The Role and Responsibilities of a Lending Professional

In today’s financial landscape, the role of a Lending Professional is pivotal in helping individuals and businesses secure the funding they need to achieve their goals. This profession combines financial expertise with a deep understanding of lending products and a strong customer-centric approach. Let’s dive into the multifaceted role of a Lending Professional, a position that requires a blend of financial acumen, relationship-building skills, and a commitment to helping borrowers achieve financial success.

What Does a Lending Professional Do?

A Lending Professional is responsible for guiding borrowers through the lending process, from the initial application to loan disbursement. They play a crucial role in evaluating applicants’ financial profiles, assessing creditworthiness, and recommending suitable loan products. Here are some key responsibilities that define the role:

- Financial Assessment: Lending Professionals thoroughly review applicants’ financial documents, including income statements, credit reports, and tax returns, to assess their ability to repay loans.

- Loan Product Knowledge: They have a deep understanding of various loan products, such as personal loans, mortgages, and business loans, and can recommend the most suitable options based on borrowers’ needs.

- Customer Relationship Management: Building and maintaining strong relationships with borrowers is essential. Lending Professionals provide personalized guidance and support throughout the loan application process.

- Compliance and Documentation: They ensure that all lending activities comply with relevant regulations and collect and review necessary documentation to complete loan applications.

- Risk Assessment: Evaluating the level of risk associated with each loan application is crucial. Lending Professionals use their expertise to identify potential risks and take appropriate measures to mitigate them.

- Communication Skills: Effective communication is key in this role. They explain complex financial terms and options in a clear and understandable manner to borrowers.

Each responsibility requires a unique skill set and contributes to the overall success of the lending process.

Qualifications and Skills Required for a Lending Professional

Becoming a Lending Professional requires meeting specific qualifications and developing essential skills. Here’s a breakdown of the prerequisites for this role:

- A Bachelor’s degree in Finance, Economics, Business, or a related field provides a strong foundation in financial principles.

- Financial Analysis Skills: Lending Professionals need to be adept at analyzing financial statements and assessing credit risk.

- Customer Service Skills: Building trust and rapport with borrowers is essential for success.

- Regulatory Knowledge: They must stay up-to-date with lending regulations and ensure compliance at all times.

- Attention to Detail: Precision in documentation and financial analysis is critical to avoid errors.

- Problem-Solving Abilities: They should be able to find solutions to complex financial situations and adapt to changing market conditions.

- Communication Skills: The ability to convey complex financial information clearly is vital.

Additionally, many Lending Professionals pursue certifications related to lending and finance to enhance their expertise and marketability.

Responsibilities of a Lending Professional

The role of a Lending Professional is multifaceted, involving various responsibilities that contribute to the overall success of lending operations. Here are some key responsibilities in more detail:

- Client Assessment: Lending Professionals assess clients’ financial situations, including income, credit history, and debt levels, to determine their eligibility for loans.

- Loan Origination: They initiate and manage the loan application process, including gathering required documents, verifying information, and submitting applications to underwriters.

- Credit Analysis: Evaluating applicants’ creditworthiness is a crucial step. Lending Professionals analyze credit reports and scores to determine the risk associated with each loan.

- Loan Structuring: They work with borrowers to determine the most suitable loan structure, including interest rates, terms, and repayment schedules.

- Compliance: Ensuring that all lending activities comply with federal and state regulations is a top priority. They keep abreast of changes in lending laws.

- Client Education: Lending Professionals educate borrowers about the terms of their loans, including interest rates, fees, and repayment expectations.

- Problem Resolution: When issues arise during the lending process, they work to resolve them efficiently to keep the process on track.

Each responsibility plays a vital role in helping borrowers secure the funding they need while minimizing risks for lenders.

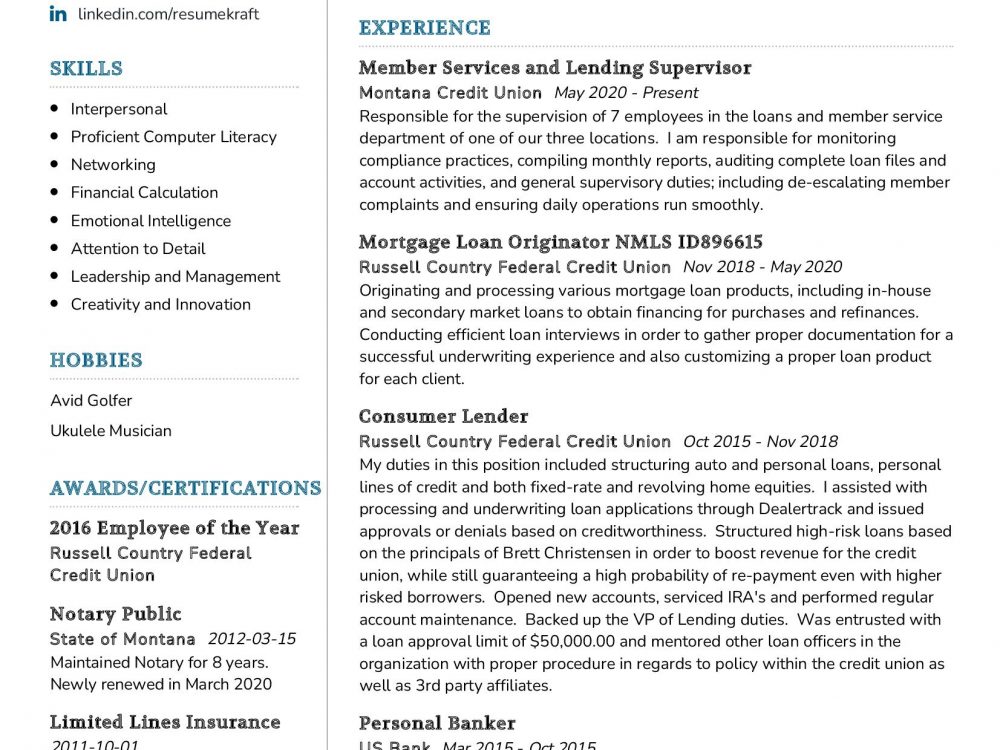

Resume Writing Tips for Lending Professionals

Your resume is your first impression in the job market, and it should effectively showcase your skills and experience as a Lending Professional. Here are some tips to create a compelling resume:

- Highlight Achievements: Use specific examples to demonstrate your accomplishments, such as the number of successful loan applications processed or improvements in loan approval rates.

- Quantify Your Impact: Include metrics and numbers to quantify your contributions, such as the percentage increase in loan portfolio value you managed.

- Emphasize Compliance: Given the importance of compliance in lending, showcase your knowledge of relevant regulations and your track record of ensuring compliance.

- Customer Service Skills: Mention instances where your exceptional customer service skills led to client satisfaction and repeat business.

- Certifications: If you hold any relevant certifications, such as Certified Lending Professional (CLP), be sure to include them in your resume.

- Customize for the Role: Tailor your resume to the specific job you’re applying for by highlighting skills and experiences most relevant to the position.

Your resume should not only showcase your qualifications but also demonstrate how you can bring value to potential employers in the lending industry.

Lending Professional Resume Summary Examples

Your resume summary is your chance to make a strong first impression. Here are some examples tailored for Lending Professionals:

- “Experienced Lending Professional with a proven track record of assessing credit risk and structuring loans that meet borrowers’ needs. Committed to compliance and client satisfaction, with a 95% loan approval rate.”

- “Detail-oriented Lending Professional with expertise in mortgage origination and credit analysis. Successfully managed a portfolio of $50 million in loans and consistently exceeded sales targets.”

- “Dedicated Lending Professional with exceptional customer service skills and a passion for helping clients achieve their financial goals. Known for simplifying complex loan terms for clients and increasing loan approval rates by 20%.”

Your resume summary should provide

a snapshot of your expertise, accomplishments, and commitment to excellence.

Building Your Career as a Lending Professional

Your journey as a Lending Professional is a dynamic one, filled with opportunities to learn and grow in the financial industry. Here are some steps to help you advance your career:

- Continued Education: Stay updated on lending industry trends and regulations by pursuing relevant courses and certifications.

- Networking: Build and maintain relationships with industry professionals, which can open doors to new career opportunities.

- Leadership Opportunities: Consider taking on leadership roles, such as becoming a senior loan officer or a lending team manager, to expand your skill set and responsibilities.

- Specialization: Explore specialized areas within lending, such as commercial real estate lending or small business lending, to become an expert in a niche field.

- Mentorship: Seek mentorship from experienced professionals in the industry who can provide guidance and insights as you progress in your career.

Remember that your journey as a Lending Professional is a continuous one, with opportunities for growth and advancement at every stage.

Conclusion

As you embark on or continue your career as a Lending Professional, remember that your role is instrumental in helping individuals and businesses achieve their financial goals. Your expertise, customer-centric approach, and commitment to compliance make you a valuable asset in the lending industry.

If you’re looking to advance your career or explore new opportunities in lending, don’t forget to update your resume to reflect your accomplishments and skills. A well-crafted resume is your ticket to securing the position that aligns with your career aspirations.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Lending Professional job interview.