What is the Role of a Credit & Collections Team Leader?

In the financial landscape, the role of a Credit & Collections Team Leader stands pivotal. They steer the team responsible for monitoring and managing the credit and collections processes of a company. This role is not just about leadership; it is about strategy, analysis, and ensuring the financial health of the organization. Let’s delve deeper into the multifaceted role that balances leadership with financial acumen.

A Credit & Collections Team Leader wears many hats. They are strategists, understanding the market trends and setting policies that safeguard the company’s interests while maintaining healthy customer relationships. They are mentors, nurturing a team of professionals to excel in their roles. Sharing personal anecdotes from their journey, they foster a culture of learning and growth. Let’s explore this role in detail, understanding the nuances that make it a cornerstone in the financial sector.

What are the Credit & Collections Team Leader Job Requirements?

Aspiring to become a Credit & Collections Team Leader involves meeting a series of stringent requirements that ensure you are well-equipped to handle the responsibilities that come with the role. Let’s break down the essential prerequisites one needs to fulfill to step into this vital role:

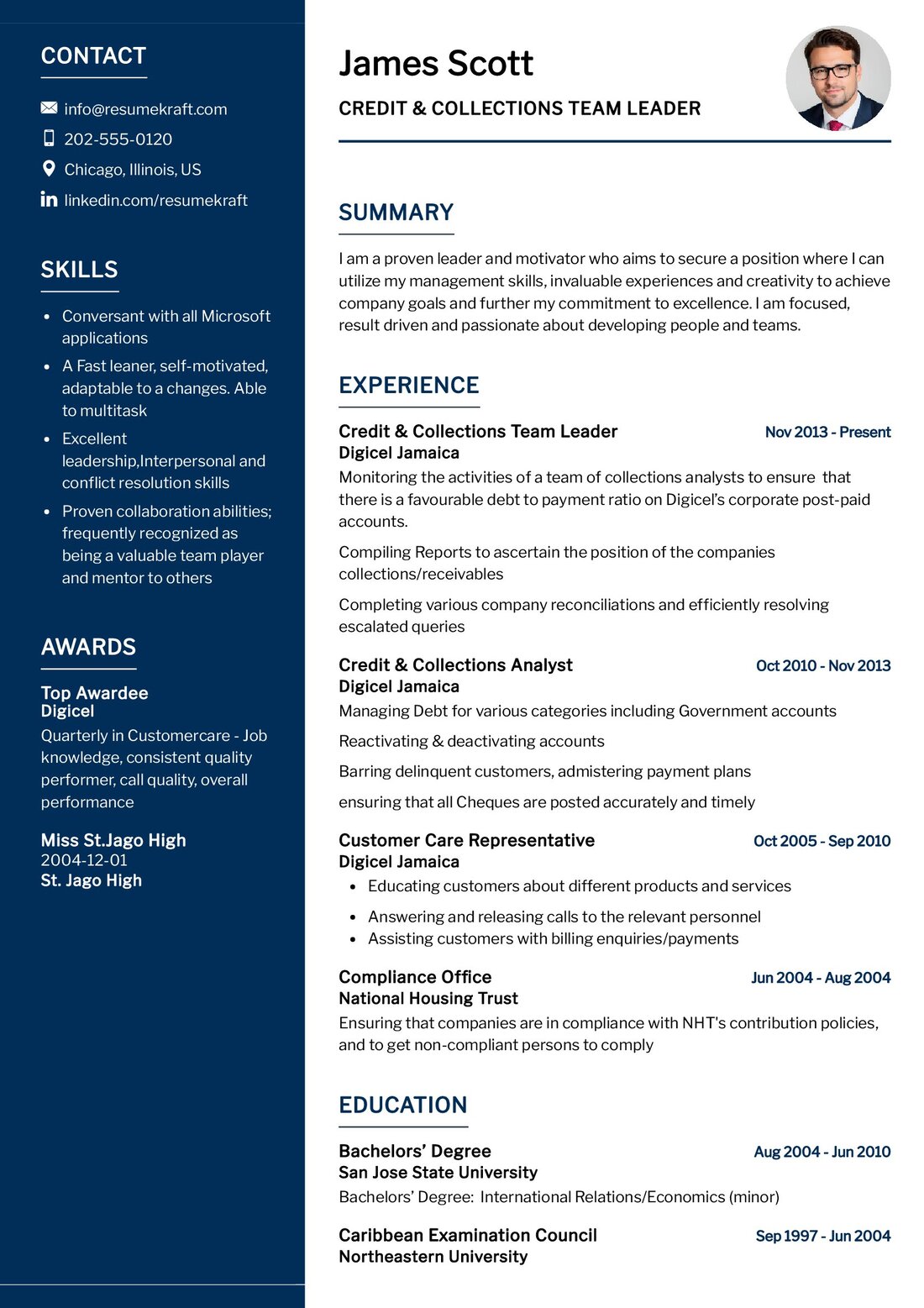

- A Bachelor’s degree in finance, accounting, or a related field, laying a strong educational foundation.

- Proven experience in credit and collections, showcasing a trajectory of growth and learning.

- Strong analytical skills, a prerequisite to delve deep into financial data and derive actionable insights.

- Leadership experience, a testimony to your ability to lead a team to success.

- Excellent communication skills, vital in negotiating and maintaining fruitful relationships with clients.

- Proficiency in using credit management software, a skill that brings efficiency to the role.

Securing additional certifications in credit management can be a feather in your cap, enhancing your profile in the competitive job market. It showcases a commitment to learning and staying abreast of the latest developments in the field.

What are the Responsibilities of a Credit & Collections Team Leader?

The role of a Credit & Collections Team Leader is a tapestry of varied responsibilities, each critical in ensuring the financial stability of the organization. Let’s unravel the core responsibilities that define this role:

- Developing and implementing credit policies, a task that involves strategic thinking and a deep understanding of market dynamics.

- Overseeing the collections process, ensuring a balance between maintaining customer relationships and safeguarding the company’s interests.

- Leading and mentoring a team of professionals, fostering a culture of growth and learning.

- Conducting risk assessments, a critical task to mitigate potential financial risks.

- Collaborating with other departments, ensuring a cohesive approach to credit and collections management.

- Preparing and presenting reports to the management, offering insights into the financial health of the organization.

Each responsibility comes with its own set of challenges, offering a role rich in learning and growth opportunities.

Credit & Collections Team Leader Resume Writing Tips

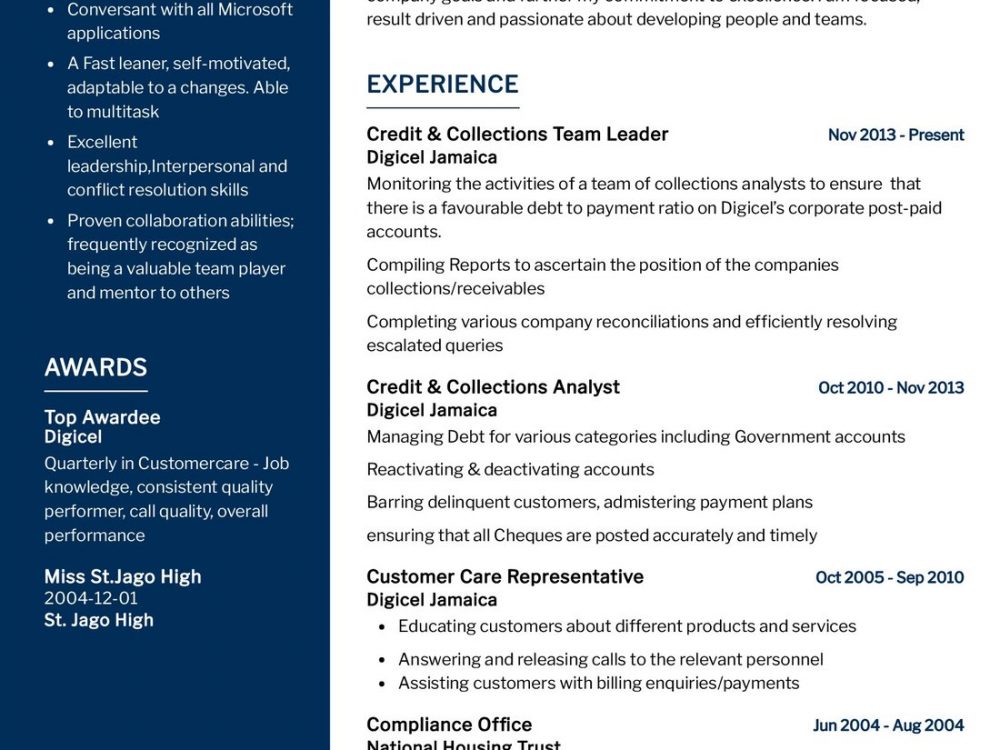

Creating a resume that stands tall in the pool of applications is a critical step in landing the Credit & Collections Team Leader role. Here are some tips to craft a resume that narrates your story effectively:

- Highlight your experience in credit and collections, showcasing your journey and the milestones achieved.

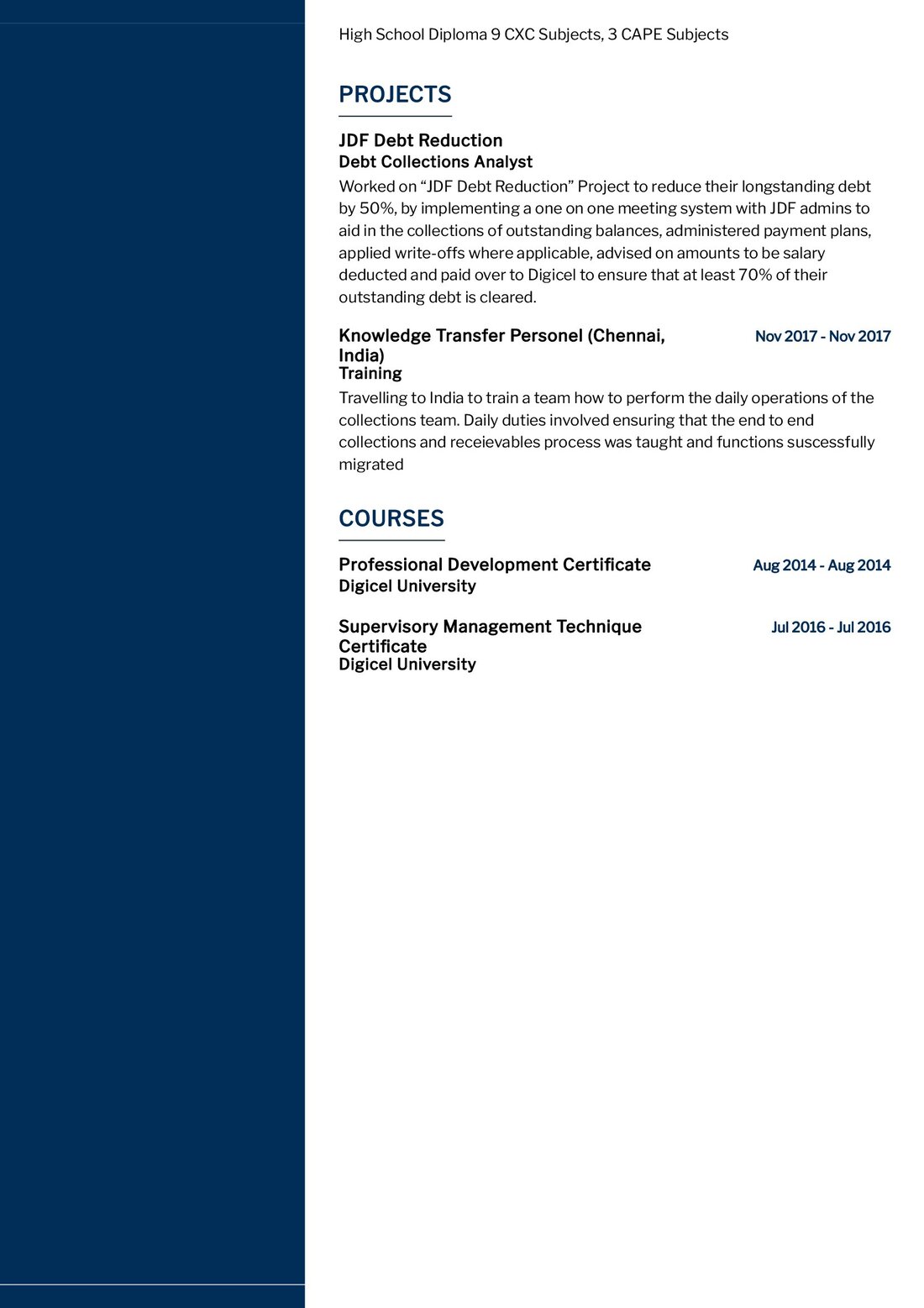

- Detail any initiatives or strategies you have spearheaded, narrating the impact they had on the organization’s financial health.

- Include metrics to quantify your achievements, offering a tangible measure of your successes.

- List relevant certifications, showcasing your commitment to learning and staying updated in the field.

- Personalize your resume for the specific role, weaving a narrative that resonates with the job description.

Each tip is a brushstroke, helping you paint a portrait that is both compelling and authentic.

Credit & Collections Team Leader Resume Summary Examples

Your resume summary is the opening act of your career story, setting the stage for what is to follow. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Credit & Collections Team Leader with over 10 years of experience, adept at strategizing and implementing policies that have significantly improved financial health.”

- “Dedicated Team Leader with a proven track record in reducing delinquencies and improving cash flow, bringing a deep understanding of credit management.”

- “Experienced leader with a focus on fostering a collaborative and learning-oriented team environment, skilled in risk assessment and financial analysis.”

Each summary offers a glimpse into your career, showcasing your strengths and your vision as a Credit & Collections Team Leader.

Create a Strong Experience Section for Your Credit & Collections Team Leader Resume

The experience section is the heart of your resume, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your career story, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led a team to reduce account receivables by 20%, a testimony to strategic policy implementation and effective leadership.”

- “Pioneered the adoption of cutting-edge credit management software, streamlining processes and improving efficiency.”

- “Developed and led training programs, nurturing a team of professionals to excel in their roles.”

Each experience narrates a chapter of your career, showcasing the challenges met and the successes achieved.

Sample Education Section for Your Credit & Collections Team Leader Resume

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Business Administration, XYZ University, a journey of deep learning and specialization, 2018.

- Bachelor of Commerce, ABC University, the foundation stone of your financial career, 2012.

- Certified Credit Professional, a recognition of your expertise in credit management, 2015.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your career.

Credit & Collections Team Leader Skills for Your Resume

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Credit & Collections Team Leader should possess:

Soft Skills:

- Leadership and team management, the ability to steer your team towards success.

- Communication and interpersonal skills, the art of conveying your thoughts effectively and building strong relationships.

- Problem-solving abilities, the knack of finding solutions in challenging situations.

- Attention to detail, the meticulous approach to ensuring nothing slips through the cracks.

- Adaptability and resilience, the strength to bounce back and adapt to changing scenarios.

Hard Skills:

- Financial analysis, a deep understanding of analyzing financial data to derive actionable insights.

- Proficiency in credit management software, a skill that brings efficiency to the role.

- Knowledge of credit and collections regulations, an understanding that ensures compliance and safeguards the company’s interests.

- Budget and resource management, the acumen to manage resources efficiently.

- Project management, the ability to see a project through from inception to completion successfully.

Each skill is a tool, aiding you in steering the credit and collections team to success.

Most Common Mistakes to Avoid When Writing a Credit & Collections Team Leader Resume

As you craft your resume, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job. Here we list down the mistakes often seen in resumes and how to avoid them:

- Using a one-size-fits-all approach, a strategy that fails to showcase your unique fit for the role.

- Listing job duties without showcasing your achievements, a narrative that lacks depth.

- Ignoring the cover letter, a missed opportunity to narrate your story and connect with the potential employer.

- Overloading your resume with financial jargon, a strategy that can obscure your true value.

- Failing to proofread, a mistake that can leave a dent in your professional image.

Each mistake is a pitfall, avoid them to craft a resume that is both authentic and compelling.

Key Takeaways for Your Credit & Collections Team Leader Resume

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Credit & Collections Team Leader resume:

- Highlight your leadership experiences, showcasing your journey as a leader.

- Customize your resume, weaving a narrative that resonates with the specific role.

- Include a diverse skill set, presenting a well-rounded profile.

- Proofread meticulously, ensuring a polished, professional resume.

Armed with these insights and tips, you are now ready to craft a resume that is a true reflection of your journey, your skills, and your aspirations. Remember, your resume is not just a document; it is a canvas where you paint your career story, a story of growth, learning, and leadership. Best of luck!