Exploring the Role of a Teller in the Banking Sector

As the financial industry continues to evolve, the role of a Teller remains a fundamental and crucial position within the banking sector. A Teller’s responsibilities extend beyond handling transactions; they play a pivotal role in providing excellent customer service and maintaining the efficiency of daily banking operations. Let’s delve into the multifaceted world of a Teller, understanding the skills, qualifications, and responsibilities that define this essential role.

What are the Teller Job Requirements?

Becoming a Teller in the banking industry requires meeting specific qualifications and possessing a unique set of skills. Here are the key requirements to embark on a successful career as a Teller:

- A high school diploma or equivalent, showcasing a solid educational foundation.

- Excellent mathematical skills, essential for accurate and efficient handling of financial transactions.

- Strong communication skills, as Tellers interact with customers on a daily basis.

- Attention to detail, ensuring precision in handling cash, checks, and other financial instruments.

- Customer service orientation, with the ability to address inquiries and concerns effectively.

- Basic computer skills, as Tellers often use banking software for transaction processing.

- Integrity and trustworthiness, given the sensitive nature of handling financial transactions.

While specific requirements may vary among banks, these foundational qualifications are generally sought after in Teller candidates.

Responsibilities of a Teller in the Banking Industry

The role of a Teller is dynamic, encompassing a range of responsibilities that contribute to the smooth functioning of a bank. Here are the core duties that define the Teller position:

- Processing routine financial transactions, including deposits, withdrawals, and check cashing.

- Assisting customers with account inquiries, providing information on account balances and transaction history.

- Promoting and cross-selling bank products and services to customers.

- Maintaining an accurate cash drawer and reconciling discrepancies.

- Adhering to security and compliance protocols to safeguard customer information and financial assets.

- Resolving customer issues and concerns in a professional and timely manner.

- Collaborating with other bank personnel to ensure efficient branch operations.

The Teller role is not only about handling transactions but also about building positive customer relationships and contributing to the overall success of the banking institution.

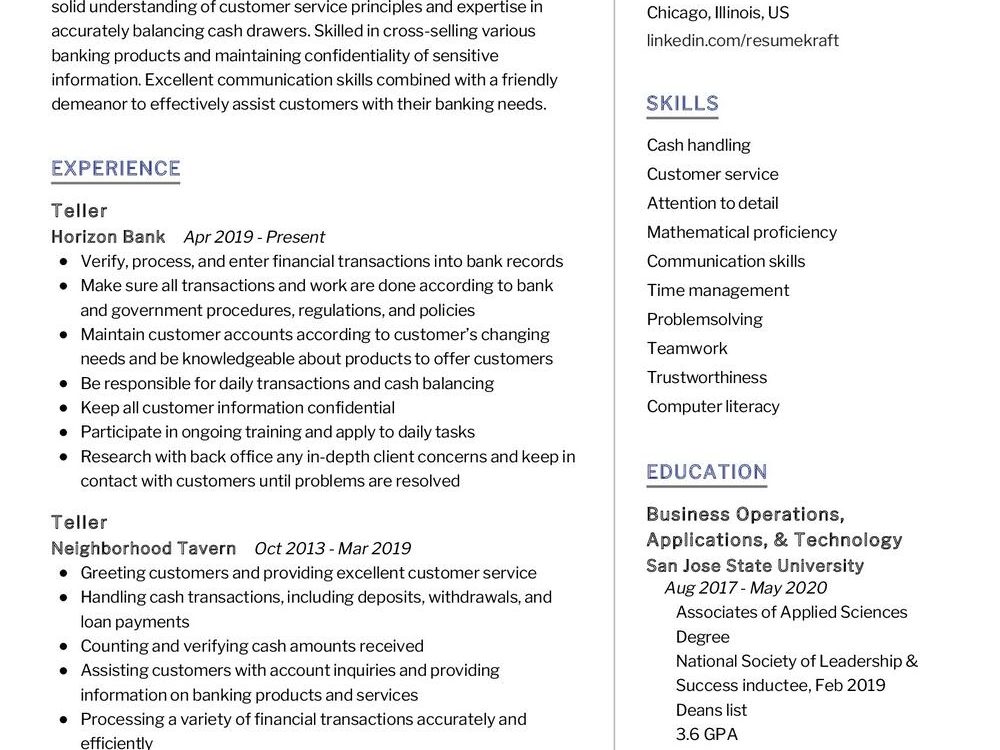

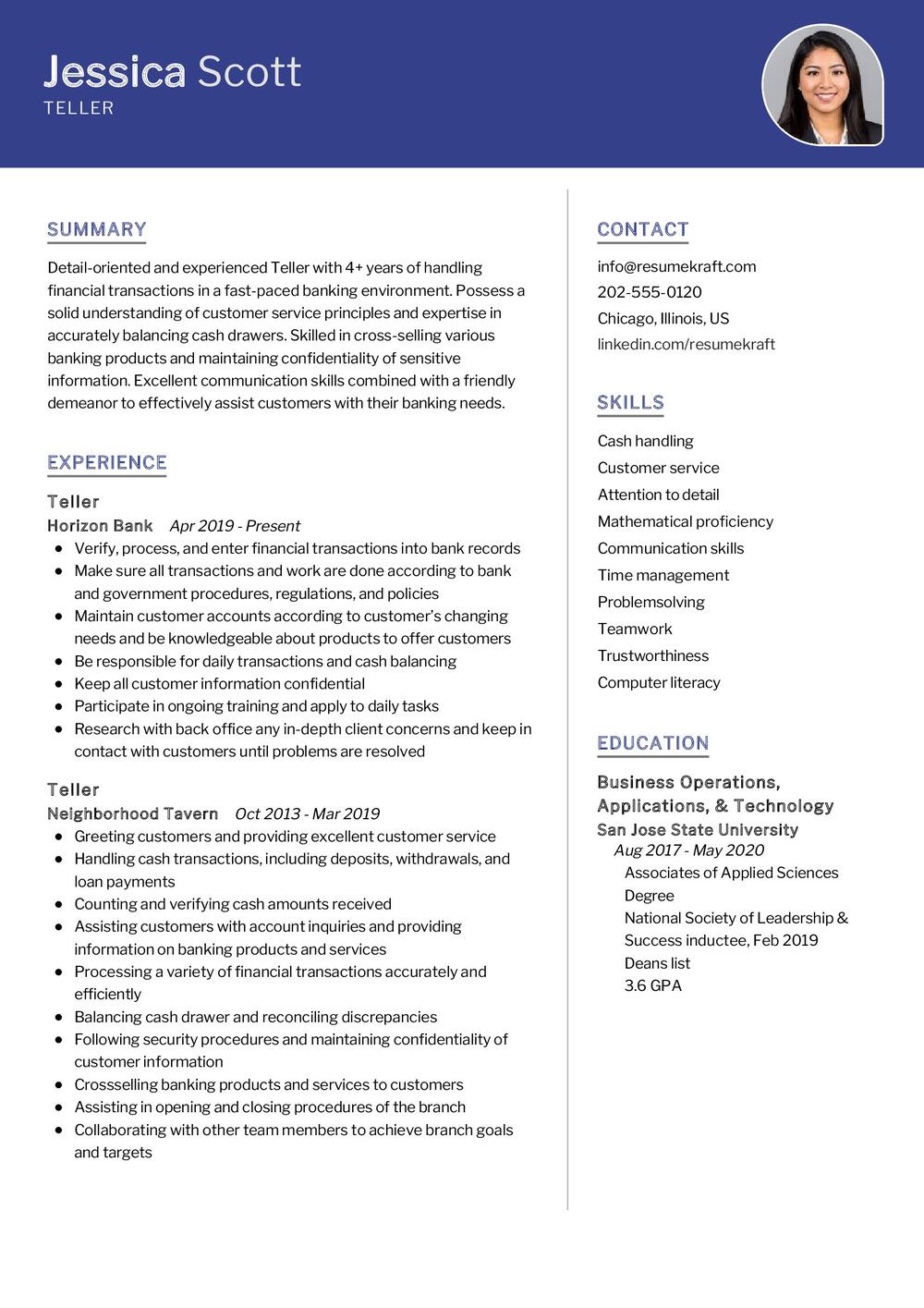

Teller CV Writing Tips

Crafting a compelling Teller CV is essential for standing out in the competitive job market. Here are some tips to enhance your CV and increase your chances of landing a Teller position:

- Highlight your mathematical skills and attention to detail in the skills section.

- Showcase any relevant customer service experience, emphasizing your ability to interact effectively with clients.

- Quantify your achievements where possible, such as the number of transactions processed accurately or customer satisfaction ratings.

- Include any relevant training or certifications related to banking or financial services.

- Customize your CV for each application, aligning your skills and experiences with the specific requirements of the job.

Your Teller CV should not only showcase your qualifications but also reflect your enthusiasm for providing exceptional customer service and contributing to the success of the bank.

Teller CV Summary Examples

Your CV summary is the first impression you make on potential employers. Craft a powerful summary that encapsulates your skills and experiences as a Teller:

- “Dedicated Teller with a strong foundation in mathematics and a proven track record of accurate and efficient transaction processing. Committed to providing excellent customer service and contributing to the success of the bank.”

- “Detail-oriented Teller with exceptional communication skills and a customer-centric approach. Experienced in promoting bank products and ensuring the satisfaction of clients through efficient transaction handling.”

- “Results-driven Teller with a focus on maintaining the integrity of financial transactions and building positive customer relationships. Proficient in utilizing banking software and adhering to security protocols.”

Your CV summary should serve as a snapshot of your Teller journey, highlighting your key strengths and achievements in the banking industry.

Create a Strong Experience Section for Your Teller CV

Your experience section is the heart of your Teller CV, showcasing your growth and accomplishments in the banking sector. Here are some examples to guide you:

- “Processed an average of 100 customer transactions daily with 100% accuracy, contributing to the efficient operation of the branch.”

- “Successfully cross-sold banking products, resulting in a 20% increase in product adoption among customers.”

- “Resolved customer issues and inquiries, maintaining a high level of customer satisfaction and loyalty.”

Each experience listed should provide a narrative of your contributions, demonstrating your value as a Teller in a banking environment.

Sample Education Section for Your Teller CV

Your educational background is a crucial aspect of your Teller CV. Here’s how you can present your educational milestones:

- High School Diploma, XYZ High School, Graduated 20XX.

- Banking Fundamentals Certification, ABC Banking Institute, Completed 20XX.

Your education section should highlight your relevant academic achievements and any certifications that enhance your qualifications as a Teller.

Teller Skills for Your CV

Your skill set as a Teller is diverse, encompassing both technical and interpersonal abilities. Here are the essential skills that a Teller should possess:

Soft Skills:

- Excellent mathematical skills for accurate transaction processing.

- Strong communication and interpersonal skills for customer interactions.

- Attention to detail in handling financial transactions and maintaining records.

- Customer service orientation, ensuring a positive experience for clients.

- Integrity and trustworthiness in handling sensitive financial information.

Hard Skills:

- Proficiency in using banking software for transaction processing.

- Knowledge of banking products and services for effective cross-selling.

- Understanding of security and compliance protocols in the banking industry.

Each skill is a tool in your toolkit, contributing to your effectiveness as a Teller in a banking setting.

Common Mistakes to Avoid When Writing a Teller CV

Avoiding common pitfalls is crucial when crafting your Teller CV. Here are some mistakes to steer clear of:

- Neglecting to quantify achievements, leaving your CV without measurable successes.

- Using generic language, which may make your CV blend in rather than stand out.

- Omitting relevant training or certifications that enhance your banking qualifications.

- Failing to tailor your CV for each application, missing the opportunity to align with specific job requirements.

- Overlooking the importance of a well-crafted CV summary, as it is the first section employers read.

Avoiding these mistakes will ensure your Teller CV effectively communicates your strengths and qualifications to potential employers.

Key Takeaways for Your Teller CV

As you conclude your journey of crafting a Teller CV, keep these key points in mind to enhance your chances of success:

- Emphasize your mathematical skills and attention to detail, showcasing your ability to handle financial transactions accurately.

- Highlight your customer service orientation, as positive client interactions are integral to the Teller role.

- Quantify your achievements to provide tangible evidence of your impact in previous roles.

- Customize your CV for each application, aligning your experiences with the specific requirements of the Teller position.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Teller job interview.