Unlocking Success: The Role of a Treasury Analyst

In the dynamic world of finance, the position of a Treasury Analyst holds a strategic key to an organization’s financial stability and growth. This article explores the multifaceted role of a Treasury Analyst, a professional who blends financial expertise with analytical prowess to navigate the complex landscape of treasury management.

Understanding the Treasury Analyst Role

As businesses operate in an increasingly interconnected global economy, the role of a Treasury Analyst has evolved into a linchpin for financial decision-making. This position demands a unique combination of financial acumen, analytical skills, and the ability to thrive in a fast-paced environment.

A Treasury Analyst is responsible for managing an organization’s financial resources efficiently. This includes overseeing cash flow, mitigating financial risks, and optimizing investment strategies. Their role is pivotal in ensuring that the company has enough liquidity to meet its obligations while maximizing returns on surplus funds.

Qualifications and Skills Required

Becoming a successful Treasury Analyst requires a specific set of qualifications and skills. Here are the key prerequisites for aspiring professionals in this field:

- A Bachelor’s or Master’s degree in Finance, Accounting, or a related field, showcasing a strong foundation in financial principles.

- Comprehensive knowledge of financial markets, investment instruments, and risk management strategies.

- Experience in financial analysis, preferably in a treasury or finance-related role, demonstrating a track record of sound decision-making.

- Strong analytical skills, with the ability to interpret complex financial data and trends.

- Proficiency in financial software and tools, essential for conducting analyses and generating reports.

- Excellent communication skills to collaborate with cross-functional teams and present findings to key stakeholders.

- Attention to detail and a proactive approach to identifying and addressing financial challenges.

Obtaining relevant certifications, such as the Certified Treasury Professional (CTP), can enhance your profile and demonstrate your commitment to excellence in treasury management.

Key Responsibilities of a Treasury Analyst

The responsibilities of a Treasury Analyst span a wide spectrum of financial activities. Here are the core duties that define their role:

- Managing cash flow by forecasting and analyzing the organization’s liquidity needs.

- Developing and implementing risk management strategies to safeguard the company against financial uncertainties.

- Monitoring and analyzing financial market trends to make informed investment decisions.

- Negotiating with financial institutions for favorable terms on loans, credit lines, and other financial services.

- Ensuring compliance with financial regulations and internal policies to mitigate legal and financial risks.

- Collaborating with internal teams to optimize working capital and support strategic financial goals.

- Preparing and presenting financial reports to senior management, providing insights for decision-making.

Each responsibility comes with its own set of challenges and opportunities, contributing to the overall financial health of the organization.

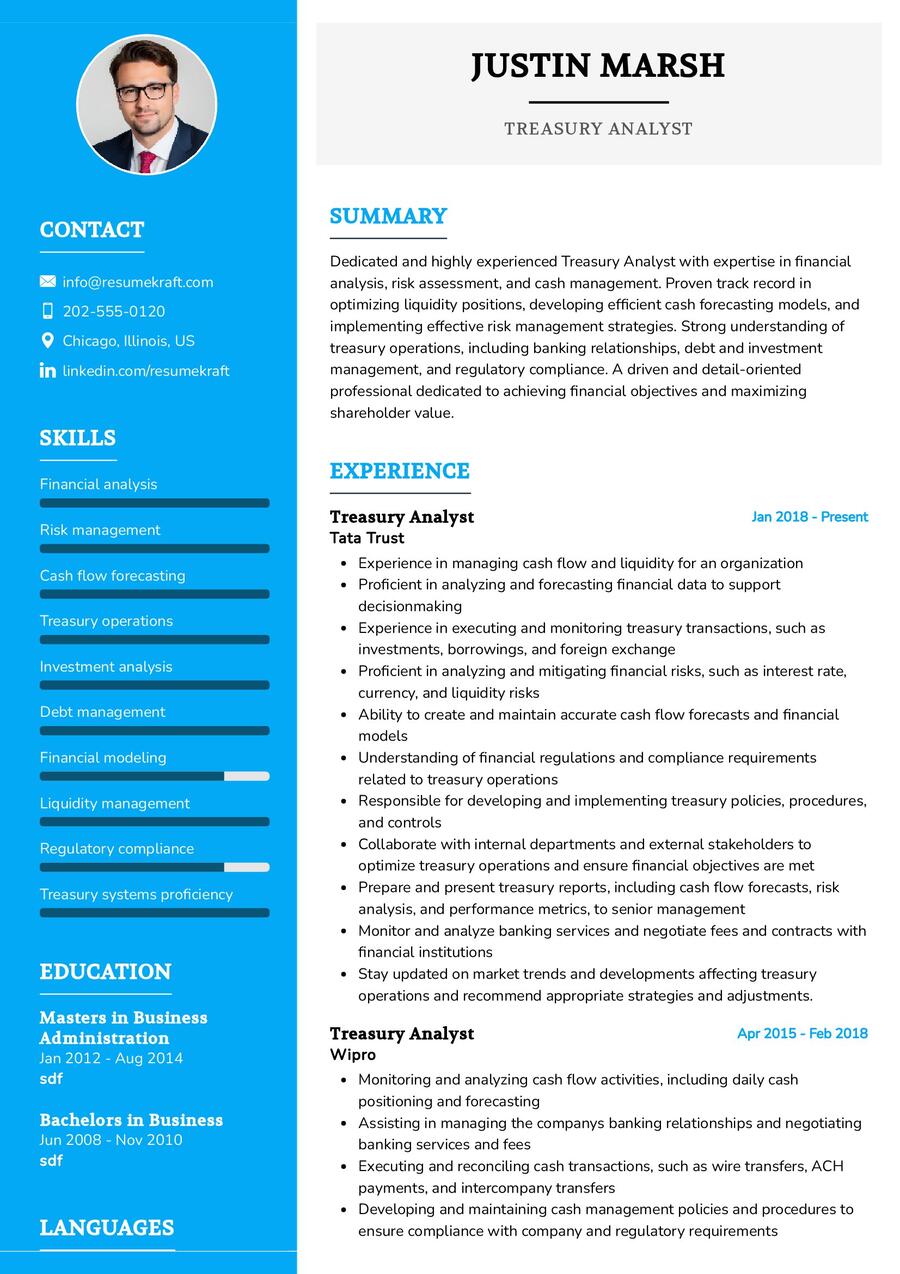

Crafting an Impressive Treasury Analyst Resume

Your resume is your professional calling card, and crafting an impressive one is essential to stand out in the competitive job market. Here are some tips for creating a compelling Treasury Analyst resume:

- Highlight your experience in cash flow management, showcasing instances where you optimized liquidity and minimized financial risks.

- Showcase your analytical skills by detailing projects where you conducted in-depth financial analyses, providing actionable insights.

- Quantify your achievements by including specific metrics, such as successful negotiation outcomes or percentage improvements in cash flow.

- List relevant certifications, emphasizing your commitment to staying updated in the dynamic field of treasury management.

- Personalize your resume for each application, aligning your skills and experiences with the specific requirements of the position.

Your resume is your gateway to a successful career as a Treasury Analyst, so make it a compelling narrative of your financial expertise and achievements.

Treasury Analyst Resume Summary Examples

Your resume summary is the first impression you make on potential employers. Craft a powerful one that encapsulates your skills and experiences as a Treasury Analyst:

- “Results-driven Treasury Analyst with over 5 years of experience, adept at optimizing cash flow and implementing robust risk management strategies.”

- “Detail-oriented Finance Professional with a proven track record in financial analysis and effective treasury management, contributing to enhanced organizational financial health.”

- “Strategic Treasury Analyst with expertise in navigating complex financial markets, negotiating favorable terms, and driving financial growth.”

Your summary should be a concise snapshot of your expertise, leaving employers eager to delve deeper into your qualifications.

Experience Section for Your Treasury Analyst Resume

The experience section of your resume is the narrative of your professional journey. Here are some examples to guide you in presenting your treasury management experience:

- “Led cash flow optimization initiatives, resulting in a 15% reduction in idle funds and increased liquidity for strategic investments.”

- “Successfully implemented a risk management framework, minimizing exposure to market volatility and protecting the company against financial uncertainties.”

- “Negotiated favorable credit terms with financial institutions, saving the company $100,000 annually in interest payments.”

Each experience is a chapter in your treasury management story, showcasing your ability to drive financial success.

Educational Background for Your Treasury Analyst Resume

Your educational background is a testament to your foundation in finance. List your academic achievements and relevant certifications:

- Master of Business Administration in Finance, XYZ University, 2017.

- Bachelor of Science in Accounting, ABC University, 2015.

- Certified Treasury Professional (CTP), demonstrating expertise in treasury and financial management, 2018.

Your education is the bedrock of your financial knowledge, laying the groundwork for your success as a Treasury Analyst.

Skills Essential for a Treasury Analyst Resume

Your skill set is your toolkit for success as a Treasury Analyst. Here are the key skills you should possess:

Soft Skills:

- Financial acumen, a deep understanding of financial principles and market dynamics.

- Analytical skills, the ability to interpret complex financial data and trends.

- Effective communication, crucial for collaborating with cross-functional teams and presenting financial insights.

- Attention to detail, ensuring accuracy in financial analyses and reports.

- Adaptability, the ability to navigate changing financial landscapes and market conditions.

Hard Skills:

- Proficiency in financial modeling and analysis, using tools such as Microsoft Excel or specialized financial software.

- Knowledge of risk management strategies and techniques to mitigate financial risks.

- Negotiation skills, essential for securing favorable terms with financial institutions.

- Familiarity with financial regulations and compliance, ensuring adherence to industry standards.

- Strategic thinking, the ability to develop and execute financial strategies aligned with organizational goals.

Each skill is a tool in your treasury management arsenal, contributing to your success in the financial realm.

Common Mistakes to Avoid in Your Treasury Analyst Resume

As you craft your resume, be mindful of common pitfalls that can diminish its effectiveness. Avoid these mistakes to ensure your resume stands out:

- Avoid generic statements; tailor your resume for each application to highlight your fit for the specific role.

- Focus on achievements rather than job duties, providing depth and impact to your professional narrative.

- Include a well-crafted cover letter, seizing the opportunity to connect with potential employers and showcase your motivation for the role.

- Strike a balance with technical terms; too much jargon can obscure your value to non-finance professionals.

- Thoroughly proofread your resume to maintain a professional image and attention to detail.

Avoiding these common mistakes ensures your resume is a compelling representation of your treasury management expertise.

Guiding Principles for Your Treasury Analyst Resume

As you create your Treasury Analyst resume, keep these guiding principles in mind:

- Highlight your strategic impact, showcasing how your decisions contributed to the financial success of the organization.

- Demonstrate your adaptability, emphasizing instances where you navigated changing financial landscapes effectively.

- Showcase continuous learning, mentioning any additional certifications or training programs you’ve undertaken to stay current in the field.

- Align your resume with the specific requirements of the job, emphasizing skills and experiences relevant to the Treasury Analyst role.

Your resume is your canvas to paint a picture of your financial expertise, analytical skills, and strategic impact in the realm of treasury management.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Treasury Analyst job interview.

Armed with these insights and tips, you are now ready to craft a resume that is a true reflection of your journey, your skills, and your aspirations. Remember, your resume is not just a document; it is a canvas where you paint your career story, a story of growth, learning, and success. Best of luck!