Risk Manager Role and ResponsibilitiesUnderstanding the Role of a Risk Manager

In today’s dynamic business landscape, the role of a Risk Manager holds significant importance in safeguarding organizations against potential threats and uncertainties. A Risk Manager serves as the guardian of financial stability and operational integrity, meticulously assessing risks and implementing strategies to mitigate them effectively. Let’s explore the multifaceted role of a Risk Manager, which demands a blend of analytical prowess, strategic thinking, and proactive decision-making.

Key Responsibilities of a Risk Manager

A Risk Manager’s responsibilities encompass a wide array of tasks aimed at identifying, analyzing, and managing risks across various facets of an organization. Here are some primary responsibilities associated with this role:

- Conducting risk assessments to identify potential threats and vulnerabilities within the organization’s operations.

- Developing risk management strategies and policies tailored to the organization’s specific needs and risk tolerance.

- Implementing risk mitigation measures to minimize the impact of identified risks on business objectives.

- Monitoring and evaluating risk management processes to ensure effectiveness and compliance with regulatory requirements.

- Collaborating with internal stakeholders, including senior management and department heads, to communicate risk-related insights and recommendations.

- Staying abreast of industry trends, regulatory changes, and emerging risks to proactively adapt risk management strategies.

- Leading risk awareness and training programs to educate employees about risk management best practices and their role in mitigating risks.

The role of a Risk Manager is dynamic and requires constant vigilance to anticipate and address evolving threats effectively.

Requirements for Becoming a Risk Manager

Becoming a successful Risk Manager entails acquiring a combination of education, experience, and specialized skills. Here are some key requirements for individuals aspiring to pursue a career in risk management:

- A bachelor’s degree in finance, business administration, economics, or a related field, providing a solid foundation in financial analysis and risk assessment.

- Relevant certifications such as Certified Risk Manager (CRM) or Professional Risk Manager (PRM) to demonstrate proficiency in risk management practices.

- Previous experience in risk management, financial analysis, or related fields, preferably in industries such as banking, insurance, or consulting.

- Strong analytical skills and attention to detail to accurately assess and quantify risks.

- Effective communication and interpersonal skills to collaborate with cross-functional teams and communicate risk-related insights to stakeholders.

- Strategic thinking and problem-solving abilities to develop innovative risk management strategies and adapt to changing business environments.

Continuous learning and professional development are essential for Risk Managers to stay ahead in a constantly evolving risk landscape.

Skills and Qualities of a Successful Risk Manager

Beyond formal education and experience, certain skills and qualities distinguish exceptional Risk Managers from their peers. Here are some essential attributes of successful Risk Managers:

- Analytical mindset: The ability to analyze complex data and information to identify patterns, trends, and potential risks.

- Decision-making prowess: The capacity to make informed and timely decisions under pressure, considering various factors and potential outcomes.

- Risk awareness: A keen understanding of different types of risks, their potential impact, and strategies to mitigate them.

- Adaptability: The flexibility to adapt to changing circumstances and adjust risk management strategies accordingly.

- Leadership skills: The capability to lead and inspire teams, fostering a culture of risk awareness and proactive risk management.

- Integrity and ethics: A commitment to upholding ethical standards and integrity in all risk management activities.

Developing and honing these skills is crucial for aspiring Risk Managers to excel in their roles and contribute effectively to organizational success.

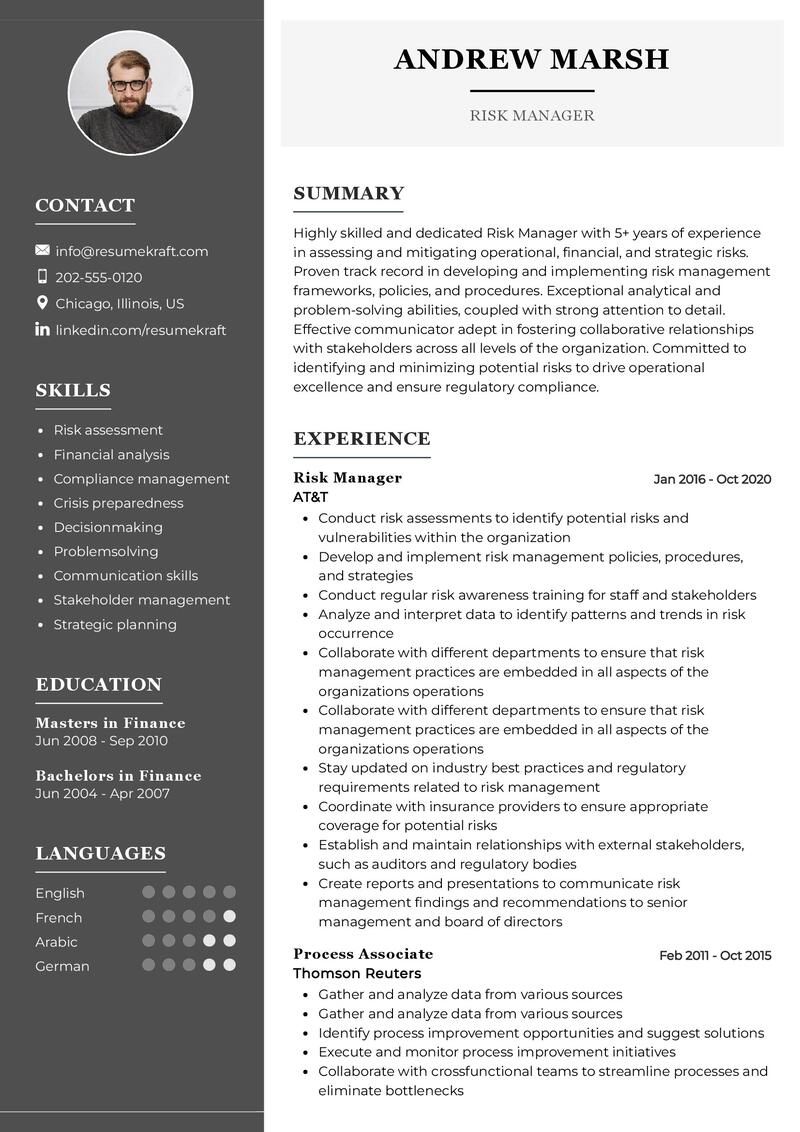

Constructing a Compelling Resume for a Risk Manager Position

Crafting a standout resume is essential for aspiring Risk Managers to showcase their qualifications, experience, and skills effectively. Here are some tips for creating a compelling resume tailored to a Risk Manager position:

- Highlight relevant experience: Emphasize previous roles or projects where you successfully identified, assessed, and mitigated risks.

- Showcase certifications: Include any relevant certifications or professional designations in risk management to demonstrate your expertise and credibility.

- Quantify achievements: Use metrics and specific examples to quantify your contributions and accomplishments in risk management initiatives.

- Customize for the role: Tailor your resume to highlight skills and experiences that align with the specific requirements and responsibilities of the target Risk Manager position.

- Proofread carefully: Ensure your resume is free from typos, grammatical errors, and inconsistencies to present a polished and professional image.

A well-crafted resume can significantly enhance your chances of securing interviews for Risk Manager positions and advancing your career in risk management.

Conclusion

In conclusion, the role of a Risk Manager is integral to safeguarding organizations against various risks and uncertainties that could impact their financial stability and operational resilience. By diligently assessing risks, developing effective mitigation strategies, and collaborating with stakeholders, Risk Managers play a crucial role in enhancing organizational resilience and achieving strategic objectives.

Are you ready to take the next step in your risk management career? Craft a compelling resume that highlights your qualifications and experiences as a Risk Manager, and unlock exciting opportunities in the field of risk management.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Risk Manager job interview.