Are you a Data Analytics Manager by profession and looking for an exciting career? We have good news for you! use our professional Data Analytics Manager Resume example. You don’t have to start writing from scratch. Just click “Edit Resume” and modify it with your details. Update the template fonts and colors have the best chance of landing your dream job. Find more resume samples.

Data Analytics Manager Resume Example

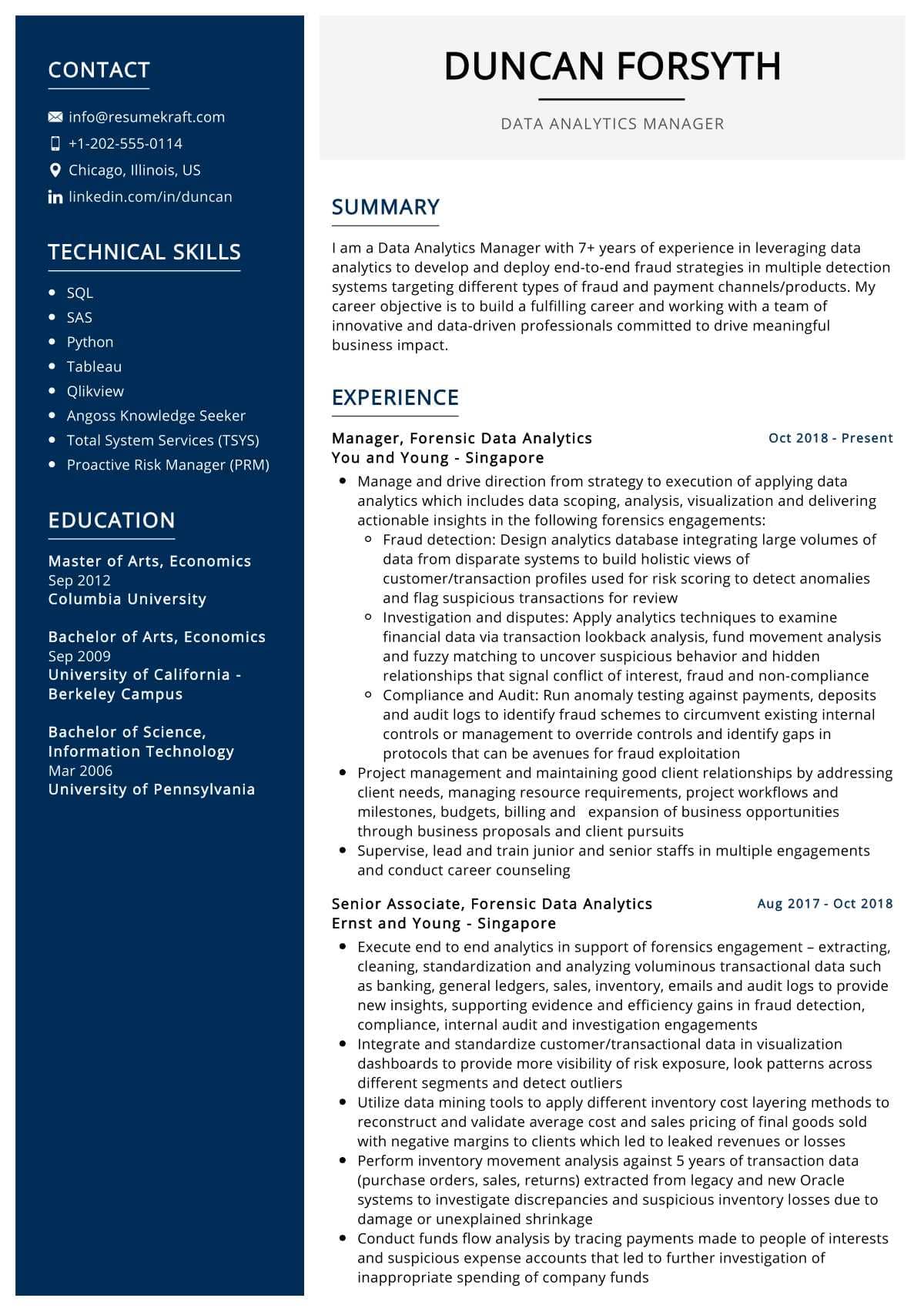

Duncan

Data Analytics Manager

Chicago

Summary

I am a Data Analytics Manager with 7+ years of experience in leveraging data analytics to develop and deploy end-to-end fraud strategies in multiple detection systems targeting different types of fraud and payment channels/products. My career objective is to build a fulfilling career and working with a team of innovative and data-driven professionals committed to driving meaningful business impact.

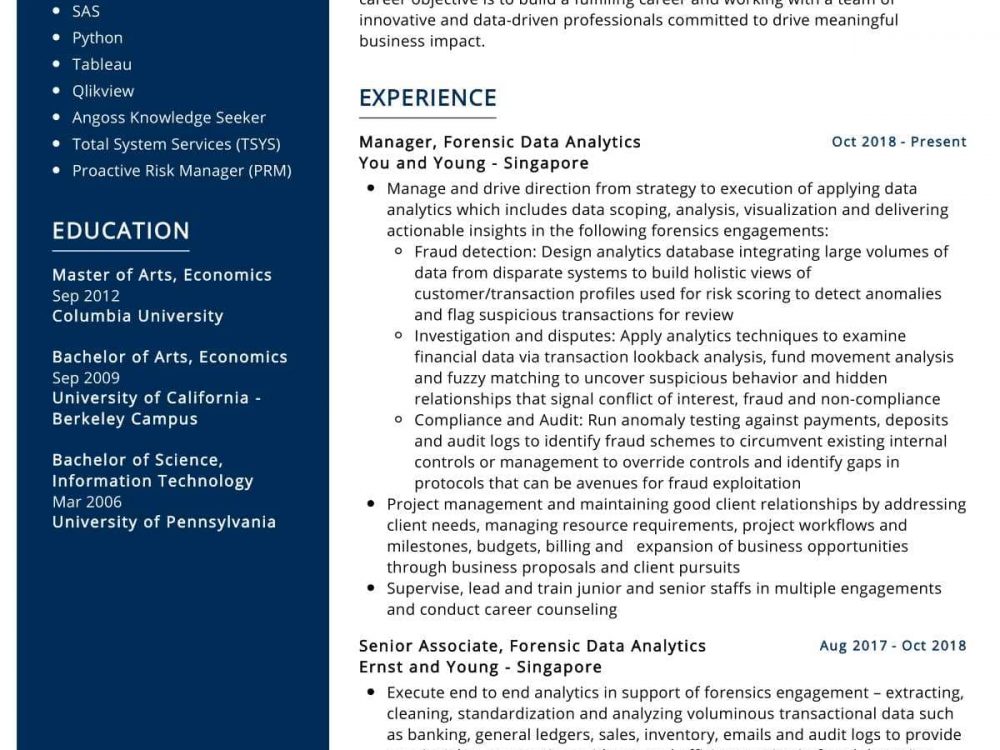

Skills

Experience

Manager, Forensic Data Analytics

You and Young – Singapore

- Manage and drive direction from strategy to execution of applying data analytics which includes data scoping, analysis, visualization and delivering actionable insights in the following forensics engagements:

- Fraud detection: Design analytics database integrating large volumes of data from disparate systems to build holistic views of customer/transaction profiles used for risk scoring to detect anomalies and flag suspicious transactions for review

- Investigation and disputes: Apply analytics techniques to examine financial data via transaction lookback analysis, fund movement analysis and fuzzy matching to uncover suspicious behavior and hidden relationships that signal conflict of interest, fraud and non-compliance

- Compliance and Audit: Run anomaly testing against payments, deposits and audit logs to identify fraud schemes to circumvent existing internal controls or management to override controls and identify gaps in protocols that can be avenues for fraud exploitation

- Project management and maintaining good client relationships by addressing client needs, managing resource requirements, project workflows and milestones, budgets, billing and expansion of business opportunities through business proposals and client pursuits

- Supervise, lead and train junior and senior staffs in multiple engagements and conduct career counseling

Senior Associate, Forensic Data Analytics

Ernst and Young – Singapore

- Execute end to end analytics in support of forensics engagement – extracting, cleaning, standardization and analyzing voluminous transactional data such as banking, general ledgers, sales, inventory, emails and audit logs to provide new insights, supporting evidence and efficiency gains in fraud detection, compliance, internal audit and investigation engagements

- Integrate and standardize customer/transactional data in visualization dashboards to provide more visibility of risk exposure, look patterns across different segments and detect outliers

- Utilize data mining tools to apply different inventory cost layering methods to reconstruct and validate average cost and sales pricing of final goods sold with negative margins to clients which led to leaked revenues or losses

- Perform inventory movement analysis against 5 years of transaction data (purchase orders, sales, returns) extracted from legacy and new Oracle systems to investigate discrepancies and suspicious inventory losses due to damage or unexplained shrinkage

- Conduct funds flow analysis by tracing payments made to people of interests and suspicious expense accounts that led to further investigation of inappropriate spending of company funds

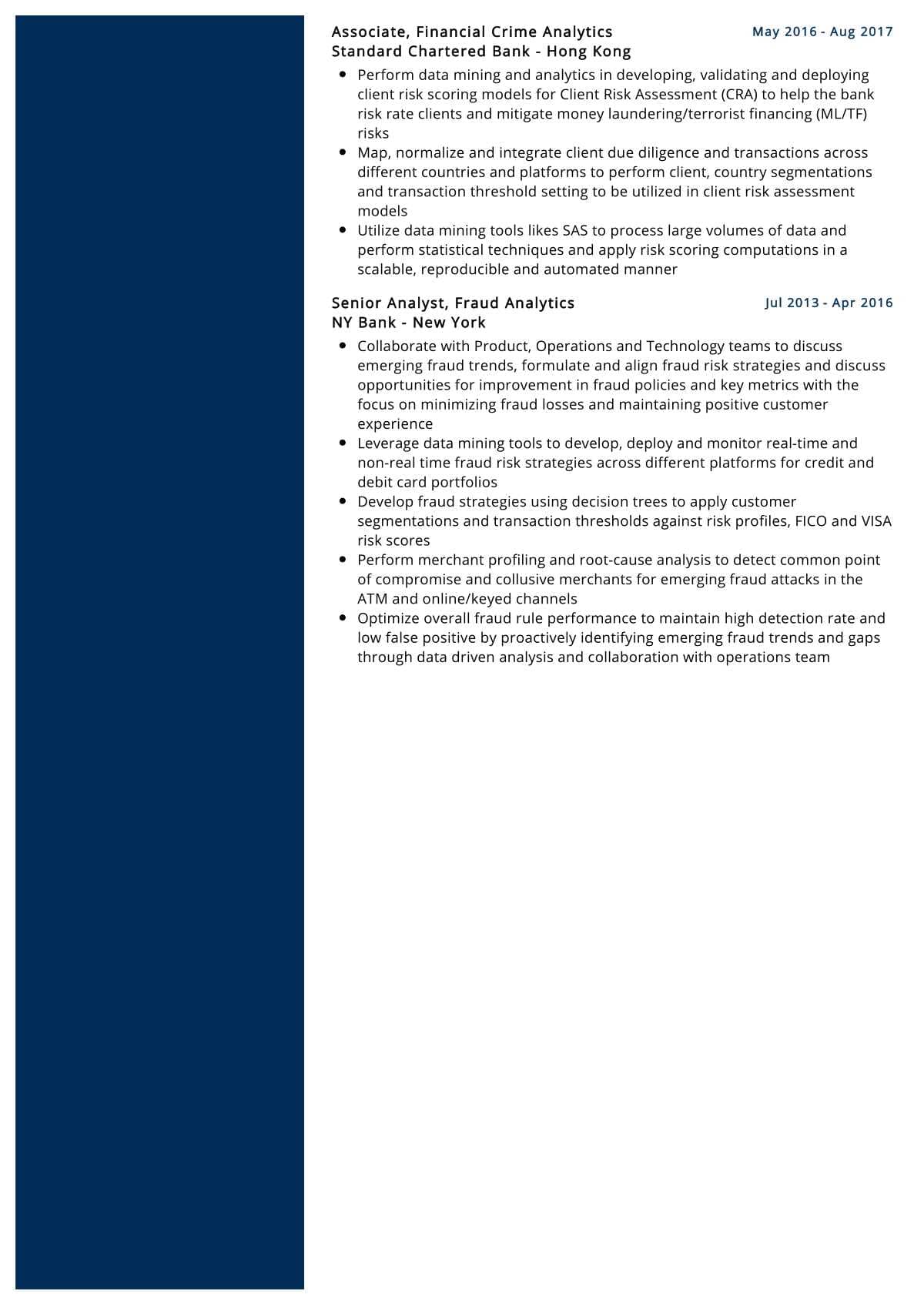

Associate, Financial Crime Analytics

Standard Chartered Bank – Hong Kong

- Perform data mining and analytics in developing, validating and deploying client risk scoring models for Client Risk Assessment (CRA) to help the bank risk rate clients and mitigate money laundering/terrorist financing (ML/TF) risks

- Map, normalize and integrate client due diligence and transactions across different countries and platforms to perform client, country segmentations and transaction threshold setting to be utilized in client risk assessment models

- Utilize data mining tools likes SAS to process large volumes of data and perform statistical techniques and apply risk scoring computations in a scalable, reproducible and automated manner

Senior Analyst, Fraud Analytics

NY Bank – New York

- Collaborate with Product, Operations and Technology teams to discuss emerging fraud trends, formulate and align fraud risk strategies and discuss opportunities for improvement in fraud policies and key metrics with the focus on minimizing fraud losses and maintaining positive customer experience

- Leverage data mining tools to develop, deploy and monitor real-time and non-real time fraud risk strategies across different platforms for credit and debit card portfolios

- Develop fraud strategies using decision trees to apply customer segmentations and transaction thresholds against risk profiles, FICO and VISA risk scores

- Perform merchant profiling and root-cause analysis to detect common point of compromise and collusive merchants for emerging fraud attacks in the ATM and online/keyed channels

- Optimize overall fraud rule performance to maintain high detection rate and low false positive by proactively identifying emerging fraud trends and gaps through data driven analysis and collaboration with operations team

Education

Master of Arts, Economics

Columbia University

Bachelor of Arts, Economics

University of California – Berkeley Campus

Bachelor of Science, Information Technology

University of Pennsylvania

Languages

Career Expert Tips:

- Always make sure you choose the perfect resume format to suit your professional experience.

- Ensure that you know how to write a resume in a way that highlights your competencies.

- Check the expert curated popular good CV and resume examples

Data Analytics Manager Resume with Writing Guide

For those who have an interest in this ever-growing and lucrative field, a Data Analytics Manager resume can be the key to their success. This article will provide you with information on what exactly makes up a resume for someone in the data analytics field, as well as what positions and skills they are looking for. By looking at this information, you will be able to tailor your resume and cover letter to emphasize important skills and experiences that are already known about you.

What is a data analytics resume?

A data analytics resume is a document of a person showing his or her experience in the form of accomplishments and skills. A data analytics manager should have solid experience in the way they interact with people, their company’s culture, and/or their industry. All these things are crucial for a successful data analytics manager. The data analytics manager is expected to be able to handle a wide variety of challenges that range from getting data or using it in a particular way to presenting it. They manage both the technology and the people and are accountable for accuracy. Data analytics managers must be able to work with programmers, statisticians, and computer scientists or others who share common goals and communicate effectively about those goals with other departments within their organization.

What does a Data Analytics Manager need to know to create a resume?

To prepare your resume for a data analytics manager position, you are going to need to include the following:

Employment History- You must include all of your work experience and tasks performed in this section. You should include all positions that you have held so that the hiring manager can see your progression and growth as an employee. Listing dates for each position will help the hiring manager recognize that you have maintained steady employment over time.

Locations- State your location for each job that you have held so that the hiring manager can see how close you are to their organization. Be sure to also include any special circumstances that may have affected the location of your employment, such as relocation.

Skills and Knowledge- This section is going to be where you list all of your work experience and other skills that you possess or acquired while in the position. This is where you are going to want to list all of your technical and analytical skills. This is also where you will want to show the hiring manager that you are familiar with their specific industry or field. For example, if you are applying for a job at IBM, include the fact that you have learned about their company and products.

Education- List your education in this section. Include any schools that may be relevant to the job for which you are applying and employment dates if possible.

Professional Membership-List any professional associations that you are a member of and the positions that you hold in those associations. Listing information about the organizations for which you have worked shows the hiring manager that you have had experience working with others in a similar profession.

Awards- A data analytics resume should include any awards or honors that you have attained during your employment. Be sure to list these awards by name and what category they fall into, such as most innovative or outstanding employee.

List of Typical Responsibilities For a Data Analytics Manager Resume:

- Completes and submits reports and analyses to management with timely, accurate, and complete information.

- Prepares data for analysis or studies analytical results.

- Researches methods and techniques for improving data analysis efficiency.

- Conducts cost-benefit analyses on program changes or improvements based on research findings or analytical results.

- Recommends processes for collecting information or developing systems.

- Recommends methods for presenting data in a format that is easy to understand.

- May direct and oversee other workers engaged in gathering, analyzing, recording, and interpreting data.

- May supervise computer programmers who produce computer software for statistical analysis and reporting purposes.

Top 10 Must-have Data Analytics Manager Skills:

- Data Analytics Manager Experience:

- Data Analytics Recruitment:

- Data Analytics Talent Acquisition:

- Data Analytics Recruiting Process:

- Data Analytics Resume Tips:

- Accounting Skills for Data Analytics Manager:

- Data Security Skills for Data Analyst-Manager:

- Marketing Skills for a Business Manager-Data Analyst with a Concentration in Internet Marketing and eCommerce Strategy

- Business Negotiating Skills for Data Analyst-Manager:

- Top 10 Data Analytics Manager Resume Secrets:

If you don’t have the proper experience, you can always “fake it till you make it”. You can work your way up to the top of the ladder, with your hunger and passion. Start out small, start out as a data analyst at a smaller company. The more you prove yourself, the better job offers will come in from every direction.

Tips to write a Data Analytics Manager Resume Summary:

- Use clear and concise language.

- Create a Data Analytics Manager Resume that is simple to read.

- Use action verbs in your Data Analytics Manager Resume if possible.

- Use bullet points to style your Data Analytics Manager Resume Summary if possible

- Use a Data Analytics Manager Resume Summary that is well written.

- Use a Data Analytics Manager Resume Summary the interests the reader.

- Use a Data Analytics Manager Resume Summary that will attract attention and interest

- Use a Data Analytics Manager Resume Summary to maximize your achievements and strengths

- Use a Data Analytics Manager Resume Summary that highlights your achievements, responsibilities, tasks, and duties

- Use action verbs in your Data Analytics Manager Resume if possible

How to write a Data Analytics Manager Resume with No experience:

- Understand your skill set at some depth.

2.Figure out which skills in your skill set are most valuable to the employer.

3.Use those skills in your resume.

4.Use that experience to show the schools or employers who might be interested in you.

5.Polish your resume to convey these skill sets in an impressive way.

6.Present a polished and impressive Data Analytics Manager Resume to the employers of your choice, building upon your previous successes and adding new achievements on the way!

When you take a look at a job description for a Data Analytics Manager, what can you see? You know that this role requires good strong analytical skills and data management expertise.

How to write a Data Analytics Manager Cover Letter:

- Introduction:

Introduces your letter as if you were applying for a position. You need to make it clear that you are applying for this position, which is described in detail as “how to write a Data Analytics Manager Resume” above. This is an introductory paragraph so it’s okay to go into more detail here without having to write anything aside from copy-pasting your resume introduction. - About yourself:

This goes into the specific details of your work experience. You may want to include anything from your skills and experience in the position, to your current employer (i.e. “to work for a few months with the big data analytics team at X corporation”), and the actual project you’re applying for (i.e. “attending training to learn how to apply big data analytics techniques to real-world problems; this position will facilitate that”). - Technical skills:

This is where you can explain what your responsibilities were within your current role/company. If you’re applying for a technical analytics role, explain what skills you must have to be qualified and some sort of description of the type of experience you had. - Education:

You can simply copy-paste what is in your LinkedIn profile here; otherwise, it’s okay to go into more detail about your education from high school, college, and/or professional training through this section. Choose a key that provides proof you’re qualified for the role and matches the skills required for this position.

Key Takeaways:

- Resumes are a great way to get someone’s attention.

- Resumes should be unique and tailored for the job you want to apply to.

- Don’t use a resume template if it’s not from an actual employer!

- Sample resumes are fantastic ways to get started, but don’t copy them word for word!

- Whether it’s formal or casual, your resume should be easy to read and concisely state all of your skills and experience.