Exploring the Role of a Taxation Manager

As the financial landscape continues to evolve, the role of a Taxation Manager has become increasingly crucial in organizations worldwide. This position requires a unique blend of financial expertise and strategic acumen, steering the tax team towards success. Let’s delve deeper into the multifaceted role of a Taxation Manager, a position that demands a deep understanding of tax regulations coupled with the ability to lead a team effectively.

A Taxation Manager is responsible for overseeing the financial aspects of an organization, ensuring compliance with tax laws, and optimizing tax strategies. They play a pivotal role in shaping the financial health of a company, often acting as a bridge between financial data and organizational goals. This article explores the key aspects of the Taxation Manager role, from job requirements to essential skills and tips for crafting an impactful CV.

Job Requirements for a Taxation Manager

Stepping into the role of a Taxation Manager requires meeting stringent requirements, a journey that is both demanding and rewarding. The path is paved with continuous learning and gaining hands-on experience. Let’s delve deeper into the prerequisites that one needs to fulfill to embrace the role of a Taxation Manager:

- A Bachelor’s or Master’s degree in Accounting, Finance, or a related field, showcasing a strong foundation in financial management.

- Profound knowledge of tax laws and regulations, including experience in tax planning and compliance.

- Experience in financial management, with a track record of successfully navigating complex financial landscapes.

- Leadership and managerial skills, honed through experiences and possibly through courses and certifications.

- Excellent analytical and problem-solving skills, essential for effective tax planning and strategy implementation.

- Proficiency in financial software and tools, ensuring accurate and efficient financial reporting.

- Ability to stay updated with changes in tax laws and regulations, ensuring compliance and optimizing tax strategies.

Obtaining additional certifications in taxation and financial management can enhance your profile in the competitive job market.

Responsibilities of a Taxation Manager

The role of a Taxation Manager is a tapestry of varied responsibilities, woven with threads of financial expertise, leadership skills, and strategic vision. Let’s unravel the core responsibilities that define this role, each thread narrating a story of dedication, knowledge, and innovation:

- Overseeing the organization’s tax planning and compliance, ensuring adherence to local and international tax laws.

- Developing and implementing tax-saving strategies, optimizing the organization’s financial position.

- Leading tax audit processes, collaborating with external auditors and regulatory bodies.

- Providing financial guidance to the executive team, contributing to strategic decision-making.

- Conducting regular reviews of financial data to identify areas for improvement and risk mitigation.

- Ensuring compliance with accounting standards and best practices in financial management.

- Leading and mentoring the tax team, fostering a culture of continuous learning and professional development.

Each responsibility comes with its own set of challenges and learning, shaping you into a financial leader par excellence.

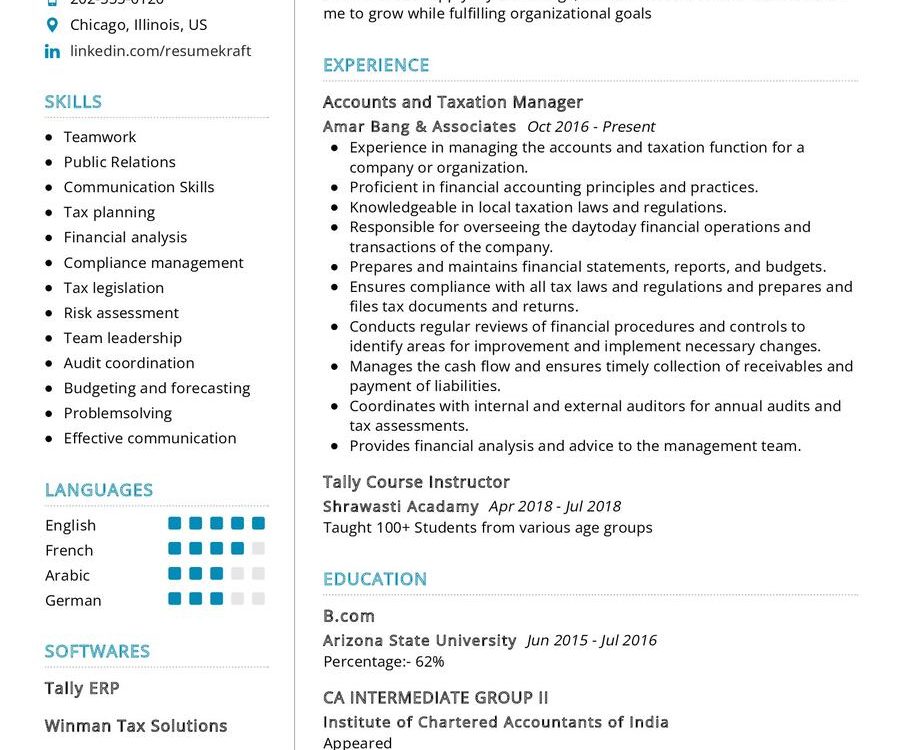

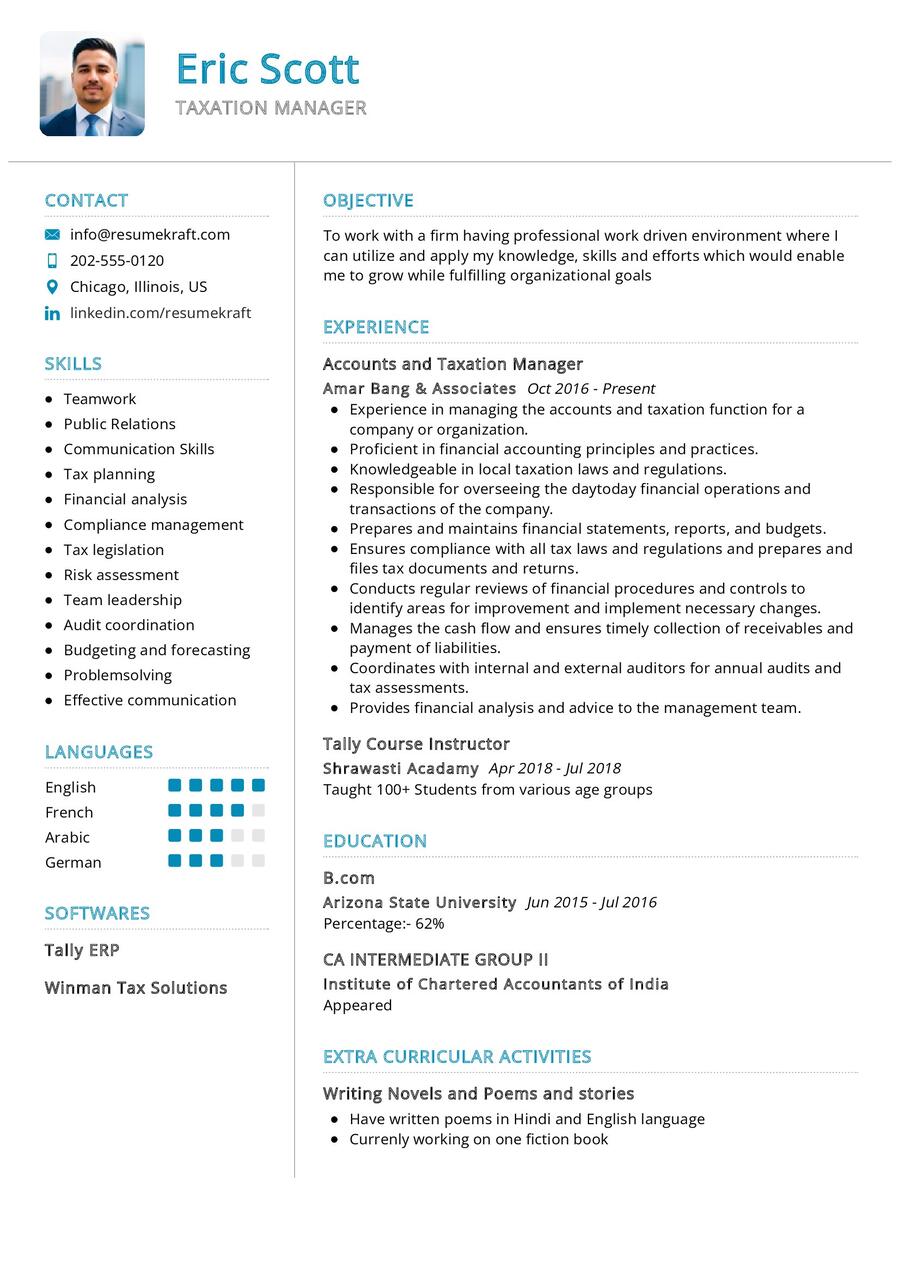

Taxation Manager CV Writing Tips

As you embark on the journey to craft a CV that stands tall in the pool of applications, remember that your CV is a reflection of your journey, your growth, and your aspirations. Here are some tips to help you narrate your story effectively through your CV:

- Highlight your leadership roles, showcasing instances where you have led financial teams to success.

- Detail initiatives or programs you have spearheaded, narrating the impact they had on the organization’s financial health.

- Include metrics to quantify your achievements, painting a picture of your successes through numbers.

- List relevant certifications, showcasing your commitment to continuous learning in taxation and financial management.

- Personalize your CV for the specific role, weaving a narrative that resonates with the job description.

Each tip is a brushstroke, helping you paint a portrait that is both compelling and authentic.

Taxation Manager CV Summary Examples

Your CV summary is the opening act of your financial career story, setting the stage for what is to follow. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Experienced Taxation Manager with over 10 years of expertise, a strategic thinker adept at optimizing tax strategies and leading financial teams to success.”

- “Dedicated financial leader with a proven track record in tax planning, a visionary who has significantly contributed to improving organizations’ financial positions.”

- “Results-driven Taxation Manager with a specialization in compliance, a leader fostering a culture of compliance and continuous improvement in financial processes.”

Each summary is a window to your financial career, offering a glimpse of your journey, your strengths, and your vision as a Taxation Manager.

Create a Strong Experience Section for Your Taxation Manager CV

Your experience section is the heart of your CV, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your financial career story, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led a financial team in a high-paced corporate environment, achieving a 15% reduction in tax liabilities through strategic tax planning.”

- “Pioneered the implementation of tax-saving initiatives, contributing to a 25% increase in the organization’s overall financial health.”

- “Developed and led training programs in financial compliance, ensuring the team’s adherence to the latest tax laws and regulations.”

Each experience is a chapter in your financial career book, narrating tales of challenges met, solutions found, and successes achieved.

Sample Education Section for Your Taxation Manager CV

Your educational journey is the foundation upon which your financial career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Science in Finance, XYZ University, a journey of deep financial knowledge and specialization, 2018.

- Bachelor of Business Administration in Accounting, ABC University, the foundation stone of your financial career, 2012.

- Certified Public Accountant (CPA), a recognition of your expertise in financial management, 2019.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your financial career.

Taxation Manager Skills for Your CV

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Taxation Manager should possess:

Soft Skills:

- Leadership and team management, the ability to steer your financial team towards success.

- Communication and interpersonal skills, the art of conveying financial information effectively and building strong relationships.

- Problem-solving abilities, the knack of finding financial solutions in challenging situations.

- Attention to detail, the meticulous approach to ensuring accurate financial reporting and compliance.

- Adaptability and resilience, the strength to navigate through changing financial scenarios.

Hard Skills:

- Proficiency in financial software and tools, ensuring accurate and efficient financial reporting.

- Strategic tax planning, the ability to optimize tax strategies for the organization’s financial benefit.

- Knowledge of financial regulations, an understanding that ensures compliance and safeguards the organization’s financial health.

- Budget and resource management, the acumen to manage financial resources efficiently.

- Financial analysis, the ability to analyze financial data and provide insights for strategic decision-making.

Each skill is a tool, aiding you in providing exceptional financial leadership and contributing to organizational success.

Common Mistakes to Avoid When Writing a Taxation Manager CV

As you craft your CV, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job. Here we list down the mistakes often seen in CVs and how to avoid them:

- Using a generic CV for all applications, a strategy that fails to showcase your unique fit for the Taxation Manager role.

- Listing job duties without showcasing your achievements, a narrative that lacks depth and impact.

- Ignoring the cover letter, a missed opportunity to narrate your financial career story and connect with the potential employer.

- Overloading your CV with financial jargon, a strategy that can obscure your true value and may be confusing for non-finance professionals.

- Failing to proofread, a mistake that can leave a dent in your professional image.

Each mistake is a pitfall, avoid them to craft a CV that is both authentic and compelling.

Key Takeaways for Your Taxation Manager CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Taxation Manager CV:

- Emphasize your financial leadership journey, showcasing the milestones achieved and the teams led.

- Highlight your technical proficiency, showcasing your expertise in tax planning and financial management.

- Detail the strategic initiatives you have spearheaded, painting a picture of your visionary approach to financial leadership.

- Include a section on continuous learning, showcasing the certifications and courses undertaken in taxation and financial management.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the [Taxation Manager] job interview.

Armed with these insights and tips, you are now ready to craft a CV that is a true reflection of your financial career journey, your skills, and your aspirations. Remember, your CV is not just a document; it is a canvas where you paint your financial career story, a story of growth, learning, and leadership. Best of luck!