Exploring the Role of a Quantitative Analyst

As the financial landscape becomes increasingly complex, the role of a Quantitative Analyst has gained prominence in organizations worldwide. This position requires a unique blend of analytical prowess, mathematical expertise, and a deep understanding of financial markets. Let’s delve into the multifaceted responsibilities of a Quantitative Analyst, a key player in driving data-informed decision-making in the finance sector.

A Quantitative Analyst is tasked with utilizing mathematical models and statistical techniques to analyze financial data, assess market trends, and develop quantitative models. This role is crucial in providing insights that guide investment strategies, risk management, and overall financial decision-making. It’s a position that demands not only technical proficiency but also the ability to communicate complex findings to non-technical stakeholders.

Quantitative Analyst Job Requirements

Becoming a Quantitative Analyst involves meeting specific requirements that highlight a combination of educational background, technical skills, and industry knowledge. Let’s explore the prerequisites one needs to fulfill to step into the role of a Quantitative Analyst:

- A Master’s or Ph.D. in Finance, Economics, Statistics, or a related quantitative field, showcasing a strong foundation in mathematical and statistical concepts.

- Proficiency in programming languages such as Python, R, or MATLAB, crucial for data analysis and model development.

- Experience in quantitative research, demonstrating the ability to apply mathematical models to real-world financial data.

- Strong understanding of financial markets, including knowledge of instruments like stocks, bonds, derivatives, and investment strategies.

- Excellent problem-solving and critical-thinking skills, honed through coursework, research projects, or relevant work experience.

- Effective communication skills, as Quantitative Analysts need to convey complex findings to both technical and non-technical audiences.

Obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), can enhance your profile in the competitive financial job market.

Responsibilities of a Quantitative Analyst

The role of a Quantitative Analyst is diverse, encompassing various responsibilities that contribute to informed decision-making and risk management. Let’s unravel the core tasks that define the day-to-day activities of a Quantitative Analyst:

- Conducting thorough financial research and data analysis to identify trends, patterns, and investment opportunities.

- Developing and implementing quantitative models to assess risk, optimize investment portfolios, and support financial decision-making.

- Collaborating with portfolio managers, traders, and other stakeholders to understand business objectives and tailor quantitative solutions accordingly.

- Evaluating the performance of existing quantitative models, making adjustments as needed to adapt to changing market conditions.

- Staying abreast of industry developments, market trends, and regulatory changes that may impact financial strategies.

- Presenting findings and insights to both technical and non-technical audiences, facilitating informed decision-making at all levels of the organization.

Each responsibility comes with its own set of challenges and opportunities, shaping Quantitative Analysts into versatile professionals in the finance sector.

Quantitative Analyst Resume Writing Tips

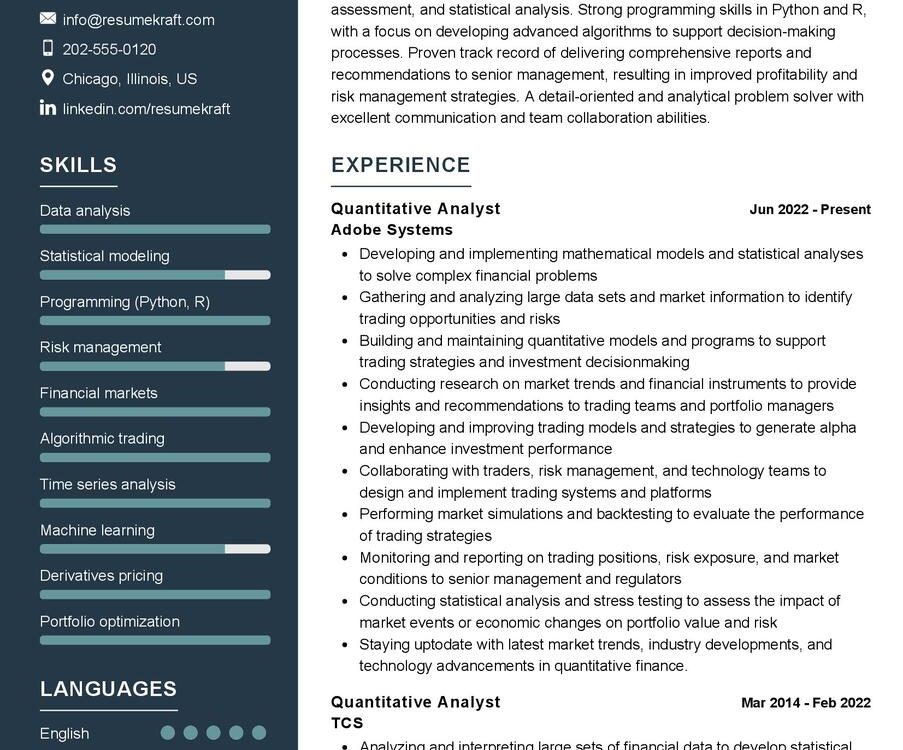

Crafting a compelling resume is crucial for standing out in the competitive job market. Here are some tips to create a Quantitative Analyst resume that effectively showcases your skills and experience:

- Highlight specific projects or research initiatives where you applied quantitative methods to solve real-world financial challenges.

- Quantify your achievements with measurable outcomes, such as percentage improvements in portfolio performance or successful risk mitigation strategies.

- Showcase your programming skills by mentioning the languages you are proficient in and specific projects where you applied coding for quantitative analysis.

- Tailor your resume for each job application, emphasizing the skills and experiences most relevant to the specific role.

Your resume is your personal marketing tool, and each section should tell a story of your quantitative skills, industry knowledge, and achievements.

Quantitative Analyst Resume Summary Examples

Your resume summary is the gateway to capturing the recruiter’s attention. Craft a powerful summary that encapsulates your expertise and value as a Quantitative Analyst:

- “Quantitative Analyst with a Master’s in Finance and a track record of developing robust models, optimizing investment portfolios, and delivering data-driven insights to drive business success.”

- “Results-driven Quantitative Analyst with expertise in statistical modeling and risk assessment. Proven ability to translate complex financial data into actionable insights for strategic decision-making.”

- “Experienced Quantitative Analyst specializing in market trend analysis and portfolio optimization. Adept at leveraging quantitative tools to enhance investment strategies and minimize risk.”

Your summary is a snapshot of your career journey, providing recruiters with a quick overview of your skills and contributions as a Quantitative Analyst.

Building a Strong Experience Section for Your Quantitative Analyst Resume

Your experience section is the heart of your resume, showcasing the depth of your expertise and the impact you’ve had in previous roles. Here are examples to guide you in constructing a robust experience section:

- “Led quantitative research projects, resulting in a 15% improvement in the accuracy of risk assessments and a 10% increase in overall portfolio performance.”

- “Developed and implemented algorithmic trading strategies, contributing to a significant reduction in trading losses and an enhancement of overall portfolio returns.”

- “Collaborated with cross-functional teams to integrate quantitative models into decision-making processes, fostering a data-driven culture within the organization.”

Each experience is a chapter in your professional story, highlighting your achievements and showcasing the value you bring as a Quantitative Analyst.

Education Section for Your Quantitative Analyst Resume

Your educational background is a cornerstone of your qualifications as a Quantitative Analyst. Highlight your academic achievements in the following manner:

- Master of Science in Finance, XYZ University, showcasing in-depth knowledge of financial concepts and quantitative methodologies, 2018.

- Bachelor of Arts in Economics, ABC University, providing a strong foundation in economic principles and analytical thinking, 2015.

- Chartered Financial Analyst (CFA) Certification, a testament to your commitment to professional excellence in the finance industry, 2019.

Each educational milestone is a testament to your dedication to acquiring the knowledge and skills necessary for success as a Quantitative Analyst.

Key Skills for Your Quantitative Analyst Resume

Your skill set is the toolbox that equips you to excel as a Quantitative Analyst. Showcase your abilities with a mix of soft and hard skills:

Soft Skills:

- Analytical thinking and problem-solving, crucial for interpreting complex financial data.

- Effective communication, enabling you to convey complex findings to both technical and non-technical stakeholders.

- Attention to detail, essential for ensuring accuracy in quantitative analysis and modeling.

- Adaptability and resilience, key traits for navigating the dynamic landscape of financial markets.

Hard Skills:

- Proficiency in Python, R, or MATLAB, essential for quantitative analysis and modeling.

- Statistical modeling, applying mathematical techniques to analyze and interpret financial data.

- Financial market knowledge, including an understanding of stocks, bonds, derivatives, and investment strategies.

- Risk assessment and management, critical for developing strategies that minimize financial risk.

Each skill is a valuable asset, contributing to your effectiveness as a Quantitative Analyst.

Common Mistakes to Avoid When Writing a Quantitative Analyst Resume

Avoid common pitfalls that can diminish the impact of your Quantitative Analyst resume. Steer clear of these mistakes:

- Using generic language and not tailoring your resume for each job application, hindering your chances of standing out to recruiters.

- Focusing on job duties rather than highlighting your achievements, resulting in a resume that lacks impact.

- Overlooking the importance of a cover letter, missing an opportunity to provide additional context and showcase your motivation for the role.

- Using excessive technical jargon that may alienate non-technical readers, aiming for a balance between precision and accessibility.

- Neglecting proofreading, which can undermine your professionalism and attention to detail.

Avoiding these mistakes ensures your Quantitative Analyst resume is polished, impactful, and tailored to catch the eye of recruiters.

Key Takeaways for Your Quantitative Analyst Resume

As you craft your Quantitative Analyst resume, keep these key takeaways in mind to maximize your impact:

- Emphasize your quantitative skills and achievements, showcasing the tangible results of your analytical expertise.

- Highlight your ability to communicate complex findings, demonstrating your value in translating data into actionable insights for decision-makers.

- Showcase your programming proficiency and its application in quantitative analysis, underscoring your technical capabilities.

- Customize your resume for each application, aligning your skills and experiences with the specific requirements of the role.

Remember, your resume is not just a document; it’s your professional narrative, illustrating your journey, skills, and contributions as a Quantitative Analyst. Best of luck!

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Quantitative Analyst job interview.