Exploring the Role of a Senior Banking Professional

In the dynamic landscape of finance, the position of a Senior Banking Professional holds a paramount role. This article will delve into the intricate responsibilities, necessary qualifications, and key skills that define the journey of a seasoned banking professional. The blend of financial expertise and leadership skills makes this role crucial in steering banking operations towards success.

Senior Banking Professional Job Requirements

Embarking on the path to becoming a Senior Banking Professional involves meeting specific requirements that demand a combination of education, experience, and essential skills. Let’s explore the prerequisites essential to embrace the role of a Senior Banking Professional:

- A Bachelor’s or Master’s degree in Finance, Business Administration, or a related field, showcasing a strong foundation in financial principles.

- Profound knowledge of banking operations, including risk management, investment strategies, and regulatory compliance.

- Extensive experience in banking, with a proven track record of progressively responsible roles that highlight leadership and decision-making capabilities.

- Demonstrated proficiency in financial analysis, strategic planning, and market trends to make informed business decisions.

- Excellent communication and interpersonal skills, essential for building relationships with clients, stakeholders, and team members.

- Leadership and managerial skills honed through experiences and possibly through relevant courses and certifications.

- Adaptability to the evolving financial landscape, showcasing the ability to navigate challenges in a competitive industry.

Continued professional development through certifications like Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) can significantly enhance your profile in the competitive banking sector.

Responsibilities of a Senior Banking Professional

The role of a Senior Banking Professional is multifaceted, requiring a strategic mindset and a deep understanding of financial markets. Let’s unravel the core responsibilities that define this role, each contributing to the overall success of banking operations:

- Strategic management of banking operations, ensuring compliance with regulations and optimizing performance.

- Developing and implementing effective financial strategies to achieve organizational goals and maximize returns.

- Leading and overseeing financial risk management, making informed decisions to safeguard the bank’s interests.

- Cultivating and maintaining relationships with high-profile clients, fostering trust and ensuring client satisfaction.

- Collaborating with cross-functional teams to integrate technology solutions for efficient banking processes.

- Providing mentorship and guidance to junior team members, contributing to their professional development.

- Staying abreast of market trends and economic indicators, guiding the team towards informed decision-making.

Each responsibility is a crucial element in the intricate tapestry of a Senior Banking Professional’s role, contributing to the overall success of the financial institution.

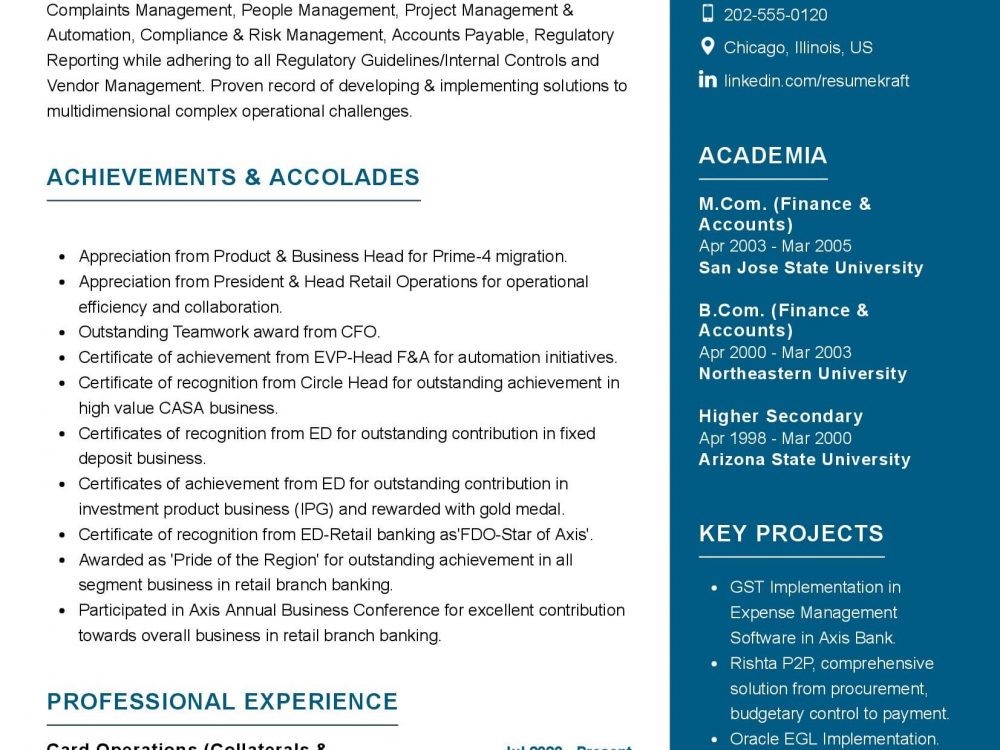

Senior Banking Professional Resume Writing Tips

Crafting a resume that stands out in the competitive banking industry requires careful attention to detail and a strategic approach. Here are some tips to help you create a compelling Senior Banking Professional resume:

- Highlight your leadership roles, emphasizing instances where you successfully led teams to achieve financial goals.

- Showcase specific financial strategies you have implemented, quantifying their impact on the organization’s success.

- Include metrics to quantify your achievements, such as percentage growth in assets under management or successful risk mitigation.

- List relevant certifications and professional development activities, demonstrating your commitment to staying current in the finance field.

- Personalize your resume for each application, aligning your skills and experiences with the specific requirements of the position.

Your resume is not just a document; it is a representation of your journey and achievements as a Senior Banking Professional.

Senior Banking Professional Resume Summary Examples

Your resume summary is the first impression you make on potential employers. Craft a powerful snapshot of your career with examples like:

- “Seasoned Senior Banking Professional with over 15 years of experience, excelling in strategic financial management and client relations, driving the bank towards unprecedented growth.”

- “Results-driven banking leader with a proven track record in risk management and financial planning, adept at navigating complexities to achieve organizational success.”

- “Experienced Senior Banking Professional with a focus on innovative financial solutions, guiding teams towards excellence and delivering outstanding client experiences.”

Your resume summary should encapsulate your expertise, achievements, and the value you bring to a senior banking role.

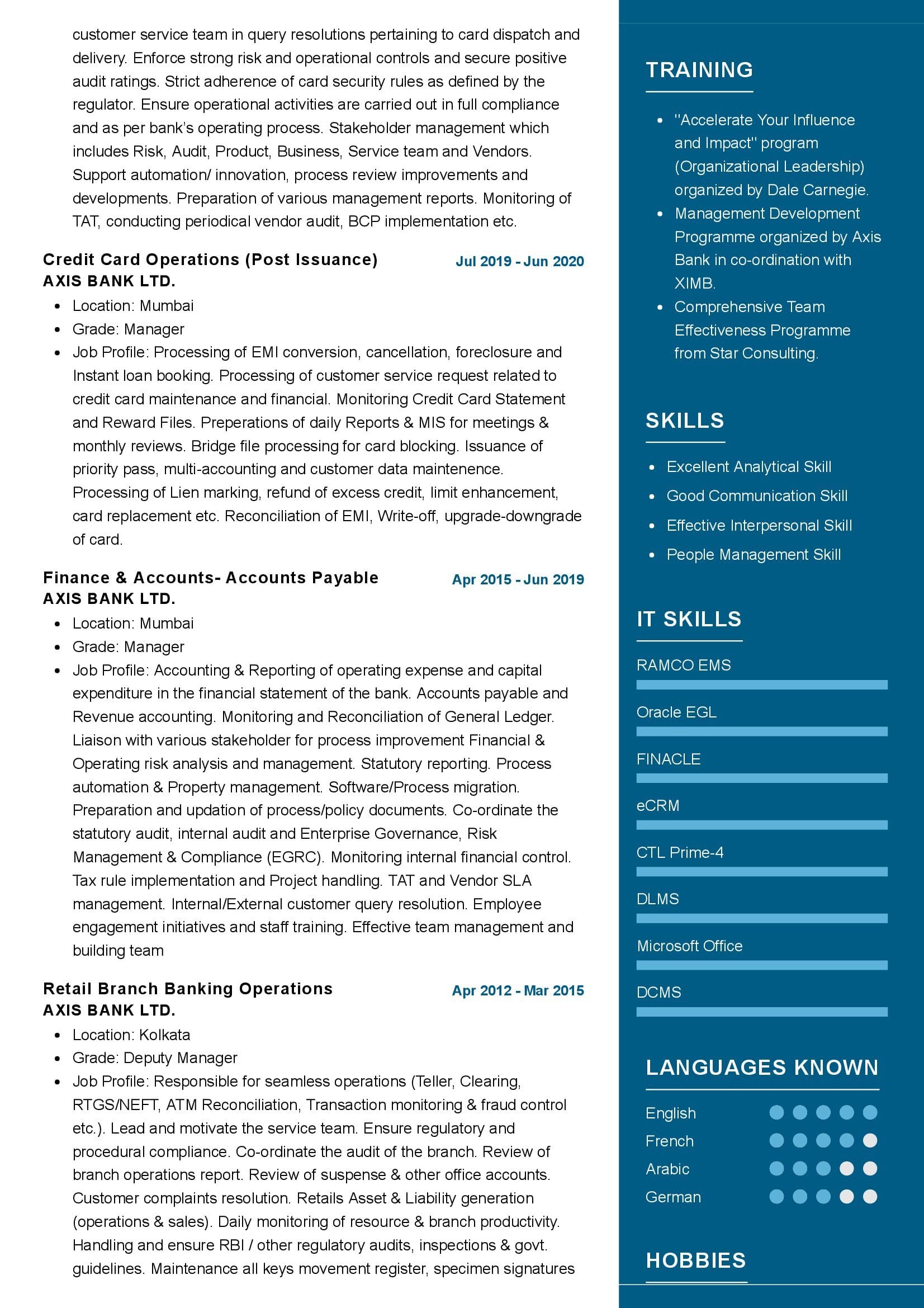

Create a Robust Experience Section for Your Senior Banking Professional Resume

Your experience section is the heart of your resume, showcasing the rich experiences and achievements gathered throughout your career. Here are some examples to guide you:

- “Led a team of financial analysts in optimizing investment portfolios, contributing to a 15% increase in the bank’s assets under management.”

- “Implemented a comprehensive risk management strategy, reducing the bank’s exposure and enhancing overall financial stability.”

- “Developed and executed client acquisition initiatives, resulting in a 30% increase in high-net-worth client accounts.”

Each experience is a chapter in your career story, narrating tales of challenges met, solutions found, and successes achieved as a Senior Banking Professional.

Educational Background for Your Senior Banking Professional Resume

Your educational journey is a foundation that showcases your commitment to learning and expertise in finance. List your educational milestones like:

- Master of Business Administration in Finance, XYZ University, a journey of advanced learning and specialization, 2005.

- Bachelor of Science in Business Administration, Major in Finance, ABC University, the foundation stone of your banking career, 2002.

- Chartered Financial Analyst (CFA) Certification, a recognition of your expertise in financial analysis and investment management, 2007.

Your educational qualifications provide a strong base for your success as a Senior Banking Professional.

Key Skills for Your Senior Banking Professional Resume

Your skill set is your toolbox, showcasing the abilities you’ve honed over the years. Let’s list down the essential skills that a Senior Banking Professional should possess:

Soft Skills:

- Leadership and team management, crucial for steering the team towards financial success.

- Communication and interpersonal skills, effective in building strong relationships with clients and stakeholders.

- Strategic thinking, essential for making informed decisions in complex financial scenarios.

- Problem-solving abilities, adept at finding solutions to challenges in the dynamic banking industry.

- Adaptability and resilience, the strength to navigate changes and uncertainties in the financial landscape.

Hard Skills:

- Financial analysis, a deep understanding of financial statements, market trends, and investment strategies.

- Risk management, the ability to assess and mitigate financial risks to ensure the stability of the institution.

- Client relationship management, fostering trust and satisfaction among high-profile clients.

- Strategic planning, developing and implementing financial strategies aligned with organizational goals.

- Regulatory compliance, ensuring the bank operates within legal and industry regulations.

Each skill is a tool, aiding you in providing exceptional financial leadership and steering your team effectively.

Common Mistakes to Avoid When Writing a Senior Banking Professional Resume

Avoiding common pitfalls in resume writing is crucial to making a strong impression. Steer clear of these mistakes to craft a resume that effectively communicates your value:

- Generic resumes, tailor your application to highlight your unique fit for the senior banking role.

- Listing job duties without showcasing achievements, a narrative that lacks depth and impact.

- Underestimating the importance of a cover letter, a missed opportunity to connect with potential employers on a personal level.

- Overloading your resume with technical jargon, which can obscure your true value and expertise.

- Failing to proofread, as mistakes can leave a negative impression on potential employers.

Avoiding these mistakes ensures your resume is both authentic and compelling, increasing your chances of landing your dream senior banking role.

Key Takeaways for Your Senior Banking Professional Resume

As we conclude this comprehensive guide, remember these key points while crafting your Senior Banking Professional resume:

- Emphasize your leadership journey, showcasing milestones achieved and teams led towards financial success.

- Highlight your strategic proficiency, showcasing your expertise in financial analysis, risk management, and client relations.

- Detail strategic initiatives you’ve spearheaded, painting a picture of your visionary approach to financial leadership.

- Include a section on continuous learning, showcasing certifications and courses that demonstrate your commitment to staying current in the finance field.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Senior Banking Professional job interview.

Armed with these insights and tips, you are now ready to craft a resume that is a true reflection of your journey, your skills, and your aspirations. Best of luck!