Exploring the Role of a Chartered Accountant

As the financial landscape evolves, the role of a Chartered Accountant has become increasingly crucial in organizations globally. This position requires a unique blend of financial expertise, analytical skills, and a deep understanding of accounting principles. Let’s dive into the multifaceted role of a Chartered Accountant, exploring the skills, qualifications, and responsibilities that define this profession.

What are the Chartered Accountant Job Requirements?

Becoming a Chartered Accountant involves meeting specific requirements, combining academic achievements with practical experience. The path to this esteemed profession is marked by continuous learning and hands-on exposure. Here are the key prerequisites for aspiring Chartered Accountants:

- A Bachelor’s or Master’s degree in Accounting, Finance, or a related field, showcasing a strong foundation in the financial domain.

- Successful completion of the Chartered Accountancy (CA) qualification, a comprehensive examination that tests knowledge and practical skills.

- Hands-on experience in accounting, gained through internships or entry-level positions, demonstrating a practical understanding of financial processes.

- Analytical and problem-solving skills, honed through academic projects and real-world financial challenges.

- Excellent communication skills, crucial for conveying complex financial information to clients and stakeholders.

- Attention to detail and a high level of accuracy, vital qualities in ensuring financial records are precise and compliant with regulations.

Additional certifications in specialized areas of accounting can enhance your profile in the competitive job market.

Responsibilities of a Chartered Accountant

The role of a Chartered Accountant is multifaceted, encompassing various responsibilities that contribute to the financial health of an organization. Let’s explore the core duties that define this profession:

- Conducting financial audits, ensuring compliance with accounting standards and regulations.

- Preparing financial statements and reports, providing insights into the financial performance of the organization.

- Offering financial advice to clients or management, aiding in strategic decision-making.

- Ensuring tax compliance, preparing and filing accurate tax returns on behalf of clients or the organization.

- Conducting risk assessments, identifying potential financial threats, and implementing strategies to mitigate them.

- Staying updated on changes in financial regulations and accounting standards, adapting practices to ensure compliance.

- Collaborating with cross-functional teams, including finance, legal, and management, to achieve organizational goals.

Each responsibility comes with its own set of challenges and learning opportunities, shaping you into a financial professional par excellence.

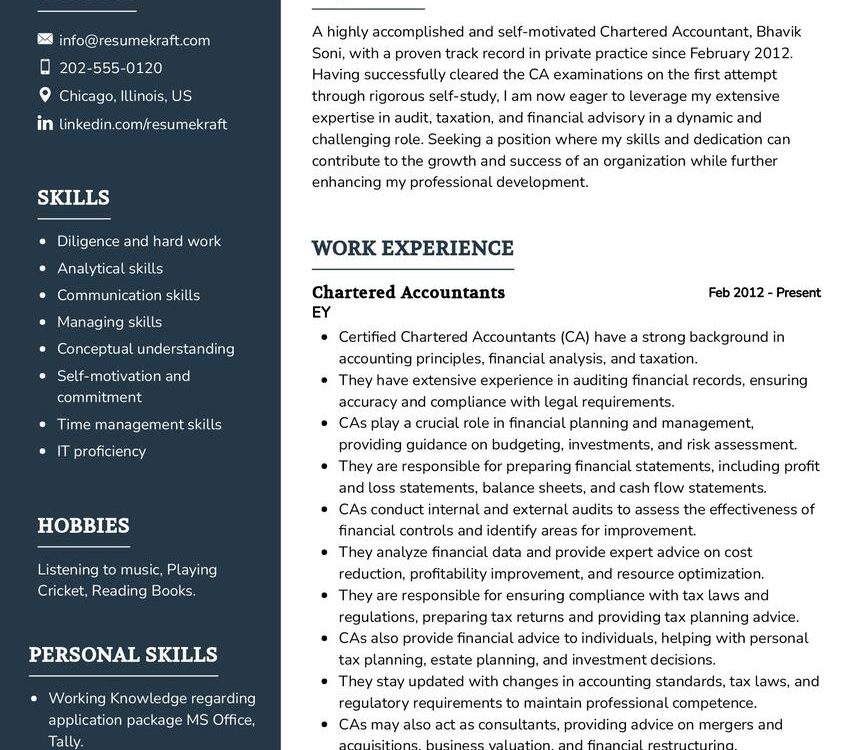

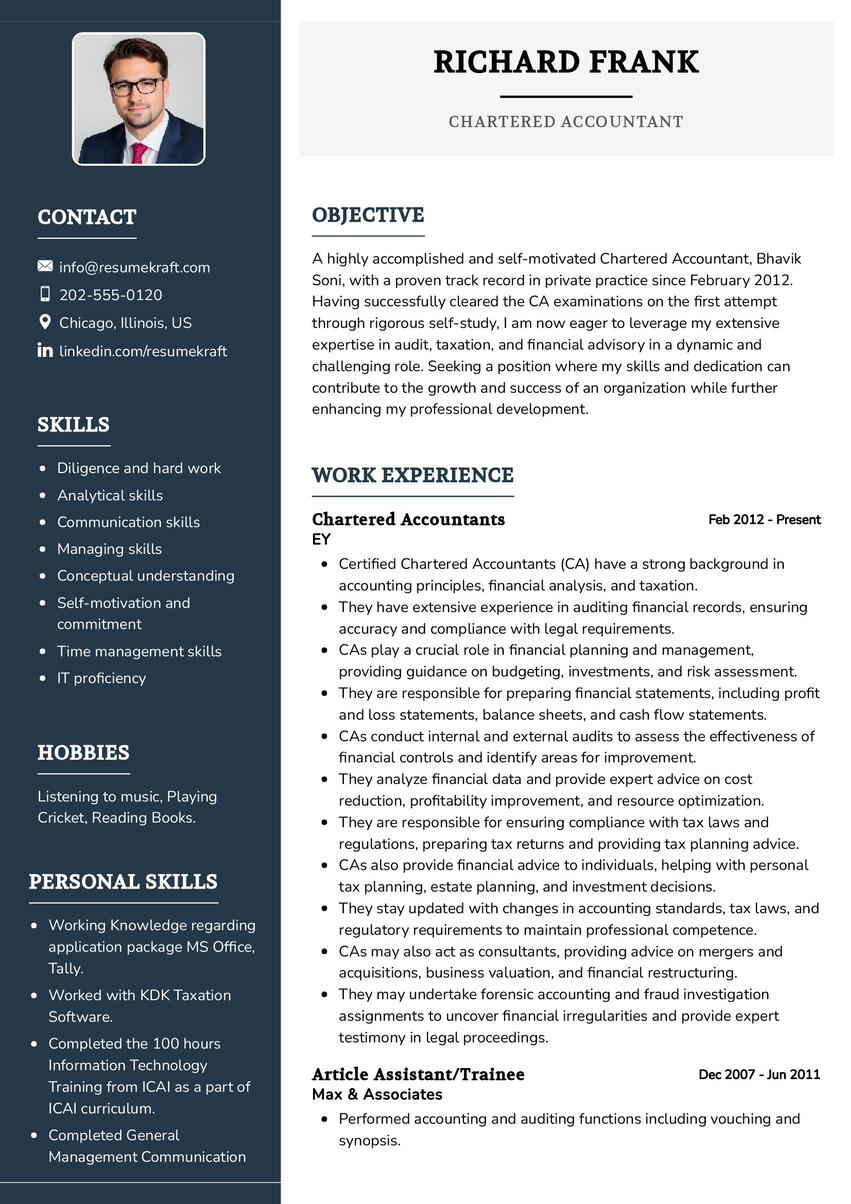

Chartered Accountant CV Writing Tips

Crafting a compelling Chartered Accountant CV is essential to stand out in the competitive job market. Your CV is a reflection of your education, experience, and skills. Here are some tips to create an impactful CV:

- Highlight your academic achievements, showcasing your performance in accounting and finance courses.

- Detail your experience in financial roles, emphasizing specific projects or achievements that demonstrate your impact.

- Include quantifiable achievements, such as cost savings, revenue increases, or successful audits, to showcase your contributions.

- List relevant certifications, such as the Chartered Accountancy qualification, prominently in your CV.

- Customize your CV for each application, aligning your skills and experience with the specific job requirements.

Each tip is a building block, helping you construct a CV that effectively communicates your expertise and accomplishments.

Chartered Accountant CV Summary Examples

Your CV summary is the opening statement of your professional story, setting the tone for what follows. It should be a powerful snapshot of your career, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Chartered Accountant with over 8 years of experience, adept at conducting thorough financial audits and providing strategic financial guidance.”

- “Results-driven Chartered Accountant with a proven track record in tax compliance and financial reporting, contributing to organizational success.”

- “Experienced financial professional with a Chartered Accountancy qualification, skilled in risk assessment and implementing effective financial strategies.”

Each summary is a window to your career, offering a glimpse of your journey, your strengths, and your vision as a Chartered Accountant.

Create a Strong Experience Section for Your Chartered Accountant CV

Your experience section is the core of your CV, showcasing the rich experiences you’ve gathered over the years. It is a space where you narrate your career story, highlighting milestones and learnings. Here are some examples to guide you:

- “Led financial audits for a diverse client portfolio, identifying and rectifying discrepancies, resulting in a 15% improvement in audit accuracy.”

- “Implemented cost-saving measures in tax compliance processes, reducing overall tax liabilities by 10% for the organization.”

- “Collaborated with cross-functional teams to streamline financial reporting processes, enhancing efficiency and accuracy in reporting.”

Each experience is a chapter in your career book, narrating tales of challenges met, solutions found, and successes achieved.

Sample Education Section for Your Chartered Accountant CV

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Finance, XYZ University, a journey of deep learning and specialization, 2016.

- Bachelor of Accounting, ABC University, the foundation stone of your accounting career, 2012.

- Chartered Accountancy (CA) qualification, a recognition of your expertise in financial management, 2014.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your career.

Chartered Accountant Skills for Your CV

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Chartered Accountant should possess:

Soft Skills:

- Analytical and critical thinking, the ability to analyze complex financial data and make informed decisions.

- Communication and interpersonal skills, essential for conveying financial information to clients and collaborating with cross-functional teams.

- Attention to detail, the meticulous approach to ensuring accuracy in financial records and reports.

- Time management, the skill to prioritize tasks and meet deadlines in a fast-paced financial environment.

- Integrity and ethical behavior, vital qualities in handling confidential financial information.

Hard Skills:

- Proficiency in financial software, showcasing your ability to work with tools essential for financial analysis and reporting.

- Expertise in tax laws and regulations, a skill crucial for ensuring tax compliance and minimizing liabilities.

- Knowledge of international accounting standards, demonstrating a global understanding of financial practices.

- Data analysis and interpretation, the ability to derive meaningful insights from complex financial data.

- Strategic financial planning, showcasing your ability to contribute to the organization’s long-term financial goals.

Each skill is a tool, aiding you in providing exceptional financial insights and contributing to organizational success.

Common Mistakes to Avoid When Writing a Chartered Accountant CV

As you craft your CV, it is crucial to steer clear of common pitfalls that can hinder your journey to landing your dream job. Here are some mistakes to avoid:

- Using a generic CV template, a strategy that fails to highlight your unique qualifications and experiences.

- Focusing solely on technical skills, neglecting to showcase your soft skills and interpersonal abilities.

- Overloading your CV with unnecessary details, creating a document that is difficult to navigate and comprehend.

- Omitting quantifiable achievements, missing an opportunity to showcase the impact of your contributions.

- Failing to tailor your CV for each application, using a one-size-fits-all approach that may not resonate with specific job requirements.

Avoiding these mistakes will help you craft a CV that is both authentic and compelling, increasing your chances of securing the desired position.

Key Takeaways for Your Chartered Accountant CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Chartered Accountant CV:

- Highlight your academic achievements and the Chartered Accountancy qualification prominently.

- Detail your experience with quantifiable achievements, showcasing the impact of your contributions.

- Emphasize your soft skills, such as communication and analytical abilities, alongside technical proficiency.

- Customize your CV for each application, aligning your skills and experience with specific job requirements.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Chartered Accountant job interview.

Armed with these insights and tips, you are now ready to craft a CV that is a true reflection of your journey, your skills, and your aspirations. Remember, your CV is not just a document; it is a canvas where you paint your career story, a story of growth, learning, and financial expertise. Best of luck!