What Should Be Included In A Compliance Manager Resume?

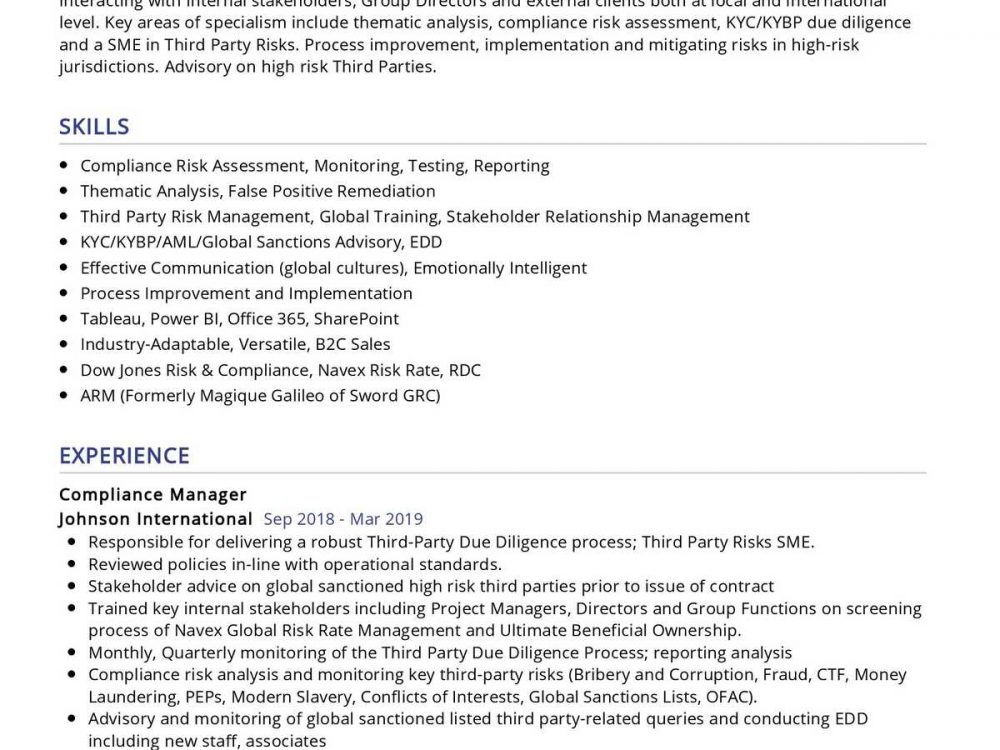

When it comes to writing a resume for a Compliance Manager position, it is important to emphasize your knowledge of regulatory, industry and organizational compliance standards. You should also showcase your experience in implementing and maintaining effective compliance programs.

Your resume should include a professional summary that outlines your core competencies and qualifications. In addition to your qualifications, you should detail any relevant experience you have, such as working with regulatory bodies, creating and maintaining a compliance management system, and conducting training. Be sure to emphasize any certifications or qualifications you have that may be relevant to the role.

When it comes to the skills section of your resume, be sure to list any technical or managerial skills related to compliance. Include any certifications or qualifications that demonstrate your compliance knowledge and expertise.

Finally, when writing a resume for a Compliance Manager position, it is important to emphasize any experience you have in leading a team or in successfully managing a compliance program. Be sure to include any successes you have had in this field, such as successful implementation of new regulations or successful audits. Highlight any areas where you have shown leadership and how you have contributed to the overall success of the organization.

What Skills Should I Put On My Resume For Compliance Manager?

When applying for a Compliance Manager role, you should ensure that your resume emphasizes your knowledge and experience in the field. As a Compliance Manager, you will be responsible for ensuring that an organization’s operations comply with applicable laws and regulations. Therefore, it is essential that your resume reflects your ability to handle this type of responsibility.

When creating your resume for a Compliance Manager position, it is important to emphasize your experience in a variety of areas. For example, you should make sure to include skills such as risk management, compliance management, and regulatory reporting. Additionally, your resume should also highlight your experience in developing and implementing compliance plans and assessing business operations to identify areas of risk.

Good communication skills are also essential to a Compliance Manager role, so you should be sure to emphasize your ability to explain complex compliance concepts to colleagues and staff. You should also demonstrate your ability to provide timely and accurate compliance advice to other departments. Lastly, you should also include any certifications or degrees relevant to the position, such as a degree in finance or accounting.

Overall, your resume should focus on your experience and qualifications related to compliance management. Demonstrating your knowledge of current regulations and laws, as well as your ability to ensure compliance with them, will be essential to getting the job. In addition, highlighting your relevant certifications and degrees will give you an edge in the hiring process.

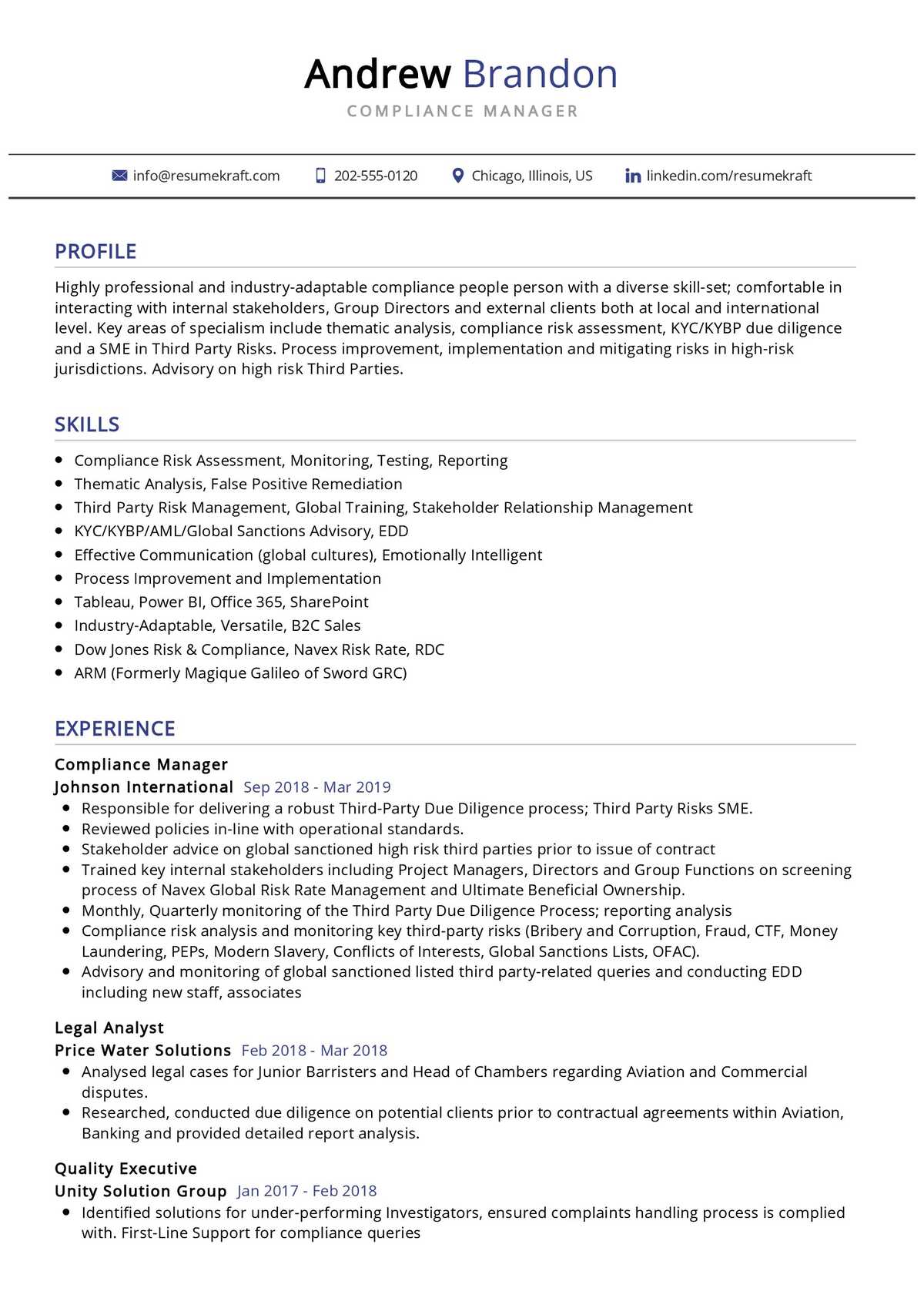

What Is The Job Description Of The Compliance Manager?

A Compliance Manager is responsible for ensuring compliance with laws, regulations, and policies within their organization. They are typically tasked with reviewing and analyzing legal documents, evaluating internal processes and procedures, and monitoring legal compliance. They also provide guidance on legal issues and policies to executives, managers, and employees.

The main job duties of a Compliance Manager include developing, implementing, and monitoring compliance procedures; researching and interpreting laws, rules, and regulations; and advising on compliance and risk issues. They must also remain up to date on changes to laws, regulations and policies that could affect the organization. In addition, they are typically responsible for developing training programs on legal and compliance topics, preparing reports, and promoting a culture of compliance and ethics throughout the organization.

To be successful in this role, a Compliance Manager must possess strong organizational and communication skills and analytical abilities. They must keep up to date on changes in laws, regulations, and policies, and be able to effectively communicate the changes to employees and executives. They must also be able to effectively manage and prioritize tasks and remain organized. In addition, they must have a strong understanding of the organization’s goals and objectives and be able to align them with compliance initiatives.

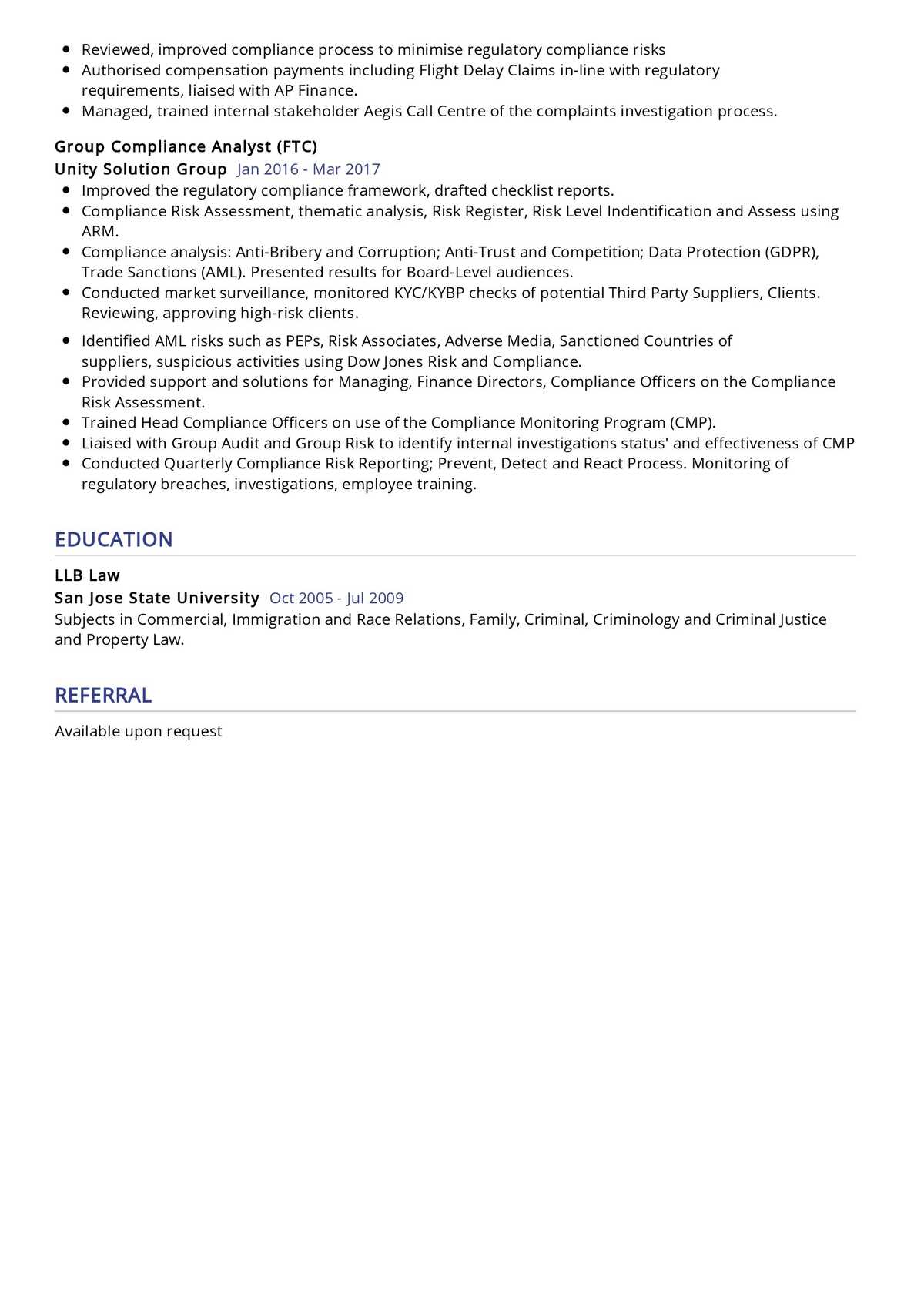

What Is A Good Objective For A Compliance Manager Resume?

When writing a compliance manager resume, you need to make sure you have a strong objective statement that will capture the attention of the hiring manager. A good objective statement should focus on your skills, capabilities, and experience that are relevant to the job and company you are applying to. This statement should be brief and precise, yet powerful enough to make the employer want to learn more about you.

When crafting your objective statement, think about the qualities employers are looking for in a compliance manager. For example, having knowledge and experience in risk management, regulatory compliance, and corporate governance are essential for this role. Additionally, you should highlight your ability to stay up-to-date on the latest industry regulations, develop and implement effective policies, and create comprehensive compliance programs.

When writing your objective statement, make sure that you include key words from the job description. This will show potential employers that you understand the role and have the necessary skills to be successful. Also, be sure to use action verbs that demonstrate your past successes and emphasize the value you can bring to the job. With a strong objective statement, you can give the hiring manager a clear understanding of why you are the best fit for the role.

What Are The Career Prospects In The Compliance Manager?

The role of a Compliance Manager is a vital one. Not only do they need to be highly organized and have a good understanding of regulations and procedures, but they also have to have the ability to effectively communicate with senior management, stakeholders, and employees to ensure compliance. As such, the career prospects in the Compliance Manager field are highly sought-after.

Compliance Managers are required to interpret and analyze legal, regulatory, and organizational requirements to ensure that their organization is abiding by the laws and regulations of their industry. They must be knowledgeable in various compliance topics, including ethics, privacy, security, and anti-corruption. Additionally, Compliance Managers often work with senior management to develop and implement policies and procedures to ensure compliance.

Moreover, Compliance Managers must be comfortable working with a variety of stakeholders and have excellent interpersonal skills. They must be able to effectively communicate policies and regulations to employees, customers, and vendors. Additionally, they must be able to identify potential compliance risks and develop strategies to reduce these risks.

Overall, the career prospects for Compliance Managers are excellent. As organizations become increasingly regulated and require more compliance, the need for skilled Compliance Managers has grown exponentially. Furthermore, Compliance Managers have the opportunity to build relationships with senior management and stakeholders and often times have the opportunity to move up the ranks within an organization.

Key Takeaways for an Compliance Manager resume

Writing a compelling Compliance Manager resume is a key step in securing a new job. The right resume should demonstrate an individual’s experience and expertise in the field, as well as their commitment to the industry. Here are some key takeaways to ensure that your Compliance Manager resume is up to the task.

First and foremost, it is important to make sure that your Compliance Manager resume is up-to-date. Include any recent certifications or education, such as any continuing education courses you have taken. This shows that you are committed to staying current in the field and have kept up with the latest trends and developments.

It is also important to highlight your experience in the field. This includes any positions you have held, as well as any work you have done in the industry. Include any contracts or projects you have worked on, as well as any accomplishments you have achieved in the field.

Don’t forget to include any relevant skills you have acquired. This could include anything from software and coding knowledge to communication and interpersonal skills. These skills can demonstrate your ability to succeed in the Compliance Manager role.

Finally, make sure that your Compliance Manager resume is formatted properly. Use a professional font, such as Calibri or Arial, and make sure that your resume is easy to read. Presentation is key in making sure that your resume stands out from the rest.