The Role of a Financial Functional Consultant

In today’s complex financial landscape, the role of a Financial Functional Consultant is more crucial than ever. This position combines financial expertise with technical proficiency to guide organizations toward financial success. In this comprehensive guide, we’ll delve into the multifaceted role of a Financial Functional Consultant, explore the job requirements, responsibilities, and provide tips for crafting an impressive resume. Let’s embark on a journey to understand and excel in this dynamic field.

What are the Job Requirements for a Financial Functional Consultant?

Entering the world of Financial Functional Consulting requires meeting certain prerequisites and a commitment to continuous learning. Here are the key requirements to embrace this role:

- A Bachelor’s or Master’s degree in Finance, Accounting, Business Administration, or a related field, showcasing a solid foundation in financial principles.

- Proficiency in financial software and tools, with expertise in platforms such as Excel, QuickBooks, or specialized financial software relevant to the industry.

- An understanding of financial regulations and compliance, ensuring that all financial activities adhere to legal standards.

- Strong analytical skills, with the ability to dissect complex financial data and provide actionable insights.

- Effective communication skills, both written and verbal, to convey financial information to stakeholders clearly.

- Experience in financial analysis and planning, demonstrating the ability to make informed financial decisions.

- Project management skills, essential for overseeing financial projects and ensuring they are completed successfully.

Additional certifications in finance or related fields can significantly enhance your profile in this competitive job market.

Responsibilities of a Financial Functional Consultant

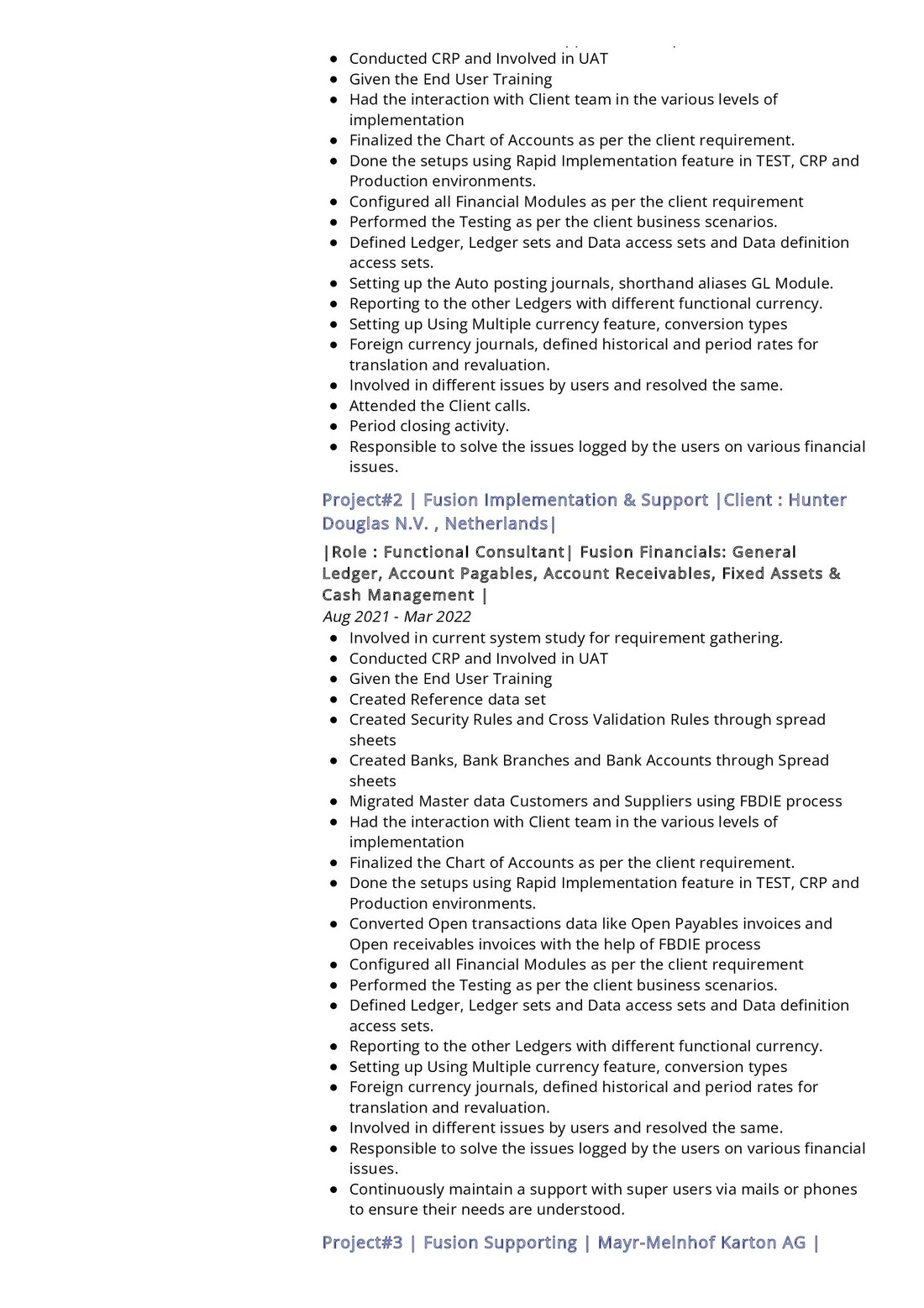

The role of a Financial Functional Consultant is diverse, involving a wide range of responsibilities that contribute to an organization’s financial well-being. Here are the core responsibilities that define this role:

- Financial Analysis: Conduct in-depth financial analysis to assess an organization’s financial health, identify areas for improvement, and make recommendations for financial strategies.

- Budgeting and Forecasting: Develop and manage budgets, including forecasting future financial trends and providing insights to support decision-making.

- Financial Planning: Create comprehensive financial plans that align with the organization’s goals and objectives, ensuring financial stability and growth.

- Financial Reporting: Generate accurate and timely financial reports, including income statements, balance sheets, and cash flow statements, for internal and external stakeholders.

- Process Improvement: Identify inefficiencies in financial processes and implement improvements to streamline operations and reduce costs.

- Compliance and Risk Management: Ensure compliance with financial regulations and mitigate financial risks by implementing effective control measures.

- Client Collaboration: Collaborate with clients or internal teams to understand their financial needs and provide tailored financial solutions.

Each responsibility comes with its unique challenges and opportunities to make a significant impact on an organization’s financial success.

Writing an Impressive Resume for a Financial Functional Consultant

Your resume is your gateway to the world of Financial Functional Consulting. To craft a standout resume, consider these tips:

- Highlight your financial expertise by showcasing specific achievements in financial analysis, budgeting, or planning.

- Detail the financial tools and software you are proficient in, emphasizing their relevance to the role.

- Showcase your ability to communicate complex financial information in a clear and understandable manner.

- Include any relevant certifications or courses that demonstrate your commitment to staying updated in the field.

- Personalize your resume for each application, tailoring it to match the specific job requirements.

Your resume should not only reflect your qualifications but also your passion for financial consulting and your potential to drive financial success for your future employers.

Financial Functional Consultant Resume Summary Examples

Your resume summary is your chance to make a strong first impression. Here are some examples to inspire you:

- “Dedicated Financial Functional Consultant with a proven track record in financial analysis and strategic planning. Adept at delivering actionable insights to drive financial growth.”

- “Experienced Financial Consultant specializing in budget management and financial reporting. Committed to optimizing financial processes for organizations.”

- “Detail-oriented Financial Professional with expertise in compliance and risk management. Skilled in streamlining financial operations to enhance efficiency.”

Your resume summary should encapsulate your financial skills and your commitment to helping organizations thrive financially.

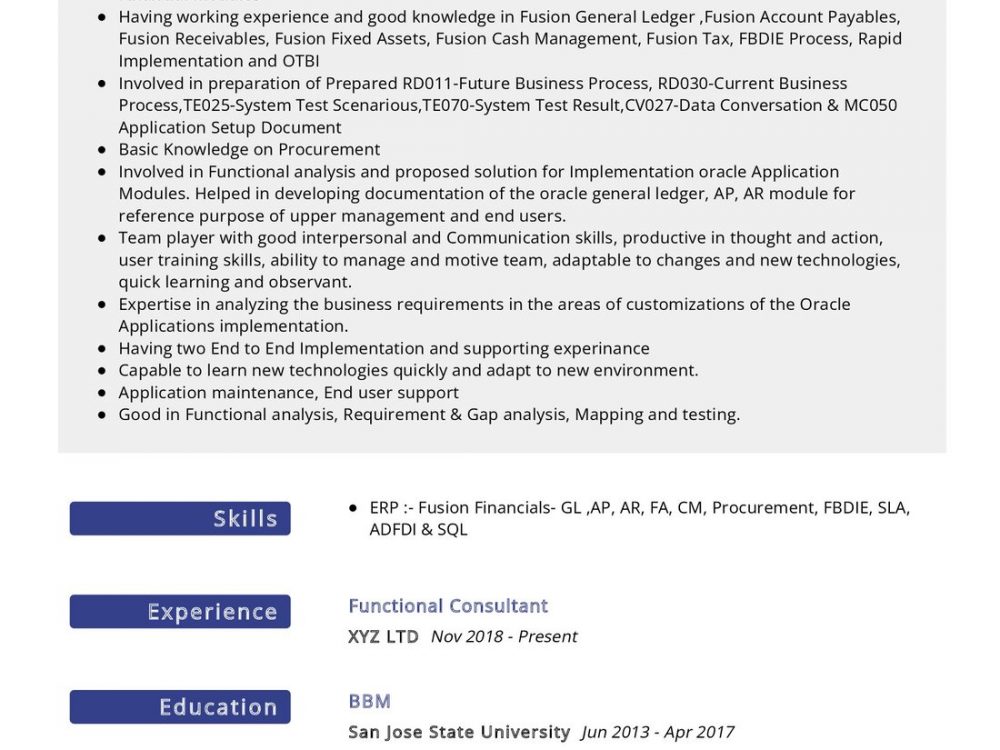

Education and Certifications for a Financial Functional Consultant

Your educational background and certifications play a vital role in establishing your credibility in the field of financial consulting. Here’s how to present them:

- Master of Business Administration (MBA) in Finance, XYZ University, a comprehensive program that honed financial expertise, 2019.

- Bachelor of Science in Accounting, ABC University, a solid foundation in financial principles, 2015.

- Certified Public Accountant (CPA), a prestigious certification demonstrating expertise in accounting and finance, 2020.

Each educational milestone and certification reflects your commitment to excellence in the field of financial consulting.

Skills Every Financial Functional Consultant Should Possess

Your skill set as a Financial Functional Consultant is your toolkit for success. Here are the essential skills you should possess:

Soft Skills:

- Effective Communication: The ability to convey complex financial information clearly to diverse audiences.

- Analytical Thinking: A knack for dissecting financial data and identifying trends and opportunities.

- Problem-Solving: The ability to devise innovative solutions to financial challenges.

- Attention to Detail: Meticulousness in financial analysis and reporting to ensure accuracy.

- Client Focus: A dedication to understanding and meeting clients’ financial needs.

Hard Skills:

- Financial Analysis: Proficiency in conducting in-depth financial analysis using tools and software.

- Budgeting and Forecasting: Skills in creating and managing budgets and forecasting financial trends.

- Financial Software: Familiarity with financial software such as Excel, QuickBooks, or industry-specific tools.

- Compliance Knowledge: Understanding of financial regulations and compliance requirements.

- Project Management: The ability to oversee financial projects from inception to completion.

Each skill is a valuable asset in helping organizations make informed financial decisions and achieve their financial goals.

Common Mistakes to Avoid When Crafting Your Financial Functional Consultant Resume

While creating your resume, be mindful of these common mistakes to ensure it stands out:

- Avoid using a generic, one-size-fits-all resume. Tailor your resume to match each job application’s specific requirements.

- Don’t merely list job duties; showcase your accomplishments and the impact you had on previous employers.

- Don’t underestimate the importance of a cover letter. It’s an opportunity to connect with potential employers and highlight your passion for financial consulting.

- Avoid overloading your resume with technical jargon. Use clear and concise language to communicate your qualifications.

- Always proofread your resume to ensure it’s free of errors that could tarnish your professional image.

Avoiding these mistakes will help you create a resume that is both authentic and compelling, setting you on the path to a successful career in financial consulting.

Key Takeaways for Your Financial Functional Consultant Resume

As you wrap up your resume crafting journey, remember these key takeaways:

- Emphasize your financial expertise and accomplishments to showcase your value to potential employers.

- Highlight your proficiency in financial tools, software, and compliance knowledge.

- Personalize your resume for each job application, aligning it with the specific requirements of the role.

- Stay committed to continuous learning and professional growth by pursuing relevant certifications and education.

Now, you’re well-equipped to create a resume that not only tells your career story but also positions you as a valuable asset in the world of Financial Functional Consulting. Best of luck in your journey to excel in this dynamic field!

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Financial Functional Consultant job interview.