Exploring the Role of a Trade Finance Officer

As the financial landscape continues to evolve, the role of a Trade Finance Officer becomes increasingly crucial in global organizations. This position requires a unique blend of financial acumen, strategic thinking, and attention to detail. In this comprehensive guide, we’ll delve into the multifaceted role of a Trade Finance Officer, exploring the responsibilities, required skills, and key tips for crafting an effective resume.

What Does the Role Entail?

A Trade Finance Officer plays a pivotal role in facilitating international trade transactions. They are responsible for managing financial activities related to imports and exports, ensuring compliance with regulations, and mitigating financial risks. Let’s delve deeper into the core responsibilities that define this role:

- Managing letters of credit, ensuring accurate documentation and compliance with international trade regulations.

- Negotiating trade finance terms with banks and financial institutions to optimize cost and mitigate risks.

- Collaborating with cross-functional teams, including sales, legal, and logistics, to ensure smooth and efficient trade transactions.

- Conducting risk assessments and implementing strategies to minimize financial exposure in international trade deals.

- Staying updated on international trade finance regulations and market trends to provide informed financial advice to the organization.

- Developing and maintaining relationships with financial partners, including banks and insurance providers.

Each responsibility presents a unique challenge, requiring a Trade Finance Officer to navigate the complex terrain of international finance with precision and expertise.

Key Requirements for a Trade Finance Officer

Stepping into the role of a Trade Finance Officer demands a specific set of skills and qualifications. Here are the key requirements that aspiring candidates should fulfill to excel in this position:

- Bachelor’s or Master’s degree in Finance, Business Administration, or a related field.

- Expertise in trade finance instruments, including letters of credit, bank guarantees, and documentary collections.

- Strong analytical and problem-solving skills to assess and mitigate financial risks.

- Effective communication skills to liaise with internal teams and external financial partners.

- Attention to detail and a meticulous approach to documentation and compliance.

- Experience in trade finance operations, demonstrating a track record of successful transactions and risk management.

- Familiarity with international trade regulations and compliance standards.

Securing additional certifications in trade finance or financial risk management can enhance your profile and demonstrate a commitment to continuous learning.

Crafting Your Trade Finance Officer Resume

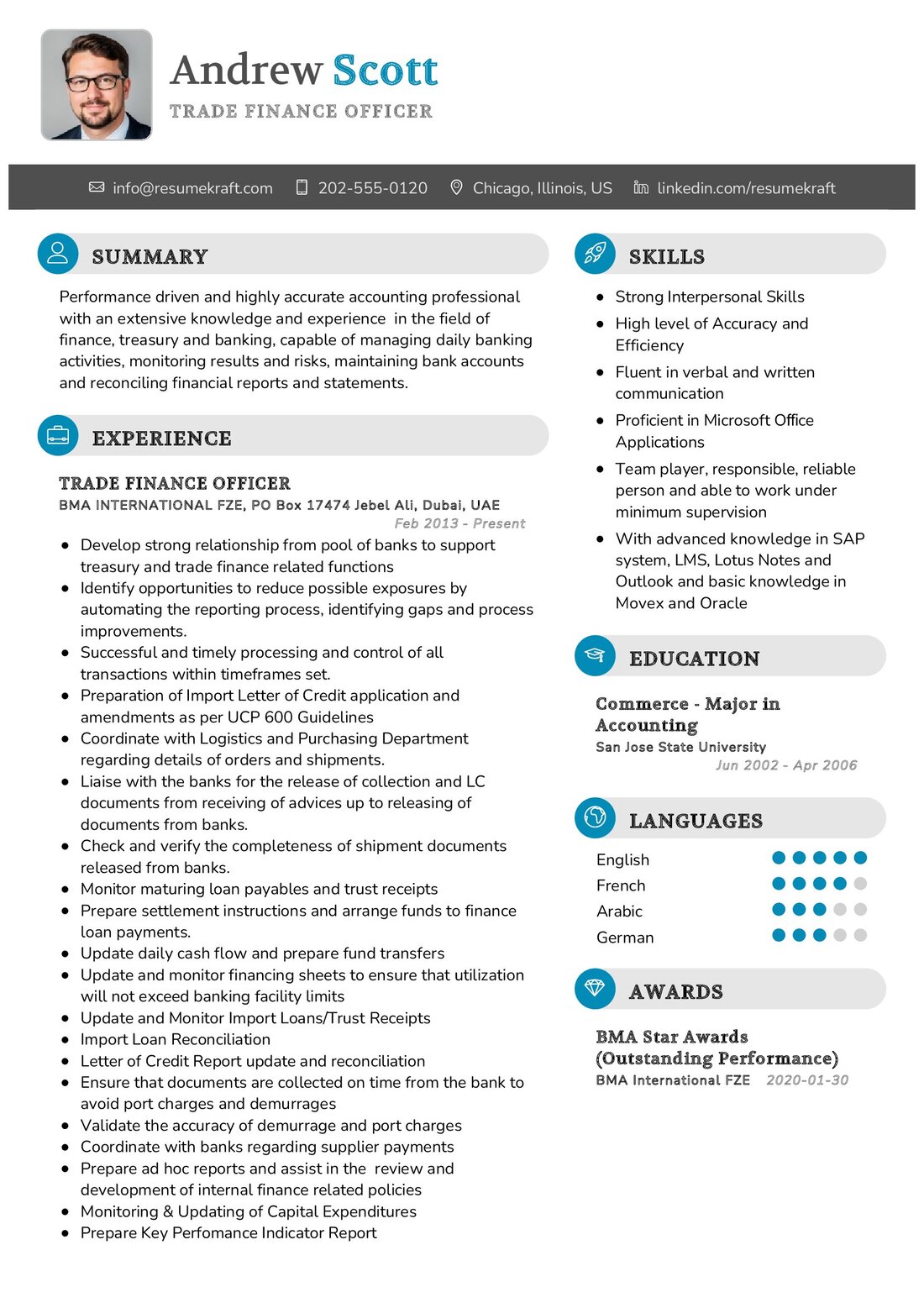

Your resume is a powerful tool to showcase your expertise and secure the desired position as a Trade Finance Officer. Here are some tips to craft a compelling resume:

- Highlight your experience in managing trade finance operations, emphasizing successful transactions and risk mitigation strategies.

- Detail your knowledge of international trade regulations and your ability to ensure compliance in complex transactions.

- Showcase your analytical skills by quantifying the impact of your financial decisions on the organization’s bottom line.

- Include any relevant certifications or training programs related to trade finance or financial risk management.

- Customize your resume for the specific job application, aligning your skills and experiences with the requirements of the role.

Your resume is your first impression, make it a strong reflection of your capabilities as a Trade Finance Officer.

Trade Finance Officer Resume Summary Examples

Your resume summary is the gateway to your professional story. Craft a powerful summary that encapsulates your skills and experience as a Trade Finance Officer:

- “Dedicated Trade Finance Officer with a proven track record of managing international trade transactions, optimizing costs, and ensuring regulatory compliance.”

- “Experienced finance professional specializing in trade finance, adept at negotiating favorable terms with financial institutions and mitigating financial risks in cross-border transactions.”

- “Strategic Trade Finance Officer with a keen eye for detail, successfully navigating the complexities of global trade and contributing to the financial success of the organization.”

Your summary sets the tone for your resume, providing a snapshot of your expertise and value as a Trade Finance Officer.

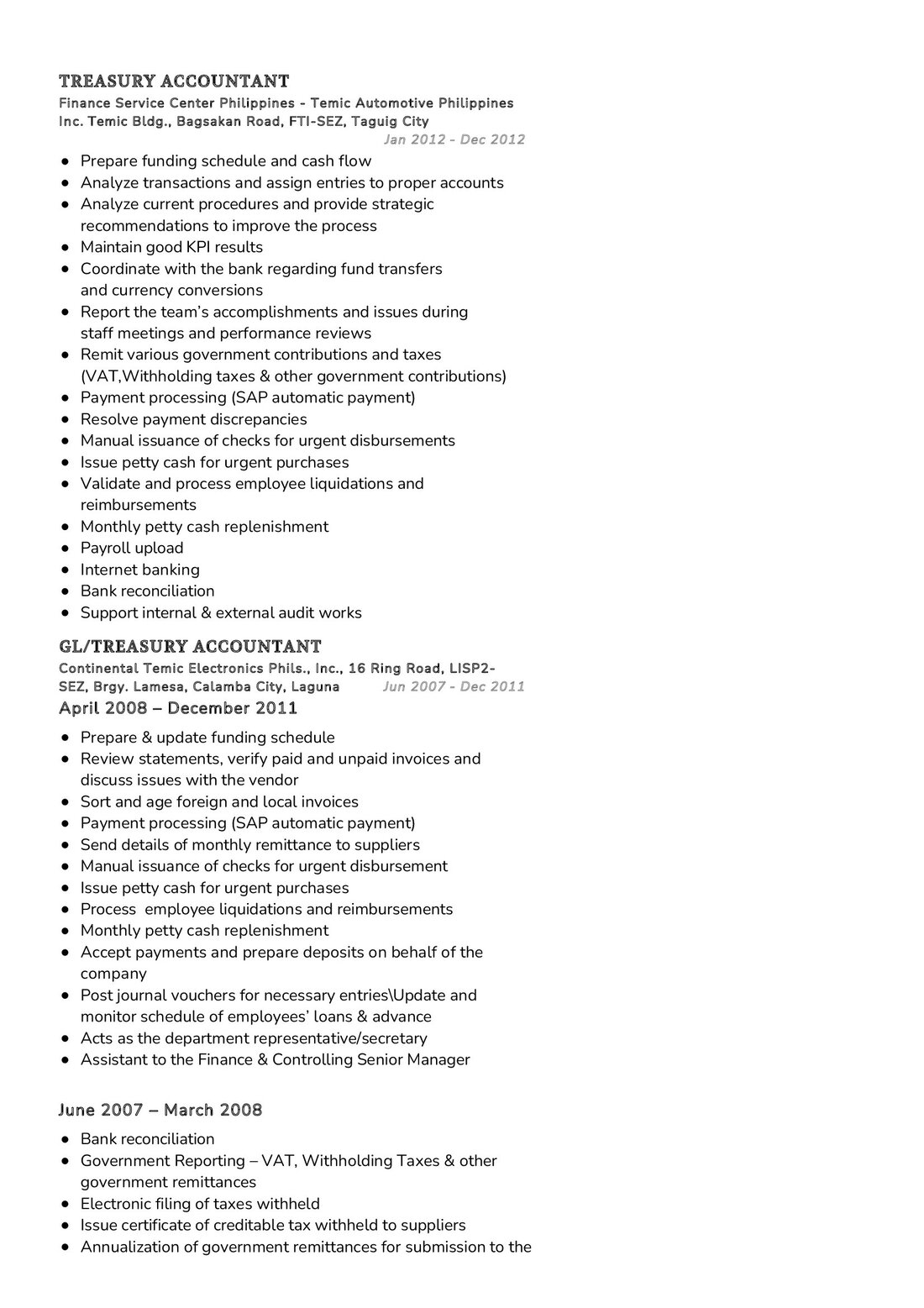

Building Your Experience Section

Your experience section is the heart of your resume, narrating the story of your career as a Trade Finance Officer. Here are examples to guide you in detailing your professional journey:

- “Led trade finance operations, negotiating favorable terms with banks and reducing transaction costs by 15%.”

- “Managed letters of credit for high-value international transactions, ensuring 100% compliance with regulatory requirements.”

- “Developed and implemented risk management strategies, resulting in a 25% reduction in financial exposure in global trade deals.”

Each experience highlights your achievements and contributions, providing a comprehensive view of your capabilities as a Trade Finance Officer.

Education Section for Your Trade Finance Officer Resume

Your educational background is a testament to your foundation in finance. Here’s how you can present your academic milestones:

- Master of Business Administration in Finance, XYZ University, 2017.

- Bachelor of Commerce in International Business, ABC University, 2015.

- Certified Trade Finance Professional (CTFP), Institute of Finance, 2018.

Your educational qualifications demonstrate your commitment to building a strong foundation in finance and trade.

Essential Skills for a Trade Finance Officer

Your skill set is the toolkit that empowers you to excel in your role as a Trade Finance Officer. Let’s categorize these skills into soft and hard skills:

Soft Skills:

- Effective communication to liaise with internal teams and external partners.

- Analytical thinking for assessing and mitigating financial risks.

- Attention to detail to ensure accuracy in documentation and compliance.

- Strategic thinking to navigate the complexities of international trade.

- Team collaboration for seamless coordination with cross-functional teams.

Hard Skills:

- Expertise in trade finance instruments, including letters of credit and bank guarantees.

- Knowledge of international trade regulations and compliance standards.

- Risk management skills to minimize financial exposure in trade transactions.

- Negotiation skills for securing favorable trade finance terms.

- Financial analysis skills to quantify the impact of financial decisions.

Each skill in your toolkit contributes to your success as a Trade Finance Officer, showcasing your ability to navigate the intricacies of international finance.

Common Mistakes to Avoid in Your Trade Finance Officer Resume

As you craft your resume, steer clear of common pitfalls that can hinder your chances of landing the desired role. Here are mistakes to avoid:

- Using generic language that fails to highlight your unique qualifications as a Trade Finance Officer.

- Overlooking the importance of quantifying achievements, missing an opportunity to showcase the impact of your contributions.

- Neglecting the cover letter, a valuable tool to provide context and express your motivation for the role.

- Overloading your resume with technical jargon, potentially alienating non-finance professionals who may be part of the hiring process.

- Failing to proofread, risking the impression of carelessness in your application.

Avoiding these mistakes ensures your resume is a compelling representation of your capabilities as a Trade Finance Officer.

Key Takeaways for Your Trade Finance Officer Resume

As you conclude crafting your Trade Finance Officer resume, keep these key takeaways in mind:

- Emphasize your experience in managing international trade transactions and mitigating financial risks.

- Highlight your expertise in trade finance instruments and your ability to ensure compliance with international regulations.

- Showcase your analytical skills by quantifying the impact of your financial decisions on organizational success.

- Include relevant certifications or training programs to demonstrate your commitment to continuous learning.

Your resume is more than a document; it’s a narrative of your journey, skills, and aspirations as a Trade Finance Officer. Best of luck!

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Trade Finance Officer job interview.