What Should Be Included In A Credit Operation Executive Resume?

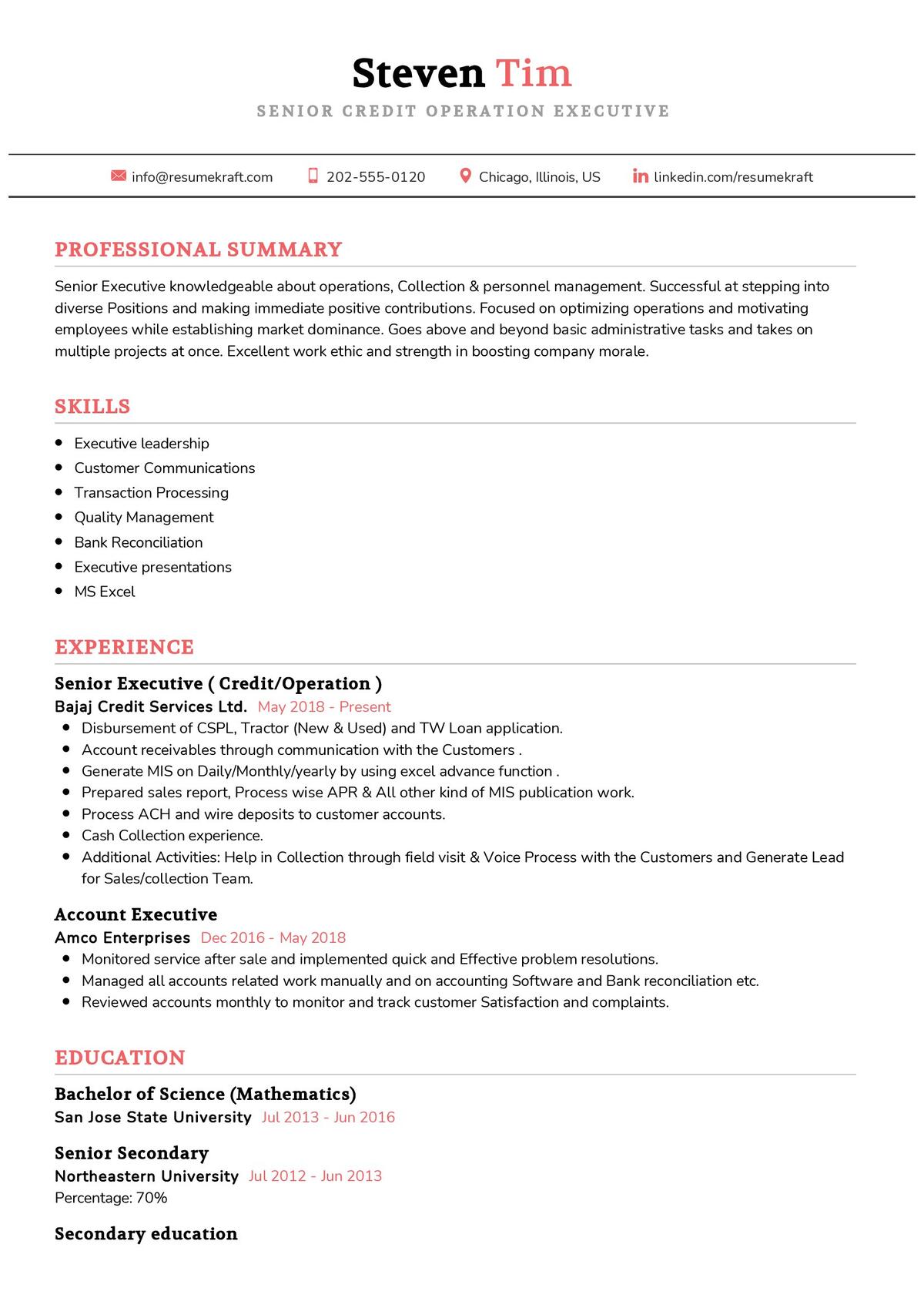

A Credit Operation Executive resume should include a variety of technical and managerial skills that demonstrate your ability to undertake a wide range of tasks. It should showcase your expertise in the banking and financial industry, especially in the field of credit operations. Your resume should be tailored to the specific position you are applying for and should focus on your qualifications, experience, and accomplishments.

When creating your resume, start by including your contact information, followed by a summary of qualifications. This section should include a brief statement about your professional experience in the credit operations field, as well as any awards or certifications you may have acquired.

The next section should list your professional experience. Here, you should specify the position you held, the company you worked for, and the dates of your employment. Further, include a brief description of the tasks you performed. Be sure to highlight projects you have completed and the successes you achieved.

Additionally, list any organizations or certifications you have obtained. Specify any relevant courses you have taken or continuing education programs you have participated in. Furthermore, include any technical skills you possess, such as proficiency in computer software or other programs related to credit operations.

Finally, you should list any references you may have. These should be professional contacts who can attest to your work ethic and the quality of the work you have done in the credit operations field.

By including all of the above information, a Credit Operation Executive resume will accurately represent your qualifications and ensure you stand out amongst other jobseekers.

What Skills Should I Put On My Resume For Credit Operation Executive?

When you are writing a resume for a position as a Credit Operation Executive, it is important to make sure that you include all the skills and experience that you have related to this role. As a Credit Operation Executive, you are responsible for ensuring that the company’s accounts are correctly maintained and managed. This means that you will need to have a good understanding of financial and accounting principles, as well as the ability to analyze data and create reports. You should also be comfortable working with software programs to help manage accounts.

In addition to these basic skills, you should also list the specific experience and capabilities that you possess that make you a great fit for the position. Some of the skills to consider including on your resume include:

- Analytical Skills: As a Credit Operation Executive, you will be expected to be able to analyze data and create reports to help the company manage their accounts. Make sure you include any analytics-related skills on your resume.

- Organizational Skills: As a Credit Operation Executive, you need to be able to organize and manage accounts, as well as the data associated with them. Make sure you list any organizational skills you have that can help the company maintain and manage their accounts.

- Communication Skills: As a Credit Operation Executive, you will be in charge of communicating with various departments within the company. Make sure you list any exceptional communication skills you possess on your resume.

- Software Skills: As a Credit Operation Executive, you will need to be comfortable with a variety of software programs that help manage accounts. Make sure you list any software skills you have on your resume.

What Is The Job Description Of The Credit Operation Executive?

A Credit Operation Executive is a professional responsible for managing the credit operations of a financial institution. They are responsible for overseeing the credit operation process, including the review of loan applications, the analysis of credit risk, the review of credit documents, and the development of credit policies. They must also be able to coordinate with other departments, such as the accounting and loan processing departments, to ensure that the credit operations are running smoothly.

The primary responsibilities of a Credit Operation Executive include developing and managing loan policies, analyzing and managing credit risk, and overseeing the loan process. They must ensure that all credit policies are followed and that all loan documents are accurate. Additionally, they must be able to evaluate loan requests, review documents for accuracy, and assess the creditworthiness of applicants.

A Credit Operation Executive must also be able to identify potential risks and develop strategies to minimize them. They must be able to work with other departments to coordinate the loan process, and they must be able to provide feedback to management on the status and performance of the loan process. A Credit Operation Executive must also be able to develop reports that provide detailed information on the credit operations.

In addition to their primary responsibilities, a Credit Operation Executive must also be familiar with the laws and regulations governing the lending industry, and they must be able to interpret and implement them. They must also be familiar with the financial accounting principles and practices that apply to loan operations. Finally, a Credit Operation Executive must be able to communicate effectively with both internal and external customers, and they must be able to provide accurate, timely information to them.

What Is A Good Objective For A Credit Operation Executive Resume?

When writing a resume for a Credit Operation Executive, it is important to craft a powerful objective. This objective should be concise and summarize the candidate’s value and experience. An objective is the first thing a potential employer will read and will give them an idea of the type of professional they will be working with.

A good objective statement should highlight the candidate’s credentials and experience in the credit operations field, such as their understanding of financial regulations and credit management policies. It can also focus on the value the candidate can bring to a company, such as their ability to maximize credit opportunities, prepare and analyze financial data, and develop and manage successful operations. Furthermore, the objective should describe the candidate’s desired role and the challenges and goals they are looking to achieve.

It is important to keep the objective statement focused on the job and the skills the candidate can bring to the table. This will not only help the candidate stand out and make the employer take notice, but it will also demonstrate that they are making an effort to showcase their capabilities. Ultimately, the goal is to make sure the employer recognizes the candidate as a valuable asset to their organization.

What Are The Career Prospects In The Credit Operation Executive?

Credit Operation Executives are highly sought-after professionals in the financial industry. As businesses continue to rely on financial practices to ensure the health of their operations, Credit Operation Executives are essential for ensuring that credit is offered responsibly and is being used correctly. As a Credit Operation Executive, you will be responsible for evaluating and managing credit requests, conducting credit assessments, and evaluating current and potential credit risk. Additionally, you will ensure that accounts receivable and payments are made according to their contractual agreements.

The career prospects of a Credit Operation Executive are quite promising, as these professionals are in high demand across the financial sector. With the right knowledge and experience, Credit Operation Executives can expect to make a very competitive salary. The job also offers numerous opportunities for professional advancement and career growth. Credit Operation Executives can expect to work in a variety of settings, from banks and financial institutions to large corporations and other organizations.

The role of Credit Operation Executive requires a great deal of skill and knowledge. To be successful in this position, you must have an in-depth understanding of the financial industry and credit policies. You must also have excellent analytical and problem-solving skills, as well as the ability to make sound decisions based on data. Additionally, you must be highly organized and be able to manage a large volume of work with accuracy and efficiency.

In order to land a job as a Credit Operation Executive, it is essential to have a well-written resume. A successful resume should highlight your qualifications, experience, and accomplishments in the field. Additionally, it should clearly showcase your knowledge of credit operation processes, financial regulations, and risk management

Key Takeaways for an Credit Operation Executive resume

When it comes to crafting a resume as a Credit Operation Executive, there are a few key takeaway points that you should keep in mind. First, you’ll want to make sure that your resume is tailored to the specific position you are applying for. Make sure that you include any relevant experience or skills that may be applicable to the role and are sure to highlight any relevant achievements you have made.

It’s also important to use keywords specific to the role you are applying for. Credit Operation Executive positions often look for people with experience in working with financial data, so make sure to include any experience in this field on your resume.

Finally, be sure to include specifics about any projects you have successfully completed, or metrics that you have helped to improve or increase. This can be a great way to show your value and help you stand out from competing candidates.

By keeping these key takeaways in mind when crafting your resume for a Credit Operation Executive role, you can ensure that you have the best chance of standing out and getting the job.