How to write a Portfolio Manager Resume?

After reading this, you’ll know how to design the perfect resume for a portfolio manager position. If you’re tired of repetitive monotony and want to break out of your work rut, this is the perfect article for you!

Before getting started, it’s important to recognize that resumes are typically employer-centric rather than candidate-centric. And a real portfolio manager resume should do more than simply list your job experience and qualifications — it must also explain why an employer would want you in their organization.

Let’s begin:

#1: What is a Portfolio Manager?

Before we get into the details, it’s worth taking a moment to define exactly what portfolio management entails.

Definition of Portfolio Management: “The management of all portfolios within an organization, which include all other asset classes such as stocks and bonds, municipals, physical commodities, currencies and so on.”

Portfolio Management is an important function in business finance. A Portfolio Manager researches, trades, and manages the various financial holdings of a business. They invest in currencies, stocks, bonds, real estate and other financial instruments in order to maximize the return on investment for a company.

Portfolio managers are responsible for determining where to invest money in order to generate profit for their organization. They also manage risk within their portfolios to ensure that the assets are not at risk of losing value.

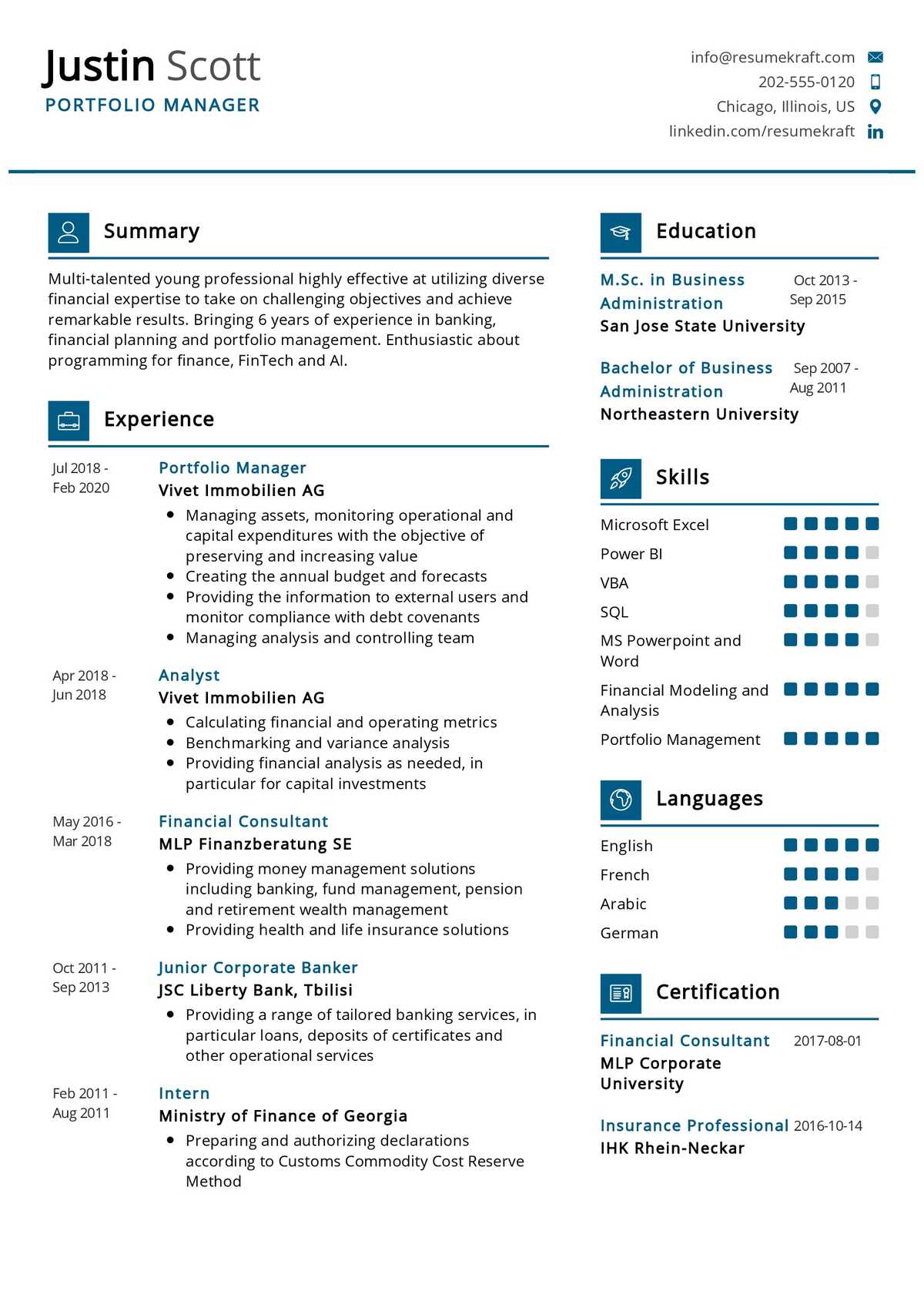

#2: How to write a Portfolio Manager Resume

While you can certainly get away with writing a traditional résumé, it’s critical for you to tailor your resume strategically. That’s because employers routinely look at your resume as a way to determine whether or not they will be able to hire you.

The perfect portfolio manager resume is short (no more than one page), tailored, tailored (emphasis on tailored) and full of specific examples of your previous work experience.

Note: You will have to design your own portfolio manager resume based on the job description posted for the position.

Important: A portfolio manager resume should be tailored to the position you are applying for. In other words, never submit the same resume to multiple employers because it sends a message that you don’t care about the specific needs of each employer.

Note: If you want some ideas on how to make your own portfolio manager resume, check out our post 10 Resume Tips That Will Help You Get Noticed . And if you aren’t sure what to write or how to format your resume, learn how to write a resume.

1. List the Employer’s Keywords

One of the first things you need to do when developing a portfolio manager resume is to check for keywords in the job description. If you don’t see any listed, ask a friend or contact person at the company if they have any suggestions.

Here’s an example of how to list the keywords from a job description:

“The ideal candidate will have extensive experience in creating and nurturing client relationships.”

So under the skills and abilities section, you would write something like this:

Client Relationship Management – Developed a proven record of building and nurturing customer relationships. Personally responsible for securing over $10 million in annual revenue. (keyword) Client Relationship Management – Developed a proven record of building and nurturing customer relationships. Personally responsible for securing over $10 million in annual revenue. (keyword)

By including the keyword in brackets, it will help you organize your skills and abilities as well as make your resume easy to read.

2. List Accomplishments Rather Than Jobs or Responsibilities

It’s important to focus on accomplishments on your portfolio manager resume instead of just listing jobs or duties. For instance, the following is a job description taken from an actual job posting for a Senior Portfolio Manager:

“Will be responsible for managing up to $400 million in assets.”

If you list this on your resume, it would come across as follows:

Portfolio Management – Managed over $400 million in assets. Portfolio Management – Managed over $400 million in assets.

This is bland and doesn’t stand out at all. It doesn’t tell a story or provides any indication as to what the candidate is capable of doing.

However, if you were to rewrite this portion of the resume to focus on accomplishments (e.g. returns, client relations, and performance), then you would have the following:

Portfolio Development Manager Responsibilities:

- Assist in the development and launch of new investment strategies.

- Oversee new product launches and guide portfolio manager’s evaluation results.

- Maintain long-term profitability through consistent investment strategy and strategy monitoring.

- Evaluate manager performance to determine financial gains for both individual managers and the firm overall.

- Assist in the design and preparation of quarterly and annual reports.

- Prepare a cost of capital report, which provides a projection of what an alternative investment would need to return in order to match the firm’s historical performance.

- Establish, monitor, and maintain a database of portfolio performance.

- Exhibit leadership in implementing and enforcing firm policies, both written and unwritten.

- Support capital expenditures for existing and new initiatives, including the purchase of new or replacement equipment.

- Support various management projects including but not limited to dividend policy changes, investment strategy development, research project implementation and data gathering efforts.

- Assist in the design of investment strategies with a focus on the client’s goals, objectives, risk tolerance, and available investment alternatives.

Top 15 Portfolio Development Manager Skills:

- Evaluate portfolio holdings and recommend changes based on changing marketplace conditions.

- Work with clients and other portfolio management staff to develop an investment strategy in line with the company’s goals.

- Select financial products for inclusion in a client’s portfolio based on their investment objectives, risk tolerance, and other criteria.

- Monitor performance of client portfolios to make sure they meet expectations, notifying clients of any deviations from benchmark indexes or preset parameters.

- Generate periodic reports detailing changes in portfolios and performance, as well as recommendations for future activity.

- Update client portfolios to adjust holdings based on market changes, company news, and individual circumstances.

- Work with clients to develop realistic financial goals, helping them develop strategies to reach these goals within a specific time frame.

- Negotiate commission or other service fees with portfolio management companies and clients to ensure greater profitability for the firm and satisfaction for customers.

- Create and maintain client accounts with brokerages to ensure compliance with company policies and applicable regulations.

- Provide financial planning services for high-net-worth clients, helping them develop investment strategies that incorporate short-, medium-, and long-term goals.

- Focus on client retention by providing professional service, recommending appropriate products, and working to develop long-lasting relationships with clients.

- Work with staff members in other departments to provide detailed information about the products a firm has to offer, facilitating more personalized assistance for customers.

- Perform other related duties as required.

- Oversee the performance of external service providers and coordinate their performance with that of the firm’s financial consultants.

- Meet the high standards of ethical behavior and professional conduct generally expected from an investment consultant or brokerage firm employee.

Key Takeaways:

Use a resume template to make your resume easier to read and more sophisticated than other applicants. Make it easy for the potential employer to judge your credentials without having to look at a bunch of numbers. Don’t just write a generic cover letter – personalize it to each employer! Ask questions, be specific, and don’t forget that you are applying with a portfolio manager resume.