What is the Role of a Financial Planning Expert?

Embarking on a career as a Financial Planning Expert means stepping into a role that is both dynamic and pivotal in the financial landscape of any organization or individual. This role demands a deep understanding of financial markets, investment strategies, and risk management, coupled with a visionary approach to long-term financial planning.

A Financial Planning Expert is entrusted with the critical responsibility of guiding individuals or organizations in making informed financial decisions. They analyze financial situations, understand goals and objectives, and devise strategies to achieve financial stability and growth. Their role extends to advising on investment opportunities, tax planning, retirement planning, and ensuring financial security through meticulous planning and foresight.

What are the Financial Planning Expert Job Requirements?

Aspiring to become a Financial Planning Expert involves meeting a set of stringent requirements that validate your expertise and readiness for this significant role. Let’s delve deeper into the prerequisites that one needs to fulfill to embrace this role:

- A Bachelor’s or Master’s degree in Finance, Economics, or a related field, laying a strong educational foundation.

- Relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), which are testimony to your expertise in the field.

- Profound knowledge of financial markets, investment strategies, and financial analysis tools.

- Experience in financial planning, showcasing a trajectory of growth and learning in the financial sector.

- Excellent analytical and mathematical skills, which are the backbone of financial planning.

- Strong communication skills, essential in building trust and understanding client needs.

Additional skills such as proficiency in financial software and a deep understanding of tax laws can give you an edge in the competitive market.

What are the Responsibilities of a Financial Planning Expert?

The role of a Financial Planning Expert is a tapestry woven with various responsibilities, each thread representing a critical aspect of financial planning. Let’s unravel the core responsibilities that define this role:

- Developing comprehensive financial plans that align with the clients’ goals and financial objectives.

- Analyzing financial data to provide informed investment advice and strategies.

- Assisting clients in tax planning to ensure tax efficiency and compliance with regulations.

- Guiding clients on retirement planning, helping them build a secure future.

- Monitoring financial market trends and advising clients on potential investment opportunities.

- Building and maintaining long-term relationships with clients, based on trust and mutual respect.

Each responsibility is a commitment to guiding clients towards financial stability and growth, leveraging your expertise and insights.

Financial Planning Expert Resume Writing Tips

Creating a resume that stands out in the competitive job market is a critical step in your career journey. Here are some tips to help you craft a resume that narrates your story effectively:

- Highlight your educational qualifications and certifications, showcasing your expertise in the field.

- Detail your experience in financial planning, including the strategies devised and the positive outcomes achieved for clients.

- Include case studies or examples where your financial advice led to substantial financial growth or savings for clients.

- Highlight your proficiency in financial software and tools, showcasing your technical skills.

- Include testimonials or references from satisfied clients, adding credibility to your profile.

Each tip is a stepping stone towards creating a resume that reflects your expertise and commitment to financial planning.

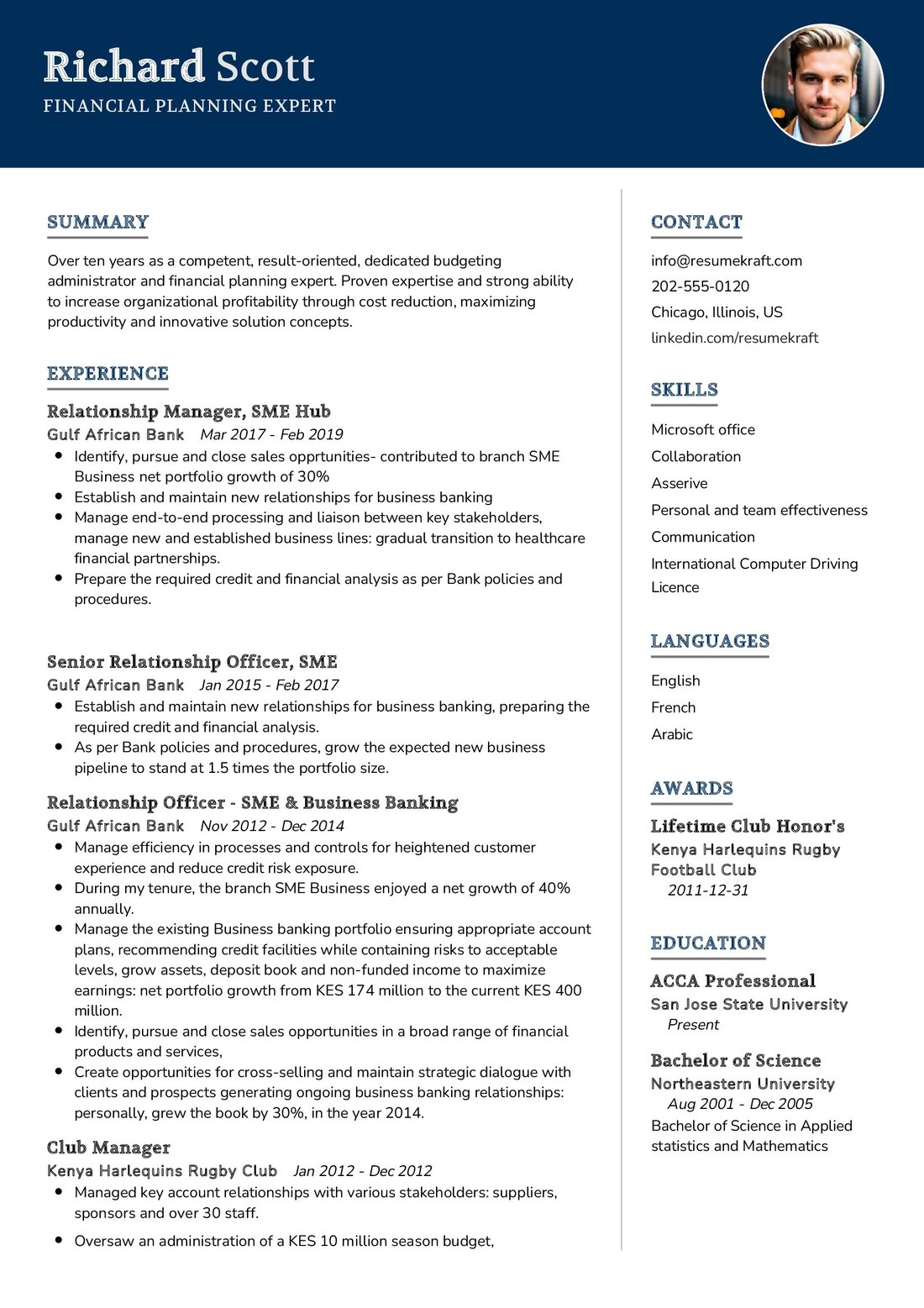

Financial Planning Expert Resume Summary Examples

Your resume summary is the gateway to your career story, offering a snapshot of your journey and the value you bring to the role. Here are some examples to inspire you:

- “Detail-oriented Financial Planning Expert with over 10 years of experience in crafting tailored financial strategies that align with clients’ goals.”

- “Certified Financial Planner with a proven track record in tax planning and investment advisory, helping clients achieve financial stability and growth.”

- “Dynamic Financial Planning Expert with a deep understanding of financial markets and a knack for identifying lucrative investment opportunities.”

Each summary is a testament to your expertise and the unique approach you bring to financial planning.

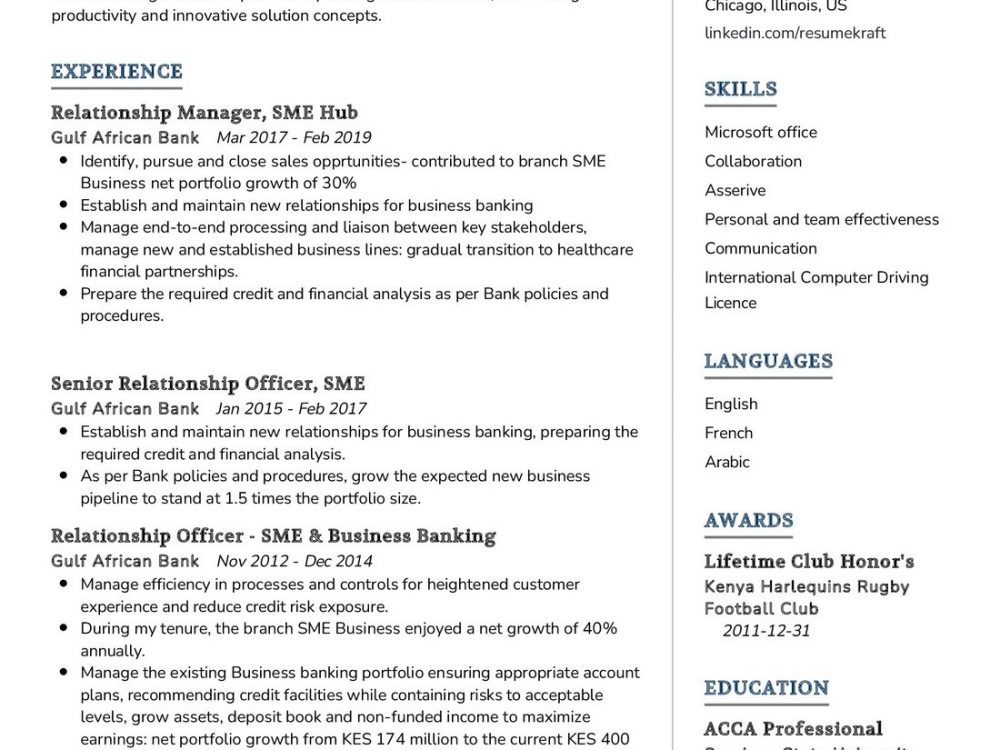

Create a Strong Experience Section for Your Financial Planning Expert Resume

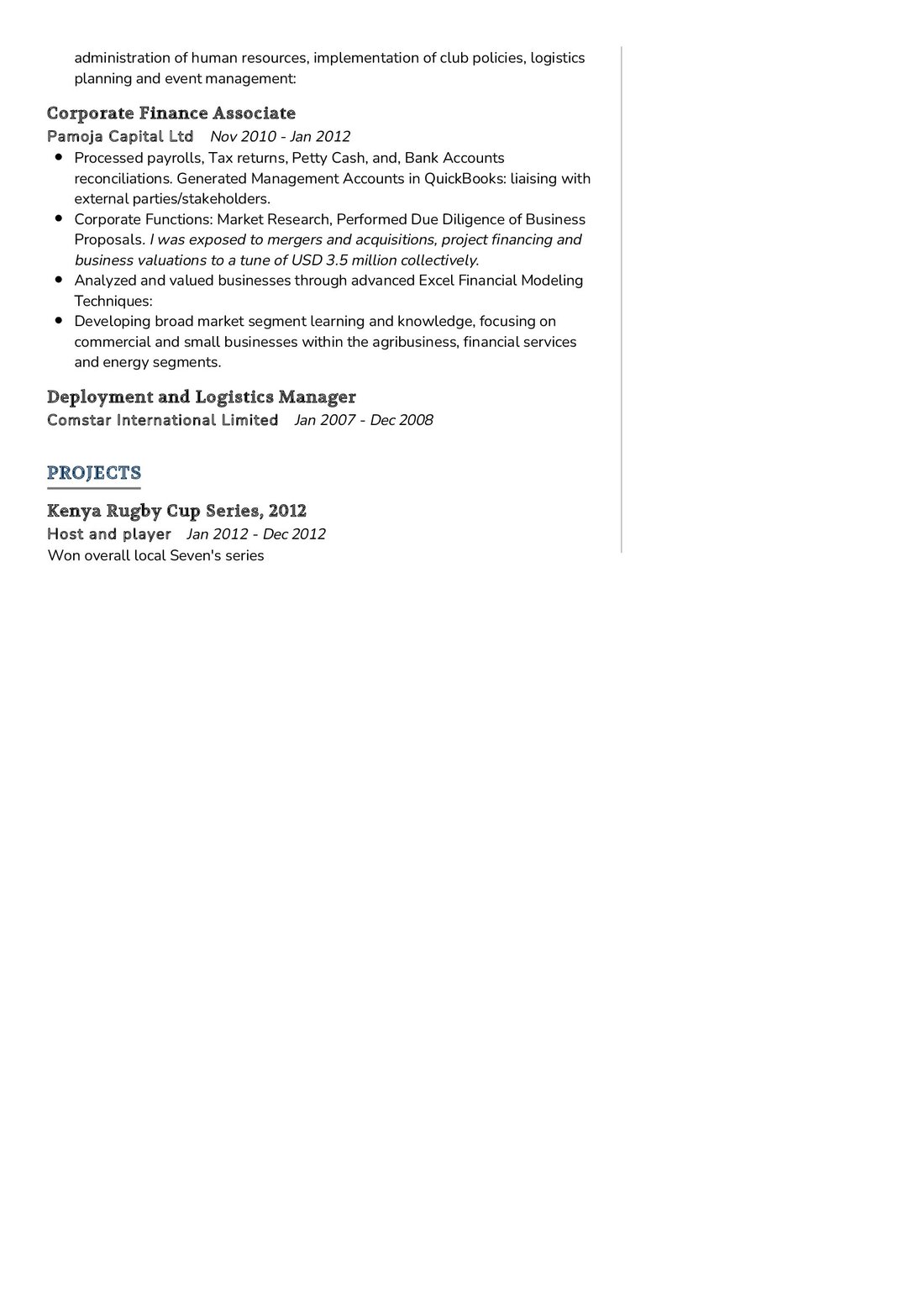

Your experience section is the heart of your resume, narrating the rich experiences and milestones in your career. Here are some examples to guide you:

Each experience narrated is a chapter in your career story, showcasing your growth and achievements in the field.

Sample Education Section for Your Financial Planning Expert Resume

Your educational background forms the foundation of your career, showcasing your academic achievements and learning in the field. Here is a sample section to guide you:

- “Master of Finance, XYZ University, 2015 – Distinction.”

- “Certified Financial Planner, ABC Institute, 2017.”

Each educational milestone is a testament to your academic rigor and commitment to learning.

Financial Planning Expert Skills for Your Resume

Your skills section is a showcase of your expertise, both acquired and innate. Here we list down the essential skills that a Financial Planning Expert should possess:

Soft Skills:

- Strategic thinking, the ability to envision long-term financial goals.

- Client relationship management, the knack for building and nurturing client relationships.

- Problem-solving abilities, the skill to navigate complex financial landscapes.

- Attention to detail, the meticulous approach to financial planning.

- Adaptability, the readiness to adapt to changing financial markets.

Hard Skills:

- Financial analysis, the expertise in analyzing financial data and trends.

- Investment advisory, the skill to identify and recommend lucrative investment opportunities.

- Tax planning, the knowledge to devise tax-efficient strategies.

- Retirement planning, the ability to guide clients towards a secure retirement.

- Proficiency in financial software, the technical skill to leverage modern tools in financial planning.

Each skill is a tool in your arsenal, aiding you in crafting successful financial strategies.

Most Common Mistakes to Avoid When Writing a Financial Planning Expert Resume

As you craft your resume, it is essential to avoid common pitfalls that can hinder your journey to landing your dream job. Here we list down the mistakes often seen in resumes and how to avoid them:

- Using a generic template, which fails to showcase your unique skills and experiences.

- Overloading your resume with jargon, which can obscure your true value.

- Failing to proofread, a mistake that can leave a dent in your professional image.

- Ignoring the cover letter, a missed opportunity to narrate your story and connect with the potential employer.

Each mistake is a pitfall, avoid them to craft a resume that is both authentic and compelling.

Key Takeaways for Your Financial Planning Expert Resume

As we reach the end of this guide, let’s recap the key points to keep in mind while crafting your Financial Planning Expert resume:

- Highlight your journey in the financial sector, showcasing the milestones achieved and the expertise gained.

- Detail the strategies you have devised and the positive outcomes achieved for clients.

- Include a section on continuous learning, showcasing the certifications and courses undertaken.

- Showcase your analytical and strategic thinking skills, painting a picture of your comprehensive approach to financial planning.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Financial Planning Expert job interview.

With this comprehensive guide, you are now equipped to craft a resume that not only narrates your career story but also showcases the depth of your expertise and your readiness to steer clients towards financial stability and growth. Best of luck!