis.

- Attention to detail and the ability to work under pressure, essential traits in the fast-paced world of credit management.

Additionally, obtaining certifications such as Certified Credit Professional (CCP) can enhance your credibility as a Credit Officer.

Responsibilities of a Credit Officer

The role of a Credit Officer is dynamic, involving a range of responsibilities that contribute to the financial health and success of an organization. Let’s break down the core duties that define this role:

- Conducting thorough credit assessments, analyzing financial data, and evaluating the creditworthiness of individuals and businesses.

- Managing credit portfolios, monitoring client accounts, and implementing risk mitigation strategies.

- Negotiating credit terms and conditions with clients, ensuring agreements align with the organization’s risk tolerance.

- Collaborating with sales and marketing teams to assess potential clients and establish credit limits.

- Reviewing and updating credit policies to ensure compliance with industry regulations and organizational standards.

- Providing financial counseling to clients, assisting them in improving credit profiles and addressing financial challenges.

- Preparing detailed credit reports and presenting findings to senior management for decision-making.

Each responsibility presents an opportunity to showcase your skills and achievements in your Credit Officer CV.

Crafting an Effective Credit Officer CV

Your CV is a powerful tool in presenting your qualifications and experience as a Credit Officer. Here are some tips to create a standout CV that reflects your expertise:

- Start with a strong CV summary, providing a snapshot of your experience, key skills, and what you bring to the role of a Credit Officer.

- Highlight specific achievements in credit management, such as successfully reducing credit risk or implementing efficient credit evaluation processes.

- Use quantifiable metrics to showcase the impact of your contributions, such as percentage improvement in credit portfolio performance.

- Include relevant keywords related to credit analysis, risk management, and financial modeling to pass through applicant tracking systems (ATS).

- Detail your experience in credit software and financial modeling tools, demonstrating your proficiency in technology-driven credit analysis.

- Emphasize your communication skills and ability to work collaboratively with cross-functional teams, essential in a Credit Officer role.

- Showcase any additional certifications or training that enhance your qualifications as a Credit Officer.

Your CV is not just a document; it is your personal marketing tool. Make it compelling, focused, and tailored to the specific requirements of a Credit Officer position.

Credit Officer CV Summary Examples

Your CV summary is the first impression you make on potential employers. Craft a compelling summary that encapsulates your experience and value as a Credit Officer:

- “Results-oriented Credit Officer with a proven track record in reducing credit risk by 15% through effective portfolio management and risk mitigation strategies.”

- “Experienced Credit Officer specializing in commercial credit analysis, adept at negotiating favorable credit terms and improving overall portfolio performance.”

- “Detail-oriented Credit Officer with a strong analytical background, recognized for implementing credit policies that ensure compliance and minimize financial risks.”

Your CV summary sets the tone for the rest of your CV, so make it impactful and tailored to the specific requirements of the Credit Officer role.

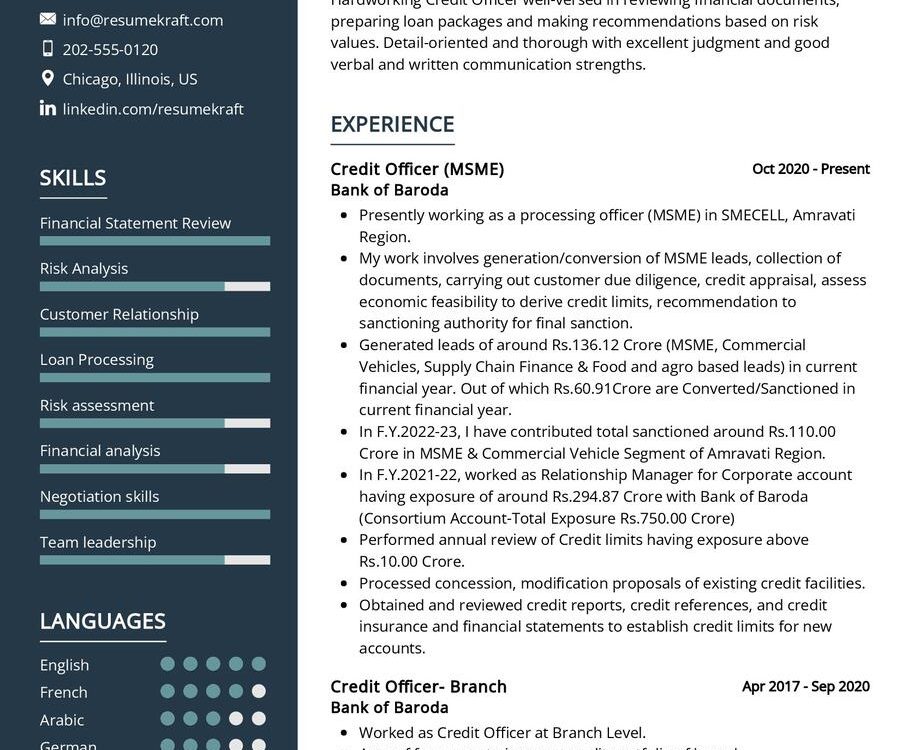

Building the Experience Section of Your Credit Officer CV

Your experience section is the heart of your CV, providing a detailed narrative of your journey as a Credit Officer. Here are some examples to guide you:

- “Managed a diverse credit portfolio, successfully implementing risk mitigation strategies that resulted in a 20% reduction in credit losses.”

- “Led cross-functional teams in the development of new credit policies, ensuring compliance with industry regulations and improving overall credit decision-making efficiency.”

- “Negotiated credit terms with key clients, resulting in a 10% increase in credit approvals and improved client satisfaction.”

Each experience listed in your CV should tell a story of challenges met, solutions found, and successes achieved as a Credit Officer.

Education Section for Your Credit Officer CV

Your educational background is a crucial aspect of your qualification as a Credit Officer. Here’s how you can present your educational milestones:

- Bachelor of Science in Finance, XYZ University, equipped with a strong foundation in financial principles and analysis, 2015.

- Master of Business Administration (MBA), specializing in Risk Management, ABC Business School, 2018.

- Certified Credit Professional (CCP), demonstrating expertise in credit management, 2019.

Your educational qualifications validate your knowledge and expertise in the financial domain, adding credibility to your role as a Credit Officer.

Credit Officer Skills for Your CV

Your skill set is a valuable asset in your role as a Credit Officer. Showcase a diverse range of skills to highlight your abilities:

Soft Skills:

- Analytical thinking and attention to detail, essential for accurate credit assessments.

- Effective communication and negotiation skills, crucial in interacting with clients and cross-functional teams.

- Problem-solving abilities, demonstrating your knack for finding solutions in complex credit scenarios.

- Time management and organizational skills, ensuring efficient handling of multiple credit evaluations simultaneously.

- Adaptability and resilience, the ability to navigate through changing financial landscapes.

Hard Skills:

- Proficiency in credit analysis software, showcasing your technical capabilities in financial modeling.

- Knowledge of regulatory compliance, ensuring adherence to legal requirements in credit operations.

- Financial statement analysis, a fundamental skill in evaluating the creditworthiness of individuals and businesses.

- Risk management expertise, demonstrating your ability to assess and mitigate credit risks effectively.

- Use of credit scoring models, showcasing your familiarity with technology-driven credit evaluation methods.

Each skill is a tool, aiding you in providing exceptional credit management and showcasing your proficiency in the role of a Credit Officer.

Common Mistakes to Avoid in Your Credit Officer CV

As you craft your CV, be mindful of common pitfalls that can hinder your chances of landing a Credit Officer position. Here are mistakes to avoid:

- Using a generic CV for multiple applications, failing to tailor it to the specific requirements of a Credit Officer role.

- Focusing solely on job duties without highlighting your achievements and impact in previous roles.

- Neglecting the importance of a well-crafted cover letter, missing an opportunity to provide additional context to your CV.

- Overloading your CV with financial jargon, potentially alienating non-financial stakeholders who may be part of the hiring process.

- Skipping the proofreading process, which can leave a negative impression on potential employers.

Avoiding these common mistakes ensures that your Credit Officer CV is authentic, compelling, and tailored to secure the attention of hiring managers.

Key Takeaways for Your Credit Officer CV

As you finalize your CV for the role of a Credit Officer, remember these key takeaways:

- Highlight your achievements in credit management, showcasing the impact of your contributions on reducing credit risk and improving portfolio performance.

- Emphasize your technical proficiency in credit analysis software and financial modeling tools.

- Showcase strategic initiatives you’ve spearheaded, such as the development of new credit policies or successful negotiation of credit terms with clients.

- Include a section on continuous learning, demonstrating your commitment to staying updated on industry trends and best practices in credit management.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the [Credit Officer] job interview.

Armed with these insights and tips, you are now ready to craft a CV that is a true reflection of your journey, your skills, and your aspirations as a Credit Officer. Best of luck!