What is the Role of an Oracle Fusion Financial Consultant?

In the ever-evolving world of finance, the role of an Oracle Fusion Financial Consultant has become indispensable for organizations seeking seamless and efficient financial management solutions. This role is a unique blend of financial expertise and technical acumen, steering the organization’s financial strategies towards success. Let’s delve deeper into the multifaceted role of an Oracle Fusion Financial Consultant, a position that demands a deep understanding of financial principles combined with the ability to implement and manage Oracle Fusion Financial solutions effectively.

An Oracle Fusion Financial Consultant is responsible for overseeing the implementation and maintenance of Oracle Fusion Financials, ensuring that the system aligns with the organization’s financial objectives and streamlines financial operations. They play a vital role in providing insights based on their extensive financial knowledge to guide the team, fostering a collaborative and innovative work environment. Their role is pivotal in bridging the gap between finance teams and technical teams, advocating for the best financial practices while ensuring the achievement of financial goals efficiently.

What are the Oracle Fusion Financial Consultant Job Requirements?

Embarking on the journey to become an Oracle Fusion Financial Consultant entails meeting a series of demanding requirements, each contributing to a comprehensive understanding of the role. The path to success involves continuous learning and gaining hands-on experience. Let’s delve deeper into the prerequisites that one needs to fulfill to excel in the role of an Oracle Fusion Financial Consultant:

- A Bachelor’s or Master’s degree in Finance, Accounting, or a related field, showcasing a strong foundation in financial principles.

- Profound knowledge of Oracle Fusion Financials, including the intricacies of its modules and applications.

- Hands-on experience in implementing Oracle Fusion Financial solutions, demonstrating a trajectory of successful project completion and financial process optimization.

- Strong analytical and problem-solving skills, honed through experiences in resolving complex financial challenges.

- Effective communication and interpersonal skills, vital in conveying financial insights and building strong relationships across departments.

- Ability to adapt to changing financial regulations and compliance standards, ensuring the organization’s adherence to financial best practices and legal requirements.

Attaining additional certifications in Oracle Fusion Financials can significantly enhance your profile and credibility in the competitive job market.

What are the Responsibilities of an Oracle Fusion Financial Consultant?

The role of an Oracle Fusion Financial Consultant encompasses a diverse range of responsibilities, each contributing to the efficient and effective management of the organization’s financial operations. Let’s explore the core responsibilities that define this role, highlighting the crucial tasks and skills necessary for success:

- Leading the implementation and customization of Oracle Fusion Financial solutions, ensuring alignment with the organization’s financial objectives.

- Collaborating with cross-functional teams to integrate Oracle Fusion Financials with other business applications, fostering seamless data flow and enhancing financial insights.

- Providing training and support to end-users, enabling them to maximize the potential of Oracle Fusion Financials in their day-to-day financial operations.

- Conducting regular audits and assessments to ensure the accuracy and compliance of financial data within the Oracle Fusion Financial system.

- Offering strategic guidance and insights to the organization’s financial leadership, aiding in the formulation and execution of financial strategies and initiatives.

- Staying updated with the latest developments in Oracle Fusion Financials, integrating innovative solutions and best practices into the organization’s financial management processes.

Each responsibility represents a crucial aspect of financial management, highlighting the critical role played by an Oracle Fusion Financial Consultant in driving financial success.

Oracle Fusion Financial Consultant CV Writing Tips

As you craft your CV to stand out in a pool of applications, remember that your CV is a reflection of your journey, your growth, and your aspirations. Here are some tips to help you narrate your story effectively through your CV:

- Highlight your successful Oracle Fusion Financial implementation projects, showcasing your ability to streamline financial operations.

- Detail your experience in handling complex financial challenges, demonstrating your analytical and problem-solving capabilities.

- Include specific metrics to quantify your achievements, providing tangible evidence of your contributions to financial optimization.

- List relevant Oracle certifications, showcasing your commitment to continuous learning and professional development.

- Customize your CV for the specific role, emphasizing your financial expertise and experience with Oracle Fusion Financials.

Each tip is a step toward creating a compelling narrative that highlights your expertise and value as an Oracle Fusion Financial Consultant.

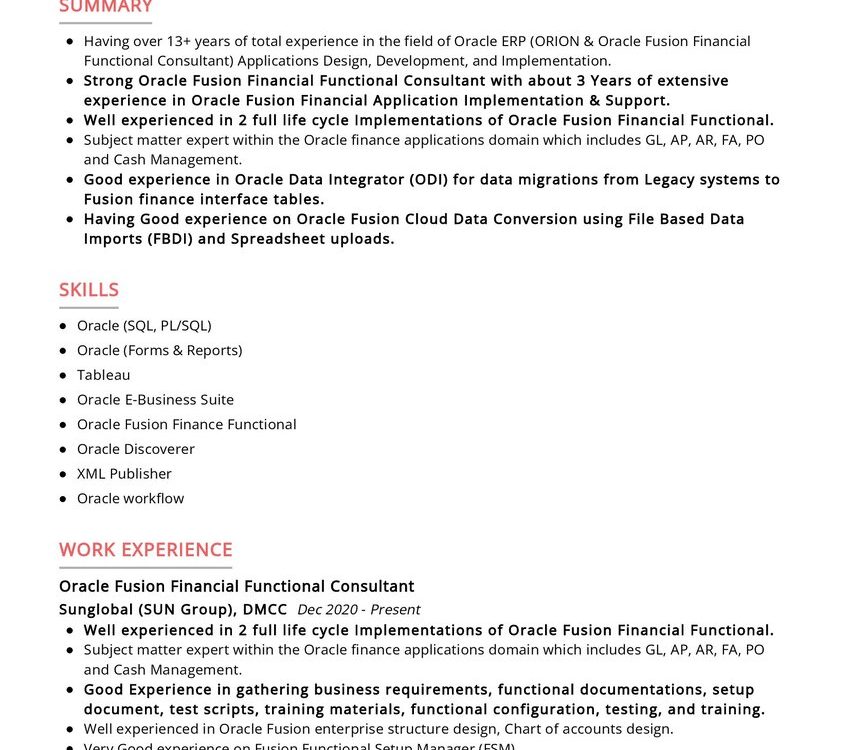

Oracle Fusion Financial Consultant CV Summary Examples

Your CV summary serves as the introduction to your professional story, presenting a concise overview of your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Dedicated Oracle Fusion Financial Consultant with over 8 years of experience, adept at implementing customized Oracle solutions, optimizing financial operations for maximum efficiency.”

- “Experienced Oracle Fusion Financial Consultant skilled in providing strategic financial guidance, leading successful Oracle Fusion Financial implementations, and ensuring seamless integration with existing systems.”

- “Detail-oriented Oracle Fusion Financial Consultant with a proven track record in optimizing financial processes, leveraging Oracle Fusion Financials to drive data accuracy and compliance within organizations.”

Each summary serves as a glimpse into your professional journey, showcasing your strengths and expertise as an Oracle Fusion Financial Consultant.

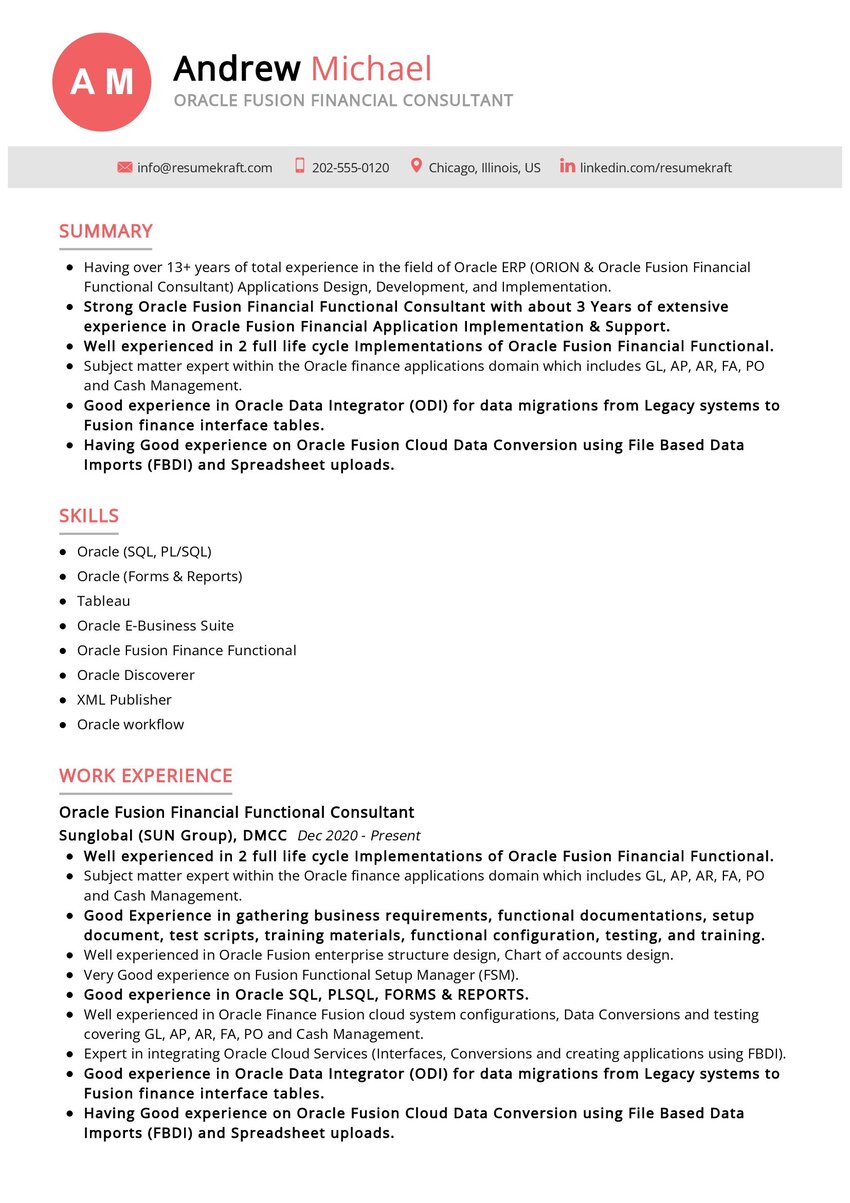

Create a Strong Experience Section for Your Oracle Fusion Financial Consultant CV

Your experience section is the cornerstone of your CV, narrating the key milestones and achievements of your professional journey. Here are some examples to guide you:

- “Led the successful implementation of Oracle Fusion Financials for a multinational corporation, streamlining financial reporting and improving data accuracy by 30%.”

- “Collaborated with cross-functional teams to integrate Oracle Fusion Financials with existing ERP systems, facilitating seamless data flow and enhancing financial insights across departments.”

- “Developed and delivered comprehensive training programs for end-users, enabling them to leverage Oracle Fusion Financials effectively in their day-to-day financial operations.”

Each experience serves as a testament to your expertise and contributions as an Oracle Fusion Financial Consultant.

Sample Education Section for Your Oracle Fusion Financial Consultant CV

Your educational background underscores your expertise and commitment to professional development. Here’s how you can present your educational qualifications:

- Master of Business Administration in Finance, XYZ University, equipped with comprehensive knowledge and practical skills in financial management, 2015.

- Bachelor of Commerce in Accounting, ABC University, providing a strong foundation in accounting principles and financial analysis, 2012.

- Oracle Certified Implementation Specialist – Oracle Fusion Financials, a testament to your expertise in Oracle Fusion Financial solutions, 2016.

Each educational qualification represents a milestone in your journey, highlighting your dedication to financial excellence and professional growth.

Oracle Fusion Financial Consultant Skills for Your CV

Your skill set is your arsenal, encompassing a diverse range of capabilities that you have honed over the years. It showcases your abilities, both inherent and acquired. Let’s list down the essential skills that an Oracle Fusion Financial Consultant should possess:

Soft Skills:

- Financial analysis and reporting, the ability to analyze complex financial data and provide valuable insights.

- Effective communication and interpersonal skills, vital in conveying financial strategies and building strong relationships with stakeholders.

- Problem-solving abilities, the knack of addressing complex financial challenges with innovative solutions.

- Attention to detail, the meticulous approach to ensuring accuracy and compliance in financial operations.

- Adaptability and resilience, the strength to navigate through dynamic financial landscapes and evolving business requirements.

Hard Skills:

- Expertise in Oracle Fusion Financials, showcasing proficiency in implementing and managing the system for streamlined financial operations.

- Financial management software proficiency, a skill that enables efficient management of financial data and processes.

- Knowledge of financial regulations and compliance standards, ensuring adherence to legal requirements and best practices.

- Data analysis and interpretation, the ability to derive actionable insights from complex financial data sets.

- Project management, the capability to oversee financial projects from initiation to completion, ensuring timely and successful delivery.

Each skill represents a crucial aspect of your proficiency as an Oracle Fusion Financial Consultant, demonstrating your ability to drive financial success within organizations.

Most Common Mistakes to Avoid When Writing an Oracle Fusion Financial Consultant CV

As you craft your CV, it is crucial to steer clear of common pitfalls that can hinder your journey to securing your dream job. Here, we list down the mistakes often observed in CVs and how to avoid them:

- Using generic language and clichés, a practice that fails to showcase your unique value as an Oracle Fusion Financial Consultant.

- Listing job responsibilities without highlighting your specific contributions and achievements, a narrative that lacks impact and depth.

- Omitting relevant certifications and training, a missed opportunity to highlight your commitment to professional development and industry expertise.

- Overcomplicating the CV with excessive technical jargon, a strategy that can obscure your core competencies and skills as a financial consultant.

- Neglecting to proofread, a mistake that can undermine your professionalism and attention to detail, potentially leading to missed opportunities.

Avoiding these mistakes can help you craft a compelling and impactful CV that highlights your expertise and value as an Oracle Fusion Financial Consultant.

Key Takeaways for Your Oracle Fusion Financial Consultant CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Oracle Fusion Financial Consultant CV:

- Emphasize your successful Oracle Fusion Financial implementation projects, highlighting your ability to streamline financial operations and processes.

- Showcase your expertise in Oracle Fusion Financials, underscoring your proficiency in implementing and managing the system for efficient financial management.

- Highlight your problem-solving skills, demonstrating your ability to address complex financial challenges with innovative and effective solutions.

- Include a section on continuous learning, showcasing the certifications and training undertaken to stay updated with the latest developments in financial technology and best practices.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Oracle Fusion Financial Consultant job interview.