Unlocking Success: The Role of a Chartered Accountant

As financial landscapes continue to evolve, the role of a Chartered Accountant (CA) has become increasingly crucial in organizations worldwide. This article explores the multifaceted role of a Chartered Accountant, a position that demands a unique blend of financial expertise, strategic thinking, and ethical responsibility.

What is the Role of a Chartered Accountant?

A Chartered Accountant is a financial expert who plays a pivotal role in ensuring the fiscal health of an organization. This position involves a harmonious blend of technical proficiency and ethical responsibility. Let’s delve deeper into the multifaceted role of a Chartered Accountant, a professional entrusted with the financial well-being of an organization.

A Chartered Accountant is responsible for overseeing financial transactions, ensuring compliance with financial regulations, and providing strategic financial advice to steer the organization towards success. They are often seen as trusted advisors, helping businesses make informed financial decisions. The role demands not only technical expertise but also effective communication skills to convey complex financial information to non-financial stakeholders.

What are the Chartered Accountant Job Requirements?

Embarking on the journey to become a Chartered Accountant requires meeting stringent requirements. Let’s explore the prerequisites that one needs to fulfill to embrace the role of a Chartered Accountant:

- A Bachelor’s or Master’s degree in Accounting, Finance, or a related field, showcasing a strong foundation in financial principles.

- Completion of the Chartered Accountancy program, demonstrating in-depth knowledge and expertise in accounting and financial management.

- Experience in auditing, accounting, or financial analysis, showcasing a trajectory of increasing responsibility.

- Strong analytical skills, attention to detail, and proficiency in financial software and tools.

- Excellent communication and interpersonal skills, essential for conveying complex financial information to diverse stakeholders.

- Adherence to ethical standards and a commitment to maintaining the integrity of financial information.

Continued professional development through certifications and staying abreast of changing financial regulations is crucial for a successful career as a Chartered Accountant.

What are the Responsibilities of a Chartered Accountant?

The role of a Chartered Accountant is diverse, encompassing financial management, compliance, and strategic planning. Let’s unravel the core responsibilities that define this role, each task contributing to the financial success of the organization:

- Conducting financial audits to ensure accuracy and compliance with regulatory standards.

- Preparing financial statements and reports, providing insights to support strategic decision-making.

- Advising organizations on financial planning, risk management, and investment strategies.

- Ensuring compliance with tax regulations and providing guidance on tax planning.

- Collaborating with cross-functional teams to provide financial insights for business planning and budgeting.

- Conducting internal financial reviews to identify areas for improvement and optimization.

- Staying informed about changes in financial regulations and incorporating best practices into financial management processes.

Each responsibility contributes to the financial health and sustainability of the organization, making the Chartered Accountant a linchpin in the business’s success.

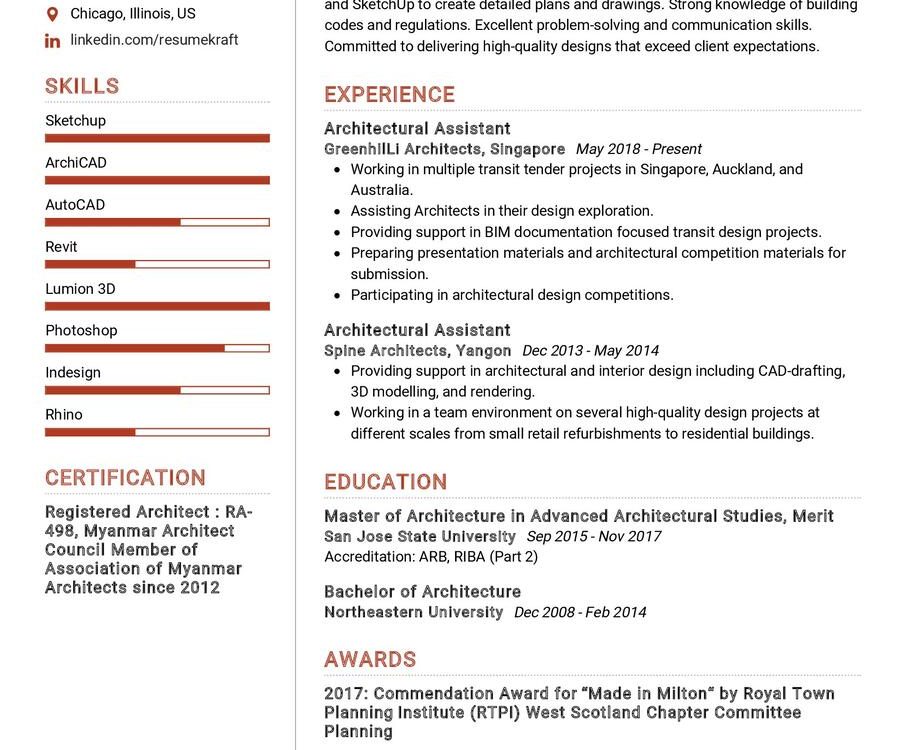

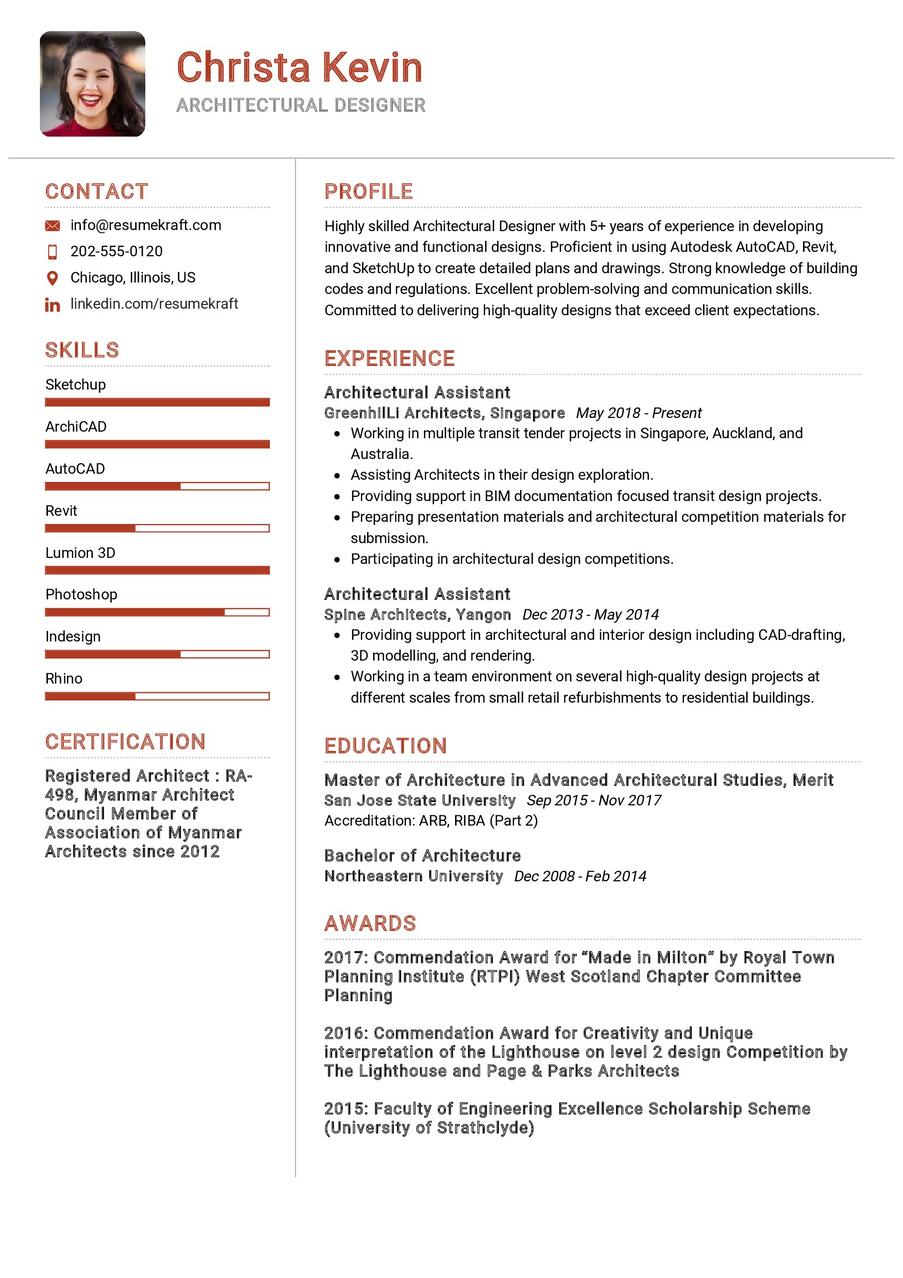

Chartered Accountant CV Writing Tips

Crafting a CV that stands out in the competitive job market is crucial for a Chartered Accountant. Here are some tips to help you create a compelling CV that highlights your skills and experiences:

- Highlight your experience in auditing or financial analysis, showcasing instances where your insights led to positive financial outcomes.

- Detail your involvement in strategic financial planning, narrating the impact of your contributions on the organization’s fiscal health.

- Quantify your achievements with metrics, providing a clear picture of your successes in financial management.

- List relevant certifications and professional development activities, demonstrating your commitment to staying current in the field.

- Personalize your CV for each application, emphasizing skills and experiences that align with the specific job requirements.

Each tip is a tool to help you craft a CV that showcases your expertise and sets you apart in the competitive field of finance.

Chartered Accountant CV Summary Examples

Your CV summary is the opening act of your career story, setting the stage for what follows. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Chartered Accountant with over 8 years of experience, adept at financial analysis and strategic planning, committed to ensuring fiscal integrity and driving organizational success.”

- “Results-oriented Chartered Accountant with a proven track record in conducting thorough audits and implementing effective financial management strategies.”

- “Experienced Chartered Accountant specializing in tax compliance and financial planning, known for delivering insightful financial advice to support business growth.”

Each summary is a window to your career, offering a glimpse of your journey, your strengths, and your vision as a Chartered Accountant.

Create a Strong Experience Section for Your Chartered Accountant CV

Your experience section is the heart of your CV, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your career story, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led financial audit teams in a prestigious accounting firm, resulting in a 15% improvement in audit efficiency.”

- “Implemented cost-saving measures through meticulous financial analysis, contributing to a 10% reduction in operational expenses.”

- “Provided strategic financial guidance to executive teams, leading to successful business expansion and increased profitability.”

Each experience is a chapter in your career book, narrating tales of challenges met, solutions found, and successes achieved.

Sample Education Section for Your Chartered Accountant CV

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Accounting, XYZ University, a journey of deep learning and specialization, 2015.

- Bachelor of Finance, ABC University, the foundation stone of your financial career, 2012.

- Chartered Accountant (CA) Certification, Institute of Chartered Accountants, demonstrating expertise and adherence to professional standards, 2016.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your career as a Chartered Accountant.

Chartered Accountant Skills for Your CV

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Chartered Accountant should possess:

Soft Skills:

- Financial analysis and reporting, the ability to interpret complex financial data.

- Strategic financial planning, the skill to provide guidance for long-term business success.

- Communication and interpersonal skills, the art of conveying financial insights effectively.

- Ethical responsibility, maintaining integrity and trust in financial practices.

- Attention to detail, ensuring accuracy in financial documentation.

Hard Skills:

- Audit and assurance, expertise in conducting thorough financial examinations.

- Tax compliance and planning, ensuring adherence to tax regulations and optimizing financial strategies.

- Financial software proficiency, utilizing tools for efficient financial management.

- Risk management, the ability to identify and mitigate financial risks.

- Business and financial acumen, understanding the broader impact of financial decisions on the organization.

Each skill is a tool, aiding you in providing exceptional financial guidance and contributing to the success of your organization.

Common Mistakes to Avoid When Writing a Chartered Accountant CV

As you craft your CV, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job. Here we list down the mistakes often seen in CVs and how to avoid them:

- Using a generic CV for multiple applications, a strategy that fails to showcase your unique fit for each role.

- Focusing solely on job duties without highlighting your achievements, resulting in a CV that lacks depth and impact.

- Neglecting the importance of a cover letter, a missed opportunity to narrate your story and connect with potential employers.

- Overloading your CV with technical jargon, a strategy that can obscure your true value to non-financial stakeholders.

- Failing to proofread, a mistake that can leave a dent in your professional image and attention to detail.

Each mistake is a pitfall; avoid them to craft a CV that is both authentic and compelling.

Key Takeaways for Your Chartered Accountant CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Chartered Accountant CV:

- Emphasize your financial expertise, showcasing the impact of your contributions on organizational success.

- Highlight your strategic financial planning skills, demonstrating your ability to guide businesses towards long-term prosperity.

- Quantify your achievements, providing concrete examples of your successes in financial management.

- Include a section on continued professional development, showcasing certifications and activities that demonstrate your commitment to staying current in the field.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Chartered Accountant job interview.

Armed with these insights and tips, you are now ready to craft a CV that is a true reflection of your journey, your skills, and your aspirations. Remember, your CV is not just a document; it is a canvas where you paint your career story, a story of growth, learning, and financial leadership. Best of luck!