Understanding the Role of a Mortgage Consultant

As the housing market continues to evolve, the role of a Mortgage Consultant has become increasingly vital for individuals seeking home financing solutions. This position requires a blend of financial expertise, customer service skills, and regulatory knowledge to guide clients through the mortgage process effectively. Let’s delve deeper into the multifaceted role of a Mortgage Consultant, exploring the responsibilities and skills necessary for success in this dynamic field.

Essential Job Requirements for Mortgage Consultants

Becoming a Mortgage Consultant entails meeting specific qualifications and acquiring relevant experience in the financial sector. Here are the key requirements to excel in this role:

- A Bachelor’s degree in Finance, Economics, Business Administration, or a related field, providing a solid foundation in financial principles.

- Strong knowledge of mortgage products, including conventional loans, FHA loans, VA loans, and jumbo loans.

- Experience in sales or customer service roles, demonstrating effective communication and relationship-building skills.

- Familiarity with mortgage regulations and compliance requirements, ensuring adherence to legal guidelines throughout the loan process.

- Proficiency in mortgage software systems and tools used for loan origination, processing, and underwriting.

- Ability to analyze financial documents, such as tax returns, pay stubs, and credit reports, to assess borrowers’ eligibility and risk.

Continuing education and obtaining relevant certifications, such as the Mortgage Loan Originator (MLO) license, can further enhance your credibility and marketability in the industry.

Responsibilities of a Mortgage Consultant

The role of a Mortgage Consultant revolves around assisting clients in securing suitable mortgage solutions tailored to their financial circumstances and goals. Here are the primary responsibilities associated with this position:

- Educating clients about various mortgage products, explaining terms, rates, and repayment options in clear and understandable terms.

- Assessing clients’ financial situations, including income, credit history, and debt levels, to determine their eligibility for different loan programs.

- Guiding clients through the mortgage application process, collecting necessary documentation, and ensuring accuracy and completeness.

- Collaborating with underwriters and loan processors to expedite the approval and closing process, addressing any issues or concerns that may arise.

- Providing ongoing support and assistance to clients throughout the loan process, answering questions, and addressing any concerns to ensure a smooth experience.

- Building and maintaining relationships with real estate agents, builders, and other referral sources to generate leads and expand the client base.

- Staying updated on market trends, interest rates, and regulatory changes affecting the mortgage industry to provide informed advice to clients.

By fulfilling these responsibilities diligently, Mortgage Consultants play a pivotal role in helping individuals achieve their dream of homeownership.

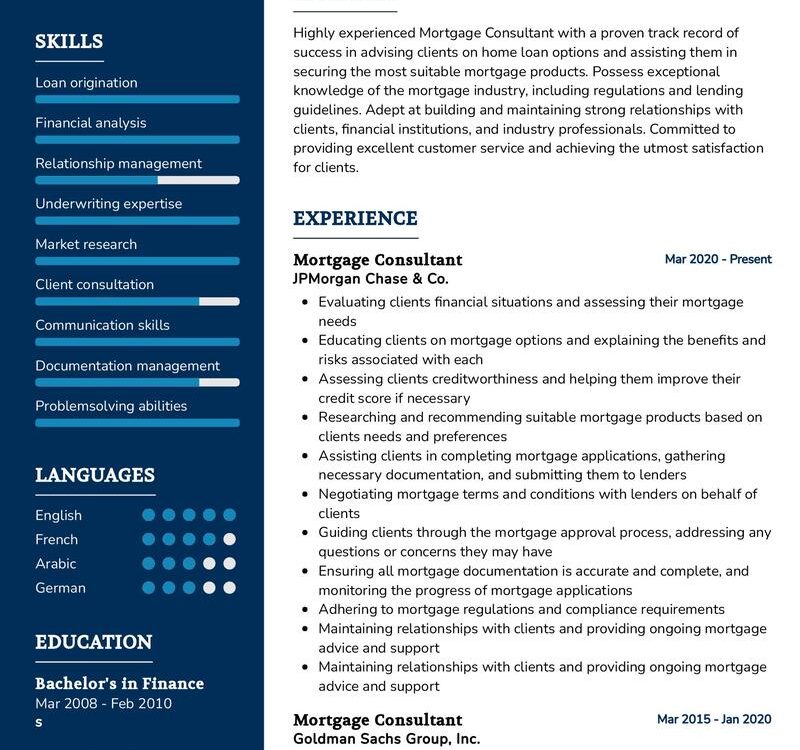

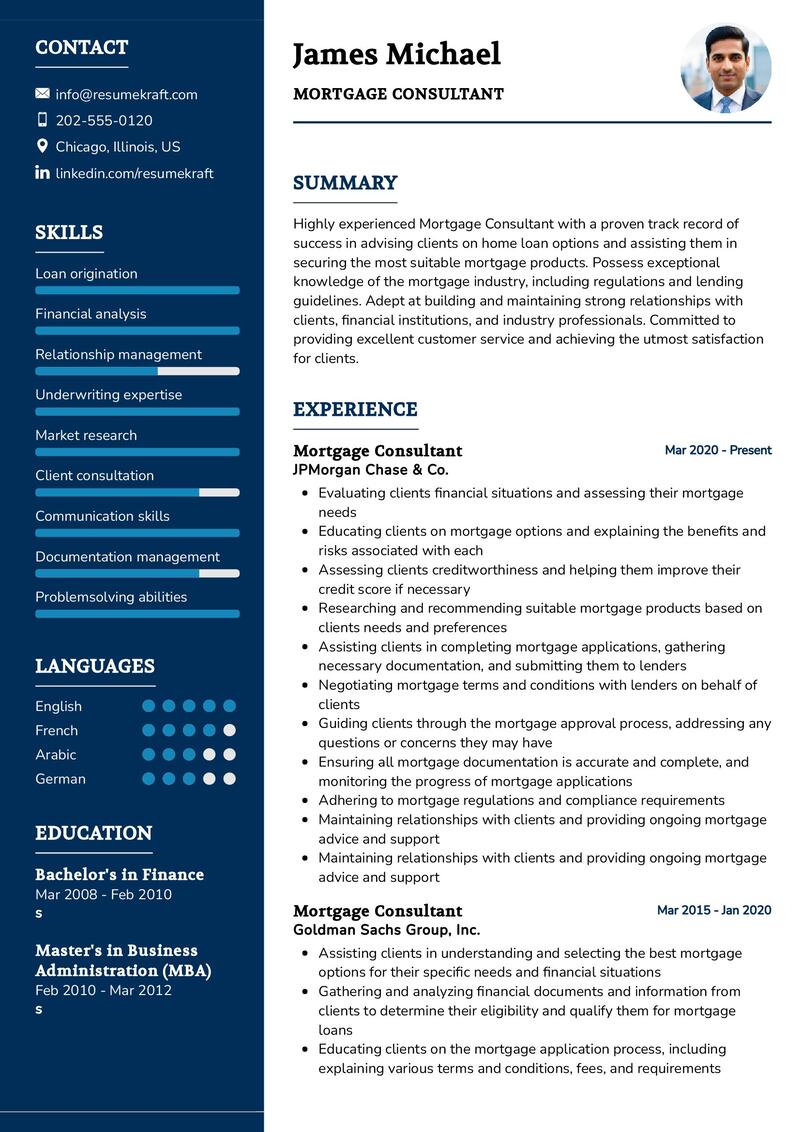

Tips for Writing an Effective Mortgage Consultant Resume

Crafting a compelling resume is essential for showcasing your skills and experience as a Mortgage Consultant. Here are some tips to make your resume stand out:

- Highlight your sales and customer service experience, emphasizing your ability to build rapport with clients and meet their needs.

- Showcase your knowledge of mortgage products and regulations, demonstrating your expertise in guiding clients through the loan process.

- Quantify your achievements, such as the number of loans closed or the volume of loans originated, to illustrate your effectiveness as a Mortgage Consultant.

- Include relevant certifications and licenses, such as the MLO license or Certified Mortgage Planning Specialist (CMPS) designation, to validate your qualifications.

- Customize your resume for each job application, tailoring your qualifications and accomplishments to match the specific requirements of the position.

By following these tips, you can create a resume that effectively highlights your skills and experience, making you a competitive candidate in the mortgage industry.

Key Takeaways for Aspiring Mortgage Consultants

Aspiring Mortgage Consultants should focus on:

- Developing a strong foundation in finance and mortgage principles through education and training.

- Building excellent communication and interpersonal skills to effectively interact with clients and industry professionals.

- Staying updated on market trends and regulatory changes to provide informed guidance to clients.

- Pursuing relevant certifications and licenses to enhance credibility and marketability in the mortgage industry.

By embodying these key takeaways, aspiring Mortgage Consultants can embark on a fulfilling career path in the dynamic and rewarding field of mortgage lending.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Mortgage Consultant job interview.