What is the Role of a Lending Professional?

As the financial landscape continues to evolve, the role of a Lending Professional has become increasingly significant in the world of banking and finance. This role is a dynamic blend of financial expertise and customer service acumen, guiding borrowers and lenders towards successful financial transactions. Let’s delve deeper into the multifaceted role of a Lending Professional, a position that demands a deep understanding of lending practices coupled with the ability to provide top-notch customer service.

A Lending Professional is responsible for facilitating lending transactions, whether it’s a personal loan, mortgage, or business loan. They play a crucial role in assessing the creditworthiness of borrowers, explaining loan terms, and ensuring a smooth lending process. Their role involves building trust with clients, addressing their financial needs, and offering solutions that align with their goals. Lending Professionals are the bridge between borrowers and financial institutions, helping both parties achieve their objectives efficiently.

What are the Lending Professional Job Requirements?

Stepping into the role of a Lending Professional requires meeting a series of essential requirements, a journey that is both demanding and rewarding. The path is paved with continuous learning and gaining hands-on experience. Let’s delve deeper into the prerequisites that one needs to fulfill to excel as a Lending Professional:

- A Bachelor’s degree in Finance, Economics, Business, or a related field, showcasing a strong foundation in financial principles.

- Profound knowledge of lending practices, including credit analysis, risk assessment, and loan underwriting.

- Experience in the financial industry, preferably in roles related to lending or customer service, showcasing a trajectory of increasing responsibility.

- Excellent communication and interpersonal skills, honed through experiences and possibly through courses and certifications.

- An understanding of banking regulations and compliance, ensuring ethical and legal lending practices.

- Attention to detail and the ability to work with financial software and tools commonly used in the industry.

Obtaining additional certifications related to lending, such as Certified Lending Professional (CLP), can enhance your profile and credibility in the competitive financial job market.

What are the Responsibilities of a Lending Professional?

The role of a Lending Professional is a tapestry of varied responsibilities, woven with threads of financial expertise, customer service skills, and a commitment to ethical lending practices. Let’s unravel the core responsibilities that define this role, with each thread narrating a story of dedication, financial knowledge, and customer satisfaction:

- Evaluating loan applications, assessing creditworthiness, and making informed decisions on loan approvals.

- Providing personalized financial guidance to clients, helping them understand loan terms and choose the right lending products.

- Collaborating with underwriters and other financial professionals to ensure loan applications meet lending criteria and regulatory standards.

- Negotiating terms and conditions with borrowers, striving to secure favorable loan agreements for both parties.

- Staying updated on financial market trends, interest rates, and lending regulations, offering clients the most relevant financial advice.

- Maintaining accurate records of loan transactions and ensuring compliance with all applicable laws and regulations.

- Building and maintaining strong relationships with clients, fostering trust and loyalty.

Each responsibility comes with its own set of challenges and learning opportunities, shaping you into a trusted advisor in the world of lending.

Lending Professional Resume Writing Tips

As you embark on the journey to craft a resume that stands out in the financial job market, remember that your resume is a reflection of your expertise, your experience, and your dedication to helping clients achieve their financial goals. Here are some tips to help you create an effective Lending Professional resume:

- Highlight your track record of successful lending transactions, showcasing instances where you have helped clients secure loans and achieve their financial objectives.

- Detail your expertise in financial analysis, credit assessment, and risk management, emphasizing your ability to make sound lending decisions.

- Include metrics and data to quantify your achievements, such as the number of loans processed, approval rates, and client satisfaction scores.

- List any relevant certifications or training programs you have completed, demonstrating your commitment to continuous learning and professional development.

- Customize your resume for each job application, tailoring your qualifications and accomplishments to match the specific requirements of the role.

Each tip is a step toward crafting a resume that effectively communicates your value as a Lending Professional.

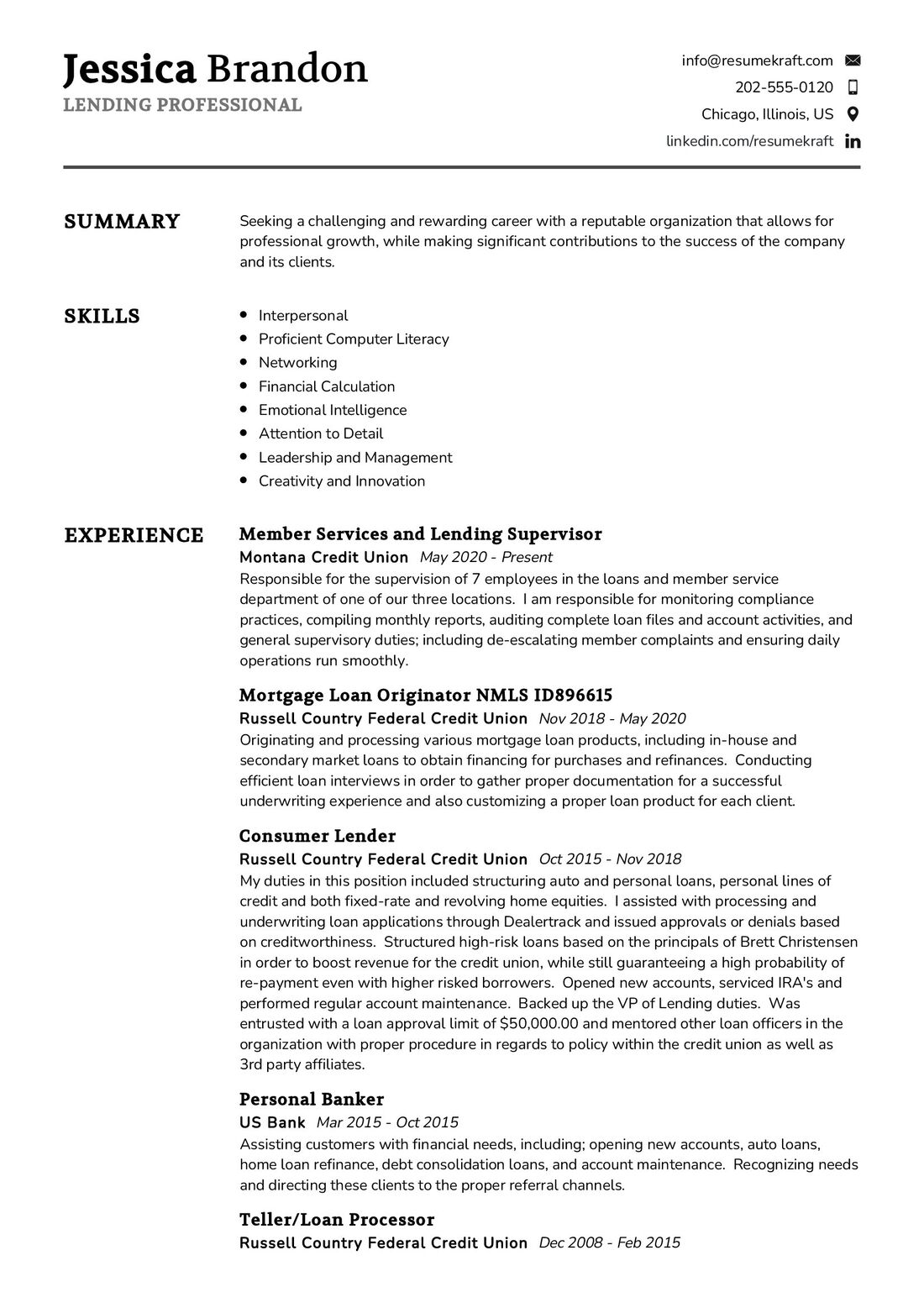

Lending Professional Resume Summary Examples

Your resume summary is the opening act of your career story, setting the stage for what is to follow. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Experienced Lending Professional with a proven track record of helping clients secure loans and achieve their financial goals. Adept at financial analysis and risk assessment, committed to providing top-notch customer service.”

- “Dedicated Lending Professional with 5 years of experience in the financial industry. Skilled in credit evaluation and loan underwriting, known for building strong client relationships and exceeding lending targets.”

- “Results-driven Lending Professional with a passion for guiding clients towards financial success. Proficient in loan origination and compliance, with a strong focus on ethical lending practices.”

Each summary is a window to your career, offering a glimpse of your journey, your strengths, and your commitment to financial excellence as a Lending Professional.

Create a Strong Experience Section for Your Lending Professional Resume

Your experience section is the heart of your resume, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your career story, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led a team of lending specialists at XYZ Bank, achieving a 15% increase in loan approvals and a 20% improvement in client satisfaction ratings.”

- “Managed a diverse portfolio of lending products, including personal loans, mortgages, and business loans, resulting in a 10% increase in loan portfolio value.”

- “Developed and implemented a streamlined loan application process, reducing processing time by 25% and improving overall efficiency.”

Each experience is a chapter in your career book, narrating tales of challenges met, solutions found, and successes achieved as a Lending Professional.

Sample Education Section for Your Lending Professional Resume

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning.

Here’s how you can list your educational milestones:

- Bachelor of Science in Finance, ABC University, a comprehensive education in financial principles and practices, 2015.

- Master of Business Administration (MBA) in Finance, XYZ Business School, an advanced degree that deepened your financial knowledge and leadership skills, 2017.

- Certified Credit Professional (CCP) certification, a recognition of your expertise in credit analysis and risk management, 2018.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your career as a Lending Professional.

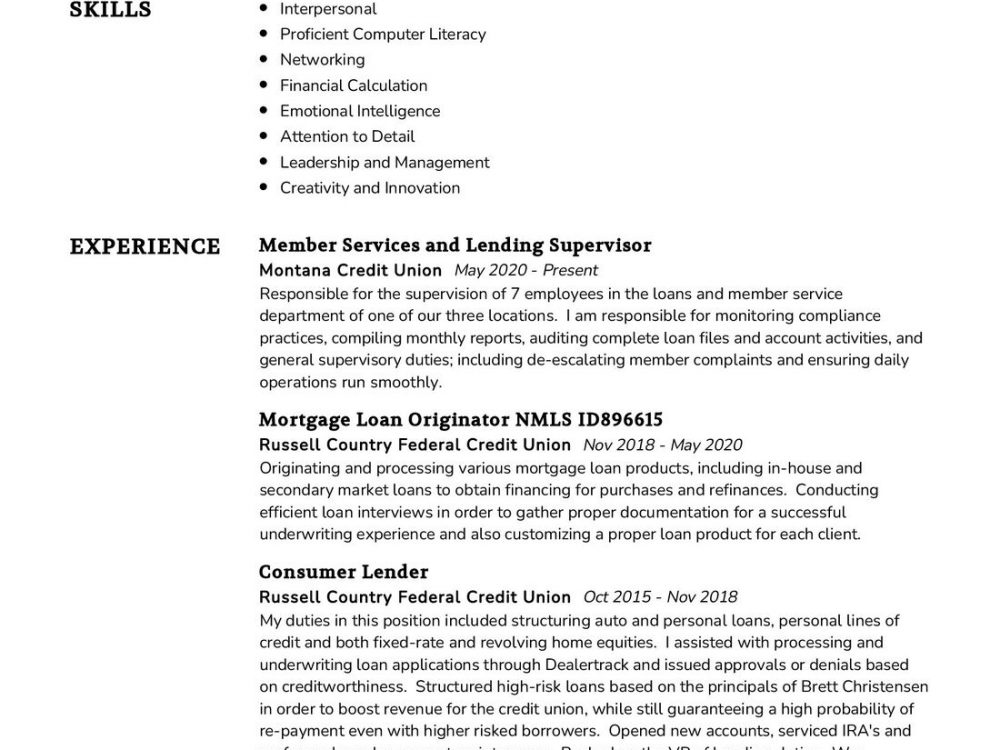

Lending Professional Skills for Your Resume

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Lending Professional should possess:

Soft Skills:

- Customer service excellence, the ability to build rapport with clients and address their financial needs.

- Effective communication, the art of explaining complex financial concepts in a clear and understandable manner.

- Attention to detail, the meticulous approach to reviewing loan applications and ensuring accuracy.

- Problem-solving abilities, the knack of finding solutions to client concerns and financial challenges.

- Ethical decision-making, a commitment to upholding the highest standards of integrity in lending practices.

Hard Skills:

- Credit analysis, a deep understanding of credit reports, risk factors, and lending criteria.

- Loan origination software proficiency, the ability to use specialized software for processing loan applications.

- Financial modeling, the skill to create financial projections and assess the impact of loans on borrowers’ financial situations.

- Regulatory compliance knowledge, an understanding of banking regulations and laws governing lending practices.

- Loan underwriting expertise, the ability to assess the risk associated with different loan applications.

Each skill is a tool, aiding you in providing exceptional service to clients and ensuring the success of lending transactions.

Most Common Mistakes to Avoid When Writing a Lending Professional Resume

As you craft your resume, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job as a Lending Professional. Here we list down the mistakes often seen in resumes and how to avoid them:

- Using a generic resume template, a strategy that fails to showcase your unique qualifications and experiences.

- Listing job duties without highlighting your accomplishments and contributions, resulting in a resume that lacks impact.

- Ignoring the importance of a well-written cover letter, a missed opportunity to personalize your application and convey your enthusiasm for the role.

- Overloading your resume with technical jargon or industry-specific terms that may not be familiar to all readers.

- Failing to proofread your resume for typos and grammatical errors, which can leave a negative impression on potential employers.

Each mistake is a potential stumbling block, so it’s important to avoid them to craft a resume that is both authentic and compelling.

Key Takeaways for Your Lending Professional Resume

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Lending Professional resume:

- Highlight your ability to build client relationships and provide exceptional customer service as a Lending Professional.

- Emphasize your financial expertise, showcasing your skills in credit analysis, risk assessment, and loan underwriting.

- Detail your achievements in terms of successful lending transactions, client satisfaction, and compliance with lending regulations.

- Include a section on continuous learning and certifications, demonstrating your commitment to professional growth.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Lending Professional job interview.

Your resume is not just a document; it is a representation of your expertise and dedication to helping clients achieve their financial goals. Best of luck in your career as a Lending Professional!